Key takeaways

- Financial promotions on social media are still financial promotions and so the FCA’s rules apply.

- Given their increased use of social media to promote their products and services, firms need to be alive to the particular issues the medium raises.

- Issues such as ensuring standalone compliance, the prominence of risk warnings, the involvement of unauthorised persons and the extra-territorial effect of the rules pose particular challenges when social media is used.

Autoren: Romin Dabir Anglee Kumar

Social media platforms have become a popular and influential channel for advertising financial products and services to consumers. However, this also poses significant risks of consumer harm due to the wide reach and accessibility of some of these promotions. To address these risks, the Financial Conduct Authority (FCA) has published Finalised guidance on financial promotions on social media (FG 24/1) (Guidance).

The Guidance focusses on how firms and others, such as influencers, should communicate financial promotions on social media in a way that is fair, clear and not misleading, and supports consumer understanding and good outcomes.

The Guidance, which replaces the previous guidance issued in 2015, clarifies the FCA’s expectations of firms and others who communicate or approve financial promotions on social media, taking into account the introduction of the Consumer Duty (which sets a higher expectation for the standard of care that firms give customers) and the changing features of social media platforms. The Guidance provides many examples of what the FCA regards as good and bad practice, which firms may find particularly instructive.

The FCA states that the Guidance is not intended to impose new obligations on firms, but it is nonetheless instructive for firms that rely on social media to promote their products and services. While the Guidance does not have the same force as the FCA’s rules, firms would be well advised to take it into account and follow it, unless they are able to justify why they have not.

The regulatory framework

Under section 21 of the Financial Services and Markets Act 2000 (FSMA), a person must not, in the course of business, communicate an invitation or inducement to engage in investment activity. This is known as the financial promotion restriction.

The financial promotion restriction does not apply if:

- the promotion is communicated by an authorised person;

- the content of the promotion is approved by an appropriately authorised person; or

- an exemption under the FSMA (Financial Promotion) Order 2005 (FPO) applies.

Unless an exemption is available, the FCA’s rules on financial promotions (Fin Prom Rules) will apply (for investment firms, these are mainly found in chapter 4 of the FCA’s Conduct of Business sourcebook (COBS)). It should also be noted that similar rules apply to financial promotions that promote other financial products (bank accounts, insurance, consumer loans, etc.).

Relevance to social media promotions

The Fin Prom Rules are platform agnostic and apply regardless of the medium or channel used (including Instagram stories); this means that firms need to ensure that their social media posts are fair, clear and not misleading, provide a balanced view of the benefits and risks, and carry the appropriate risk warnings associated with the promoted product or service. This may encompass interactions via exclusive social media platforms such as chatrooms like Discord and Telegram, contributions on public forum sites like Reddit, as well as content or correspondence from unauthorised ‘finfluencers’. Memes are also considered as a type of communication capable of being a financial promotion.

Social media financial promotions are particularly prevalent in the cryptoasset sector. The FCA has published separate guidance and rules on its expectations regarding cryptoasset promotions generally.

The FCA’s expectations in respect of social media financial promotions

The Guidance sets out clearly the FCA’s expectations in respect of financial promotions made on social media. Important points for firms to bear in mind include:

- Standalone compliance: The FCA expects promotions to be standalone compliant and will consider each promotion individually. As mentioned above, it is crucial that the promotion provides a balanced view.

- Prominence: Firms must ensure that any promotion clearly displays both the benefits and risks within the promotion rather than leading their audience to read about the risks of a product or service within a caption or requiring them to click on a ‘see more’ button taking them to various links.

The Guidance reiterates the requirement under the Consumer Duty to support consumer understanding and consider whether a promotion is likely to meet this requirement if it can only be communicated on a social media platform by obscuring or partly truncating key information.

- Firms and their responsibilities as approvers of financial promotions: Financial promotions communicated by unauthorised influencers on social media platforms will be in breach of the financial promotion restriction unless they are approved by an authorised person or exempt under the FPO. Firms that approve financial promotions should consider the suitability and vulnerability of the influencer’s audience, and should comply with the strengthened requirements for investment-related promotions in COBS 4.10.

Ongoing monitoring and attestation of approved promotions is critical, and firms must ensure the influencer’s understanding of the products and services that they promote and compliance with the applicable financial promotion rules.

- Recipients sharing or forwarding communications: Sharing or reposting a promotion by a third party does not remove the original firm’s responsibility for compliance. Firms should be careful about using social media for products or services with a limited target market, as they may reach unintended audiences. If a firm shares a customer’s post that invites or induces investment activity, the firm is responsible for compliance, even if it did not create the post.

- Affiliate marketing: Affiliate marketing is a common way for firms to promote their products or services online, by paying commission to a person or entity (an affiliate) who refers customers to them. However, if the product or service is a regulated financial one, such as an investment, a loan or insurance, both the firm and the affiliate need to comply with the relevant rules and regulations. Firms are responsible for the compliance of their affiliates’ financial promotions.

Aside from the relevant Fin Prom Rules, both firms and affiliates should follow other relevant standards and guidance. For example, the Advertising Standards Authority (ASA) has guidance on online affiliate marketing, which covers issues such as transparency, disclosure and misleading claims.

- High-risk investments (HRIs): HRIs are subject to the restrictions set out in COBS 4.12A, COBS 4.12B and COBS 22.

Some HRIs, such as non-mainstream pooled investments (e.g., interests in private funds such as alternative investment funds) and speculative illiquid securities (e.g., most preference shares and debentures, including speculative ‘mini-bonds’), are prohibited from being mass marketed to retail investors and should not be promoted on social media at all unless the firm can ensure that only eligible investors will see them.

HRIs such as crowdfunding, cryptoassets and contracts for differences (CFDs) can be mass marketed to retail investors but must comply with specific rules, such as enhanced risk warnings, cooling-off periods and bans on incentives.

- Prescribed risk warnings: Promotions of HRIs must contain certain prescribed risk warnings. For example, where the financial promotion relates to a restricted mass market investment (e.g., an illiquid security or a cryptoasset), the FCA expects that the risk warnings should be displayed for the duration of the financial promotion in line with COBS 4.12A.36R.

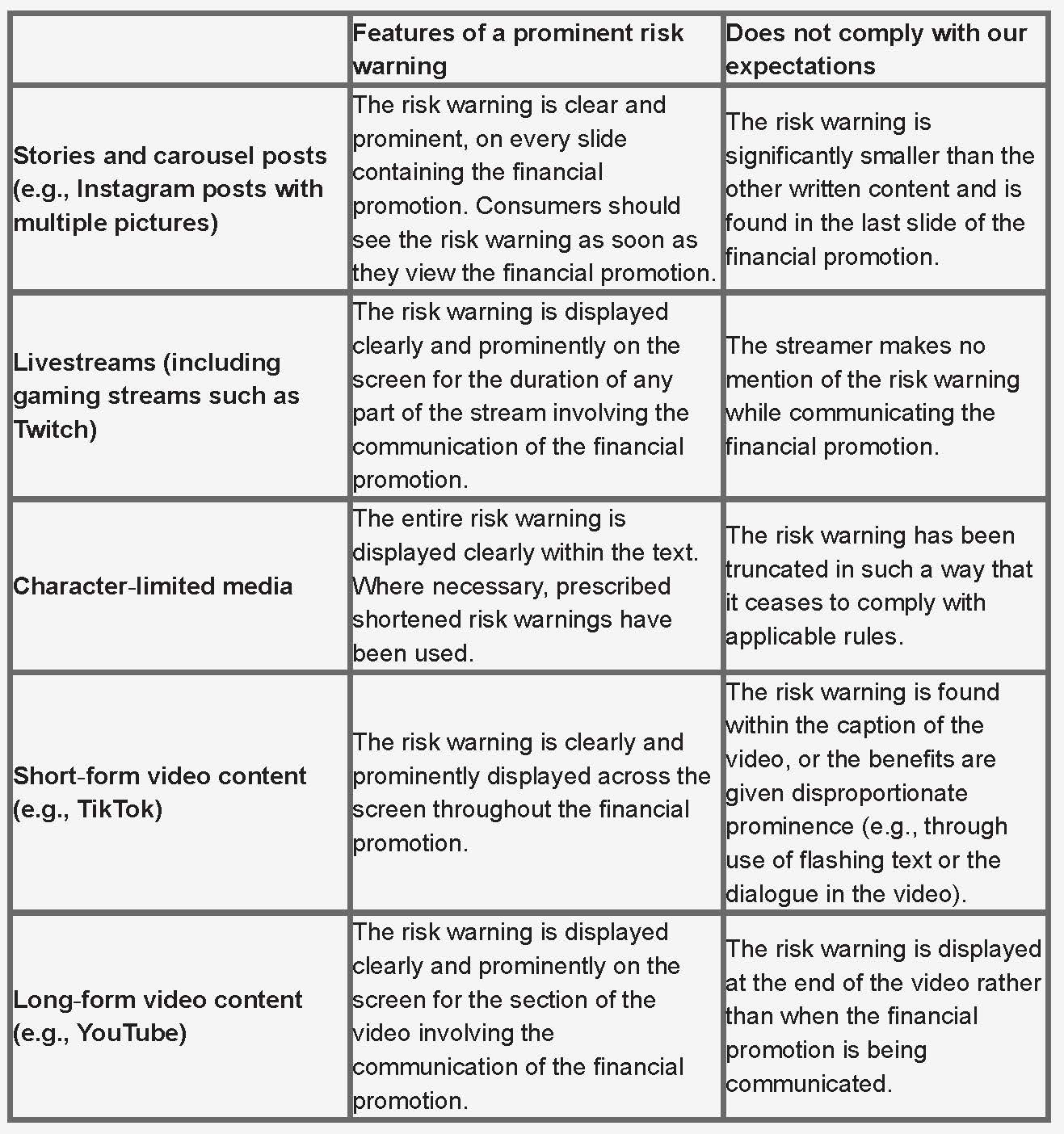

Where prescribed risk warnings are required, the table below provided in the Guidance is a helpful guide:

Application of prescribed risk warning prominence standards to social media channels

Particular issues for non-UK based firms – extra-territorial effect

Non-UK firms should bear in mind that the UK financial promotion regime applies to any communication that is capable of having an effect in the UK, regardless of where the communicator is based or whether the communication is targeted at UK consumers.

This means that if UK consumers can see a promotion on social media by a non-UK based entity and potentially engage in the investment activity that is being promoted, then that entity will likely be subject to the regime unless an exemption applies.

One of the exemptions that may be relevant to overseas communicators is article 12 of the FPO, which applies to communications that are made only to, or directed only at, persons outside the UK. However, this exemption has various conditions that need to be met, and should be read alongside the detailed guidance in PERG 8.12 of the FCA Handbook.

Some of the steps that overseas firms can take to comply with the regime and avoid breaching the financial promotion restriction include:

- having a UK authorised firm approve any financial promotions;

- geo-blocking promotions so that they are not accessible to UK persons;

- changing the form and content of communications so that they do not contain invitations or inducements to engage in investment activity; and

- implementing proper systems and controls to prevent UK persons from engaging in the investment activity that is being promoted, supported by appropriate indications that the promotion is directed only at persons outside the UK and should not be acted on by UK consumers.

Firms should also be aware that simply adding a warning that the promotion is not intended for UK consumers may not be enough to comply with the regime, especially if they do not take any other measures to restrict UK consumers’ access to or engagement with the promotion.

If a firm is part of a global group that has both authorised and non-authorised entities that communicate financial promotions on social media, they will need to manage the risk that the communications may confuse or mislead UK consumers. For example, UK consumers may think that they are dealing with an FCA-regulated firm and benefit from regulatory protection, when in fact they are directed to an unregulated overseas entity that may not comply with the UK rules or may carry on regulated activities without authorisation.

Summary of issues to consider

The Guidance suggests some helpful questions for firms to consider when they use social media to promote their products or services:

- Is the message fair and clear? Firms need to make sure that consumers get a balanced picture of the benefits and risks of the product or service they are promoting. The amount of detail needed to help consumers understand the promotion will depend on factors such as who the promotion is aimed at, what information they need to know, what kind of decision they have to make and what might confuse them.

- Is social media the right channel? Can the message explain the complexity of the product? Social media allows for quick customer engagement, which might not be suitable for all products, especially HRIs that might be hard for consumers to understand. The likely audience should be taken into account.

- Are the risk warnings noticeable? Space is limited for these messages; firms should check whether risk warnings have been cut short by the platform’s functionality, as this might affect consumer understanding (helping consumer understanding is a key requirement of the Consumer Duty). Firms should also make sure that they use the required risk warnings where applicable, e.g., for HRIs and high-cost short-term credit (HCSTC) products. The whole risk warning should be clear and not require clicking through to access.

- What are the relevant Consumer Duty considerations? For example, is the financial promotion tailored to the target market and likely to be understood by the audience (regular consumer testing might be appropriate)? Firms advertising on social media must consider how their marketing strategies align with acting to deliver good outcomes for retail consumers.

- Is there a risk that consumers are getting overwhelmed by social media financial promotions when they are vulnerable? Firms should refer to FG22/5, which outlines good and poor practice under the Consumer Duty.

- How should firms deal with the risk of forwarding and sharing? Social media content is often forwarded or shared, which could result in non-compliance. Whether a social media post will count as a financial promotion will depend on its content and context. Firms are still responsible for compliance if they share the post, even if they did not create the original content of the message.

- Affiliate marketing – does the firm have appropriate systems and controls in place? Firms are required to take responsibility for how their affiliate marketers communicate financial promotions. Firms are liable for the compliance of any financial promotion made by their affiliate marketers, even if they have not been involved in the development or creation of the content – if the firm’s referral link is on the advert, then they are responsible. Firms should make sure they have proper systems and controls to manage how their promotions are used on social media.

In-depth 2024-071