Authors

Key takeaways

- The Stock Exchange introduced a new financial qualification test for high-growth companies engaged in R&D activities, namely the “market capitalisation/revenue/R&D test”.

- The Stock Exchange cancelled the mandatory quarterly reporting requirement.

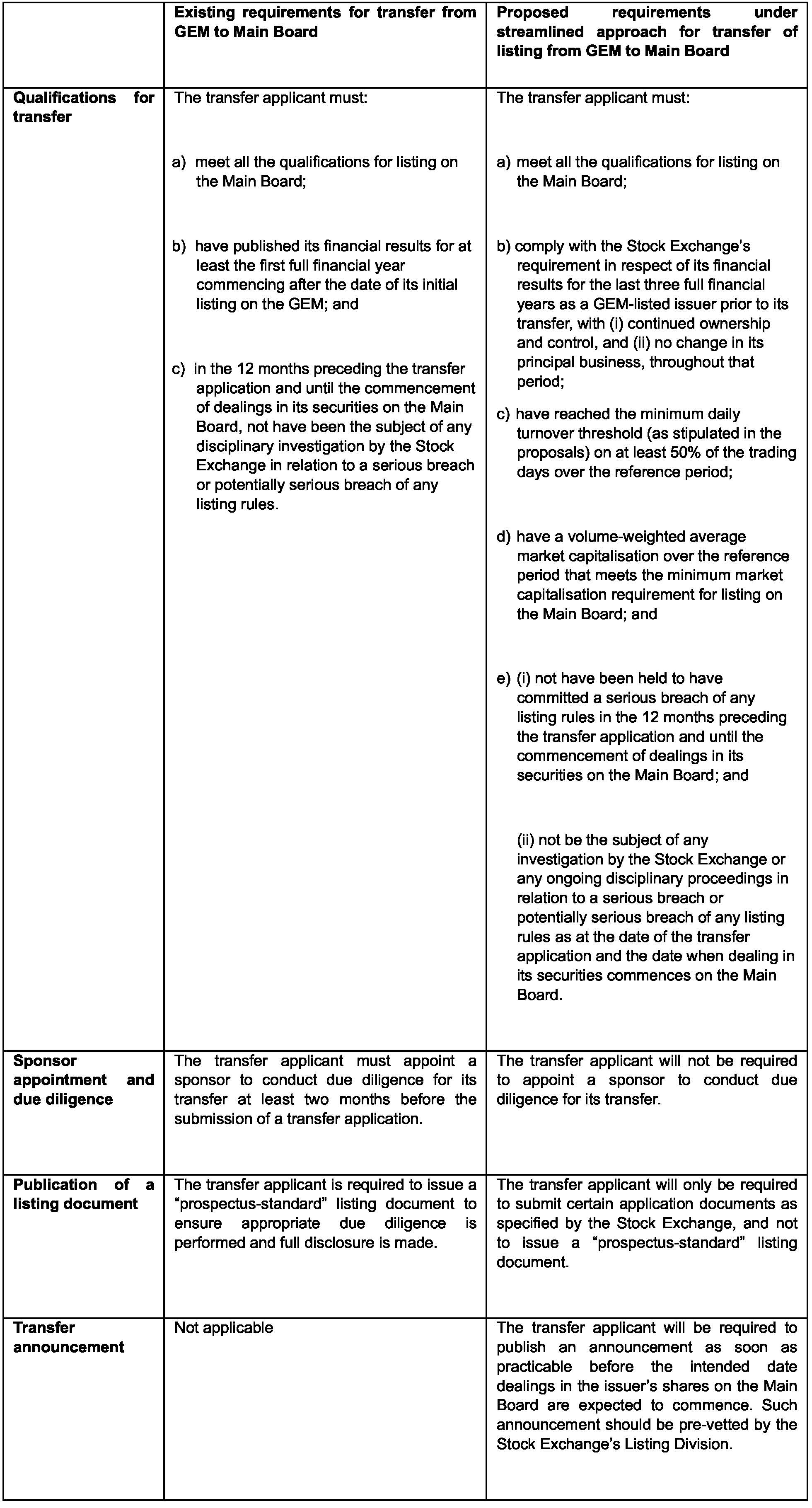

- The Stock Exchange simplified the Main Board transfer mechanism.

On 26 September 2023, The Stock Exchange of Hong Kong Limited (the Stock Exchange) published a consultation on the proposed revisions to the Growth Enterprise Market (GEM) Listing Rules (the Consultation). In 2022, there were no new GEM-listed issuers in Hong Kong. In order to promote the listing of small and medium-sized mainland Chinese enterprises in Hong Kong, the Stock Exchange proposed the reform of the GEM Listing Rules and sought opinions from investors and the market regarding the rules, so that more favourable listing conditions may be provided for small and medium-sized enterprises.

Major changes

Since 2019, the number of new IPOs and the size of fundraising on the GEM have been in steep decline. In 2022, with no new issuers listed on GEM, existing listed issuers only raised HK$ 2.7 billion in funds. The main reasons for the continued slump in the number of GEM-listed issuers may include: (1) the COVID-19 pandemic having taken a heavy toll on the financial performance of potential listing applicants, the number of companies that can meet GEM listing qualification requirements declining in the past few years; (2) Mainland China has established more financing platforms for small and medium-sized enterprises – in addition to the Shanghai Stock Exchange and Shenzhen Stock Exchange, the Beijing Stock Exchange was established in November 2020, bolstering services for innovative small and medium-sized enterprises; and (3) Hong Kong’s GEM listing threshold and listing costs are relatively higher, which hinders mainland Chinese companies from listing in Hong Kong. In view of this, in order to attract more small and medium-sized mainland Chinese enterprises and encourage them to list in Hong Kong, it is imperative for the Stock Exchange to reform the GEM Listing Rules.

The major changes to the GEM Listing Rules are as follows:

1. Introduction of new financial eligibility test for high-growth enterprises engaged in R&D activities, namely the “market capitalisation/revenue/R&D test”

Listing applicants must provide evidence of:

- An adequate trading record over at least the last two most recent financial years;

- An expected market capitalisation of at least HK$ 250 million at the time of listing;

- Revenue of at least HK$ 100 million in aggregate for the two most recent financial years, as well as year-on-year growth over those two years; and

- Incurred R&D expenditure of at least HK$ 30 million in aggregate in the most recent financial years, with the R&D expenditure incurred for each financial year being at least 15% of its total operating costs over the same period.

2. Removal of mandatory quarterly reporting requirement

Since 1999, as part of the reinforced scrutiny of GEM-listed companies, issuers have been required to submit quarterly reports. However, companies listed on the Main Board are not subject to similar requirements. After years of development, the provisions of the GEM Listing Rules and the Main Board Listing Rules have now converged. As a result, the Stock Exchange considers it unnecessary for GEM-listed issuers to report financial data more frequently than Main Board issuers. The removal of the mandatory quarterly reporting requirement will be helpful in reducing compliance costs for GEM-listed issuers.

3. New streamlined transfer mechanism

While small and medium-sized mainland Chinese enterprises form an indispensable part of the financial market in Hong Kong, it is of paramount importance for the Stock Exchange to continue to attract such enterprises and encourage them to go public in Hong Kong. Not only can the Stock Exchange provide them with financial support, it may also pave the way for their continued growth and value creation through their compliance with listing requirements. The reform of the GEM Listing Rules by the Stock Exchange will attract more high-growth companies to the listing platform, providing them with opportunities for expansion and thus giving added impetus to the comprehensive and sustainable development of the economy in Hong Kong.

Client Alert 2023-216