Background

The NSR regime for foreign investments was first introduced by the Chinese government in 2006 under the Provisions on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors.1 Since then, the PRC Anti-Monopoly Law (2007), the PRC National Security Law (2015) and the PRC Foreign Investment Law (2019), as well as notices issued by the State Council in 2011 and 2015, have reaffirmed and further developed the regime governing the NSR foreign investments.

In the light of China’s further opening up to foreign investment (see our client alert) in the past two years, the FINSR Measures, as the latest development in the NSR regime for foreign investments, are expected to become a major policy tool to mitigate the negative impact of foreign investments on the PRC’s national security.

Key provisions

We set out below the key provisions of the FINSR Measures, which consist of 23 articles.

Foreign investments

Under the FINSR Measures, ‘foreign investments’ refers to investments made directly or indirectly by foreign investors in China, including:

- New projects or companies in China that a foreign investor, acting alone or jointly with other investor(s) (i.e., greenfield foreign investments), has invested in or established.

- The acquisition by foreign investors of equity interests in or the assets of domestic companies (i.e., foreign investments via M&A).

- Investments in China by foreign investors through other means (such as through contractual arrangements, trusts, leases, re-investments, subscription for convertible bonds, or public trading on stock exchanges).

Investments in China made by investors from Hong Kong, Macau and Taiwan are treated as foreign investments for the purpose of the FINSR Measures.

Covered foreign investments

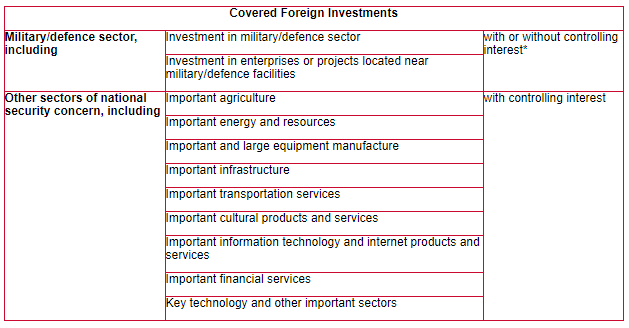

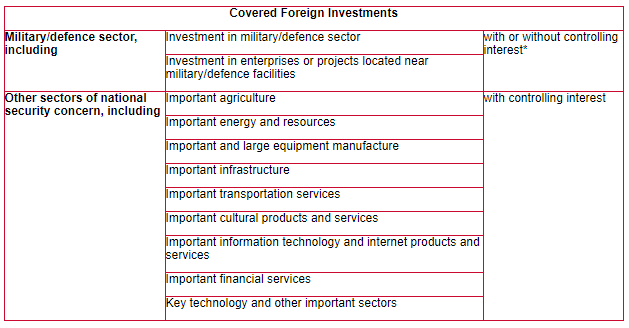

Under the FINSR Measures, foreign investments with a controlling interest that are made in specific sectors of the economy (other than those made in the military/defence sector) will trigger the NSR filing requirement. The applicable foreign investments (the Covered Foreign Investments) are summarised in the table below.

A ‘controlling interest’ is considered to exist if (i) an entity has a 50 per cent or more ownership interest in the invested company; (ii) an entity has less than a 50 per cent ownership interest, but has the voting rights to materially influence decisions of the board or shareholders’ meetings; or (iii) other scenarios occur, giving rise to foreign investors’ ability to exert a material influence on the operational decisions, personnel, finances, technology and similar of the invested company.

NSR Mechanism and procedure

- The NDRC will establish an office (the FINSR Office) to work together with MOFCOM in leading and administering national security reviews.

- NSR filings must be made through the NDRC’s administrative services centre in Beijing, or through applicable departments at the provincial government level when and as authorised by the FINSR Office.

- Parties to a proposed foreign investment may conduct a pre-filing consultation with the FINSR Office to confirm whether a filing is necessary for the proposed foreign investment.

- The NSR filing and review of a Covered Foreign Investment consist of the following three stages. The decision of the FINSR Office is final and not subject to judicial review or appeal.

(a) Preliminary review

Prior to carrying out the Covered Foreign Investment, the foreign investor(s) or Chinese parties to the investment must make a filing to the FINSR Office. Within 15 working days of official receipt, the FINSR Office shall carry out a preliminary review and decide whether or not a security review is necessary and notify its decision in writing to the filing party.

(b) General review

If after the preliminary review the FINSR Office decides to conduct a security review in respect of the proposed foreign investment, it shall complete a general review to determine whether the foreign investment will or might have a negative impact on national security, within 30 working days after its decision to carry out the general review.

(c) Special review

- If after the general review the FINSR Office determines that the foreign investment will or might have a negative impact on national security, the FINSR Office shall proceed with a special review and notify the filing party of its decision.

- The FINSR Office shall complete the special review within 60 working days of notification, which may be extended in specific circumstances.

- Upon completion of the special review, if the FINSR Office determines that the investment will not impact national security, it will notify the filing party and the foreign investment may proceed; otherwise, the FINSR Office may prohibit the foreign investment or impose certain conditions to mitigate the impact of the foreign investment.

Consequences of non-compliance

If parties carry out a Covered Foreign Investment in violation of the FINSR Measures, the FINSR Office has the power to order the divesture of the associated equity interests or assets, or otherwise reverse the foreign investment or take other measures to eliminate the impact on national security.

Parties that violate the FINSR Measures will also be logged in the Chinese national credit information system and subject to sanction by Chinese government agencies (including restrictions on bidding for projects, removal of preferential tax treatment, etc.).

Conclusion

Given that covered sectors and controlling interests are broadly defined, the FINSR Office will have wide scope in interpreting and administering the FINSR Measures. It remains to be seen whether the NDRC will issue any further guidance on the FINSR Measures. We will closely follow up and keep you updated on any further developments in this regard.

- Promulgated by MOFCOM, together with five other ministries and state commissions, on 8 August 2006.

Client Alert 2020-626