Important

In light of the amendments, as further described below, in respect of the continuing obligations of listed issuers, please, in particular, be reminded to:

(i) ensure that the listed issuer establishes a nomination committee pursuant to the Listing Rules, if the listed issuer fails to set up a nomination committee on 1 January 2022, it must set up a nomination committee and/or appoint appropriate members to the nomination committee to meet the requirement(s) within three months. From 1 April 2022, if the listed issuer fails to set up a nomination committee, it must immediately publish an announcement containing the relevant details and reasons. If a nomination committee has already been established on 1 January 2022, to review the composition of the existing nomination committee and ensure that the requirements of the Listing Rules (as amended) are complied with;

(ii) review the corporate governance structure of the listed issuer to ensure that the new Corporate Governance Code Provision (CP) and new Mandatory Disclosure Requirements (MDR) (and, preferably, also the new Recommended Best Practice (RBP)) can be complied with in the financial year commencing on or after 1 January 2022, and establish, adopt and/or modify the relevant corporate governance policies and procedures of the listed issuer (including (i) its board diversity policy, (ii) its shareholders communication policy, (iii) alignment of the listed issuer’s purpose, values and strategy with its culture, (iv) a mechanism to ensure that independent views and input are available to the board, (v) its anti-corruption policy, (vi) its whistleblowing policy, (vii) its policy on directors’ remuneration, etc.) as appropriate; and

(iii) review the composition of the board of the listed issuer, and: (i) for listed issuers with a single gender board, take steps to ensure that there is no longer a single gender board by 31 December 2024 (or if earlier commitments were made, in accordance with such commitments), and (ii) for listed issuers whose non-executive directors (INEDs) are all INEDs serving more than nine years (Long Serving INEDs) take steps to appoint a new INED by the financial year commencing on or after 1 January 2023.

Please also note that the Stock Exchange has now stated emphatically that, going forward, deviation of CPs and failure to provide considered reasons and explanation in the manner set out in the Corporate Governance Code (CG Code) will be regarded as a breach of the Listing Rules.

Background

In April 2021, The Stock Exchange of Hong Kong Limited (the Stock Exchange) published a “Consultation Paper on Review of Corporate Governance Code and Related Listing Rules”.

The Stock Exchange stated that the key focus of the consultation was to “instil changes in mindset of an issuer’s board, promote board independence, incentivise board refreshment and succession planning, improve board diversity amongst issuers, and enhance communication between issuers and their shareholders and market integrity”.

The conclusions of the consultation were published on 10 December 2021, and, in view of the positive feedback from the market, amendments will be made to the Listing Rules accordingly.

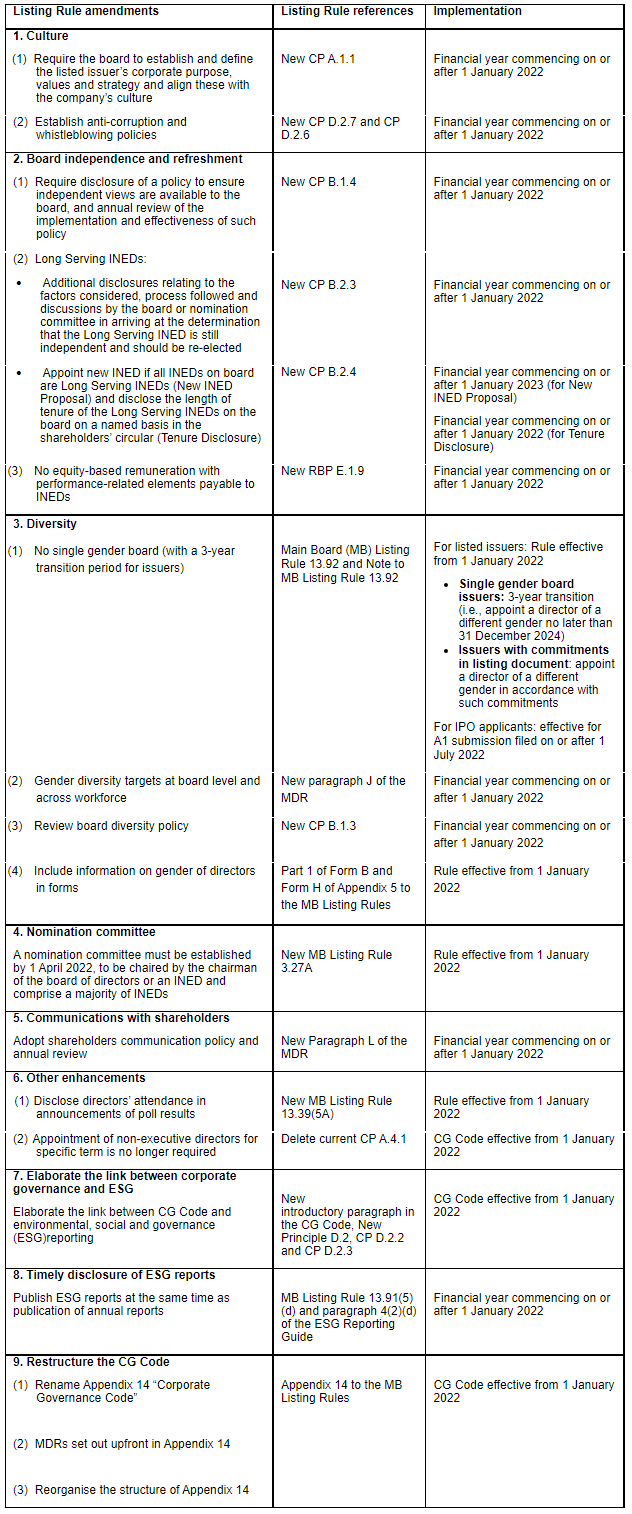

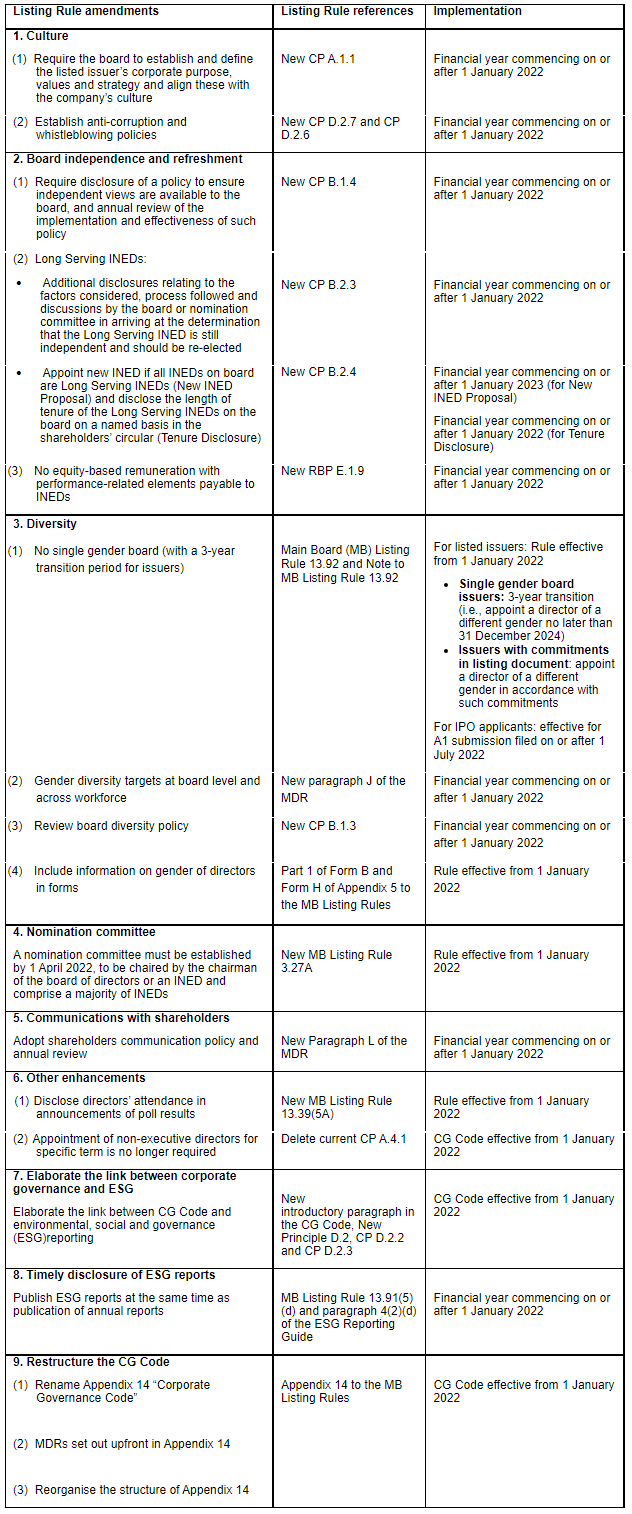

Key Listing Rule amendments and their implementation

Notes

- Like all existing CPs, the new CPs operate on a ‘comply or explain’ basis, pursuant to which listed issuers must state whether they have complied with the relevant CPs in their annual or interim reports (as appropriate), and if the listed issuers deviate from such new CPs, considered reasons for the deviation, and an explanation of how good corporate governance was nonetheless achieved, should be provided. Deviation of CPs and failure to provide considered reasons and an explanation in the manner set out in the CG Code will be regarded as a breach of the Listing Rules.

- In respect of the compliance requirements under the revised Listing Rules and disclosure to be made under the new MDRs, compliance and/or disclosure is mandatory. Failure to comply or disclose pursuant to such requirements will be regarded as a breach of the Listing Rules.

Brief notes on certain amendments

(1) Culture

- To align the company’s culture with its purpose, value and strategy –– The Stock Exchange believes that when a company’s culture is properly aligned with its strategy and leadership, the company can achieve long term sustainability.

The Stock Exchange believes that, as stated in its Consultation Paper:

“While it is not possible for the Exchange to prescribe a list of information for disclosure that suits all issuers, disclosures on “culture” may include the following issues which may be helpful to stakeholders to understand the company’s culture. Such disclosures should be precise and succinct (in general, should be no more than one page):

a) Description of the vision, value and strategy of the company, alongside with the company’s culture, and how all these affect the business model.

b) Description of the success measurements of the company (e.g. KPIs in terms of revenue growth; profit margins; return on equity; and market share), and discussion on how the company’s desired culture affects or contributes to the company’s performance.

c) Discussion on the measures used for assessing and monitoring culture (e.g. any specific indicators such as turnover rate; whistleblowing data; employee surveys; breaches of code of conduct; and regulatory breaches).

d) Description of the measures in place to ensure the desired culture and expected behaviours are clearly communicated to all employees, for example, through developing a code of conduct.

e) Information on the forum(s) available for sharing ideas and concerns on any misconduct or misalignment identified, and how they are dealt with.

f) Discussion on the company’s financial and non-financial incentives which support the desired culture.”

Thus, the new CP is not intended to codify ‘culture’, but to highlight the board’s role in (i) defining the company’s purpose, values and strategy, and (ii) developing the culture to support the pursuit of success. (The Stock Exchange will issue guidance with suggested disclosures.)

- Anti-corruption policy and whistleblowing policy – As accepted in many jurisdictions, anti-corruption and whistleblowing policies are crucial to establishing a healthy corporate culture, and such policies can raise awareness among the employees and management of listed issuers.

Under the existing Environmental, Social and Governance Reporting Guide (Appendix 27 to the Main Board Listing Rules), listed issuers are already required to disclose information relating to anti-corruption and whistleblowing policies and their implementation. The Stock Exchange has indicated that, depending on their individual circumstances, listed issuers may choose to have stand-alone anti-corruption and whistleblowing policies, or include the relevant provisions in their code of conduct or other policies.

(2) Board independence

- All independent INEDs serve more than nine years – In this case, the new CP requires that the listed issuer appoint a new INED at the next annual general meeting. A transition period will be allowed to implement this new proposal, i.e., the financial year commencing on or after 1 January 2023, to minimise the challenges in finding a suitable new INED.

(3) Diversity

- Single gender board – The Stock Exchange has decided to tighten the requirement for issuers to phase out single gender boards by stating in the Listing Rules that the Stock Exchange will not consider diversity to have been achieved if there is a single gender board; the absence of a prescribed percentage in the Listing Rules does not mean having a sole director of a different gender on the board is considered sufficient. For a listed issuer who already has directors of both genders on board on or after 1 January 2022, if the listed issuer subsequently fails to meet such requirement, it must immediately publish an announcement containing the relevant details and reasons. The listed issuer must appoint appropriate members to the board to meet the requirement within three months after failing to meet such requirement.

- Workforce diversity – At the workforce level, listed issuers will be required to disclose: (i) gender ratios in the workforce (including senior management), (ii) any plans or measurable objectives that they have set for achieving gender diversity, and (iii) any mitigating factors or circumstances which make achieving gender diversity across the workforce (including senior management) more challenging (or less relevant).

(4) Nomination committee

- Chairman of committee – The Listing Rules require listed issuers to establish a nomination committee. The Stock Exchange recognises the role of the board chairman in overseeing the board’s composition and succession planning, and ensuring its effective functioning, and will allow either the board chairman or an INED to chair the nomination committee with a majority of its members comprising INEDs.

(5) Renaming and restructuring the CG Code and establishing link with ESG

- Restructuring CG Code –– While the structure of Appendix 14 will be revised to enhance its flow and readability, and drafting amendments will be made to improve clarity, the Stock Exchange has stated that such changes involve no change in policy direction and will not result in any additional corporate governance requirements other than those referred to in the above table.

- Establishing link between CG Code and ESG –– As corporate governance and social responsibility are intrinsically linked, it is believed that an effective governance structure should include governance of ESG matters to ensure that listed issuers evaluate and manage ESG risks. The Listing Rules will be amended to ‘‘link’ the CG Code (Appendix 14) and the ESG Reporting Guide (Appendix 27) (cf.. New Principle D.2, and CPs D.2.2 and D.2.3).

- ESG reports – ESG reports must be published at the same time as annual reports.

We strongly recommend all directors should read the attached “Corporate Governance Guide for Boards and Directors” issued by the Stock Exchange in December 2021.

In relation to the amendments set out above, the Stock Exchange has also published an “Updates of Frequently Asked Questions on Corporate Governance Code and Related Listing Rules (FAQ Series 17)” on 29 December 2021.

In-depth 2021-342