Authors

Authors

Key takeaways

- The FTC’s annual threshold adjustments remind parties to work with outside counsel to determine whether transactions will require an HSR filing based on the value of the transaction and the size of the parties

- Even for nonreportable transactions, parties should consult with counsel regarding substantive antitrust issues because U.S. antitrust enforcers scrutinize transactions that fall below HSR reporting thresholds

- In addition to evaluating reportability under the updated HSR thresholds, merging parties must also prepare for the overhaul and additional burdens of the new HSR rules, effective for filings made on or after February 10, 2025

On January 10, 2025, the Federal Trade Commission (FTC) announced the annual threshold adjustments for premerger filings under the Hart-Scott-Rodino (HSR) Antitrust Improvements Act of 1976, as amended (15 U.S.C. section 18a). The FTC annually revises the thresholds based on the change in gross national product. The updated thresholds have increased the dollar amounts required to trigger an HSR filing for both the size-of-transaction and the size-of-person tests. The revised HSR thresholds will apply to all transactions that close on or after the effective date of 30 days after publication in the Federal Register.

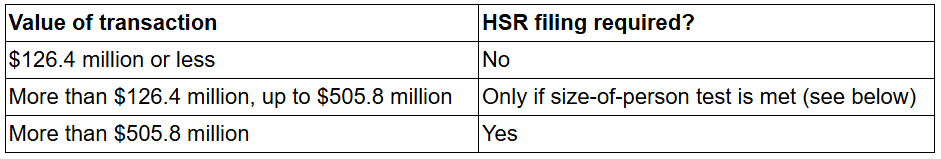

Adjusted threshold for the size-of-transaction test

The minimum value of a transaction that could trigger an HSR filing will increase from $119.5 million to $126.4 million.

For any agreement entered into prior to the effective date (30 days after publication in the Federal Register), the new thresholds will apply so long as the transaction is closed on or after the effective date.

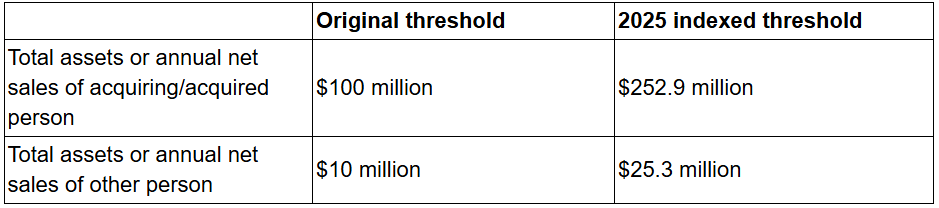

Adjusted thresholds for the size-of-person test

The following table reflects the new annual thresholds for the size-of-person test. For transactions valued at more than $126.4 million and up to $505.8 million, an HSR filing is required only if the size-of-person test is met.

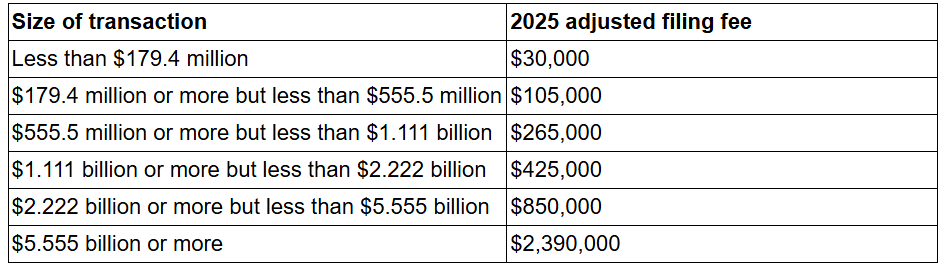

Filing fee thresholds

The fees paid by parties subject to HSR review depend on the reported size of the transaction. The FTC approved changes to the HSR filing fee thresholds, which will similarly become effective 30 days after publication in the Federal Register. For transactions that are imminent or currently underway, the applicable filing fee thresholds are those in effect at the time of filing notification.

Amendments to the HSR rules

In addition to the revised size-of-transaction thresholds and filing fees, sweeping amendments to the HSR rules are slated to go into effect on February 10, 2025, which will dramatically increase the scope of information and documents required to be submitted with HSR filings. Among other changes, filing parties will be required to collect and submit a broader array of responsive documents; prepare descriptions of the parties’ competitive overlap, ownership structure, and deal rationale; and provide additional details regarding areas of potential or future competition and past acquisitions. In light of these substantial additional burdens, buyers and sellers should prepare and consult early with their antitrust counsel to avoid delays and tackle the new HSR form in stride.

Non-reportable and cleared transactions

The fact that a transaction does not meet HSR filing thresholds or has already received HSR clearance does not mean that the transaction is immune from scrutiny by antitrust enforcers. The Antitrust Division of the Department of Justice and the FTC have previously filed suits seeking to unwind consummated mergers, including mergers that had received clearance following antitrust review. Enforcers have also challenged transactions well below the threshold for the size-of-transaction test, including those with a purchase price of less than $10 million. Additionally, the FTC’s renewed interest in Section 5 of the FTC Act signals the agency’s intention to investigate unreportable transactions (or a series of unreportable transactions) that it views as constituting an “unfair method of competition.”

Given the overhaul of the HSR rules and the complexities and nuances in this area of the law, it is wise to consult with experienced antitrust counsel early in your transaction analysis regarding HSR filing obligations and substantive antitrust issues in connection with transactions of all sizes. To learn more about our antitrust experience, please contact any of the authors listed below or the Reed Smith lawyer with whom you regularly work.

Client Alert 2025-011

Authors