Authors

Authors

Michael Kwan (Resource Law LLC)

Darren Sie (Resource Law LLC)

Key takeaways

- New measures to enhance investor interest, attract quality listings and streamline regulations

- S$5 billion Equity Market Development Programme and tax incentives introduced

- Next phase to refine listing framework, boost investor protection and enhance market efficiency

Introduction

On 21 February 2025, the Equities Market Review Group (Review Group), established by the Monetary Authority of Singapore (MAS), released its first set of measures to strengthen the equities market in Singapore. The Review Group consulted industry stakeholders and proposed measures to strengthen Singapore’s equities market and attract companies seeking to list and access growth capital. The measures aim to target firms with a strong local or regional presence that may not gain sustained interest on global exchanges, while also enhancing engagement from retail and institutional investors.

The full set of measures focuses on four key areas:

- Supply: Improving attractiveness to quality listings

- Demand: Increasing investor interest and liquidity

- Connectivity/trading: Developing cross-border partnerships and improving trading and settlement efficiency for investors

- Regulatory measures: Shifting to a more disclosure-based listing regime and strengthening investor confidence

The first set of measures includes measures to: (1) increase investor interest (demand); (2) increase attractiveness to quality listings (supply); and (3) streamline the regulatory framework.

The second set of measures is in development and expected to be completed by the end of 2025.

The first set of measures

1. Measures to increase investor interest (demand)

a. Equity Market Development Programme to strengthen the local fund management ecosystem

MAS will launch a S$5 billion Equity Market Development Programme (EQDP). Funded by the MAS and the Financial Sector Development Fund, the EQDP will provide an initial investment into a range of funds managed by fund managers with a strong investment track record and capabilities in Singapore.

b. Tax incentives for fund managers investing substantially in Singapore-listed equities

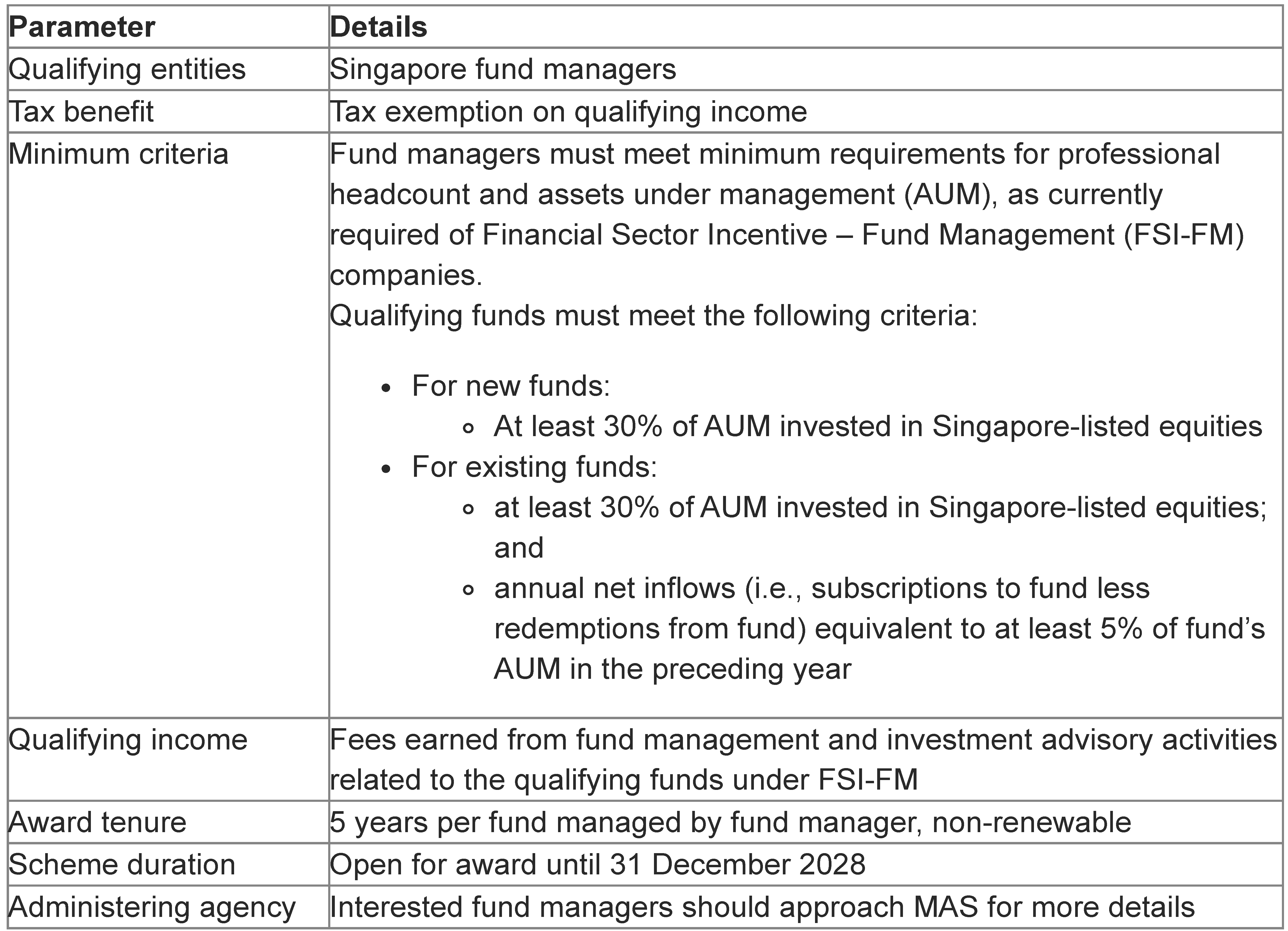

As announced in Budget 2025, a tax exemption will be introduced for qualifying income from fund management and investment advisory activities related to funds that invest substantially in Singapore-listed equities.

Further details can be found in the table below:

Parameters of tax exemption on fund manager’s qualifying income arising from funds investing substantially in Singapore-listed equities

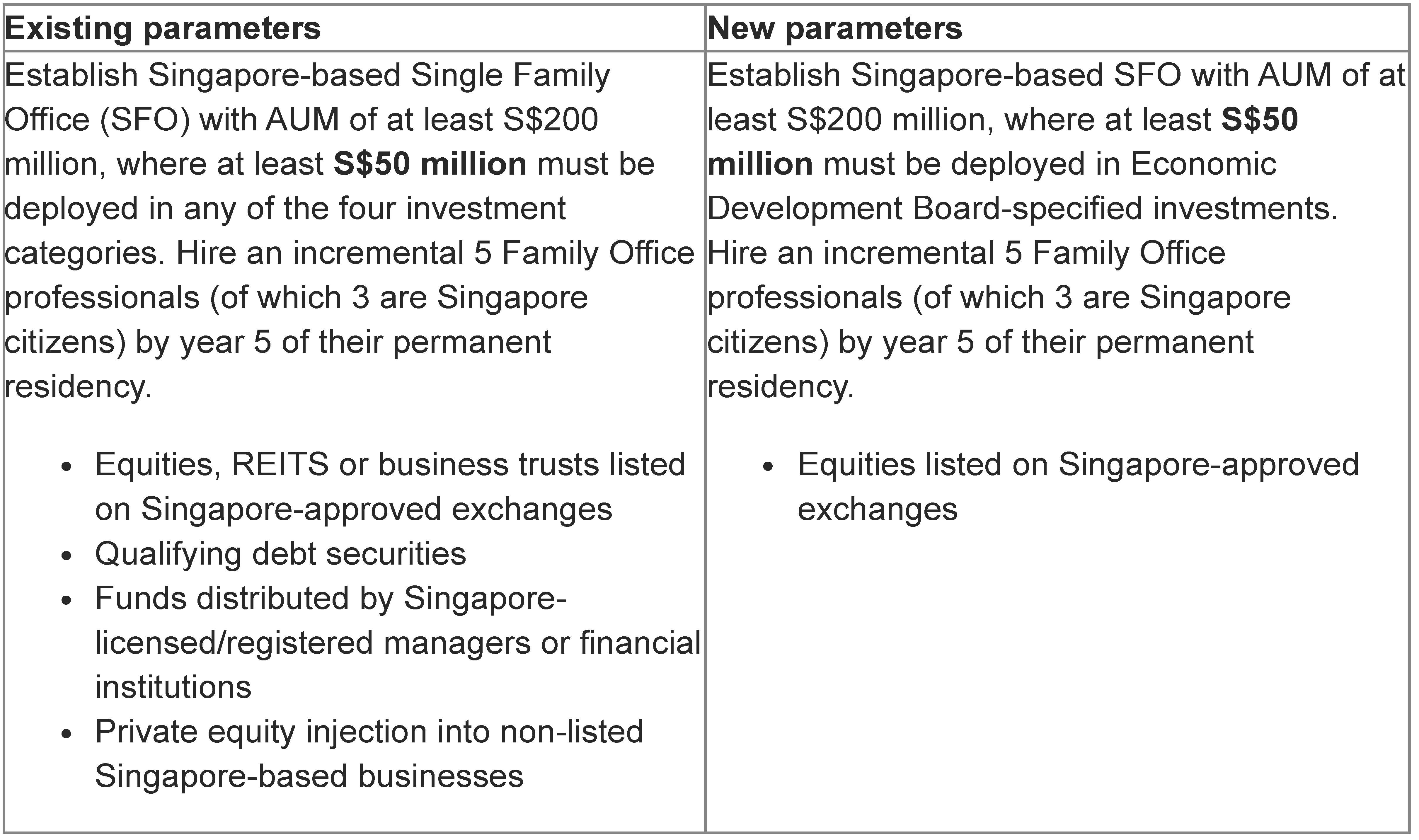

c. Adjustment to the Global Investor Programme to support capital inflows to Singapore-listed equities

Adjustments will be made to Option C (Family Office Investments) of the Global Investor Programme (GIP) to support more capital inflows into Singapore’s equities market. See the table below for the new criteria:

Changes to GIP

d. Enhance research ecosystem to build ready investor base, sharpen focus on mid- and small-cap enterprises, and broaden research dissemination

The Review Group recommends an expansion of the Grant for Equity Market Singapore (GEMS) research grant to include research coverage on pre-IPO companies and to sharpen focus on mid- and small-cap enterprises.

The GEMS scheme also could be expanded to allow more research entities to participate and to broaden the eligible dissemination channels and forms of research published, for example, by including social media platforms. MAS and the Singapore Exchange (SGX) will release further details in mid-2025.

2. Measures to improve attractiveness to quality listings (supply)

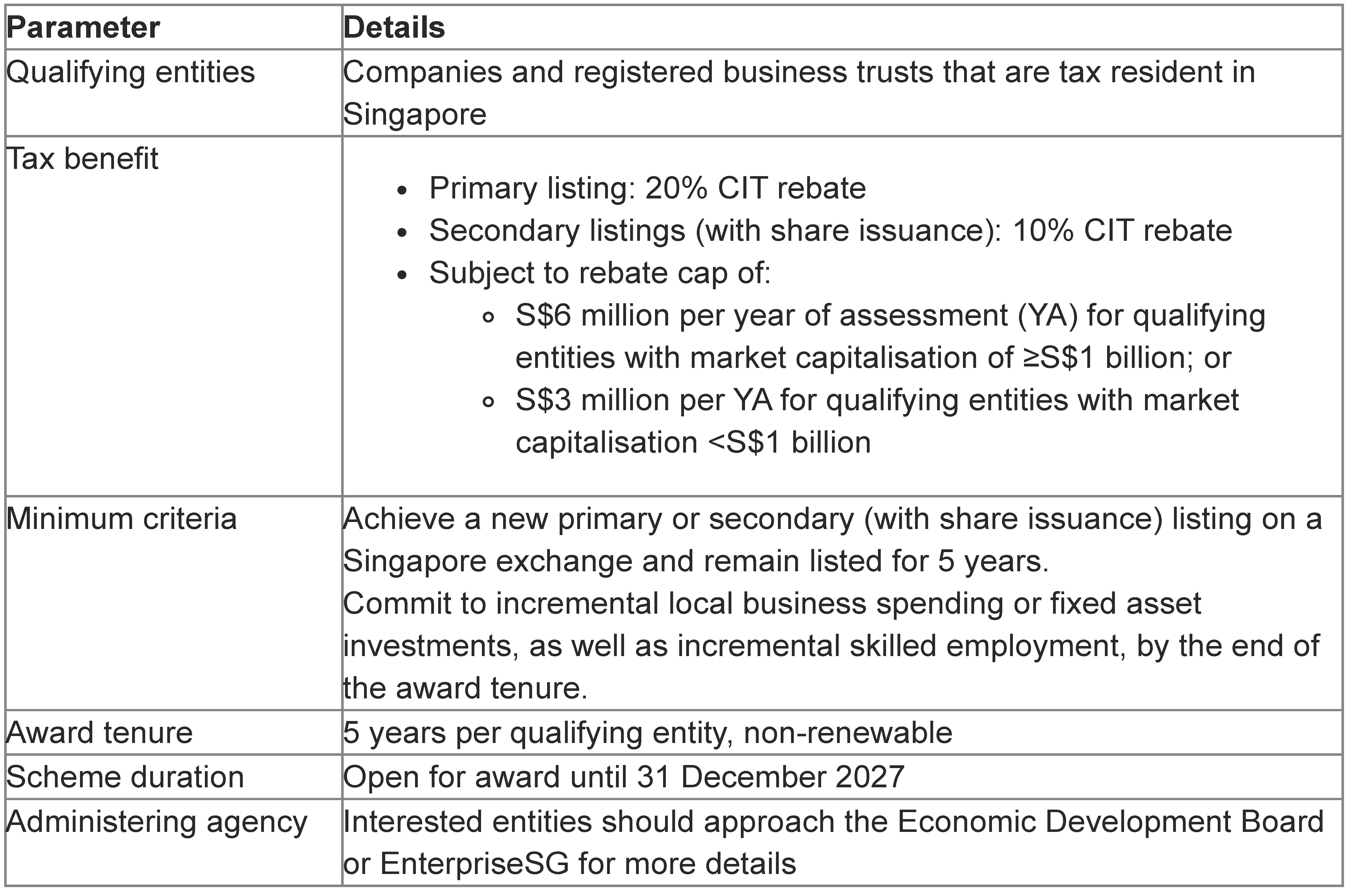

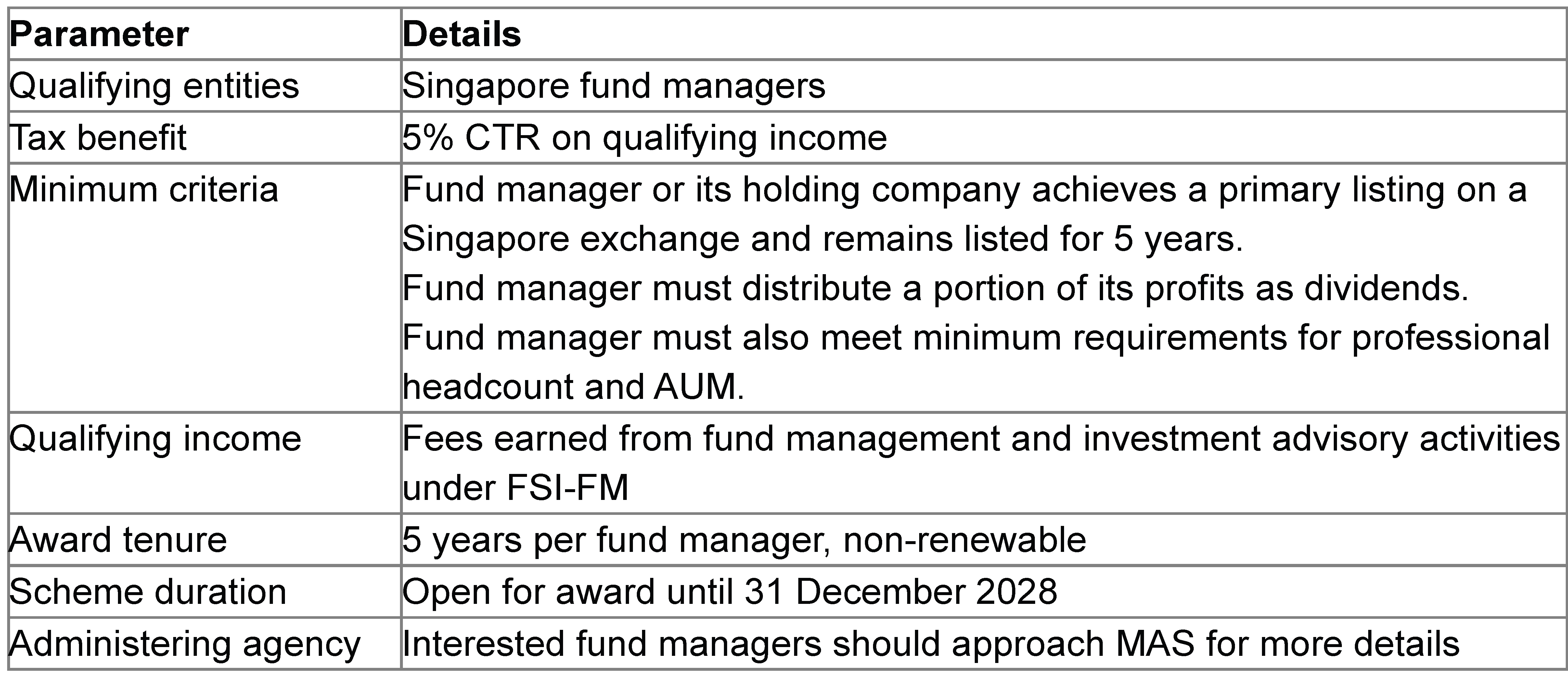

a. Tax incentives to attract corporate and fund manager listings in Singapore

As announced in Budget 2025, tax incentives will be introduced to attract growth companies and fund managers to list in Singapore. Further details can be found in the tables below:

Parameters of corporate income tax (CIT) rebate for new corporate listings in Singapore

Parameters of enhanced concessionary tax rate (CTR) for new fund manager listings in Singapore

b. Financing support to strengthen growth of companies

The Review Group acknowledges feedback on strengthening the pre-IPO pipeline by identifying promising companies, supporting their growth and anchoring their listings in Singapore. While Singapore’s early-stage venture financing market is well-developed, more can be done for growth-stage financing. The Singapore government will continue enhancing its enterprise development efforts, including new investment schemes announced in Budget 2025, to nurture local companies as potential future listings.

3. Measures to streamline the regulatory framework

The Review Group recommends a shift toward a more disclosure-based listing regime that is more efficient and competitive, and is aligned with global financial hubs, while maintaining high standards of corporate governance and enforcement to uphold investor confidence. Key ecosystem players, such as issue managers, auditors and research analysts, must ensure accurate and reliable disclosures to support investment decisions.

The first set of regulatory measures includes the following:

(a) consolidate listing suitability and prospectus disclosures review with a single regulator (i.e., Singapore Exchange Regulation) to streamline the listing review process;

(b) reduce scope for merit-based judgment when admitting new listings, by streamlining Singapore Exchange Regulation’s qualitative admission criteria;

(c) streamline prospectus disclosure requirements to refocus on core requirements that are key to informed decision-making by investors, while continuing to adhere to international standards;

(d) streamline the listing process to shorten the time to market and provide more flexibility for issuers to engage investors prior to the launch of an IPO; and

(e) adopt a more targeted approach to post-listing queries, alerts and trading suspensions, to strike a better balance in facilitating market discipline and achieving investor protection.

These measures may involve changes to statutory requirements and SGX’s listing rules, and will go through a public consultation before the finalised set of measures is implemented.

Next phase

In its next phase, set for completion by the end of 2025, the Review Group aims to further enhance Singapore’s equities market by:

- exploring the value proposition and regulatory framework of Catalist;

- enhancing avenues for investors to seek recourse and recompense for losses suffered due to market misconduct;

- considering proposals to enhance shareholder engagement;

- reviewing issue manager business conduct requirements and expectations to deliver robust due diligence outcomes;

- developing cross-border partnerships to facilitate the development of the product class in Singapore;

- making trading and custody more efficient; and

- consulting with MAS to streamline the complex products framework to improve product access and enhance product disclosures and risk warnings.

Conclusion

The measures introduced by the Review Group are very much welcome to boost the equities market in Singapore. These initiatives will solidify Singapore’s position as a leading financial hub, fostering a more vibrant, efficient and investor-friendly marketplace and strengthening the competitiveness of Singapore’s equities market to create a more sustainable and attractive ecosystem for capital formation.

Reed Smith LLP is licensed to operate as a foreign law practice in Singapore under the name and style Reed Smith Pte Ltd (hereafter collectively, "Reed Smith"). Where advice on Singapore law is required, we will refer the matter to and work with Reed Smith's Formal Law Alliance partner in Singapore, Resource Law LLC, where necessary.

Authors

Authors

Michael Kwan (Resource Law LLC)

Darren Sie (Resource Law LLC)