Authors

Authors

Laura Neuhaus

Key takeaways

- FCA publishes new rule amending the Code of Conduct (COCON) to address serious non-financial misconduct, such as bullying and harassment, for non-banks

- FCA is also consulting on draft Handbook guidance to support consistent application of the rules, including updated guidance on the application of the Fit and Proper test

- The new COCON rule is set to come into force on 1 September 2026

Overview

On 2 July 2025, the Financial Conduct Authority (FCA) published Consultation Paper CP25/18, setting out amendments to its regulatory framework to tackle non-financial misconduct in financial services.

The FCA’s new rule aims to address serious work-related non-financial misconduct, such as bullying, harassment and violence, by clarifying when such behaviour constitutes a breach of regulatory rules and by aligning the scope of COCON for non-banks with that for banks. The FCA is also consulting on draft guidance to support firms in interpreting and applying the rules consistently.

Scope and application

The new COCON rule will make explicit that serious non-financial misconduct in the workplace falls within the regulatory perimeter for non-banks. Although the FCA has suggested in places that this is a clarification of the existing position, it also makes clear that the new rule will not apply retrospectively and does not extend to conduct in an individual’s private or personal life, although such conduct may still be relevant to the Fit and Proper Test.

The new non-financial misconduct rule will apply from 1 September 2026 to all firms authorised under the Financial Services and Markets Act 2000 and all staff in those firms who are subject to COCON. Before this date, firms will be well advised to have regard to the clear direction of travel and ensure that all staff are aware of the types of behaviour that will not be tolerated and will be subject to internal disciplinary proceedings and, potentially, regulatory sanction.

Key proposals

Amendments to COCON

- Non-financial misconduct will be a conduct issue under COCON if it (i) has the purpose or effect of violating an individual’s dignity or creating an intimidating, hostile, degrading, humiliating or offensive environment, or (ii) involves violence towards an individual.

- The new rule applies specifically to misconduct between colleagues, which includes employees of group companies and contractors. However, the FCA makes clear that work-related misconduct towards clients and business contacts could fall within the scope of the existing rules.

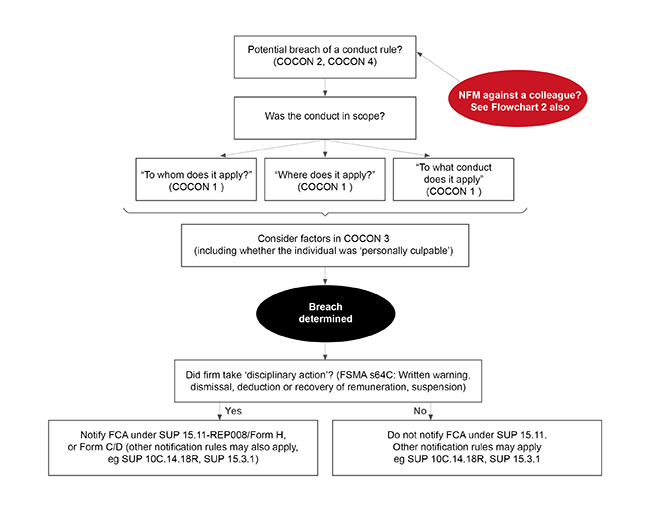

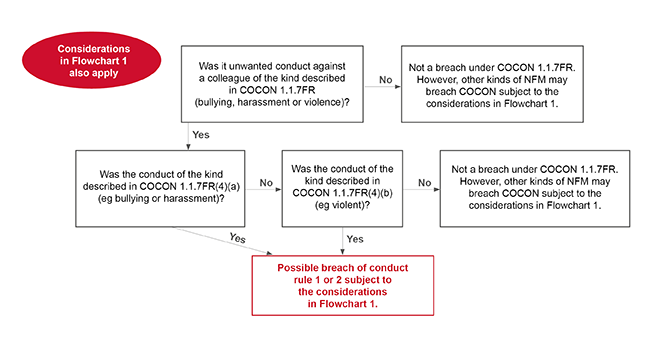

Within CP25/18, the FCA has provided two helpful decision trees, to assist firms with navigating both the existing COCON rules and the new rule, which we have reproduced at the end of this alert.

We have advised many clients grappling with the question of whether non-financial misconduct is required to be disclosed in a regulatory reference, particularly under Question G (“Are we aware of any other information that we reasonably consider to be relevant to your assessment of whether the individual is fit and proper?”). The FCA clarifies that, while this question is intended to allow firms to comment on matters that might be reasonably relevant to the assessment of an individual’s fitness and propriety, the risk of an inappropriate or unfair reference is mitigated by Handbook guidance and the duty under general law to provide fair and accurate references.

The FCA also points out that while firms must “have regard” to certain matters when responding to Question G, they are not required to disclose information that they reasonably believe to be irrelevant. This is the case even if that information would need to be disclosed in a Senior Management Function (SMF) application or, if they were an approved person, under SUP 10C.14.

Handbook guidance

The FCA is consulting on draft guidance to support consistent application of the rules.

Factors determining whether misconduct breaches the non-financial misconduct rule

For misconduct to breach the rule, the following three conditions must be met:

- Seriousness. Firms must consider the number of occurrences, the duration and impact of these occurrences, the seniority of the perpetrator, the vulnerabilities of the individual affected, previous disciplinary proceedings or instances of similar conduct, and whether the conduct is criminal.

- Effect. To determine whether the misconduct has the effect of “violating an individual’s dignity or creating an intimidating, hostile, degrading, humiliating or offensive environment”, firms must consider the affected individual’s perception and objectively assess whether it is reasonable for the conduct to have the alleged effect.

- Individual conduct. The misconduct must be in breach of Individual Conduct Rules 1 (integrity) or 2 (due skill, care and diligence).

Factors determining the scope of the non-financial misconduct rule

COCON does not capture conduct that occurs in the private life of individuals. To determine whether conduct takes place in the context of an individual’s private life, firms should consider key factors such as the nature of the event, its location and the people involved. In borderline cases, relevant factors include whether the event in question was:

- organised by a manager so direct reports felt obliged to attend;

- a continuation of a firm event; or

- a firm event where the misconduct started and then continued at a separate event.

COCON also does not apply to conduct that relates to a firm’s business rather than its SMCR financial activities.

Impact on the Fit and Proper test

Non-financial misconduct should be taken into account when assessing whether a person meets the Fit and Proper test, even where such misconduct takes place in his or her private life, provided that such misconduct shows that the individual is likely to breach regulatory requirements.

Firms are not required to monitor employees’ private lives under the guidance but do need to determine the steps they would take on becoming aware of relevant matters.

Compatibility with employment law and equality considerations

- The new non-financial misconduct rule aligns closely with employment law, particularly the Equality Act 2010. The definition of non-financial misconduct derives from the definition of harassment under the Act.

- If non-financial misconduct is carried out in relation to protected characteristics, this will be factored into an assessment of the conduct’s seriousness.

Next steps

The consultation on the draft guidance is open until 10 September 2025. As mentioned above, the new COCON rule will come into force on 1 September 2026, with any accompanying guidance to be published in advance to allow firms time to update their policies and procedures.

Firms are encouraged to review the consultation paper and provide feedback on the proposed guidance, cost estimates and the implementation timeline.

Decision trees

Client Alert 2025-185

Authors

Authors

Laura Neuhaus