Authors

Authors

Key takeaways

- The Corporate Sustainability Reporting Directive (EU) 2022/2464 (the “CSRD”) introduces new rules concerning the social and environmental disclosures companies are required to make.

- The CSRD will not only apply to a greater number of EU companies than previous reporting rules, but will also bring a number of non-EU companies into scope.

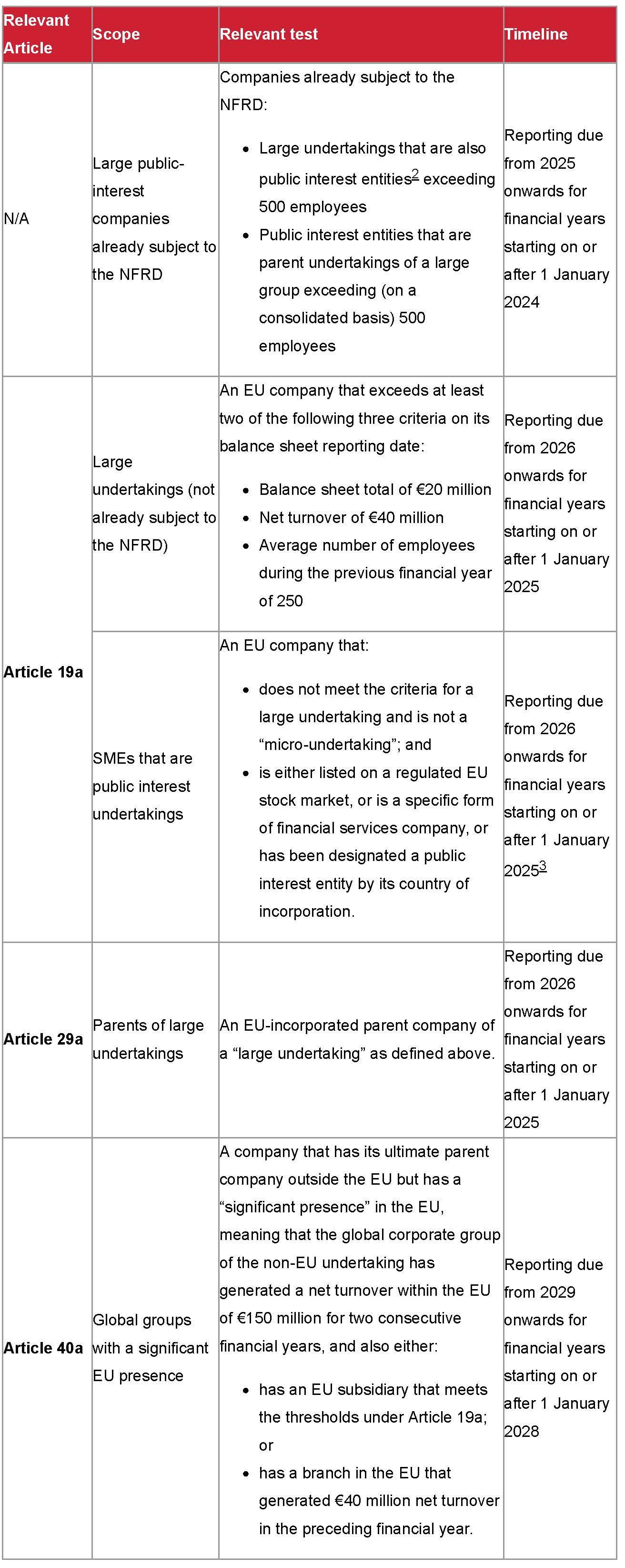

- The reporting requirements will be implemented in stages from 2024 to 2028 for different categories of companies.

Abstract

The Corporate Sustainability Reporting Directive (EU) 2022/2464 (the CSRD) introduces new rules concerning the social and environmental disclosures companies are required to make and expands the scope of reporting requirements to include a broader range of companies. Most notably, the CSRD will not only apply to a greater number of EU companies than previous reporting rules, but will also bring a number of non-EU companies into scope. The extra-territorial effect of the rules is potentially very broad and companies with a significant presence or product placement in Europe would be well advised to consider how they might be affected. Companies subject to the CSRD will be required to report according to European Sustainability Reporting Standards (ESRS) on the social and environmental risks they face, and on the impact of their activities on people and the environment. In addition, in-scope companies will need to disclose how sustainability factors affect their financial performance. The reporting requirements will be implemented in stages from 2024 to 2028 for different categories of companies.

Assessing the impact of the CSRD on a company’s reporting requirements is complex and is likely to be particularly challenging for those that may already be subject to different reporting regimes (whether they be compulsory or voluntary, or in the U.S., the UK or elsewhere).

Overview of the CSRD

The CSRD, which entered into force on 5 January 2023, revises and extends the requirements for sustainability reporting on environmental, social and governance (ESG) matters under Directive 2013/34/EU (the Accounting Directive).

The aim of the CSRD is to improve the standard and comparability of ESG disclosures by considerably extending the scope and application of the Non-Financial Reporting Directive (EU) 2014/95 (the NFRD). As a result, the CSRD potentially captures a far broader range of companies than the NFRD (including some non-EU companies) and at the same time increases the detail and extent of ESG disclosures required by those companies that fall within the ambit of the CSRD.

The CSRD provides a broad overview of the reporting requirements applicable to various categories of company (discussed below). A more detailed breakdown of the required ESG disclosures, and guidance on the details to be included in them, will be set out in the ESRS, which will enter into force at intervals over the next few years.

While the new regime will ultimately result in significantly increased reporting obligations, not all in-scope firms will have to comply with them at the same time. The EU is taking a staggered approach, implementing the reporting requirements in stages from 2024 to 2028, dependent on the category of company. The changes will apply to companies currently within scope of the NFRD first before extending to other newly in-scope companies.

At this stage, companies should begin identifying to what extent they may fall within the scope of the CSRD and preparing for the implementation of the necessary procedures and processes to comply with the new disclosure requirements. Companies should also have regard to the national legislation which implements the CSRD in each relevant EEA member state in case national competent authorities implement reporting requirements over and above those set out in the Directive (known as “gold plating”).

This Client Alert addresses some of the key aspects of the CSRD, by providing:

- A high-level summary of the timeline for implementation

- A breakdown of scope, including the extent to which non-EU companies may be within scope

- A summary of the key reporting requirements for different categories of company under the relevant articles of the Accounting Directive1

- A brief overview of the ESRS

- Some of the key challenges that may arise from the new requirements

- Key considerations and next steps for businesses

Scope and timeline for implementation – summary

The new reporting requirements under the CSRD will be implemented using a staggered approach from 2024 to 2028:

Scope and timeline for implementation – breakdown

The CSRD imposes requirements on a greater range of companies than the NFRD, including certain non-EU companies. The following Articles introduce requirements for companies not previously within the scope of the NFRD:

Article 19a: Large undertakings and public interest undertakings

Article 19a introduces reporting requirements for two “categories” of EU companies:

i. Large undertakings

ii. Small and medium-sized enterprises (SMEs) that are public interest undertakings

The test for “large undertakings”

A company will be considered a “large undertaking” if it is an EU company that satisfies at least two of the following three criteria on its balance sheet date for any financial year:

i. Balance sheet total of €20 million

ii. Net turnover of €40 million

iii. Average number of employees during the preceding financial year of 250

The test for “SMEs that are public interest undertakings”

A company will be considered a “public interest undertaking” if it is an EU company that either: (i) has securities listed on a regulated market in the EU; (ii) is a specific form of financial services company (such as an insurance company or credit institution); or (iii) has been designated a public interest entity by its country of incorporation.

A company will be considered an “SME” if it is an EU company that does not meet the criteria for a “large undertaking” (see above) and is not a “micro-undertaking”.4

Article 19a reporting requirements

Large undertakings or SMEs that are public interest undertakings will be subject to Article 19a reporting requirements for financial years starting on or after 1 January 2025, and the first CSRD-aligned reports will need to be issued in 2026. It should be noted that an exemption may apply if these companies are included in ESRS-aligned (see "Overview of the ESRS" below) or equivalent sustainability reporting conducted on a group level by a parent company (see "Article 29a" below).

Article 19a of the CSRD requires large undertakings and SMEs that are public interest undertakings (but not micro-undertakings) to include in a clearly identifiable section of their management report the information necessary to understand the undertaking’s impact on sustainability matters, and information necessary to understand how sustainability matters affect the undertaking’s development, performance and position.

Article 19a sets out the information which should be contained in the relevant section of the management report. At a high level, Article 19a requires undertakings to disclose information relating to a number of areas including:

i. The undertaking’s business model and strategy

ii. A description of the time-bound targets related to sustainability matters set by the undertaking

iii. The undertaking’s oversight and governance arrangements in relation to sustainability matters

iv. A description of the undertaking’s policies in relation to sustainability matters

v. Any incentive arrangements in place for those responsible for sustainability matters

vi. A description of the undertaking’s due diligence approach to sustainability matters, the principal potential and actual adverse sustainability risks to which it is exposed, and any actions taken by the undertaking to mitigate those risks

The reporting obligations with respect to SMEs that are public interest undertakings, though they cover the same areas, are less extensive than those that apply to large undertakings.

Notably, undertakings will need to take a “double materiality” approach. This is discussed in detail below, but essentially requires that undertakings report information regarding:

i. The undertaking’s impact on sustainability matters

ii. The financial effect of sustainability matters on the undertaking

The CSRD also provides that in-scope undertakings report in accordance with the ESRS.

Article 29a: EU-incorporated parents of large groups

The CSRD imposes additional reporting requirements on those who are an EU-incorporated parent of a “large group”.

The test for a “large group”

A “large group” is a group of parent and subsidiary companies that, on a consolidated basis, satisfy the criteria for “large undertakings” as set out above.

Article 29a reporting requirements

EU-incorporated parents of “large groups” will be subject to reporting requirements under Article 29a for financial years starting on or after 1 January 2025, with the first CSRD-aligned reports due in 2026.

The requirements under Article 29a are substantially the same as under Article 19a. However, an EU-incorporated parent company of a large group must file consolidated CSRD-aligned reports in relation to the whole group. Notably, this would include non-EU subsidiary companies that are included in such consolidated reports, bringing non-EU companies within the ambit of the CSRD for the first time. Where the EU parent company identifies any significant differences between the risks for, or impacts of, the group as a whole and one or more of the subsidiaries included in the CSRD-aligned report, these differences must be adequately explained.

As previously mentioned, companies that fall into the category of “large undertaking” under Article 19a will be exempt from their reporting requirements under that Article if they are included in their parent company’s group reporting under Article 29a.

An exception will similarly apply where an EU parent company normally required to report under Article 29a is included in the reporting of their own parent company in alignment with ESRS (or standards that have been designated by the EU as being equivalent). To date, no standards have been designated as being equivalent.

The EU has acknowledged the potential administrative challenges of the new requirements. In response, Article 48i provides that, until 6 January 2030, where a non-EU parent company has multiple EU subsidiaries required to report under either Article 19a or 29a, one EU subsidiary of that non-EU company is permitted to report on behalf of all such in-scope subsidiaries.

Article 40a (Global groups with a significant EU presence)

Under Article 40a, a group which has its ultimate parent company outside the EU, but nevertheless has a significant EU presence, may be required to issue CSRD-aligned (or equivalent) reports in relation to the whole global group, including non-EU companies with no EU presence. Other consolidated reporting requirements may also be triggered under Article 40a in circumstances where the non-EU parent has securities listed on an EU regulated market.

The test for “significant EU presence”

A significant presence in the EU means that the global corporate group of the non-EU undertaking has generated a net turnover within the EU of €150 million for two consecutive financial years, and also either:

i. has an EU subsidiary that meets the thresholds under Article 19a (e.g., is a large undertaking or public interest entity); or

ii. has a branch in the EU that generated €40 million net turnover in the preceding financial year.

Article 40a reporting requirements

The reporting requirements for Article 40a companies will apply for financial years starting on or after 1 January 2028, and the first CSRD-aligned reports will be issued in 2029.

As previously mentioned, in-scope undertakings may be required to disclose a CSRD-aligned report in relation to the whole global group, including non-EU group companies, on a consolidated basis. These disclosures will be less extensive than those that apply to EU group companies. The EU plans to ease the transition by phasing in the approach from 2024 to 2030.

One of the EU subsidiaries within the group must request all of the necessary information from the non-EU parent and, if this is not available, must publish the sustainability report containing all of the available information in its possession and explain that the non-EU parent was unable to provide the rest of the required information. The same requirement applies in circumstances where the non-EU parent does not provide the required assurance opinion (see “Auditing and assurance of CSRD reporting” below).

In recognition of the fact that global reporting standards in this area may vary, the CSRD permits non-EU parent undertakings to report on a consolidated basis for their EU subsidiaries, provided that the consolidated sustainability reporting is prepared in an equivalent manner to the EU standards.

Overview of the ESRS

As mentioned above, the detailed reporting requirements for in-scope companies are set out in the ESRS. The general sector-agnostic ESRS contain:

i. Two cross-cutting standards:

a) ESRS 1 (General Requirements), which sets out the overarching principles for preparing and presenting sustainability-related information

b) ESRS 2 (General Disclosures), which sets out the general information that must be disclosed across all topical standards

ii. Ten “topical” sustainability standards, five of which are environmental standards, four are social standards and one is a governance standard

The requirements of ESRS 2 and the topical standards are structured in broadly the same way and cover the following “reporting areas”:

i. Governance: governance processes in place to monitor, manage and oversee sustainability matters

ii. Strategy: material impacts, risks and opportunities and their interaction with strategy and business model

iii. Impact, risk and opportunity management: the processes through which the company’s material effects, risks and opportunities are identified, assessed and managed

iv. Metrics and targets: the metrics used to track the effectiveness of the company’s actions to manage and mitigate material sustainability matters

This section provides a high-level overview of the requirements only. For a detailed breakdown, please refer to the ESRS contained at Annex I to Commission Delegated Regulation supplementing Directive 2013/34/EU.

As well as reporting in accordance with ESRS 2, companies will need to consider whether any of the topical standards are relevant to them, having applied the “double materiality” principle outlined below.

Key challenges

There are likely to be a number of administrative challenges posed during the implementation of the new CSRD requirements. The following areas in particular are worth noting:

Double materiality

Under the CSRD, in-scope undertakings must report based on the “double materiality” principle. This requires the disclosure of information on both:

i. Impact materiality: the undertaking’s material, actual or potential, positive or negative impacts on people or the environment, over the short, medium or long term, including those connected with its business relationships in its upstream and downstream value chain; and

ii. Financial materiality: the material financial effects of sustainability matters on the undertaking’s development, performance and position, including risks and opportunities.

This concept is reflected in the ESRS. ESRS 1 sets out further guidance on double materiality, including a list of sustainability matters, to assist undertakings when establishing the issues that they should consider as part of their materiality assessment for each topical standard under the ESRS.

Value chain reporting

The CSRD requires that, in addition to reporting on its own operations, an in-scope undertaking will need to disclose information on the material impacts, risks and opportunities arising through its business relationships in its value chain. This means undertakings will have to obtain sustainability-related data from certain of their business partners in their upstream and downstream value chains. The information will only be required from business partners that are considered material (assessed on the basis of double materiality).

The ESRS recognise that this requirement may pose challenges, particularly when trying to obtain information from entities that are not subject to the CSRD themselves, such as non-EU entities. The EU has implemented a grace period of three years for reporting on these issues, and suggests that, if an undertaking has taken reasonable steps to collect the information but has not been successful, it can use sector average data to make an estimate.

Auditing and assurance of CSRD reporting

The CSRD introduces mandatory assurance of sustainability information for the first time. An independent auditor or audit firm will need to assess the quality and accuracy of sustainability disclosures made by in-scope undertakings. This is likely to pose a number of challenges, not least stemming from the uncertainty surrounding specific assurance standards.

The EC is not set to establish “limited assurance” standards until 2026 – limited assurance meaning non-financial assurance in which the assurer reviews processes and procedures to identify potential issues.

For “reasonable assurance”, a more extensive form of non-financial assurance, the EC has until 2028 to set standards. In the meantime, EEA member states have discretion to apply national assurance standards, procedures or requirements.

Key considerations and next steps

If businesses have not already begun to prepare for the introduction of the new requirements, it is advisable that they start that process now. This should include the following:

- Determining the extent to which the CSRD might impact on their group and the companies within it.

- Reviewing the national legislation which implements the CSRD in each relevant EEA member state to ensure that no gold plating has occurred, and to ensure that no requirements derived from any other national laws are relevant.

- Following that assessment, deciding how to approach CSRD reporting. This will include consideration of the following:

- Availability of exemptions

- Level at which reporting will be made/required

- Extent of reporting requirements

- Reviewing policies and processes in place for the collection and analysis of reliable and verifiable ESG data.

- Assessing the impact of CSRD reporting requirements on current or anticipated voluntary and compulsory reporting standards in other geographies.

- Engaging with business partners in anticipation of potential value chain reporting.

- All references to Articles are to the Articles of the Accounting Directive, as amended by the CSRD, unless stated otherwise.

- A public interest entity is an EU company that either: (i) has securities listed on a regulated market in the EU; (ii) is a specific form of financial services company (such as an insurance company or credit institution); or (iii) has been designated a public interest entity by its country of incorporation.

- Reporting can be delayed for financial years starting before 1 January 2028, in which case a brief explanation for this delay must be included in the management report.

- A micro-undertaking is a company that meets at least two of the following three criteria: (i) balance sheet total of no more than €350,000; (ii) net turnover of no more than €700,000; or (iii) 10 or fewer employees.

In-depth 2023-265

Authors