Authors

Read time: 6 mins

Asia’s need for energy is growing rapidly, as a result of a growing middle class (by 2030, 3.5 billion Asians will be middle class), rapid urbanization (by 2050, Asia’s urbanization rate will be nearly 65%, up from 50% today), industrialization, and economic growth (by 2040, the Asia-Pacific region will represent 50% of global GDP; currently it represents 47%). At present, fossil fuels (coal, oil and natural gas) dominate the total primary energy supply in Asia, with Asia accounting for 80% of the world’s coal power consumption. As the economies of Asia develop, the demand for energy is rising. According to the International Energy Agency, the overall energy demand for Southeast Asia grew 80% since 2000. As Asia seeks to reduce its greenhouse gas emissions, the energy transition is critical.

NEW: Energy transition in Asia 2024

The energy transition is a key phase in the ongoing fight against climate change and global warming where every country, including those in Asia, has a role to play.

Simply put by IRENA, “…the energy transition is a pathway toward transformation of the global energy sector from fossil-based to zero-carbon by the second half of this century. At its heart is the need to reduce energy-related (carbon dioxide) emissions to limit climate change.”

Even though Asian countries are at different stages of their energy transition journey, the 2021 United Nations Climate Change Conference (COP 26) fast-tracked climate action with more Asian governments and corporations committing to net-zero targets, piloting carbon taxes and considering sustainable solutions. The 2022 UN Climate Change Conference (COP 27) was marked by the historic announcement of the plan to create the Loss and Damage Fund aimed at “assisting developing countries that are particularly vulnerable to the adverse effects of climate change.” The idea is that the countries that are most impacted by the climate crisis, but which have contributed the least to its creation would be compensated. Although the scope of the fund, including the sources of funding and which countries would be eligible to receive aid, is yet to be determined, it is safe to assume that certain countries in Asia would be eligible to benefit from it. One such country mentioned by the UN Environment Program is Pakistan which “has suffered $30 billion in damages from severe flooding but emits less than 1% of global emissions.”

Another landmark announcement from COP 27 pertains to the Indonesia Just Energy Transition Plan (JETP). The JETP involves $20 billion in finance pledged by global lenders led by the U.S. and Japan over 3 to 5 years to facilitate Indonesia’s transition to lower carbon energy mixes. To accelerate the realization of financing commitments, Indonesia launched the investment proposal, known as the Comprehensive Investment Policy Plan (CIPP), on 21 November 2023.

The momentum around energy transition persisted through COP 28 which recently took place in Dubai. Over 120 nations (including Singapore, Japan, Malaysia, Republic of Korea and Thailand) signed the Global Renewables And Energy Efficiency Pledge. The pledge outlines a commitment to work together to triple the world’s installed renewable energy generation capacity to at least 11,000 GW by 2030 and collectively double the global average annual rate of energy efficiency improvements from around 2% to over 4% every year until 2030.

In addition, 63 countries signed a Global Cooling Pledge which seeks to cut cooling-related emissions across all sectors by at least 68% globally by 2050. These measures could pose significant difficulties for Southeast Asian signatories who are increasingly reliant on cooling technologies. COP 28 also saw the launch of the Climate Club – an initiative to tackle emissions from industry. Members (including Japan, Singapore, and South Korea) are to develop and share their assessments and best practices on climate mitigation policies and work towards a common understanding of the effectiveness and economic impact of such policies. The Club intends to help match countries with technical and financial support from private/public sources through its Global Matchmaking Platform.

Furthermore, COP 28 marked a groundbreaking agreement to shift away from fossil fuels. This marks the first time that the COP formally acknowledges and agrees to address the main cause of the climate crisis, signaling the end of the era of fossil fuel. This historic moment begs the question – who will pay for it and how do we get there?

In 2022, nearly 55% of global energy transition investment (of circa $546 billion) was made in China, Japan, Korea and India. This creates the right driver for increased levels of investment in the ‘Asian Green Economy’, the transition to which will impact multiple sectors, including healthcare, energy, agriculture and food industries.

The energy transition presents the biggest of all green economy investments and green house reduction opportunities for the region. Over the last decade, Asia has made visible progress toward the energy transition. The Asia Energy Transition Index (ETI) for 2021 – a benchmark measure of a country’s energy transition progress based on the current energy system and transition readiness – has improved at the fastest rate of 6% over the past 10 years, surpassing other regions in the world. In 2020, South Korea and Japan pledged to achieve “net zero” by 2050, commitments which have been embodied in legislation. While Malaysia and Vietnam committed to reaching net-zero by 2050 and Indonesia by 2060, their policy clarity is yet to be ironed out. China has also announced plans to peak its carbon emissions by 2030 and to become carbon neutral by 2060. More recently, Singapore joined the fray, announcing a new target of reaching “net zero by or around mid-century” during the 2022 Budget.

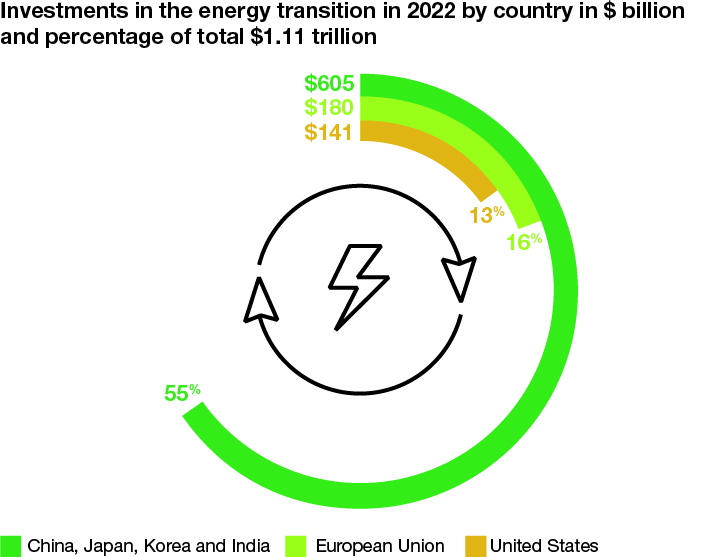

Investments in the energy transition in 2022 by country in $ billion and percentage of total $1.11 trillion

This chart shows the investment levels in energy transition in dollars and the percentage of the total investment ($1.11 trilion) by the key jurisdictions, which in summary is the following:

- China, Japan, Korea and India together accounts for 55% of the total invested, which is $605 trillion

- United States accounts for 13% of the total invested, which is $141 trillion

- European Union accounts for 16% of the total invested, which is $180 trillion

In these articles, we share our observations on certain key areas of the energy transition in Asia and some thoughts on what we can expect to see next in these areas. At the core of the energy transition is the move from fossil-based systems of energy production and consumption (including oil and coal) to renewable energy sources. Such renewable energy sources include wind, solar, geothermal and hydroelectric. The Renewables section examines some of the trends across the Asian renewable energy landscape.

While Asia’s renewable energy infrastructure continues to develop, there has been an increased focus on the role that new energy sources – in particular, hydrogen – can play in the energy transition journey. National and regional hydrogen plans are still in their infancy; however, some observers predict that hydrogen can constitute 5% or more of the 2030 energy system.

During the COP 28 Presidency’s High-Level Roundtable on Hydrogen a suite of flagship initiatives was launched to accelerate commercialisation of hydrogen, including (1) the Mutual Recognition of Certification Schemes for Hydrogen and Hydrogen Derivatives acknowledging that renewable and low-carbon hydrogen and hydrogen derivatives will play an essential role in meeting global energy needs and decarbonizing industries; and (2) a new ISO methodology (ISO/TS 19870) providing a global benchmark for greenhouse gas (GHG) emissions assessment of hydrogen pathways. Hydrogen (including its derivatives such as ammonia) has emerged as a key potential pathway for the energy transition as the world looks to sustainable fuels for shipping and aviation. Singapore in particular is striving to position itself as a regional hydrogen hub, having previously launched its National Hydrogen Strategy with the aim of adopting hydrogen across the power generation, industry, maritime, aviation and land transport sectors in the coming years.

As various Asian governments unveil initiatives promoting net carbon neutrality, we are also seeing bolder statements being made by governments and transportation manufacturers to phase out traditional fuel-based vehicles in favor of electric vehicles.

While battery-operated airplanes remain on the wish list, the growth in demand for electrified transportation vehicles, such as cars, buses, other commercial vehicles and even drones (electric vertical take-off and landing or eVTOL), has been significant.