Authors

Key takeaways

- UK Treasury Technology Working Group report provides a blueprint for tokenising UK funds.

- Report sets out staged approach, baseline model, and key requirements for tokenised funds

- FCA and market participants found no significant barriers to creating a Stage One tokenised fund, report states

- Report lists Group recommendations for what is required to realise the benefits of tokenised funds

In November 2023, the Technology Working Group (the Group) of HM Treasury’s Asset Management Taskforce published an interim report that provides a blueprint for tokenising UK investment funds (the Report). The Report forms part of a wider initiative to harness the potential of innovative technologies, including blockchain and distributed ledger technology (DLT), for the UK asset management industry.

The Group worked closely with other sections of HM Treasury (HMT) and the FCA to produce the Report, which outlines a shared vision for a future funds industry where the full value chain is operated on DLT. The Report sets out a staged approach, starting with a baseline model (Stage One) which establishes the infrastructure for fund tokenisation in the UK funds market and could be used within the existing legal and regulatory framework, before adopting more complex approaches.

What is a tokenised fund?

Also known as digital funds, tokenised funds issue digital tokens that represent an investor’s shares or units in the fund. They are generally recorded and traded on a DLT, such as a smart contract-enabled blockchain, rather than using a traditional system of records. There are a number of variables in how they are tokenised (e.g the type of blockchain used, how record-keeping processes are kept on-chain, how public the ledger is, the distribution channels of the fund). Ultimately, tokenised funds are intended to provide a means of accessing increasingly digitised capital markets, where new and traditional forms of asset are issued and traded using DLT.

Why is the Group recommending that tokenised funds are developed further?

The Report notes three key drivers calling for urgent development of fund tokenisation in the UK:

- An increasing appetite from fund managers to leverage the experience gained from work being done in other jurisdictions. Fund tokenisation has been gathering pace internationally. Jurisdictions, including the EU, the United States and Singapore, are developing various models for fund tokenisation to cater for different distribution models. Investment from overseas makes up a significant portion of the UK’s asset management industry (almost half of the £8.8trn in assets managed in the UK are for international clients). Fund managers now have their sights set on equivalent opportunities within the UK market.

- A time-limited opportunity deriving from the UK authorities’ workstreams on future regulatory frameworks, the financial market, and digital forms of money. In July 2023, HMT consulted on its plans to introduce the UK Digital Securities Sandbox, which grants HMT powers to set up financial market infrastructure sandboxes and temporarily disapply or modify relevant legislation for selected participants, thereby allowing participants to trial the use of evolving market technologies within a more adaptable legal framework. These powers also allow HMT to make permanent changes to legislation based on what is learned from the sandbox. This means the changes can be implemented immediately following the conclusion of the sandbox.

- An ambition to interact more effectively with both the wider capital markets and investor communities. There is an ongoing need to remain competitive in the global context and interact efficiently with the international capital markets ecosystem which is increasingly focused on different use cases for DLT and tokenisation.

The Report lists various benefits of fund tokenisation for investment funds and investors, including the following:

- Simplification of records. A real-time record-keeping system shared across all parties eliminates the need for a centralised register and it also helps in simplifying records. This will help reduce the associated administrative costs to investors.

- Quicker settlement and reduced temporary liquidity funding. The time frame for settling fund interest transfers is often not aligned with the time frame for settlement of the underlying asset transfers. The resulting misaligned cashflows then require temporary funding. The ability of DLT to allow for settlement on a near-immediate basis will provide greater flexibility, reduce credit and operational risks and subsequently produce lower running costs for participants.

- Smart contracts. Smart contracts help enable the scaling of automated processes, such as distributions or corporate actions.

- Use as collateral. Institutional investors will be able to post their tokens as collateral, rather than needing to redeem their position in the fund in order to raise cash, which would prove useful in thinly traded markets or at times of stress. Likewise, it allows institutional investors greater autonomy in relation to the utilisation of their tokens.

- Data transparency. The tokens themselves can be embedded with data, enabling a direct route for investor disclosure of information such as rights and obligations of the token holder.

It is worthwhile to note that the Report describes the progress of fund tokenisation as a spectrum, with full implementation and maximum benefits as the end goal. However, the Group notes that a more efficient funds market is still achievable earlier on in the spectrum, with fast transaction and registry capabilities, more trading opportunities and a streamlined and automated fund servicing obligation.

The Vision

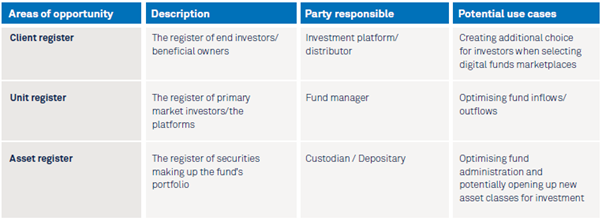

The Group has established a “Shared Vision” for implementing an operating model with full fund tokenisation as the long-term goal. The Group’s Shared Vision contemplates the following three potential fund registers in respect of UK funds:

The long-term vision sees each of these registers being accessible on-chain to provide the best commercial use case, with “synergies across the funds industry, linking individual investors at one end with the investible assets at the other and operating on a robust settlement layer that is secure, trustworthy, and capable of being decentralised”.

A staged approach

In order to tackle commercial, legal and technological issues that might challenge the achievement of the Shared Vision, the Report details a staged approach to implementing fund tokenisation in the UK. The first stage -- the Stage One baseline model -- focuses on the unit register, utilising DLT for sales and redemption transactions and acting as the register of holders. As units in funds (including those in digital form) are financial instruments, existing regulatory requirements in relation to the marketing and trading of such instruments are likely to apply.

A Stage One tokenised investment fund (which could be a new or pre-existing fund, or share class(es) of an otherwise off-chain fund) would have the following characteristics:

- Authorised fund. Established in the UK and FCA-authorised, the fund would be in scope of existing legal and regulatory regimes and the current legal and regulatory roles of all parties would remain the same (e.g. fund manager, depositary).

- Holds traditional assets. The fund’s portfolio would be comprised of mainstream assets, such as equities or bonds held by a custodian. The Report specifies that it would not hold cryptocurrencies.

- Off-chain, usual settlement cycle. Settlement of the transactions in the units of the fund would continue to be carried out off-chain (i.e. purchased from/redemption by the manager). The same timescales would apply, and payment records would need to interact effectively to ensure the on-chain register is up-to-date and compliant with regulatory client money requirements.

- Private, permissioned chain. Only identifiable parties with a legitimate interest would be able to access the network.

- Fund valuation. Fund valuation would continue to be provided on a daily basis, in line with existing regulation and market practice.

- Control over the register. The traditional register would be replaced by DLT records. Firms would need to have sufficient control over the register to carry out one-sided transactions or prevent transactions where required.

- Future-proof. Developments under Stage One should not prohibit any future innovation or interoperability.

The Report notes that the FCA and market participants have not identified any significant barriers to this approach under existing FCA rules applying to authorised funds. They do suggest, however, that firms should seek professional advice in relation to their individual legal and regulatory requirements. Where tokenised units fall within the regulatory perimeter (e.g. as transferable securities), firms carrying out custody of these assets are likely to be subject to regulatory requirements (e.g. the requirements set out in the FCA’s Client Assets Sourcebook.

Further stages following Stage One will explore how to develop the model. The characteristics of these will be considered in more detail in Phase Two, which is due to conclude this month.

The blueprint for implementation

The blueprint for implementation is intended to send a definitive message to the industry and wider stakeholders that the infrastructure for fund tokenisation in the UK has been established and can be utilised via the Stage One baseline model as described above. The various steps towards the Shared Vision are summarised below:

A: Utilising Stage One

The Report explains that firms are now able to utilise fund tokenisation using the Stage One baseline characteristics described above. However, the development of the market requires progress in a number of areas, including:

- Regulatory certainty for UK fund tokenisation. The FCA, together with a number of market participants, have conducted a high-level review of the existing rules and no obvious or significant barriers to Stage One were identified. However, as previously mentioned, the FCA expects firms to do their own due diligence to ensure their compliance with all relevant legal and regulatory frameworks.

- Foster DLT innovation across UK investment management industry: Stakeholders in the UK investment management industry should feel encouraged by the high level of engagement and commitment by UK regulatory authorities. The Group recommends that the Investment Association engages with the industry, the FCA, and HMT to progress stages of fund tokenisation and also that it works with relevant stakeholders to ensure they realise the tangible benefits and cost reduction promised by the technology.

- Money laundering regulations registration process. Currently, firms proposing to use DLT for fund tokenisation must register with the FCA, even if they are already FCA-authorised to undertake other financial services activities. Whilst this is a statutory requirement, the FCA is exploring whether it could more quickly determine money laundering regulations registration applications for firms already authorised to carry out regulated financial services activities.

B: Utilising future stages

The Report notes that any future stages will be dependent on industry feedback. It does, however, list some items relevant to certain use cases or that could be remedied to enable future progress:

- Industry to develop further stages of fund tokenisation. The Group invited industry participants to share their views on the Stage One model by the end of 2023 to develop further stages.

- Availability of digital forms of money to settle transactions. Digital forms of money, compared to traditional payment rails, provide greater efficiency and an on-chain mechanism. Fiat-backed stablecoins, where the coin is issued in or from the UK, are being brought within the perimeter of the Financial Services and Markets Act 2000 (FSMA), and these may be suitable for on-chain fund settlement. The retail digital pound, or a separate form of wholesale central digital bank currency, could also be used to settle high-value payments between financial firms.

- Legal considerations for investible assets. Whilst the Group notes that English law is flexible enough to cater for digital assets, various amendments to legislation might be necessary. The Group highlights the Law Commission’s concerns on the requirements of the Companies Act 2006 relating to the maintenance of members’ registers. They recommend that the government consider making the necessary modifications to provide clarity and drive investment. The Group also notes that future case law may provide clarity on the existing common law position for investors on ownership, title, delivery, and categorisation at the issuance level or tokenisation level.

- Central securities depository requirements. Admittance of securities to a trading venue requires admission to a central securities depository (CSD) under the UK Central Securities Depositories Regulation. This would apply to some tokenised funds and the Group notes that adding a digital security to a non-digital CSD results in the digital representation transitioning back to traditional operational structures rather than utilising the benefits and efficiencies of DLT. The Reports adds, however, that the HMT Digital Securities Sandbox will enable firms to act as a CSD in relation to digital securities under a modified legislative framework by applying to be designated as a digital securities depositary.

- Availability of digital identity. Concerns relating to the identification of potential investors within the digital funds industry remain, particularly regarding the ability to meet requirements under the Money Laundering Regulations 2017. The Report notes that the Data Protection and Information (No. 2) Bill, due to become law in 2024, should help to provide clarity and ensure an appropriate framework is in place for digital identification and verification services.

- Availability of banking services. Some firms providing services relating to tokenisation, such as FinTech companies, are unable to obtain banking services from UK banks. The Group recommends that HM Treasury consider whether further action is needed to encourage wider access to business accounts.

What’s next?

With the publication of the Report, the Group has completed Phase One: enabling UK funds to leverage DLT. Phase Two (Further Fund Tokenisation) is ongoing and scheduled to end in February 2024. The Group will explore how to develop the Stage One baseline model in more detail and expects there to be further Stages over time. The Group plans to look at these further Stages of fund tokenisation and monitor progress against the short-term recommendations made in the Report. Phase Three (Artificial Intelligence and other tech), due in H1 2024, will expand the scope of the Group’s outlook to focus on the application and risks of AI and associated other technologies. In its conclusion, the Report highlights that there “is no room for complacency” and urges the UK industry to maintain its position as world leaders in asset management.

The Group considers that some firms may want to move quickly towards the use of a single open, public chain operating on a robust settlement layer that is secure, trustworthy, and decentralised. Others will see value in other features such as global market access and interoperability, secondary markets or rethinking the funds’ ecosystem more drastically. Settlement utilising digital money, or on a much-reduced timescale, will be a likely area of development, as will increasing links to the asset and client registers.

Final thoughts

The Report’s publication is a strong signal from the FCA and HMT that the UK authorities are in favour of the fund industry adopting tokenisation. In addition, the UK authorities have indicated that they do not foresee any major commercial, legal or regulatory stumbling blocks in at least achieving Phase One of fund tokenisation.

We envisage increased interest from participants in the UK fund industry in tokenisation. The following are some key areas which merit additional consideration:

- Overall regulatory framework. As mentioned above, where a token constitutes a security token, it will likely fall within the regulatory perimeter as a specified investment (for FSMA purposes) and as a financial instrument (for UK MiFID purposes). This means that a person would need the requisite regulatory permissions, or otherwise need to benefit from a FSMA exclusion, in order to deal with them. The issue and marketing of such tokens will similarly be governed by existing requirements.

It is worthwhile to bear in mind that the regulatory perimeter for crypto-assets, other than security tokens, is undergoing a fundamental review. In February 2023, HMT published a consultation on the future financial services regulatory regime for cryptoassets. The consultation closed in April 2023 and HMT subsequently published its feedback in October 2023. Amongst other things, the consultation lays out HMT’s plans to regulate core activities pertaining to crypto-assets within the existing FSMA framework. HMT envisages that the following activities will require prior FCA authorisation when conducted in relation to crypto-assets: issuance, payment activities, operating a trading venue, dealing, arranging, activities relating to lending and borrowing, custody and validation activities. - Equity tokens. Where a fund intends to issue digital equity securities (or equity tokens), it is important that applicable requirements of the Companies Act 2006 are adhered to, particularly in respect of share transfers and registrations. Whilst the statutory requirement for the issue of share certificates can be dispensed with by way of the fund’s constitutional documentation, this is not presently the case with statutory requirements for registers of members and instruments of title.

As noted by the LawTech’s Legal Statement on the issuance and transfer of digital securities under English private law, complying with these two requirements in a private, permissioned DLT should not be problematic as the DLT would itself constitute a register. However, the DLT would need to be designed to reflect all the requisite statutory information and it would also need to be capable of producing that information in hardcopy format. Finally, a smart contract (or an off-chain mechanism) would be required to generate an instrument of title that is capable of being submitted to HMRC for payment of stamp duty.

In light of these issues, it is sensible for a Stage One tokenised investment fund’s tokens to be issued on a private, permissioned DLT and that issuances on permissionless DLT only occur in the future when the requirements of the Companies Act 2006 are amended. - Custody of crypto-assets. As mentioned above, it is not envisaged for a Stage One tokenised investment fund to invest only in traditional assets and not in cryptocurrencies. Where a fund holds other crypto-assets such as security tokens with a custodian, it is important for the fund as well as investors to be cognisant of the resulting practical and legal risks (e.g. whether the custodian holds the crypto-assets by way of trust, bankruptcy remoteness, security hacks).

In-depth 2024-034

Authors