Authors: Carolyn Chia

Policy objectives

Following the convergence of the media and telecoms regulatory frameworks in Singapore and the reconstitution of two previously separate authorities into a single statutory board, the Infocomm Media Development Authority of Singapore (IMDA), the code has been amended to merge and align the provisions in both frameworks, as well as to incorporate relevant updates arising from technological and business developments affecting both the media and telecoms industries.

Based on a thorough market study that was initiated as early as in 2014, IMDA spotted several macro trends that were expected to impact on competition in the media and telecoms markets over the coming years. These trends included:

- the transition to internet protocol (IP)-based services on the Nationwide Broadband Network;

- the increasing competitive edge of service bundling;

- the increasing competition from non-traditional digital platforms;the growth of over-the-top (OTT) media services; and

- the diminishing reach of traditional media platforms.

IMDA also took the opportunity to align the following regulatory principles and key provisions set forth in the previously separate codes for media and telecoms:

- Reliance on market forces, private negotiations and industry self-regulation

- Promotion of effective and sustainable competition

- Proportionate regulation

- Technology neutrality

- Open, transparent and reasoned decision making

- Avoidance of unnecessary delay

- Non-discrimination

- Consultation with other regulatory authorities

The code will be reviewed every five years, or sooner if necessary to reflect market developments.

Dominance

An entity which is dominant will be held to a higher standard of scrutiny. In other words, it will be subject to more ex ante and ex post regulation.

A licensed entity is dominant if it:

- operates facilities used to provide telecoms services that are sufficiently costly or difficult to replicate; or

- has significant market power. A presumption threshold of 50 per cent market share will be adopted for both the media and telecoms markets.

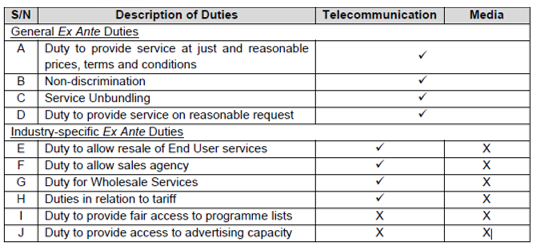

The duties imposed on dominant entities are as follows:

In relation to item H above (Duties in relation to tariff), a dominant telecoms licensee will need to notify IMDA of, and publish:

- tariffs for any new retail, wholesale or resale services offered to end users;

- any modifications to existing tariffs; and

- tariffs for offering services designed for specific customers or promotional schemes.

Such notification is a departure from the previous requirement for specific approval from IMDA. The change is aimed at more proportionate regulation whilst safeguarding against anti-competitive behaviour.

Anti-competitive conduct

Joint dominance

A new concept of joint dominance will be introduced into the code. There will be advisory guidelines to provide further clarity on its implementation, and any industry feedback will be taken into account.

Objects- vs effects-based tests

IMDA will adopt an effects-based test to determine if a dominant entity abused its dominance by engaging in discriminatory conduct. This means that evidence is required to show that the discriminatory conduct had the effect of restricting other licensees’ ability to compete, as opposed to merely showing that prices or terms were discriminatory under an objects-based test.

Price squeezes

In relation to price squeezes, the previous codes for media and telecoms differed in how they assessed whether there was anti-competitive price squeezing. In particular:

- The media code considered whether the input price affected the ability of an efficient, non-affiliated competitor to profitably offer services to consumers (the reasonably efficient operator, or REO, test).

- In contrast, the telecoms code determined whether the input price affected the ability of a dominant licensee’s downstream affiliate or equally efficient competitor to obtain a commercially reasonable profit for their end service (the equally efficient operator, or EEO, test).

IMDA decided that the EEO test should be adopted for determining if a dominant entity abused its dominance by engaging in price squeezes. This is due to the following reasons:

- The EEO test is similarly adopted under Singapore’s general competition law.

- Price squeezes could occur when a vertically integrated licensee that is dominant in the wholesale market sets the price of an input so high that competing downstream retailers that require the input to provide their service are unable to sell profitably even though they are equally efficient.

- The REO test could result in the false conclusion that a dominant entity has engaged in a price squeeze. A reasonably efficient, non-affiliated downstream retailer could have higher operating costs due to its smaller scale compared to the integrated dominant entity. The exit of a market player might also be caused by its own inefficiency.

Predatory pricing

Predatory pricing is another form of anti-competitive conduct addressed in the code. IMDA may adopt different cost benchmarks for assessing if pricing by a dominant entity is predatory.

Cross-subsidisation

The cross-subsidisation provisions, which previously only applied to the telecoms market, will now also apply to the media market. These will be triggered if a dominant entity uses revenues from the provision of a service in a market with no effective competition to cross-subsidise the price of a service in another market with effective competition, thereby unreasonably restricting competition in the latter market. Specifically, given that ‘intra-market’ cross-subsidisation (e.g., subsidising within TV content packages) is an industry practice in the media market, which is largely characterised by two-sided markets, IMDA recognised that network effects need to be taken into consideration in any assessment. Hence, the prohibition on cross-subsidisation will only apply to inter-market subsidising that leverages on a dominant entity’s significant market power, and not to inter-TV content package (or intra-market) subsidising.

Predator network alteration

The provisions on predator network alteration have been extended to apply consistently to both the media and telecoms markets. These are to be read alongside the existing general prohibition against unfair methods of competition that apply to all licensees, even if not dominant. For instance, a licensee is prohibited from taking or inducing anyone to take any action with the effect of degrading the availability or quality of another licensee’s services, or raising that other licensee’s costs, without a legitimate business, operational or technical justification.

Tying and bundling

Bundle-play is increasingly offered by media and telecoms providers in Singapore. Such providers must not leverage their dominance in one market to distort competition in other, relatively competitive markets. This form of ‘tying and bundling’ by a dominant licensee is a form of abuse of dominance under the code if it unreasonably restricts competition in any market. Such a policy position is aligned with the positions taken by overseas competition authorities in the EU, Australia, and Hong Kong.

Anti-competitive agreements

Currently, certain horizontal anti-competitive agreements (e.g., price fixing and bid rigging) are outright prohibited, without needing any assessment of their actual effect on competition (Per Se Prohibitions). However, Per Se Prohibitions are permitted if they are necessary to achieve significant efficiencies which will be passed on to end users. Such efficiencies could include reductions in the cost of developing, producing, marketing and delivering media or telecoms services. For consistency with other global frameworks, when determining if an agreement is anti-competitive, IMDA will apply a dual, alternative limb ‘object or effect’ test under the code.

IMDA will apply prohibitions on the following anti-competitive agreements to both the media and telecoms markets, subject to an assessment of their actual or likely effect on competition:

- Group boycott agreements

- Foreclosure of access

- Vertical market allocation

- Exclusive dealing

In addition, under the code, IMDA will prohibit the following types of unfair competition in both the media and telecoms markets:

- Degradation of service availability or quality

- Provision of false or misleading information to competitors

- Improper use of information regarding competing licensees’ customers

Consumer protection

The code is intended to safeguard consumer interests and ensure that entities provide services to end users on fair, reasonable, and non-discriminatory terms.

With that in mind, the consumer protection provisions in the updated code will:

- exclude resellers;

- apply to both residential and business end users in both media and telecoms markets, except for those provisions that relate specifically to the pay TV market, to the critical information summary requirement, and to the prohibition of detrimental or disadvantageous mid-contract changes in the telecoms market (which will only be applied to residential end users); and

- continue to not apply to OTT TV content.

Quality of service (QoS) standards

The intention for minimum QoS standards is to protect consumers. In view of declining pay TV services, IMDA will align the requirement on QoS standards for both media and telecoms markets, whilst extending the flexibility for lower QoS standards within the media market and continuously reviewing such standards to ensure their relevance given market developments.

Service termination and suspension

The same procedures for service termination and suspension will apply to both media and telecoms. End users must also be entitled to access a pay TV service even if it terminates a broadband service by the same provider.

End user service information

It was clarified that the end user service information requirements under the code will apply to both residential and business end users.

Critical information summary

To enhance transparency and understanding of the service terms by end users at the point of subscription:

- the disclosure requirements will be merged for both media and telecoms licensees; and

- the timeframe for providing end users with critical information summaries and service agreements will be shortened from 14 calendar days to five working days.

Free trial or complimentary services

A new requirement has been introduced to require licensees to provide a reminder notice to end users at least three, but not more than 14, working days before the end of a free trial or complimentary services, informing such users of the trial end date and that charges may be imposed thereafter.

Mandatory contract provisions

The following provisions must be included in all service agreements for both the media and telecoms markets:

- Billing period

- Prices and terms and conditions on the basis of which service will be provided

- No charges for unsolicited services

- Procedures for contesting charges

- Procedures for private dispute resolution

- Grounds and procedures for service termination or suspension by the licensee

- Purposes for which business end users’ service information may be used, and the means of granting and withdrawing consent

The following minimum information must be included in all bills to end users in both markets:

- The services subscribed to

- The respective value-added and ad hoc services and their charges, as well as third-party charges (roaming charges, international call charges, global SMS/MMS charges, premium rate service charges, billing-on-behalf charges, excess usage charges, etc.)

- The billing period

- An indication of when services are provided on a free trial or complimentary basis

- The expiry date of such free trial or complimentary service

Procedures for contesting charges

In their end user service agreements, telecoms providers are already required to detail the procedures for end users to contest disputed charges. This requirement will be extended to the media market, such that service contracts will need to spell out the circumstances under which an end user might withhold payment, the timeframe for contesting any disputed charges, and the applicable interest rates or methodology for establishing such rates.

Advance notice of advantageous service change or cessation of service

IMDA will introduce a requirement that end users must be notified in advance of any service change by a licensee that is “advantageous” to such end users. Some degree of flexibility will be provided as to how and when such notice should be given.

As for any cessation of service, at least three months’ advance notice in writing must be given to affected end users. IMDA retains the flexibility to specify a reasonable notice period in circumstances where it considers this necessary and appropriate.

Provisions that apply to a specific market

(A) The following provisions will apply to the telecoms market only:

- Prohibition on slamming

- Prohibition on detrimental mid-contract changes

Prohibition on slamming

It is prohibited for a telecoms licensee to change an end user’s telephone service without their prior consent. As competition in the telecoms sector intensifies, this prohibition will be retained, to ensure that consumers are safeguarded against such an unfair practice.

Prohibition on detrimental mid-contract changes

The prohibition against mid-contract changes that are detrimental to end users will apply to all telecoms licensees. However, as business end users are typically able to protect themselves better than residential end users, they will be excluded from such prohibition. IMDA will continue to monitor closely for related developments in the broader OTT landscape, and revisit its regulatory approach as may be necessary and appropriate.

(B) Conversely, the following provisions will apply to the media market only:

- One-month advance notice for mid-contract changes detrimental to end users

- Duty to offer short-term agreements

- Duty not to contract unreasonably

One-month advance notice for mid-contract changes detrimental to end users

As changes to pay TV content and channel line-ups are inevitable, providers must give at least one month’s notice to end users of any increase in subscription fees or the cessation of any content. Users are also allowed to exit their service contracts without incurring any early termination charges in certain circumstances, as specified under the code. This position has been maintained in the new code.

Duty to offer short-term agreements

IMDA has retained the requirement for pay TV providers to offer short-term agreements for all their service packages.

Duty not to contract unreasonably

It is common practice for providers to bundle their pay TV services with telecoms services, and there have been instances where end users have been forced to upgrade their telecoms services in order to purchase additional pay TV services. Hence, IMDA can claim a justifiable basis for retaining the prohibition against leveraging an end user’s pay TV service agreement to impose changes on a non-pay TV service from the same provider.

Mergers and acquisitions

The objective of the mergers and acquisitions (M&A) provisions in the code is to ensure that there is no substantial lessening of competition in either the media or telecoms market.

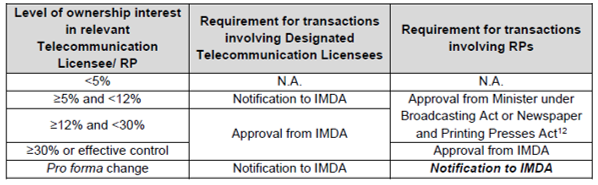

To this end, the following notification and approval requirements are imposed on M&A activity involving licensees:

For uniformity between the media and telecoms sectors, IMDA has adopted a 30 per cent market share threshold to determine whether a long-form or short-form consolidation application can be used. Consolidations involving at least 12 per cent but less than 30 per cent of the ownership interest in a licensee can rely on a short-form application, whereas consolidations involving 30 per cent or more of such ownership interest or effective control of a licensee will require a long-form application.

Whilst previously the time period for IMDA to review a consolidation application differed for the media and telecoms sectors, the following shorter review period will now apply to both:

- IMDA will ordinarily complete its consolidation review within 30 days after the start of the consolidation review period; and

- IMDA may extend the review period by up to 90 days, to a maximum of 120 days, if a consolidation application is deemed to raise novel or complex issues.

Resource sharing

IMDA has the power to designate a resource which requires sharing as either ‘critical support infrastructure’ (CSI) for the telecoms market, or an ‘essential resource’ for the media market. These terms will be retained for each of their respective markets. In certain instances, IMDA has the power to determine if public interest warrants a particular resource to be shared even if it is neither CSI nor an essential resource.

Whilst resource sharing can be required of all telecoms licensees, only facilities-based (and not services-based) operators can initiate a request for CSI to be shared.

Public interest obligations

These obligations will continue to apply to the media market only.

In 2010, a cross-carriage measure (CCM) was introduced in Singapore to discourage pay TV operators from pursuing an exclusive, content-centric strategy. Such a strategy resulted in a high degree of content fragmentation and inconvenience to consumers, whilst diverting resources away from other aspects of competition such as content and service innovation. IMDA has observed that, since the introduction of the CCM, content fragmentation has abated. As the CCM has been effective in achieving its policy objective, it remains relevant and will be retained, although its application will be limited to live programmes that are acquired on an exclusive basis.

Telecoms interconnection

The interconnection framework in the code has been updated to take into account, in particular, the shift from traditional copper and hybrid fibre-coaxial-based networks to IP-based networks.

Administrative provisions

Amendments were also made to align the administrative and enforcement procedures in the code for both markets, including for any reconsideration or informal guidance by IMDA, dispute resolution, and requests for enforcement by a private party.

Concluding remarks

Whilst the code review was largely focused on competition and market conduct, it was recognised that a broader policy objective might include fostering a pro-innovation environment, enhancing productivity, and elevating data privacy standards, all of which can only benefit Singapore as a whole.

What does this mean for you?

The changes made to the code span a wide range of activities, from the drafting and implementation of end user terms, to a licensee’s day-to-day operations, to potential merger transactions. If you are involved in the media and/or telecoms landscape and want to understand how these regulatory developments might impact your business, do reach out to any of the contacts in our market-leading team below.

In-depth 2022-126