Background

Singapore’s drive towards environmentally sustainable financial conduct is consistent with international commitments and policy principles that are giving environmental, social and corporate governance (ESG) standards an increasingly prominent role in the financial sector. These include, among others, the Paris Agreement (which obliges its 195 signatories, including Singapore, to reduce the risk and impacts of climate change with an objective of the overall amount of global emissions peaking by 2030 at the latest), the United Nations Principles for Responsible Investment (which have led to an increase in asset owners and professional investors adopting ESG objectives and policy commitments), and the United Nations Sustainable Development Goals (a set of aspirational sustainable objectives, many with targets that have to be achieved by 2030, agreed to by all member states of the United Nations).

The MAS is also working closely with other financial supervisors to strengthen the financial system’s resilience to environmental risk, for example, within the Central Banks and Supervisors Network for Greening the Financial System, the Sustainable Insurance Forum, and the International Organisation of Securities Commissions.

Overview of the ERM Guidelines

The ERM Guidelines set out the MAS’ supervisory expectations for FIs in respect of their governance, risk management, and disclosure of environmental risk. They comprise the following core components:

- Governance – Boards and senior management of FIs are expected to factor environmental considerations into their strategies, business plans and product offerings, and maintain effective oversight of the management of environmental risk.

- Risk management – FIs should implement policies and processes to assess, monitor, and manage environmental risk.

- Disclosure – FIs should disclose their environmental risks on a regular and meaningful basis, with a view to enhancing market discipline by investors.

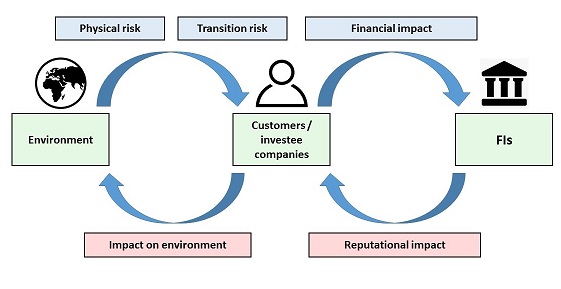

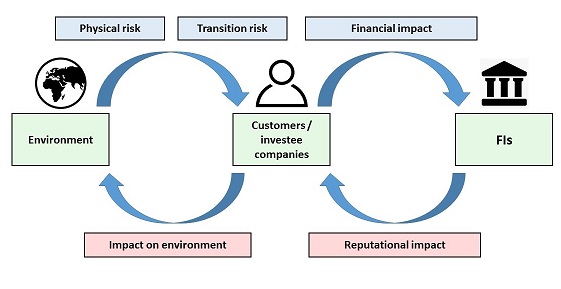

In this context, environmental risk should be understood not only as the risk of reputational impact on an FI, but also as a factor that has a direct financial bearing on FIs due to environmental interactions with their physical and transition risk channels. In relation to physical risk, the MAS highlights the impact of weather events and long-term or widespread environmental changes, which can impair the collateral value of bank loans and revenue-generating assets, and can lead to significant insurance claims. As concerns transition risk, the MAS considers this to arise from the process of adjustment to an environmentally sustainable economy, including changes in public policies, disruptive technological developments, and shifts in consumer and investor preferences. For example, in the transition to a low-carbon economy, loans and investments in carbon-intensive sectors can be impaired as the profitability of these businesses is impacted. This impact may be aggravated by other environmental factors, such as changes in land use, pollution and loss of biodiversity.

We set out below a summary overview of the proposed requirements under the ERM Guidelines for banks, asset managers and insurers, respectively. Given that business models and their scale and scope differ across FIs, an FI will be expected to apply the ERM Guidelines in a manner commensurate with the size and nature of its activities and its risk profile.

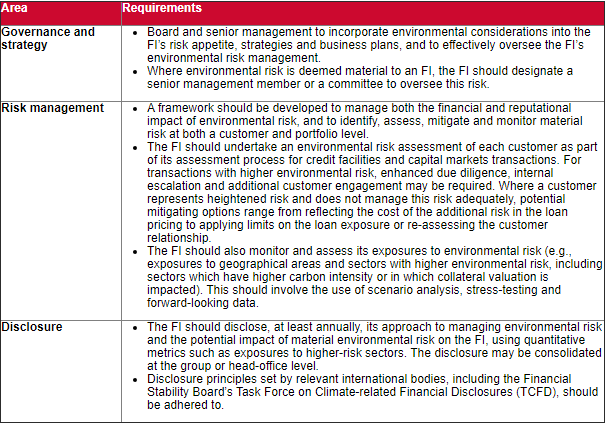

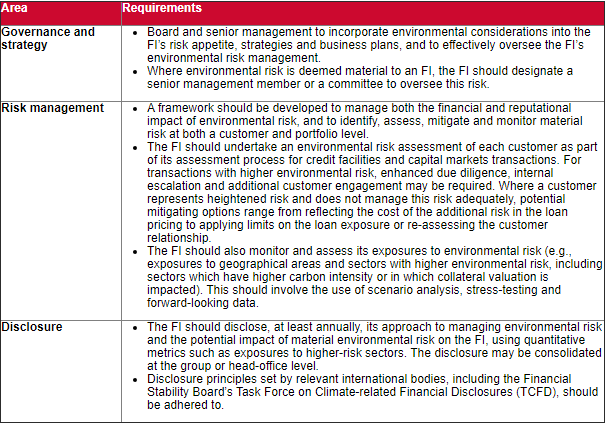

Banks and finance companies

FIs subject to the ERM Guidelines for banks and finance companies will include banks licensed under the Banking Act, merchant banks approved under the Monetary Authority of Singapore Act, and finance companies licensed under the Finance Companies Act. These FIs should apply the ERM Guidelines when extending credit to corporate customers, underwriting capital market transactions, and conducting other activities exposing them to material environmental risk.

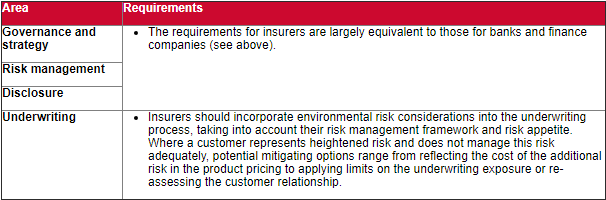

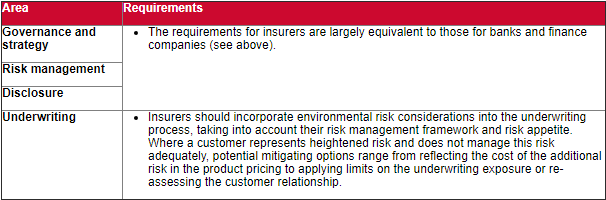

Insurers

FIs subject to the ERM Guidelines for insurers will include all insurers regulated under the Insurance Act, including general and life insurers, and those carrying on business under a foreign insurer scheme. These FIs should apply the ERM Guidelines when carrying on underwriting and investment activities, and other activities exposing them to material environmental risk.

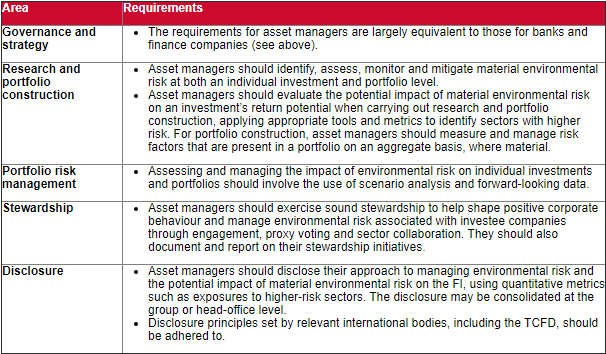

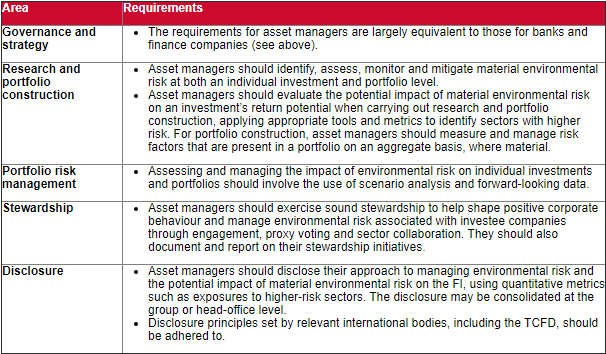

Asset managers

FIs subject to the ERM Guidelines for asset managers will include all institutions licensed to carry on the regulated activity of fund management or real estate investment trust management, and all registered fund management companies, under the Securities and Futures Act. To the extent they engage in investment management, banks should also adhere to the ERM Guidelines for asset managers. These FIs should apply the ERM Guidelines when carrying on discretionary fund management activities.

Implementation timeframe

The consultations will close on 7 August 2020. The MAS will then respond to industry feedback, and the ERM Guidelines will take effect on a date that remains to be confirmed.

Recognising that FIs may face initial challenges in implementing the ERM Guidelines (e.g., as relevant data and risk-management expertise may not be immediately available), the MAS proposes to allow a 12-month transition period following issuance of the ERM Guidelines, during which FIs can phase in their compliance incrementally.

Commentary

The introduction of the ERM Guidelines represents a vital step in Singapore’s transition towards an environmentally sustainable financial sector. Formerly the preserve of industry-driven stewardship and internal FI policy, the effective management of environmental risk is now being elevated to the status of a regulatory expectation. In introducing the proposed ERM Guidelines, the MAS is aligning itself with regulators in other sophisticated financial jurisdictions where similar implementation processes are underway. These include, for example, the European Union (where sustainability considerations are being integrated into the financial policy framework via corporate disclosure standards, a taxonomy for sustainable activities, low-carbon benchmark standards and a green-bond standard) and Hong Kong (where various initiatives have been launched to incorporate sustainability standards into the local regulatory framework, including a multi-agency steering group to provide strategic policy direction in this area).

Although the proposed ERM Guidelines do not take the form of statute or of a notice issued by the MAS (either of which would be legally binding on FIs), enshrining them in the form of guidelines is a significant step. While guidelines technically set out ‘best practice standards’ and contravening them is not a criminal offence and does not attract civil penalties, FIs are nonetheless expected to observe the spirit of guidelines, and non-compliance may have an impact on the MAS’ overall risk assessment of an FI. While many FIs already apply their own ESG standards on a voluntary basis, the ERM Guidelines are likely to accelerate and intensify FIs’ focus on environmental risk factors.

Added to the regulatory status of the ERM Guidelines, their content is of great significance. It is clear that while the ERM Guidelines only apply to certain categories of FI, these FIs are fundamental to the provision of credit, the underwriting of risk and the distribution of capital, both within Singapore and across the various regions in which the FIs and their customers operate. The ERM Guidelines are therefore likely to exert a significant ripple effect which, in the medium to long term, is likely to have a broader systemic impact across all sectors of the economy. It is noteworthy, for example, that the ERM Guidelines require FIs to scrutinise the environmental credentials of their customers and to draw concrete consequences where the latter are not able to adequately manage environmental risk, which may require the FI to reassess and even exit the customer relationship where appropriate. This is consistent with a trend that is already observable in the financial sector, e.g., in the policy of numerous banks to refuse to extend credit to businesses operating in the coal sector or other areas that are not deemed environmentally sustainable.

While the ERM Guidelines still remain subject to change through the consultation process, FIs and their customers should already assess how the ERM Guidelines are likely to impact them, and consider which practical steps may need to be taken to ensure compliance with the expectations set out in the ERM Guidelines. For FIs, this is likely to require, at a minimum, a comprehensive review and gap analysis of:

- their internal governance and control framework (including at board and senior management level);

- their investment policies;

- their policies and procedures for customer due diligence and engagement;

- their customer-facing documentation and disclosures; and

- their supplier and outsourcing relationships.

Reed Smith LLP is licensed to operate as a foreign law practice in Singapore under the name and style, Reed Smith Pte Ltd (hereafter collectively, "Reed Smith"). Where advice on Singapore law is required, we will refer the matter to and work with Reed Smith's Formal Law Alliance partner in Singapore, Resource Law LLC, where necessary.

- The consultation papers can be accessed on www.mas.gov.sg.

- The Association of Banks in Singapore, General Insurance Association of Singapore, Life Insurance Association Singapore, Singapore Reinsurers’ Association, and Investment Management Association of Singapore.

Client Alert 2020-426