Due to COVID-19, small and medium-sized businesses are facing a liquidity problem as cash reserves dry up. With no cash, due in part to government-mandated closures, businesses face bankruptcy. To keep these businesses afloat during this unprecedented time, the Senate proposed the Coronavirus Aid, Relief, and Economic Security Act (the CARES Act). The CARES Act aims to, among other things, provide working capital loans to small and medium-sized businesses through expanding the Small Business Administration’s (the SBA’s) loan eligibility requirements. The loan program is called the Paycheck Protection Program (PPP).

Eligible period

All PPP loans must be made on or before June 30, 2020.

Eligible businesses

To be eligible, a borrower needs to fit into one of the following three categories:

- The borrower employs not more than the greater of (i) 500 employees; or (ii) the “size standard in number of employees established by the [SBA]” for the industry in which the business operates.

- The borrower (i) is a sole proprietor, independent contractor, or eligible self-employed individual; and (ii) provides necessary documentation, as determined by the Administration, such as (a) payroll tax filings reported to the IRS, (b) Form 1099-MISC, and (c) income and expenses from the sole proprietorship.

- If the borrower has more than one physical location, the borrower (i) does not employ more than 500 employees per physical location, and (ii) is assigned a North American Industry Classification System (NAICS) code beginning with 72 (Accommodation and Food Services).

Waived affiliation rules

The SBA regulations1 used to determine affiliations and control are waived if:

- A borrower with less than 500 employees is assigned a NAICS code beginning with 72.

- A borrower operating as a franchise is assigned a franchiser code by the SBA.

- A borrower receives financial assistance from a company licensed under the Small Business Investment Act.

That said, these SBA regulations (13 CFR 121.103(b)) continue to provide for exclusion from the SBA’s affiliation rules for certain specifically identified business arrangements.

Loan Terms

- Loan amount

The maximum loan amount is the lesser of:

A. (2.5 Times Average Monthly Payroll Costs2) + (Outstanding Loan Amount3)

OR

B. $10,000,000

- Interest rate and maturity

The loan may not bear interest at a rate higher than 4 percent. The loan shall have a maximum maturity date of 10 years from the date on which the borrower applies for loan forgiveness under section 1106 of the CARES Act.

- Deferred principal and interest payments

If a borrower (i) was in operation on February 15, 2020, and (ii) has an application pending or approved for a PPP loan, then the SBA shall require lenders to provide complete payment deferment relief, including payments of principal, interest, and fees, for a period of not less than six months and not more than one year.

- Use of loan proceeds

The borrower may use the loan proceeds for (i) payroll costs; (ii) costs related to group healthcare benefits during periods of paid sick, medical, or family leave, and insurance premiums; (iii) employee salaries, commissions, or similar compensations; (iv) payment of interest on any mortgage obligation (not including prepayment or payment of principal); (v) rent; (vi) utilities; and (vii) interest on any other debt obligation incurred prior to February 15, 2020.

The SBA will not have any recourse against any individual shareholder, member, or partner of an eligible borrower, except to the extent that the individual shareholder, member, or partner uses the loan proceeds for an unauthorized purpose.

- Borrower certification

The borrower must make the following certifications in good faith:

- That the uncertainty of current economic conditions makes necessary the loan request to support the ongoing operations of the eligible borrower.

- That funds will be used to retain workers and maintain payroll or make mortgage payments, lease payments, and utility payments.

- That the eligible recipient does not have an application pending for a loan under this subsection for the same purpose and duplicative of amounts applied for or received under a covered loan.

- That during the period beginning December 31, 2020, the eligible borrower has not received amounts under this subsection for the same purpose and duplicative of amounts applied for or received under an SBA loan.

- Lenders’ considerations

In making a PPP loan, a lender must consider whether the borrower (i) was in operation on February 15, 2020, and (ii) had (a) employees that the borrower paid salaries and payroll taxes, or (b) independent contractors, as reported on a Form 1099-MISC.

- Waiver of fees, forgiveness, taxability, personal guaranty, and collateral

The SBA shall collect no fee. A PPP loan shall not require an individual or entity to provide a personal guaranty. Further, a PPP loan shall not require a borrower to provide collateral.

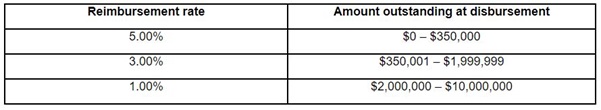

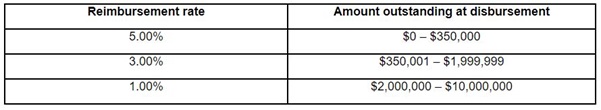

Lender Reimbursement

The SBA shall reimburse a lender authorized to make a PPP loan. The reimbursement rates are equal to:

Forgiveness

All or a portion of the principal amount of a PPP loan may be forgiven. The principal eligible for forgiveness is calculated by determining the applicable expenses incurred and paid by the borrower during a “covered period” of eight weeks. Expenses, such as payroll costs, interest on covered mortgage obligations, rent paid on covered lease obligations, and covered utility costs are included in the applicable calculation. Covered mortgage obligations are debts secured by a mortgage on real or personal property prior to February 15, 2020. A covered rent obligation is rent payable under a lease agreement in force prior to February 15, 2020. Covered utility payments are payments for electricity, gas, water, transportation, telephone, or internet, for which the service was in place prior to February 15, 2020. The covered period is the eight-week period beginning on the date of origination of the PPP loan.

Taxability

For purposes of the Internal Revenue Code of 1986, any amount that would be included in the gross income of the eligible recipient by reason of forgiveness (see above) shall be excluded from gross income.

Secondary market transactions and regulatory capital requirements

PPP loans are eligible to be sold in the secondary market. The SBA may not collect any fee for any loan sold into the secondary market. Each PPP loan shall receive a risk weight of zero percent with respect to appropriate federal banking agencies or the National Credit Union Administration (NCUA) Board applying their risk-based capital requirements.

Troubled Debt Restructuring (TDR) disclosures

Notwithstanding any other provision of law, an insured depository institution or an insured credit union that modifies a covered loan in relation to COVID–19-related difficulties in a TDR on or after March 13, 2020 shall not be required to comply with the Financial Accounting Standards Board Accounting Standards Codification Subtopic 310-40 ('Receivables – Troubled Debt Restructurings by Creditors') for purposes of compliance with the requirements of the Federal Deposit Insurance Act (12 USC 1811 et seq.), until such time and under such circumstances as the appropriate federal banking agency or the NCUA Board, as applicable, determines appropriate.

Additional guidance coming soon

In the coming days, lenders can expect to see additional guidance with lending mechanics for PPP loans. Specifically, the CARES Act directs the SBA to promulgate guidance for lenders to ensure that PPP loans prioritize small businesses and entities in underserved and rural markets or controlled by economically disadvantaged individuals.

Conclusion

Lenders are preparing to make these business-saving loans to eligible small businesses. With Treasury Department and SBA guidance expected in the next few days, Lenders will be in a position to start lending immediately.

- 13 CFR section 121.103.

- As defined in the CARES Act.

- The CARES Act allows the SBA’s disaster loans between January 31, 2020 and the date of the PPP loan to be included in the PPP loan amount calculation.

Our Reed Smith Coronavirus team includes multidisciplinary lawyers from Asia, EME and the United States who stand ready to advise you on the issues above or others you may face related to COVID-19.

For more information on the legal and business implications of COVID-19, visit the Reed Smith Coronavirus (COVID-19) Resource Center or contact us at COVID-19@reedsmith.com

Client Alert 2020-181