How the global freighter fleet looks today

The global air freighter fleet has grown significantly since the COVID-19 pandemic struck. As noted above, this has been driven in part by the very rapid decrease in belly cargo capacity, which reached its nadir in April 2020. Since then, global passenger aircraft use has increased gradually but remains below pre-pandemic levels.

In terms of aircraft types, the air freighter market has been gradually adopting more modern aircraft types (such as the Boeing 737-800 and Airbus A321-200) and phasing out older aircraft (such as the Boeing 737-300 and McDonnell MD-10).

However, some older aircraft types (such as the Boeing 747-400) have been reactivated to cater to the increased demand caused by the COVID-19 pandemic, although this is likely to be a relatively short-term solution (until demand settles post-COVID and newer aircraft become available).

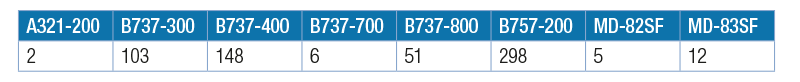

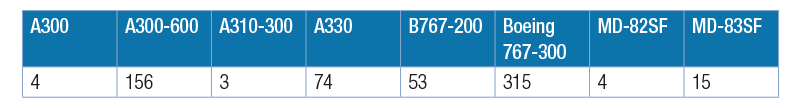

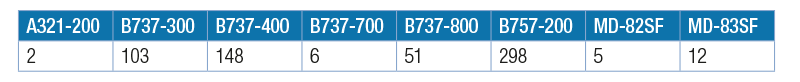

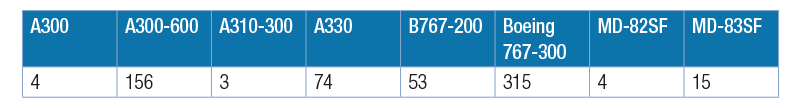

The following tables show the make-up of the current global air freighter fleet. The data below has been obtained from IBA and is current as of February 2021.

Narrowbodies

- Since May 2020, all aircraft fleets have increased with the exception of the Boeing 737-700 and McDonnell Douglas MD-10.

- The Boeing 737-800 fleet has grown most significantly since May 2020 (by 243 percent).

Mid-size wide-bodies

- Since May 2020, all aircraft fleets have increased with the exception of the Airbus A310-300 and McDonnell Douglas MD-10.

- The Airbus A330 fleet has grown most significantly since May 2020 (by 176 percent).

Large wide-bodies

- Since May 2020, all aircraft fleets have increased with the exception of the Boeing 747-100.

Relevant new technology and environmental considerations

With the ever-increasing focus on the environment, the air cargo industry is having to look closely at its carbon footprint and ways to reduce its environmental harm. The following technologies are ways in which the industry is looking to achieve this.

Sustainable aviation fuel

Sustainable aviation fuel (SAF) is produced from sustainable feedstocks and is very similar in its chemistry to traditional fossil jet fuel. It helps reduce carbon emissions over the life cycle of the fuel compared to the traditional jet fuel it replaces.

Some typical feedstocks used are cooking oil and other non-palm waste oils from animals or plants and solid waste from homes and businesses, such as packaging, paper, textiles, and food scraps that would otherwise go to landfill or incineration. Other potential sources include forestry waste, such as waste wood, and energy crops, including fast-growing plants and algae.

By using SAF, air freight operators can reduce their carbon footprint and also demonstrate good leadership and responsibility towards a more sustainable future.

While SAF adoption has been hampered by high prices compared with conventional jet fuel, it seems probable that this price gap will gradually narrow as countries incentivize investment in the development of SAF and its use by operators (through grants and tax exemptions).

More efficient flight routing

Airlines and air freight operators are now looking at technology to set more efficient flight paths in order to reduce environmental harm and cut delays.

In particular, studies have shown that by exploiting the jet stream, the “air distance” between two points on the globe can be significantly reduced (even if the ground distance between those points is longer), thereby reducing fuel burn and CO2 emissions.

Similarly, the negative environmental consequences of condensation trails (or contrails) left by aircraft can be reduced by flight plans that avoid the atmospheric conditions in which contrails form. This can be achieved by small altitude changes, which would not significantly increase the amount of fuel used (or, therefore, CO2 emissions).

More efficient aircraft

As has already been noted, the air cargo industry has historically used older, more polluting aircraft. However, the air cargo operators themselves are increasingly motivated to use newer aircraft in order to minimize environmental harm and reduce costs.

One of the consequences of the COVID-19 pandemic is that there has been a surplus of aircraft not utilized (following repossessions, for example) and, as a result of this, (i) the “feedstock” of newer passenger aircraft has increased, and (ii) the purchase price for those aircraft has significantly reduced (particularly for certain aircraft types, such as the Airbus A330).

The inevitable consequence of this has been an accelerated adoption of newer, more fuel-efficient, aircraft types.

In the longer term, perhaps we will see the air cargo industry using technology currently in development, such as open rotor engines, hybrid-electric propulsion, and/or electric propulsion.

Lightweight unit load devices

Unit load device (ULD) manufacturers are now offering lightweight pallets and containers for the consolidated carriage of loose shipments. The reduced weight helps save fuel.

In some cases, lighter ULDs could allow more packages to be shipped at once if the limiting factor was weight. While this wouldn’t decrease fuel use for that flight, it would still result in increased efficiency as more cargo per plane could be transported.

Carbon offsets

Many companies are setting ambitious environmental goals to be achieved in a short timeframe. Carbon offsets can help the air cargo industry bridge the gap as it researches and implements new techniques to improve the efficiency and sustainability of direct operations.

Carbon offset is an investment in something that pulls carbon dioxide out of the atmosphere to compensate for emissions in another area. One of the most popular carbon offset investments is tree planting. Depending on the location, conditions, and the type of tree, there will be a certain amount of carbon tree planting is expected to sequester. Generally, it takes about 15 trees to offset 1 ton of carbon.

Organizations and initiatives like the Carbon Offsetting and Reduction Scheme for International Aviation are tracking the emissions of different SAFs throughout their entire life cycles and making sure that carbon offsets are not counted twice. There are also regulations around what counts as an offset.

Regional variations in the global freighter fleet

Regional air cargo market shares have changed significantly during the past two decades. According to Boeing, airlines based in the Asia-Pacific region, Europe, and North America have accounted for over 80 percent of the world’s air cargo traffic for that entire period. In 1999, airlines based in the Asia-Pacific region had the largest share at 34 percent, while airlines based in North America had a 31 percent share of the world’s air cargo traffic.

Since 2000, however, carriers based in the Middle East have leveraged their geographic position at the crossroad between Africa, the Asia-Pacific region, and Europe. Middle Eastern carriers quickly expanded their wide-body passenger and freighter fleets, which allowed them to increase their share of world air cargo traffic from 4 percent in 1999 to 13 percent in 2019. In 2019, airlines based in the Asia-Pacific region, Europe, North America, and the Middle East accounted for over 90 percent of all world air cargo traffic.

North America, Asia Pacific, and Europe collectively make up around 75 percent of the global freighter fleet. The North American air freighter fleet is currently the largest in the world, by some margin. However, with the rapid economic growth of the Asia-Pacific region, it’s expected that, within the next 20 years, the Asia-Pacific fleet will more than triple, bringing it close to parity with the North American fleet in terms of size.

With the exception of Russia and Central Asia, Boeing forecasts that all geographic regions are expected to see an increase in freighter fleet size during the course of the next 20 years.

The growing use of drones and unmanned air vehicles

For logistics companies, the first and last mile constitute the most expensive and least efficient part of a delivery. Typically, this requires significant manpower, vehicle numbers, and time. Further, goods are increasingly required in remote areas with limited airport facilities, which presents further challenges for logistics companies.

These issues have therefore contributed to the rapid progress of drone technology. Wing, the cargo drone specialist owned by Google parent Alphabet, achieved a breakthrough in this respect in April 2019. It was awarded the first-ever U.S. Federal Aviation Administration air carrier certificate licensing unlimited commercial deliveries using cargo drones. The license made no restrictions on flights over crowds or urban areas – the first time this had been granted outside a pilot project.

About the author

Chris Jackson acts for lessors, banks, private equity funds and airlines in relation to domestic and cross-border asset finance and leasing transactions. Chris has particular experience in aircraft and engine leasing and trading, structured finance and sales finance. Chris also advises on the procurement of aviation assets and on after-market support programs provided by manufacturers. Identified as a leading individual in the aviation finance and leasing market, Chris is recognized for his “in-depth understanding of the aircraft leasing and finance business” (The Legal 500 UK, 2017) and his “sensible and commercial” approach to matters (Chambers & Partners UK, 2018).