Authors

Key takeaways

- Two new deposit return schemes (DRSs) will go live from 1 October 2027 in England and Northern Ireland, and separately in Scotland.

- The schemes will require drinks suppliers to add a deposit to the price of their products and larger groceries retailers to host return points, where consumers can obtain a refund when containers are returned.

- The DRSs are intended to drive recycling rates for plastic (PET), aluminium and steel drinks containers up to 90% by the end of 2030. Glass is not included.

The English/NI scheme in a nutshell

- From 1 October 2027, the price of drinks sold in England and Northern Ireland (NI) in single-use closed containers made of plastic (PET), aluminium or steel, with a volume of between 150ml and 3 litres, will need to include a deposit.

- Consumers will be entitled to obtain a refund of the deposit paid when they return the drinks containers to one of a network of return points.

- Numerous retailers will be obliged to set up return points on their premises, but will be reimbursed a handling fee to cover their costs and compensate for the lost retail space.

- Eligible drinks containers will be marked with a new logo and include prescribed information in an electronic barcode or QR code, which will identify the relevant drinks manufacturer.

- The new Deposit Management Organisation (DMO), which will shortly be appointed by the government, will set the amount of deposit that must be charged on containers, establish the annual registration fees payable to it by drinks manufacturers and reimburse retailers the deposit on containers that are returned to the DMO.

- Upon collection from return points, the containers are to be delivered to recycling facilities for materials recovery, on behalf of the DMO.

- The DMO will be responsible for ensuring that collection targets are met and will be subject to regulatory oversight.

- Drinks manufacturers must register with the DMO and will be given first right of refusal to buy back a proportion of the recovered materials from the DMO at a market rate.

The Scottish scheme is broadly similar.

What are the objectives?

The objectives of each of the new schemes are to reduce littering, divert containers from landfill and generate a stream of recycled materials that can be reused by producers as part of a circular economy approach, reducing the need for virgin raw materials. In Scotland alone, it is estimated that 42,000 fewer plastic bottles will be littered every day, saving £46 million in clean-up costs, with the carbon savings equivalent to taking 90,000 cars off the roads.1

DRSs have been used successfully across the world for a number of years. Approximately 50 countries and territories currently have one in place (including several EU member states), and some achieve return rates of more than 90%. For instance, Germany reportedly captures up to 98% of returnable containers.

The creation of a DRS within England has been discussed since at least 2018 and is a commitment within the Environmental Improvement Plan (2023 version), which was due to be delivered by 2025.

Why isn’t it a single UK-wide scheme?

Waste regulation is a devolved matter in the UK, meaning that each of the devolved nations (Scotland, Wales and NI) can adopt its own laws. The regulations to establish the scheme in England and NI came into effect on 24 January 2025.2

Scotland had initially intended to introduce a DRS in 2023, to include glass bottles. Regulations were passed in May 2020. However, having faced opposition to the new scheme due to fears about the impact on business, the Scottish government reluctantly agreed to defer the start of its scheme and remove glass from the scope following the refusal of the UK government in Westminster to grant Scotland the necessary exclusion under UK internal markets legislation.

The Welsh government is rethinking plans to bring in its own DRS, having been similarly refused permission by the UK government to include glass.

Provisions within the English/NI regulations require the DMO to attempt to reach agreement with other scheme administrators (such as Circularity Scotland) on running the schemes in a compatible fashion, although that does not necessarily mean that elements like the deposit amounts, scheme logos or barcoding requirements will be identical. Any significant divergence between the schemes could present a challenge for producers (including importers and bottlers) and retailers with businesses spanning the UK.

Who is involved in operating the England/NI scheme?

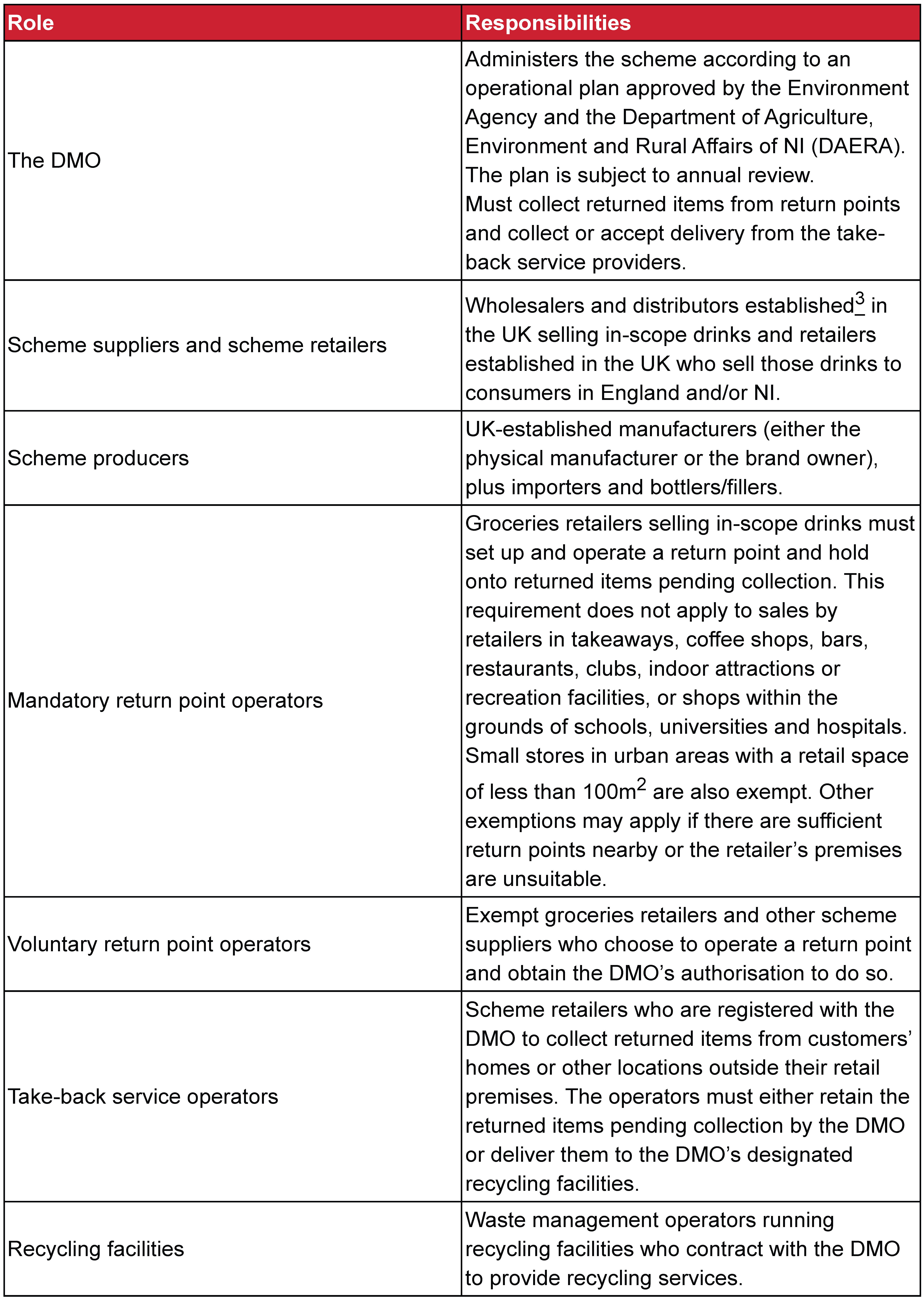

The cast of the DRS includes the following principal players:

The DMO

The DMO must be a not-for-profit entity and is to be appointed by the Department for Environment, Food and Rural Affairs (DEFRA). Applications to act as the DMO close on 3 February 2025, with the successful applicant expected to be announced by DEFRA in April.

The DMO is a quasi-regulatory body in that it has powers set out in the regulations to register participants, grant exemptions and raise fees from producers, as well as having powers to require them to provide it with information such as sales volumes of their drinks. It must report annually to the Secretary of State for DEFRA, the Environment Agency and DAERA.

Amongst other responsibilities, the DMO determines the amount of the deposit to be charged on each drink and the amount of regulation fees payable by drinks producers. In setting the deposit level, the DMO must have regard to a list of factors including affordability for consumers, effects on drinks sales and achieving its statutory collection targets.

The first DMO appointee must set up a reserve fund to cover the expenses for the continuing operation of the scheme if its appointment is revoked. Should the entity appointed as the DMO go bankrupt, a statutory transfer scheme is included in the regulations to allow assets necessary for the operation of the DRS, and rights and liabilities associated with the DRS’s statutory functions, to be transferred either to an interim scheme operator or directly to the outgoing DMO’s successor once they have been appointed.

Collection targets

The DMO must ensure that the scheme achieves return rates of 70% for all types of returnable containers in 2028 (in each of England and NI), rising to 80% in 2029 and 90% in 2030. For 2030, there are additional sub-targets for the return of at least 85% of PET drinks containers, and at least 85% of steel and aluminium drinks containers.

Selling in-scope drinks

In-scope items cannot be sold unless the supplier is registered, the price includes the deposit and the container carries the DRS scheme logo and barcode. This includes drinks sold in a multipack. The multipack packaging must also carry the DRS packaging logo. The DMO will issue details of the logos and barcodes to apply.

Suppliers must also display at their premises a notice regarding the requirement to charge a deposit and the amount of the deposit added to the price of the product, or include that information within product descriptions when advertising for sale on websites, apps, or in print media. The information should be delivered orally when making telephone sales.

Return points

Groceries retailers will be required to host return points and must register as a mandatory return point operator with the DMO, unless they successfully apply for an exemption. The obligation does not extend to sales of drinks on board motor vehicles, ships, trains or aeroplanes, where sales are from vending machines only, or where drinks are only sold for consumption on the premises.

Others may apply for an authorisation to voluntarily host a return point.

In addition, the DMO may choose to set up its own return points, in order to ensure there is a sufficient network of points available in convenient locations.

Exclusions and exceptions

The drinks that are in-scope for the scheme are water and any other beverages (whether or not alcoholic), as well as cordials, squashes and fizzy drinks bases that are intended to be diluted or carbonated. Liquids used to flavour drinks, such as coffee syrups, fall outside of the scheme.

Drinks first supplied in any part of the UK before the scheme takes effect on 1 October 2027 also fall outside of the scheme.

In addition, the scheme does not apply to sales from duty free shops or to drinks supplied to the export market or intended for overseas consumption.

It does, however, apply to drinks that are imported for sale in England or NI.

Producers of drinks production lines manufacturing 6,250 or fewer units in the first year (thereafter 5,000 per year) can register the line as a low-volume line with the DMO, subject to annual renewal. Once registered, the deposit does not need to be added to the price of those products.

Retailers can opt not to charge the deposit on drinks they supply for immediate consumption at mixed retail or on-sale premises such as pubs, but if so, customers must be requested not to take the containers away from the premises, and the containers will be collected by the DMO.

Customers will not be guaranteed a refund for items that are no longer intact, do not carry the scheme barcode, or are soiled or not empty when they are returned (although missing lids will not matter). Retailers may give other reasonable grounds not to pay the refund.

How the scheme is funded

The DMO will charge each scheme producer a registration fee, plus the total amount of deposits on drinks that they have supplied in England and NI over the year:

- The deposit funds have to be used by the DMO firstly in paying for refunds on containers that it accepts back from retailers, secondly to meet the national enforcement authority’s costs, and thirdly to defray its own costs incurred in running the scheme.

- The registration fees received from scheme producers can only be used for the second and third purposes. Registration fees can be set at different rates for PET, steel and aluminium containers and are based on the supplier’s forecast sales volumes (ignoring those registered as low-volume products) over the year ahead. The DMO has to consider the costs of collecting, processing and recycling the returned items and the likely sale value of the recycled materials when setting the amount of registration fee payable.

As mentioned above, the DMO must also pay the return point operators a handling fee to cover their costs, including a ‘rent’ for the floor space taken up by their return point.

How is the scheme enforced?

The obligations under the scheme are enforced by a combination of the Environment Agency (in England), DAERA (in NI) and (for certain contraventions) local weights and measures authorities (Trading Standards).

Those enforcement authorities are able to deploy civil sanctions (fixed and variable monetary penalties, compliance notices and enforcement undertakings, as specified in the regulations). It is an offence not to comply with a civil sanction. Any enforcement action taken is to be recorded in a public register, including details of convictions and civil sanctions. Civil sanctions, however, will only stay on the register for four years. Appeals against civil sanctions may be submitted to the First Tier Tribunal (in England) or the Planning Appeals Commission (in NI), but in each case this is only if there has been a material mistake of law.

The DMO has the power to revoke registrations, authorisations and exemptions that it has granted. Those decisions, as well as decisions on the amount of fees it charges to producers, are subject to the right of the applicant to ask the DMO, within 28 days of the decision notice, to conduct a review. The DMO must adopt procedures for conducting these reviews.

What might the impact of the new DRSs be?

Drinks containers that are currently collected by local authorities at the kerbside as a public service are expected to be diverted to DRS return points, reducing volumes collected and recycled on behalf of local authorities.

Assigning a value to waste raises concerns over fraud and the security of return points. Reverse vending machines are likely to be employed.

Existing recyclers may view the scheme as a potential new source of revenue, assuming the rates on offer from the DMO are competitive. Investors may also consider that the additional demand created for recycling makes investment in new UK recycling infrastructure projects a viable option. We may therefore see new projects come forward to planning or existing facilities extended and repurposed. The new scheme comes at a time when the UK’s planning system for national infrastructure is about to be reformed, which could potentially benefit recycling infrastructure.

What are the next steps?

- The successful DMO applicant is due to be announced in April 2025.

- Retailers, drinks manufacturers, bottlers, importers and take-back service operators should look out for information on how to register under the scheme. (The regulations do not set precise statutory deadlines for the DMO to make decisions, but it must in general make decisions within a reasonable time.)

- Low-volume product lines (below 6,250 units initially) need to be registered to avoid the need to apply the deposit.

- Retailers who are obliged to operate a return point but do not wish to do so should consider their eligibility for an exemption and make the application as soon as possible.

- Others who are not obliged to operate a return point but wish to do so should apply to the DMO for authorisation.

- Recycling operators should engage with the DMO to secure a contract.

- Producers will need to prepare to meet the labelling, barcoding and record-keeping requirements for products to be sold after 1 October 2027.

If you would like help assessing whether and how the new schemes will affect your business, please contact the authors below.

- Deposit Return Scheme Environmental Benefits

- The regulations are made under powers contained in the Environment Act 2021, sections 54 and 143(1) and Schedule 8.

- Being “established in the UK” for corporates means being UK registered, having a principal place of business in the UK or carrying out activities from a permanent place in the UK.

In-depth 2025-029

Authors