Section 4003(c)(3)(D)(ii) of the Act provides that the Board of Governors of the Federal Reserve System (the Federal Reserve) may establish a main street lending program in order to support lending to small and mid-sized businesses by eligible lenders (the Main Street Lending Program), which must remain consistent with the requirements of section 13(3) of the Federal Reserve Act, using such funds as appropriated by section 4027 of the Act.

On April 9, 2020, the Federal Reserve released additional guidance on the Main Street Lending Program. The Secretary provided that under a Main Street New Loan Facility (the MSNLF) and a Main Street Expanded Loan Facility (the MSELF), a federal reserve bank will lend to a single common special purpose vehicle (SPV) on a recourse basis. Such SPV will then use these funds to (i) purchase 95 percent participations in Eligible Loans (as defined below) from U.S. insured depository institutions, U.S. bank holding companies, and U.S. savings and loan holding companies (Eligible Lenders) under the MSNLF; and (ii) purchase 95 percent participations in the updated tranche of Eligible Loans from Eligible Lenders. In each case, the Eligible Lenders will be required to retain 5 percent of each Eligible Loan under the MSNLF, and each upsized tranche of each Eligible Loan under the MSELF, respectively. The Secretary will make an initial $75 billion combined contribution in connection with the MSNLF and the MSELF, with up to $600 billion expected to be made available to the programs collectively.

General Terms of the Eligible Loans

Eligible Borrower: It is important to note that a borrower (an Eligible Borrower) that participates in either the MSNLF or the MSELF may not also participate in the other facility, or the Primary Market Corporate Credit Facility (the PMCCF). The PMCCF is a program that was introduced concurrently with the MSNLF and MSELF, whereby funding is available for direct purchases by an SPV to be established by the Federal Reserve of “Eligible Assets” (corporate bonds and/or portions of syndicated loans) from “Eligible Issuers”. Additionally, in order to be eligible for either the MSNLF or the MSELF, a borrower:

- May have up to (i) 10,000 employees or (ii) $2.5 billion in 2019 annual revenue; and

- Must be a business (i) that is created or organized in the United States or under the laws of the United States, (ii) with significant operations in the United States, and (iii) with a majority of its employees based in the United States.

Eligible Loan: The terms of an Eligible Loan under the MSNLF (the loan must have the following features) and the MSELF (the upsized tranche must have the following features) are as follows:

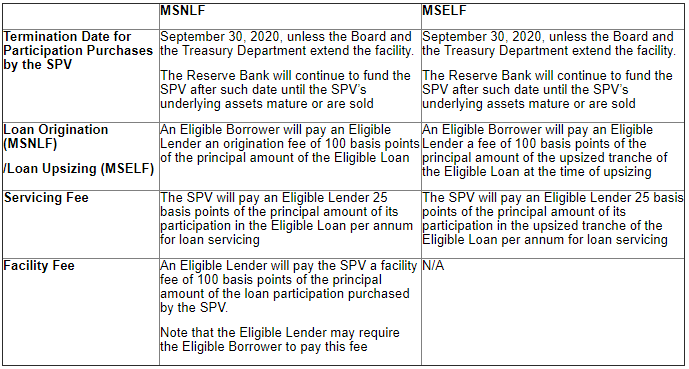

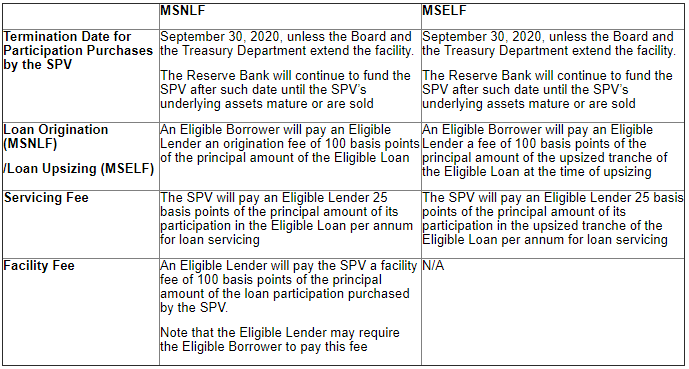

Fees, Servicing and Termination:

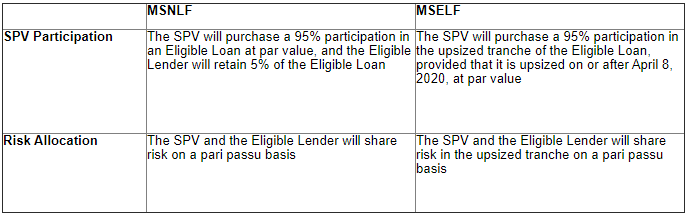

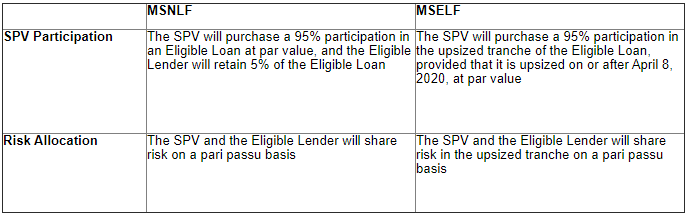

Participation

Certifications

In addition to the certifications required by the CARES Act, and other applicable statutes and regulations, the following attestations are required.

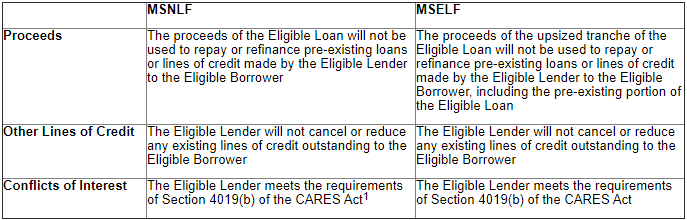

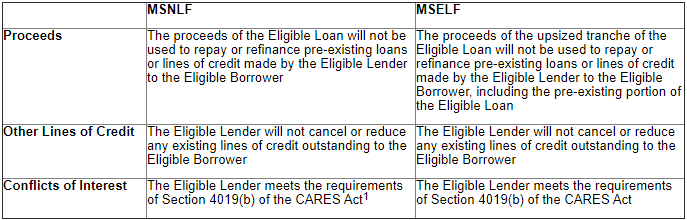

Eligible Lenders: The Eligible Lenders must certify as to the following in connection with each respective program.

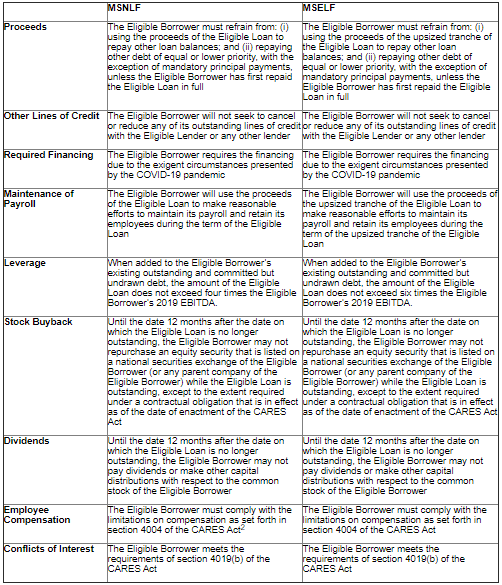

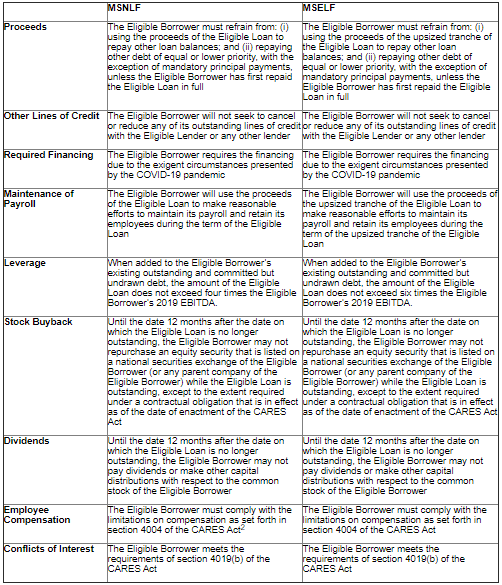

Eligible Borrowers: The Eligible Borrowers must certify as to the following in connection with each respective program.

Section 4019(b) of the CARES Act requires that a 20 percent interest of the Eligible Lender or the Eligible Borrower, as applicable, is not held by the President; the Vice President; the head of an executive department; a member of Congress; or a spouse, child, son-in-law, or daughter-in-law of such an individual.- Section 4004 of the CARES Act provides that from the execution date of the Eligible Loan to the date that is one year after that execution date, (1) no officer or employee of the Eligible Borrower whose total compensation exceeded $425,000 in calendar year 2019 (other than an employee whose compensation is determined through an existing collective bargaining agreement entered into prior to March 1, 2020): (A) will receive from the Eligible Borrower total compensation which exceeds, during any 12 consecutive months of such period, the total compensation received by the officer or employee from the Eligible Borrower in calendar year 2019; or (B) will receive from the Eligible Borrower severance pay or other benefits upon termination of employment with the Eligible Borrower which exceeds twice the maximum total compensation received by the officer or employee from the Eligible Borrower in calendar year 2019; and (2) no officer or employee of the Eligible Borrower whose total compensation exceeded $3 million in calendar year 2019 may receive during any 12 consecutive months of such period total compensation in excess of the sum of: (A) $3 million and (B) 50 percent of the excess over $3 million of the total compensation received by the officer or employee from the Eligible Borrower in calendar year 2019. As used herein, “total compensation” includes salary, bonuses, awards of stock, and other financial benefits provided by an Eligible Borrower to an officer or employee of the Eligible Borrower.

Our Reed Smith Coronavirus team includes multidisciplinary lawyers from Asia, EME and the United States who stand ready to advise you on the issues above or others you may face related to COVID-19.

For more information on the legal and business implications of COVID-19, visit the Reed Smith Coronavirus (COVID-19) Resource Center or contact us at COVID-19@reedsmith.com

Client Alert 2020-234