1. What is LIBOR, and what went wrong with it?

For decades, interbank offered rates (IBORs) have served as the reference rate at which banks borrow funds from other banks. The London Interbank Offered Rate (LIBOR), which measures the cost of unsecured borrowing between banks across five currencies (USD, EUR, GBP, CHF and JPY) and seven tenors (Overnight, 1W, 1M, 2M, 3M, 6M and 12M), is a barometer for the global economy and is widely used by financial institutions and investors who operate internationally. It is an interest-rate average calculated from submissions made by a panel of contributor banks in London. With LIBOR being the benchmark interest rate that underpins more than US$300 trillion worth of financial contracts worldwide, the importance of LIBOR as a global index in financial markets across the world has never been questioned.

However, since the global financial crisis in 2008, it has been discovered that certain contributor banks had manipulated their LIBOR submissions, which ultimately led to the LIBOR scandal and triggered concerns about the reliability and sustainability of certain IBORs in the unsecured interbank funding market.

2. When will LIBOR be discontinued, and which transactions will be affected?

The Financial Stability Board (the FSB) was established in April 2009 in the immediate aftermath of the LIBOR scandal, and was tasked with reviewing major interest rate benchmarks and coming up with suitable alternatives to the existing reference rates. In July 2014, the FSB set out its recommendations to reform major interest rate benchmarks, including key major IBORs, and opined that risk-free reference rates could be used as alternative reference rates.

Then in July 2017, the UK Financial Conduct Authority (the FCA) announced that they would no longer compel contributor banks to make LIBOR submissions after 2021, further accelerating the need for financial institutions and other market participants to move away from LIBOR.

The impending discontinuance of LIBOR will affect both new and existing loan facilities and other financial products referencing LIBOR which mature after the end of 2021.

3. Has COVID-19 postponed the deadline?

So far, no. On 25 March 2020, the FCA, the Bank of England and the Working Group on Sterling Risk-Free Reference Rates published a joint statement in which they confirmed that, despite the impact of COVID-19, the general timeline for LIBOR discontinuance by the end of 2021 had not changed, although they would continue to monitor and assess the impact on transition timelines.

On 29 April 2020, the FCA reaffirmed that there was no change to the 2021 date, but recognized the challenges posed by COVID-19 and pushed back certain milestone dates for the discontinuance of sterling LIBOR.

4. What will replace USD LIBOR?

The Alternative Reference Rates Committee (the ARRC), convened by the U.S. Federal Reserve to oversee the transition process for U.S. dollars, has named the Secured Overnight Financing Rate (SOFR) as its recommended alternative to USD LIBOR.

5. What will replace LIBOR for other currencies?

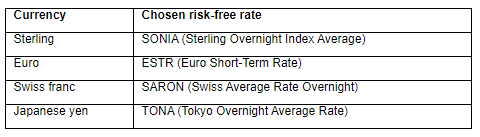

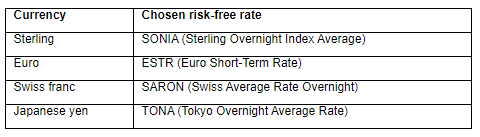

Apart from SOFR, other risk-free rates have also been identified as alternatives for the other LIBOR currencies:

The transition for other currencies is beyond the scope of discussion of this memo, which focuses on U.S. dollars only. In the remainder of this memo, we will simply refer to USD LIBOR as “LIBOR”.

6. What is SOFR, and how is it different from LIBOR?

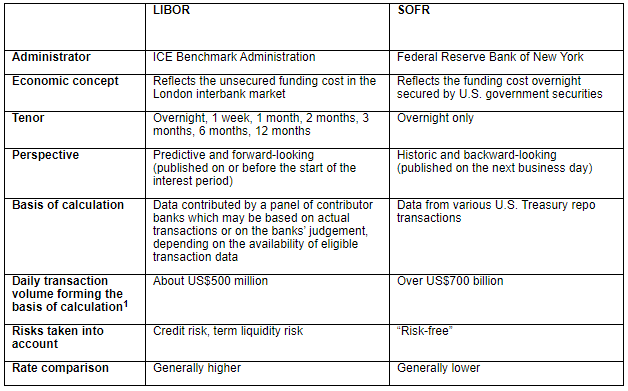

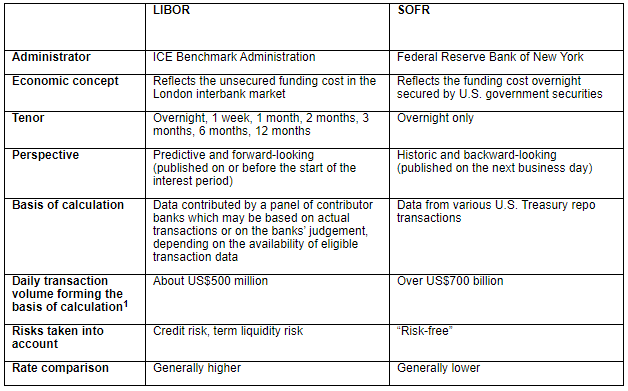

SOFR is based on the funding cost of overnight transactions secured by U.S. government securities. The major differences between SOFR and LIBOR are summarised in the table below:

As can be seen, compared to LIBOR, SOFR’s objectivity in calculating from a large pool of underlying transactions makes it more reliable and less susceptible to manipulation.

However, SOFR is overnight, published only the next morning and generally lower, which is drastically different from LIBOR, which all loan market participants have now grown accustomed to. In order to make SOFR better suited for loan transactions and to ensure the smooth transition of legacy LIBOR loans, the following adaptations would need to be made to SOFR:

(a) Allow interest to be accrued for a time period longer than overnight.

(b) Allow the rate to be fixed well before the interest payment date, to make time for payment arrangements.

(c) Raise the rate to a level more comparable to LIBOR.

(d) Develop a set of conventions for the determination and compounding of the interest rate and accrual of interest under SOFR.

6.1. Forward-looking term SOFR and compounded SOFR in arrears

There are a number of ways to achieve (a) and (b) above, the details of which are highly technical and beyond the scope of discussion of this memo. It should be noted, though, that recent market efforts have mainly focused on the following two options:

i. Forward-looking term SOFR – devise a forward-looking term SOFR for different maturities, which should be published as a screen rate. This rate is not yet available as of the date of this memo, although the ARRC has set the goal to establish an RFP process and criteria for recommendations by the end of September 2020, in order to select the administrator of an ARRC-recommended forward-looking term SOFR to be published by the first half of 2021, if sufficient SOFR derivative liquidity develops.

ii. Compounded average SOFR in arrear – in the absence of a forward-looking term rate, a compounded average of SOFR should be calculated in arrear over an “observation period” (i.e., the “lookback” method, where the SOFR rate from k days earlier (“lag time”) is adopted for each day in the interest period). Since 2 March 2020, the Federal Bank of New York has been publishing 30-, 90-, and 180-day compounded average SOFR rates.

6.2. Spread adjustment

For (c) above, this can be achieved by adding a spread adjustment to SOFR. Such spread adjustment may need to be varied for different tenors. On 8 April 2020, the ARRC announced that it had agreed on a recommended spread adjustment methodology, and would soon release a more detailed final recommendation. Similarly, the ARRC has also set the goal to establish an RFP process by the end of September 2020, in order to select the administrator to publish the ARRC’s recommended spread adjustments and spread-adjusted rates.

6.3. SOFR conventions

For (d) above, the ARRC has set the goal to establish final recommended conventions for, inter alia, SOFR-based business loans by the end of July 2020.

7. Where are we in terms of loan documentation?

7.1. New SOFR loans

In the EMEA market, the Loan Market Association (the LMA) published an exposure draft compounded SOFR U.S. dollar facility agreement in September 2019 (as further updated in February 2020). Interest for any given interest period is determined by reference to a compounded average of SOFR, calculated in arrear over an observation period starting before the start of, and ending before the end of, that interest period (i.e., the ‘lookback’ method – see section 6.1.ii above). It should be noted that the draft is for discussion purposes only, and does not yet constitute the LMA’s officially recommended form of facility agreement.

Meanwhile, in February and March 2020, the Loan Syndications and Trading Association (the LSTA) in the U.S. published two SOFR concept credit agreements, one for compounded SOFR and one for simple SOFR. The compounded SOFR credit agreement also references a compounded average of SOFR calculated in arrear using the “look-back” method, and contains optional language for the transition to a forward-looking term SOFR, once available.

7.2. New or existing LIBOR loans

What then for new or existing LIBOR loans that mature after the end of 2021?

7.2.1. ARRC

The U.S. market has so far been more progressive on this front. In May 2019, the ARRC recommended “fall-back language” to be inserted into new or existing LIBOR facility agreements, which will become effective upon the occurrence of a trigger event (e.g., LIBOR ceasing to be available). There are three sets of fall-back language, each with a different approach:

a. “Hardwired” approach – the parties agree upfront on a “waterfall” of replacement rate and spread adjustment options. Revised “hardwired” fall-back language is expected to be published by the ARRC by the end of June 2020.

b. “Amendment” approach – the parties agree that decisions relating to the replacement rate and spread adjustment are to be made in the future, which may or may not require the Borrower’s consent (depending on whether the parties opt for this requirement).

c. “Hedged loan” approach – the parties agree upfront to refer to whatever is adopted by the ISDA for derivatives transactions (more suitable for loan transactions where the parties have also entered into interest rate swaps).

7.2.2. LMA

In the EMEA market, the LMA has so far been more reserved in its approach, and in November 2018 expressed concerns over the appropriateness of the ARRC’s “hardwired” approach, pointing out, among other reasons, that there was still insufficient visibility into the details of the waterfall options at the time.

a. “Replacement of Screen Rate” clause

For now, the go-to solution for syndicated loans in the EMEA market is the “Replacement of Screen Rate” clause published by the LMA in December 2018, which has also been incorporated into LMA standard form syndicated facility agreements. The clause lowers the required threshold for Lenders’/ Majority Lenders’ approval in making amendments relating to the replacement interest rate if a Lender fails to make timely requests or responses in relation to those amendments. However, the clause is not particularly useful for bilateral loans.

The LMA’s “Replacement of Screen Rate” clause is more akin to the “amendment” approach proposed by the ARRC in that decisions relating to the replacement rate are left until later, the major difference being that requirement for any amendment to be made with the Borrower’s consent is a must and is not an option that the parties can opt out of.

b. Reference Rate Selection Agreement

In October 2019, the LMA also published an exposure draft Reference Rate Selection Agreement, allowing Lenders / Majority Lenders to authorise the Facility Agent to agree on their behalf with the Borrower on the necessary amendments to the facility agreement, in accordance with the terms set out therein and in the recommended forms of SOFR facility agreements (yet to be published by the LMA – see section 7.1 above). The Reference Rate Selection Agreement is therefore not expected to be used until the LMA recommended form SOFR facility agreements are available.

c. “Unavailability of Screen Rate” and “Cost of Funds” clauses

In the absence of agreement between the loan parties to either amend the facility agreement or to enter into a Reference Rate Selection Agreement, the default position under existing LMA form facility agreements will be the “Unavailability of Screen Rate” and “Costs of Funds” clauses, which many market participants are by now quite familiar with. Essentially, under these clauses, LIBOR is determined in the order of the following waterfall of fall-backs:

- Screen Rate →

- Interpolated Screen Rate →

- [Screen Rate for shortened interest period] →

- [Historic Screen Rate for shortened interest period] →

- [Interpolated Historic Screen Rate for shortened interest period] →

- [Reference Bank Rate] →

- Lenders’ Cost of Funds,

noting that in practice, parties often opt out of fall-backs (3) to (5), and sometimes out of fall-back (6).

However, upon the discontinuance of LIBOR, the Screen Rate (i.e., (1) above) will cease to be available, as will fall-backs (2) to (6). As a last resort, fall-back (7) will apply and the benchmark rate will no longer be LIBOR or LIBOR-based, but will instead be determined as each Lender’s cost of funds as notified to the Borrower. However, these provisions were only designed to address the temporary unavailability of LIBOR, and are not meant to be a long-term solution to LIBOR’s discontinuance. The level of discretion given to the Lenders in determining its cost of funds is also inherently disadvantageous to the Borrower. Eventually, the Borrower will likely want to invoke its right to request negotiations and, if the parties fail to agree on a fair solution, get out of the deal by prepaying the loan in full.

7.2.3. APLMA

In the Asia Pacific region, the Asia Pacific Loan Market Association (the APLMA) generally follows the position of the LMA, and has incorporated an older version of the LMA’s “Replacement of Screen Rate” clause into its standard form U.S.-dollar facility agreements. From our observation, this is the approach currently adopted in the vast majority of Asian syndicated loan transactions, while bilateral loans still typically rely on the “Unavailability of Screen Rate” and “Cost of Funds” clauses.

8. What has the market seen so far?

In the past nine months or so, a number of SOFR-linked loans have already been reported in the market.

For example, for syndicated loans, Royal Dutch Shell announced in December 2019 that it had reached a deal with a syndicate of 25 banks on a US$10 billion revolving credit facility. Under the terms of the transaction, the LIBOR interest rate will be replaced by SOFR as early as the first anniversary of its signing date, once the bank market is fully prepared for SOFR as an underlying rate. For bilateral loans, JP Morgan announced in October 2019 the execution of its first bilateral SOFR-linked loan with Brazilian bank Itau BBA.

9. What should Borrowers do now?

We set out in the Appendix hereto some questions for Borrowers to consider. Kindly note that it is not an exhaustive list, nor is it (or any part of this memo) intended to constitute legal advice.

For specific queries and advice, please contact your usual relationship lawyers at Reed Smith, who would be delighted to advise you further on this.

1. federalreserve.gov/speech

Appendix

Questions for Borrowers

1. Are there any existing facility agreements, facility letters or other contracts of financial products which adopt LIBOR (for calculating interest rate, default interest rate, break costs, etc.)?

2. If the answer to Q1 is yes, do any of their repayment dates and/or interest payment dates go beyond 2021?

3. If the answer to Q2 is yes, are there any existing amendment/fall-back provisions, and how do they work?

(a) Are there any existing provisions dealing with replacement of the screen rate? What approach is being adopted?

(i) If an “amendment” approach is adopted (see sections 7.2.1.b and 7.2.2.a), when and how will an amendment of the reference rate be effected? (Does it require all Lenders’ consent? Does it require the Borrower’s consent? If the Borrower’s consent is not required, how much discretion is given to the Lender /Facility Agent in making the amendment? How many days’ prior notice is required? Who should lead the amendment process? Should the Borrower reach out to the Lender / Facility Agent for amendment requests, and if so, when?)

(ii) If a “hardwired” approach is adopted (see section 7.2.1.a), what are the trigger events and what are the pre-identified replacement rates? Is the Borrower prepared financially and operationally if such replacement rates replace LIBOR?

(b) Have the parties also entered into an ISDA or other interest rate swap agreement? If yes, and if a “hedged loan” approach (see section 7.2.1.c) is not adopted, what is the risk of any potential mismatch of interest rates in the loan and swap agreements?

4. If there are no specific provisions dealing with replacement of the screen rate, based on the existing “Amendments”, “Unavailability of Screen Rate” and “Cost of Funds” clauses (see section 7.2.2.c), how will the interest rate be determined upon the discontinuance of LIBOR? How can an amendment to the reference rate be effected? Does it require all Lenders’ consent? How many days’ prior notice is required?

5. Going forward, can the Borrower accommodate arrangements associated with a “backward-looking” interest rate (operationally and financially), in case no forward-looking screen rate is available, and a backward-looking SOFR is officially announced as a recommended replacement for LIBOR? How much lag time would the Borrower need in order to make payment arrangements? (See section 6.1.ii.)

6. If the Borrower is a listed company, are there any disclosure or announcement obligations (e.g., to any stock exchange and/or to shareholders) if any amendment to the reference rate is effected or any “hardwired” provision is triggered?

Client Alert 2020-268