Authors

Authors

Key takeaways

- The amendments shorten the filing deadline for initial filings of Schedules 13D and 13G;

- Clarify the amendment requirements for Schedule 13G and shorten the filing deadline; and

- Clarify the filing deadline for amendments to Schedule 13D

Background

Sections 13(d) and 13(g) of the Securities Exchange Act of 1934 require investors who beneficially own (directly or indirectly) more than 5 percent of a covered class of equity securities to publicly file a Schedule 13D or 13G. Beneficial ownership of an equity security occurs when a person has or shares the power to vote or direct the voting of a security or dispose of or direct the disposition of a security. In October 2023, the SEC issued release (33-11253) adopting certain rules and providing further guidance for existing rules. The amendments and related compliance obligations will be effective on February 5, 2024; however, required compliance with the accelerated filing deadlines for Schedule 13G is delayed until September 30, 2024.

In summary, the amendments:

- Increased the frequency of disclosures for “Passive Investors.”

- “Passive Investors” are defined as shareholders beneficially owning more than 5 percent of the class of subject securities and who can certify that the subject securities were not acquired or held for the purpose of and do not have the effect of changing or influencing the control of the issuer of such securities and were not acquired in connection with or as a participant in any transaction having such purpose or effect.

- Shortened filing deadlines for Schedule 13D and 13G filers.

- Extended EDGAR cut-off times for filing acceptance.

The guidance:

- Clarified who is a beneficial owner for reporting purposes under Rule 13d-3 when using certain cash-settled derivatives.

- Clarified the legal standard of the formation of a “group” under Rule 13d-5.

Accelerated filing timelines

To better reflect the fast-paced nature of modern markets, the amended rule shortened the filing timelines for Schedule 13D and Schedule 13G. For Schedule 13D filers, the filing deadlines will be five business days instead of ten calendar days. Further, any amendments must be filed within two business days of a “material change” as opposed to the vague “prompt filing” requirements under existing rules.

Schedule 13G filers will need to comply with the following timelines when making initial filings:

- Five business days after acquiring more than 5 percent of a covered class of securities, if the filer is a Passive Investor.

- Forty-five days after the end of a calendar quarter, if the filer is a Qualified Institutional Investor (QII) or an Exempt Investor, and its beneficial ownership exceeds 5 percent as of that quarter-end; or

- An “Exempt Investor” refers to a person holding more than 5 percent of a class of subject securities at the end of the calendar quarter, but who has not made an acquisition subject to Section 13(d).

- “Qualified Institutional Investors” refers to registered broker-dealers, banks, registered investment advisors, registered investments companies, and insurance companies.

- Five business days after the end of a calendar month, if the filer is a QII and its beneficial ownership exceeds 10 percent as of that month-end.

Schedule 13G filers will need to file amendments within 45 days after any calendar quarter in which a “material change” occurred as opposed to the old rule, which required amendments to be filed within 45 days of a calendar year after “any change” in the information previously reported.

Additionally, the EDGAR cut-off times for Schedule 13D and Schedule 13G filings will be extended from 5:30-10 p.m. Eastern time. This change allows filings received after 5:30 p.m. of a business day that were transmitted to the SEC on or before 10 p.m. to be deemed filed on that business day. This should provide additional time for beneficial owners to prepare and submit their Schedule 13 D and 13G filings.

Guidance on determining groups for beneficial ownership

As part of the reporting requirements of beneficial ownership, reporting may be required if two or more individuals act together to form a “group” to acquire, hold, vote on, or dispose of an issuer’s securities. The SEC elected to not adopt proposed amendments to Rule 13d-5 that would have codified the definition of a “group.” Rather, the SEC issued guidance on the current legal standard of group formation, emphasizing that a “group” can be formed even if there is no express agreement between parties if they “act as” a group. Whether two or more persons “act as” a group will depend on a fact-and-circumstance test that determines if those persons acted together for the purpose of “acquiring,” “holding,” or “disposing of” securities of a company. Additionally, the new guidance provided examples of activities, including common shareholder engagement actions among multiple shareholders that would not solely constitute “acting as” a group, such as:

- Discussions among shareholders in public or private involving independent and free exchange of ideas.

- Two or more shareholders engaging in conversations with management.

- Two or more shareholders jointly making recommendations to a company about the structure or composition of the board of directors, without commitments, agreements, understandings, or attempts to influence specific action.

- A shareholder’s intention to vote for an unaffiliated activist investor’s director nominees.

Moreover, the new guidance provided that a “group” can exist when a beneficial owner of a substantial block of securities shares information about an upcoming Schedule 13D filing, to the extent this information is not yet public and communicated with the intent of causing others to make similar purchases, and a person subsequently purchases the same securities based on this information. In this situation, both parties will become a “group,” which may trigger Schedule 13D filing obligations.

Guidance on cash-settled derivative securities

The SEC elected to not adopt a proposed addition to Rule 13d-3 that would have treated certain holders of cash-settled derivative securities as beneficial owners. Instead, the SEC provided guidance on its existing regulatory framework, similar to its 2011 guidance. Under the new guidance provided, while mere economic exposure is still insufficient to create beneficial ownership under Section 13(d) of the Securities Exchange Act, the holder of a non-security-based swap (non-SBS) cash-settled derivative will be deemed a beneficial owner of the underlying security and may have beneficial ownership reporting obligations if any of the following is true:

- The holder has, directly or indirectly, voting or investment power over the underlying security through a contractual term of the derivative security or otherwise;

- The non-SBS cash-settled derivative security was acquired with the purpose or effect of divesting its holder of beneficial ownership of the underlying security or preventing the vesting of beneficial ownership in order to evade the reporting requirements of Sections 13(d) or 13(g);

- The holder has a right to acquire the beneficial ownership of the equity security within 60 days; or

- The holder gained the right to acquire beneficial ownership of the equity security with the purpose or effect of changing or influencing the control of the issuer of the security for which the right is exercisable, or in connection with or as a participant in any transaction having such purpose or effect, regardless of when the right is exercisable.

New XBRL requirements and other changes

Beginning December 18, 2024, all disclosures – including quantitative disclosures, textual narratives, and identification checkboxes on Schedules 13D and 13G – must be tagged in Inline XBRL. Only exhibits filed with a Schedule 13D or 13G can remain unstructured. Voluntary compliance will be permitted beginning December 18, 2023.

The amendments updated the rules to clarify that:

- A group with reporting obligations under Sections 13(d) or 13(g) will be deemed to acquire any additional equity securities acquired by a member of the group after the group’s formation, while carving out intra-group transfers of equity securities.

- In Item 6 of Schedule 13D, a person is required to disclose interests in all derivative securities (including cash-settled derivative securities) that use the company’s equity security as an underlying security.

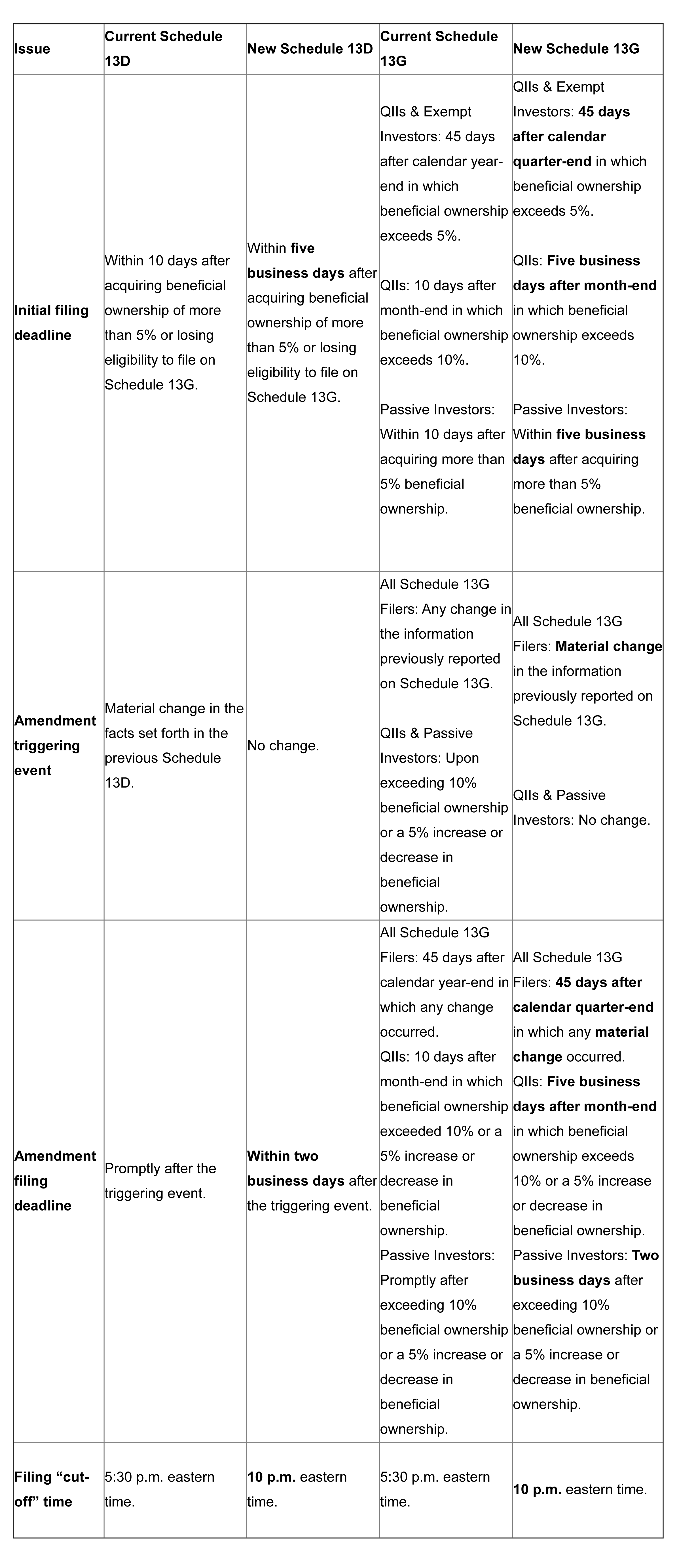

The below table from the adopting release summarizes many of the amendments.

Client Alert 2023-251

Authors