What are pre-pack sales?

Pre-pack sales involve the sale of company assets (usually the entire business) by an administrator immediately upon or shortly after commencement of the administration. The marketing of the assets as well as the negotiations of the sale terms between the company and the purchaser occur confidentially prior to the opening of insolvency proceedings with the involvement of the proposed administrator.

Pre-pack sales are a useful tool to enable a quick and smooth transfer of company assets through a going concern sale, thereby preserving value by ensuring business continuity. Used appropriately, pre-pack sales avoid the costs of a trading administration, save jobs and often result in higher returns for creditors than would be achievable in alternative insolvency processes. Pre-pack sales represent around 29 per cent of all administrations.1

Why reform pre-pack sales?

The inherent lack of transparency of pre-pack sales can be a source of criticism, although predominately in the SME market. Unsecured creditors of the company in particular will not receive prior notice of the pre-pack sale and so can feel disenfranchised from the process.

The perception of a lack of transparency can be heightened when the sale is to a connected party (i.e. someone who was involved in the insolvent company, such as a director or shareholder). This can reinforce the view of creditors with little hope of meaningful recovery that the purchaser is ‘asset stripping’ the company by transferring valuable assets out and leaving the liabilities behind.

Given that sales to connected parties account for roughly half of all pre-pack sales, the Government has recognised the importance of ensuring that creditors have confidence in the process.

Background to the reforms

Criticisms of pre-pack sales are not new. In 2013, the Government commissioned the Graham Review2 that recommended a package of voluntary measures to address the concerns raised.

These included the establishment of:

- Six principles of good marketing to be included in the administrator’s SIP 16 report.

- An option for a connected party purchaser to provide a ‘viability review’ on the new company’s survival prospects for the next 12 months following the administration purchase.

- A group of experienced business people available to independently review pre-pack sales, known as the ‘Pool’.

The Pool operates by the connected party making an application via a secure, online portal. A Pool member then provides (for a small fee) an independent review of the proposed sale by assessing the reasonableness of the transaction within 48 hours of the application.3 On reviewing the details of the deal (including its heads of terms), the value of the assets being purchased and the likely involvement of connected parties in the new business, the Pool member issues an opinion that:

- Nothing was found to suggest that the grounds for the proposed pre-pack sale are unreasonable. This means the Pool member has been provided with sufficient information and nothing within the information suggests the proposed pre-pack sale to the connected party is unreasonable.

- Evidence provided has been limited in some areas, but otherwise nothing has been found to suggest that the grounds for the proposed pre-pack sale are unreasonable. This means the Pool member has been provided with information and there is nothing within that information to suggest the proposed pre-pack sale is unreasonable. However some elements of the evidence presented or arguments made by the connected party (mostly likely considered by the Pool member as not being of major significance) were limited and not sufficiently made out.

- There is a lack of evidence to support a statement that the grounds for the proposed pre-pack sale are reasonable. This means the Pool member was not persuaded that the grounds for proceeding through a pre-pack transaction were sufficiently made out, on the basis of the evidence presented or arguments made by the connected party.

A negative opinion from the Pool does not mean that a sale cannot go ahead but, if the administrator decides to proceed with the sale to the connected party, the SIP 16 report needs to include an explanation as to why the sale was appropriate despite the unfavourable opinion.

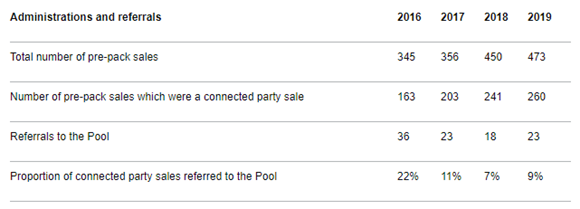

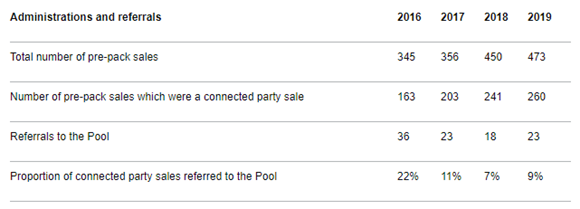

It was expected that the Pool would deal with around 200 applications per year, but uptake has been significantly lower than expected. As you can see from below table,4 despite a rising number of pre-pack sales involving connected parties, referrals to the Pool have remained low:

Around the time that the recommendations of the Graham Review were implemented, the Government also passed the Small Business, Enterprise and Employment Act 2015. This legislation introduced a reserve power into the Insolvency Act 1986 that granted the Secretary of State for Business, Energy & Industrial Strategy the power to either ban sales in administration to connected persons or impose restrictions on such sales through regulation. This power (which lasted for a five-year period) lapsed in May 2020. The power was granted to allow the Government a reasonable period to review the effectiveness of the measures described above and if those measures did not result in the desired change of behaviour or increased transparency, to then legislate accordingly.

The economic consequences of COVID-19 and associated lockdowns have raised concerns that a continued lack of effective regulation could exacerbate the issues surrounding pre-pack sales given the shortcomings of the current framework. Accordingly, as part of the passage of CIGA, the Government decided to revive and extend the power to regulate pre-pack sales to connected parties and the Government now has until June 2021 to regulate such sales.

While stating that the findings of the Graham Review remained valid and recognising the improvement brought to the pre-pack sales process in instances where the recommendations of the review were adopted, the Government has proposed further regulations to build on the existing voluntary measures.

What do the draft Regulations say?

The proposed Administration (Restrictions on Disposal etc. to Connected Persons) Regulations (Regulations) will apply to any ‘substantial disposal’ by an administrator. A substantial disposal involves a disposal, hiring out or sale to one or more connected persons during the first eight weeks of an administration, and includes disposals effected by a series of transactions.

‘Connected persons’ for the purposes of a substantial disposal captures those with a significant prior connection to the insolvent company, including directors, shareholders and close family members of those persons and also companies in the same group. The Regulations will restrict an administrator from making a substantial disposal unless:

- it is approved by the company’s creditors in conjunction with their approval of the administrator’s proposals (provided to creditors within eight weeks of the administration); or

- the connected person purchaser has obtained a report that meets the requirements set out in the Regulations.

Among other things, the report must specify the knowledge and experience of the evaluator and must identify the relevant assets to be sold, the consideration to be provided for the assets and the identity of the connected persons and their connection to the company.

The report must include a statement that the evaluator is either satisfied (a ‘case made opinion’) or not satisfied (a ‘case not made opinion’) that the consideration to be provided for the assets and the grounds for the substantial disposal are reasonable in the circumstances, along with (i) the reasons for such statement, (ii) a summary of the evidence relied on, and (iii) a statement that there was sufficient evidence for the evaluator to reach their opinion.

The report must be provided by an appropriately qualified independent evaluator unconnected to the purchaser and the administrator. The evaluator cannot have provided insolvency- or restructuring-related advice to the company or a connected company within the 12 months before the date of the report or have a conflict of interest that might prejudice their independence.

The administrator must send a copy of the report (excluding any confidential or commercially sensitive information) to creditors and to Companies House at the same time as the administrator’s statement of proposals (i.e. within eight weeks of the administration).

The administrator may nevertheless go ahead with the sale even where the evaluator is not satisfied that the consideration to be provided and the grounds for the substantial disposal are reasonable. If so, the evaluator’s report must include a statement from the administrator setting out the reasons for proceeding with the disposal.

Whilst no date has been set, we expect that the draft Regulations will go before Parliament soon given the June 2021 deadline.

Better for creditors?

The government has not implemented an outright ban on pre-pack sales to connected parties and instead tried to achieve a balance between addressing the concerns whilst not prohibiting the use of a valuable tool. It is unclear how the Regulations will work in practice and it remains to be seen whether they will achieve their stated aim of bringing greater transparency to the process. A number of concerns have been raised in respect of the proposed Regulations:

- Creditor involvement: Given the reason for using pre-pack sales, it is unlikely that creditors as a whole can be consulted in advance. This means that unless an administrator choses to obtain a report, they would need to rely on retrospective creditor consent for the sale. Given the uncertainty this creates, it is unlikely that an administrator would pursue this route. Creditors expecting to be more closely involved in the sale process will be disappointed.

- Opinion shopping: The Regulations do not prohibit connected party purchasers from obtaining multiple reports, so there may be a degree of “shopping around” by purchasers to find an evaluator who will provide a favourable report.

- The evaluator: The lack of specificity in the Regulations regarding the qualifications required of the evaluator are also of concern. Under the current draft, the evaluator simply needs to be satisfied that they have the requisite knowledge and experience to provide the report. There is presently no requirement for the evaluator to be a licensed insolvency practitioner or a similarly qualified person, whereas the administrator actually implementing the transaction must be.

- Transparency: The administrator’s ability to withhold information in the report on the basis that it is confidential or commercially sensitive may also mean that the Regulation’s aim of improving transparency may not be achievable in all situations.

- Effect of non-compliance: Whilst the administrator is not required to accept the evaluator’s opinion, it is unlikely that an administrator would want to agree to the sale where the evaluator determined that the sale is not reasonable in the circumstances. Conversely, it is presently unclear what recourse creditors may have should the administrator proceed in any event.

- Costs and likely impact: The Regulations are likely to add to the cost of the transaction and may result in delays where time is of the essence.

We understand the draft Regulations are currently expected to come into effect in April 2021 (in advance of the June 2021 deadline) and so are likely to be before Parliament in the spring. We look forward to the Parliamentary discussion on the proposed Regulations but anticipate there may be a number of amendments in response to the above concerns. In its current form, particularly in light of potential opinion shopping, it seems the Regulations may only bring limited improvements to creditors while simply adding further costs to the estate.

- Available at gov.uk.

- Available at gov.uk.

- Available at prepackpool.co.uk.

- Business, Energy and Industrial Strategy: Pre-pack sales in administration report, available at gov.uk.

In-depth 2020-613