The EU Regulation on sustainability (environmental, social and governance (ESG)) disclosures in the financial services sector (the Disclosure Regulation) came into force on 19 December 2019 and will apply from 10 March 2021.

The Disclosure Regulation will require financial market participants (FMPs) and financial advisers (FAs) (see below) to provide investors with certain ESG-related information in relation to certain financial products in order to enable investors to make informed investment decisions based on ESG factors.

Authors: Claude Brown Andrzej Janiszewski Sophie Davis

Who is in scope for the Disclosure Regulation?

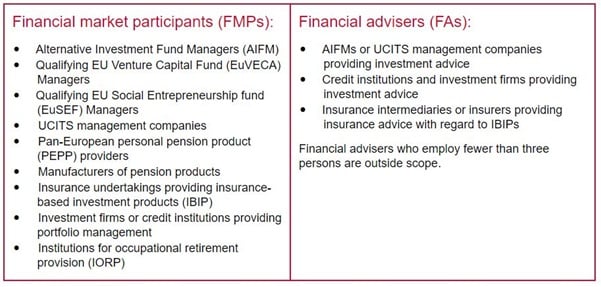

The Disclosure Regulation will require certain asset and fund managers, as well as advisers listed in the table below, to comply with the rules on ESG disclosures.

The Disclosure Regulation explains that where entities carry out both FMP and FA activities, such entities will be deemed to be FMPs where they act in the capacity of a manufacturer of financial products (e.g. AIFs, UCITS, PEPS or portfolio managers) and will be deemed to be FAs where they provide investment or insurance advice.

What will this mean in practice?

The Disclosure Regulation imposes requirements on FMPs and FAs to provide investors with pre-contractual information, disclosures on their websites and disclosures in periodic reports as required under relevant sector regulation.

This will require FMPs and FAs to make changes to their internal processes, procedures and policies in order to comply with these new requirements.

The table below provides a summary of the core requirements under the Disclosure Regulation.

FMPs and FAs must ensure that marketing communications do not contradict the information disclosed pursuant to the Disclosure Regulation.

Whilst the Disclosure Regulation does not make it compulsory to provide training to employees on the Disclosure Regulation, it is inevitable that relevant persons (for example, client-facing financial advisers and senior managers with ultimate responsibility for compliance with the Disclosure Regulation) will require, and should be provided with, training on these regulatory changes.

Technical Standards

Corresponding technical standards, which will provide further guidance on how to fulfil the requirements of the Disclosure Regulation, are currently in the consultation phase (see consultation paper published on 23 April 2020) and open to feedback until 1 September 2020.

It will be important for FMPs and FAs to keep abreast of these developments to ensure that their policies and procedures comply with the prescriptive requirements in the Disclosure Regulations as amended from time to time.

Brexit

A recent version of the Financial Miscellaneous Amendments (EU Exit) Regulations 2020 (the Exit Regulations – see part 3, item 22), published on 6 May 2020, states that the Disclosure Regulation will continue to apply in the UK when the Brexit transition period ends on 31 December 2020, but only in part, with key omissions relating to the upcoming technical standards and financial product-specific disclosure requirements in article 7 (i.e. transparency of adverse sustainability at the financial product level). Given that the Exit Regulations are in draft form and the nature of Brexit remains unclear, FMPs and FAs will need to consider the effect of any divergences between the UK and EU legislation in their Brexit planning.

The German view

The German Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin)) has published a non-legally binding good practice guideline (Guideline) for all financial institutions, which is designed to encourage financial institutions to consider “sustainability risks” when developing their business strategy and providing services to clients. It is clear that this topic is a key priority for the BaFin.

The Guideline makes clear that the term “sustainability risks” is not restricted to climate issues but extends to all ESG risk factors, including compliance with recognised labour standards and tax rules. The Guideline covers such matters as risk identification, risk management and risk control processes; internal stress tests including scenario analyses, especially with regard to individual company tests; transition scenarios and impact scenarios; and also addresses questions on outsourcing, intra-group issues and the use of sustainability ratings.

What next?

This latest initiative forms part of the EU’s Action Plan for wider sustainability, which was launched in March 2018 with the aim of promoting ESG finance. (More information on the wider EU Action Plan 2018 and other relevant regulations effecting the financial services sector is available in our previous client alert, 'Developments in sustainable finance: EU Commission action plan for financing sustainable growth'.) Further legislative initiatives in this space include:

- The Taxonomy Regulation which aims to introduce an EU-wide classification system (i.e. a taxonomy) for ESG-related investments. The regulation was adopted by the European Council on 15 April 2020 with the aim of establishing the taxonomy by the end of 2020 with full application by the end of 2021.

- Draft delegated regulations clarifying the effect of ESG considerations for suitability assessments under MIFID II and the Insurance Distribution Directive which were published by the European Commission on 4 January 2019 and are expected to be adopted in 2021.

This latest development clearly highlights the need for financial institutions to take greater account of ESG factors in their business practices, strategies and compliance frameworks.

Please get in touch with your usual Reed Smith contact if you have any questions or concerns.

- The Disclosure Regulation defines “sustainability risk” as an ESG “event or condition that, if it occurs, could cause a negative material impact on the value of the investment”.

- The Disclosure Regulation defines “sustainability factors” as “environmental, social and employee matters, respect for human rights, anti‐corruption and anti‐bribery matters”.

- Available at boersen-zeitung.de/.

Client Alert 2020-376