The Ordinance

i. Tax rate

The tax rates for qualifying ship lessors and ship leasing managers will be as follows:

#Note: i.e. half of the current profits tax rate for corporations.

ii. Ships

The Ordinance targets ships in general (including barges, air-cushion vehicles, and dynamically supported crafts) but excludes junks, vessels propelled by oars, and military vessels. It also does not appear to cover seaborne units, such as offshore drilling rigs, which are not capable of navigating in water.

For qualifying ship leasing activities, the ship being leased should be over 500 gross tonnage, and be navigating solely or mainly outside Hong Kong waters.

iii. Ship leasing activities and ship leasing management activities

Ship leasing activities consist of operating leases and finance leases, including sale and leasebacks and sub-leases. Also covered are certain corollary pre- and post-lease activities such as agreeing on funding terms, acquiring target ships, monitoring or revising funding and/or leasing agreements and managing risks associated with leases.

Ship leasing management activities cover a broad range of financing and management activities relating to ship leasing, including providing intra-group financing, providing credit support for external financing, and overseeing the design and construction of newbuilds.

iv. Substantial Hong Kong presence and activity

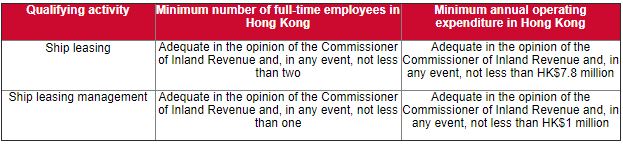

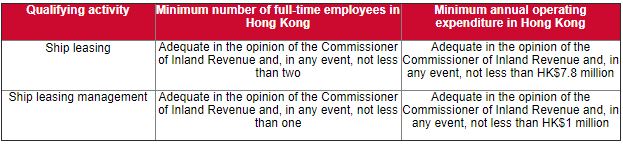

The central management and control of qualifying ship lessors and qualifying ship leasing managers must be located in Hong Kong. The activities that produce their qualifying profits should also be carried out in Hong Kong, which will only be considered as such if the following threshold requirements are met:

v. Safe harbor

For qualifying ship leasing managers, there will be a “safe harbor” allowing them to carry on certain non-qualifying activities, provided that (i) at least 75 percent of the profits come from qualifying activities, and (ii) the value of assets used by the company to conduct qualifying activities is at least 75 percent of its total assets.

vi. Other anti-abuse measures

Apart from the requirement for substantial presence and activity in Hong Kong, the new regime also incorporates the following anti-abuse features to safeguard the integrity of the tax system and to comply with international tax rules:

(a) Requiring qualifying ship lessors and qualifying ship leasing managers to be standalone corporate entities to prohibit loss transfer.

(b) Requiring qualifying ship lessors and qualifying ship leasing managers to conduct business transactions with their associated parties on an arm’s length basis.

(c) Introducing main purpose tests to prevent tax avoidance and treaty shopping.

(d) Disallowing a qualifying ship lessor or a qualifying ship leasing manager to use the loss sustained in the year of assessment where its profits are assessed at 0 percent for set off against of its assessable profits for any subsequent year of assessment.

Significance and implications

Under section 23B of the Inland Revenue Ordinance (Chapter 112), namely, the existing tax regime for Hong Kong shipowners, charterhire income of ships engaged in international trade is exempt from profit tax, as is 50 percent of the charterhire income of ships navigating between Hong Kong and river trade limits. However, there has been uncertainty as to the application of section 23B to taxpayers who are not ship operators but derive rental income from pure ship leasing businesses. The new regime provides certainty on the tax rate applicable to leasing companies going forward.

The new regime also gives ship leasing companies another tax-efficient option when building a business platform in Asia. Currently, Singapore provides tax exemption for qualifying ship leasing companies and a concessionary tax rate of 10 percent for approved leasing managers under its Maritime Sector Incentive (MSI) scheme.

At present, a number of leasing companies based in the People’s Republic of China already have a presence in Hong Kong, although their Hong Kong bases are primarily used for obtaining financing rather than for actual leasing operations. It is likely that the attractiveness of the new tax regime will prompt these leasing companies to further expand their presence in Hong Kong and book their profits there.

What remains unclear, though, is what factors will be considered in determining whether the qualifying activities carried out in Hong Kong are “adequate” (see the table under iv above). Pending further guidelines from the Inland Revenue Department, the uncertainty and subjectivity of the law may reduce its attractiveness to ship leasing companies seeking to take advantage of the new tax regime.

Client Alert 2020-409