Though known for its beautiful mountains and lush forests, Washington State also has a less inviting side that out-of-state companies are increasingly seeing. Washington’s relatively unique status as a separate company state1 with a statutory economic nexus standard2 catches many out-of-state taxpayers by surprise. In particular, entities that exclusively perform administrative, managerial, and other services for out-of-state affiliates are often swept up in the Business and Occupation (“B&O”) tax regime, despite lacking any direct physical presence in Washington. For impacted taxpayers, awareness of some recent guidance may help soften the blow.

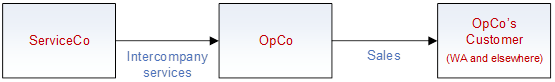

Businesses with the following fact pattern are often captured in Washington’s nexus web: one entity (“ServiceCo”) performs various services (i.e. corporate governance, legal, finance and accounting, human resources, procurement, and/or marketing) for its affiliate (“OpCo”), which is a wholesaler or retailer of tangible personal property:

Both ServiceCo and OpCo are based outside Washington and may have little or no property or payroll in the state. OpCo makes sales nationwide and pays B&O tax, while ServiceCo has no filing history in Washington prior to being audited by the Department of Revenue (“Department”). On audit, the Department sources a portion of ServiceCo’s intercompany receipts from OpCo to Washington, resulting in B&O tax liability for ServiceCo.

Given that the U.S. Supreme Court has already upheld the imposition of the B&O tax on the receipts of taxpayers without a physical presence in Washington,3 the most viable challenge to an assessment of B&O tax against ServiceCo should involve a focus on the sourcing of the fees received from OpCo, rather than on ServiceCo’s nexus with Washington. With this in mind, the Washington Court of Appeals’ recent decision in LendingTree4 may be instructive.

LendingTree involved an online marketplace that matched prospective borrowers with potential lenders. LendingTree received fees from lenders for each borrower referral, and an additional fee if the referral resulted in a loan. In overturning a trial court, the Court of Appeals held that LendingTree’s receipts must be sourced to the location where the lenders conducted their business activity, rejecting the Department’s position that LendingTree should look through the lenders and source its receipts based on borrower location. Specifically, the court determined that under Washington’s regulations5, the benefit of LendingTree’s services were received at the location where its customers were physically located, not at the location of its customers’ market (the borrower location).

Taxpayers should consider the effect of LendingTree when sourcing receipts from services to affiliates. There are at least four different sourcing approaches that may apply:

Source receipts based on the proportion of OpCo’s sales made into Washington. This is perhaps the method least supported by LendingTree and Washington’s statute and regulations because those authorities are clear that it is the location of the customer, not the customer’s customer, that controls. Nonetheless, the Department has taken this approach at audit in the past when sourcing service receipts from the provision of services to affiliates on the basis that the affiliate’s ultimate sales to consumers are the “related business activity” that Washington law looks to for sourcing purposes. This sourcing approach should be considered by taxpayers if OpCo’s presence in Washington exceeds the proportion of OpCo’s sales made into Washington.

Source receipts to the state where OpCo is headquartered. This is the method that is arguably most consistent with LendingTree and Washington regulatory guidance because it looks to the location of the business activity of ServiceCo’s customer (OpCo). The Department has accepted this approach with respect to fees for shared corporate officers and support staff provided to an affiliate because the affiliate’s related business activity is deemed to have occurred at its corporate domicile.

Source receipts to Washington to the extent OpCo’s property and payroll are in Washington. The Department took this sourcing approach in a Determination issued to an affiliate of a large retailer. In the Determination, the Department sourced receipts from services provided to the affiliated retailer (including developing retail store operating strategies and operating policies, advice on store location and local demographics, logistical and distribution strategy, financial advice, and order placement for store fixtures and supplies), based on the location of the retailer’s stores.

Source receipts using a hybrid model. Finally, for taxpayers that provide more than one type of service to an affiliate in exchange for a single service fee, the Department may require the taxpayer to allocate the fee among the service types and source the fee for each service separately.6 For example, the Department might source receipts for product branding using OpCo’s sales factor (as in option 1 above), receipts for corporate officer services based on the location of OpCo’s headquarters (option 2), and receipts for human resource services using OpCo’s payroll factor (option 3).

Taken together, Washington State’s tax structure can create a trap for unwary taxpayers, but its sourcing guidance can also give out-of-state companies ample interpretive opportunities.

- WAC 458-20-203.

- RCW 82.04.067(1)(c)(i).

- Tyler Pipe Industries, Inc. v. Dep’t of Revenue, 483 U.S. 232 (1987). See also Crutchfield Corp. v. Testa, 88 NE3d 900 (2016) (finding by Ohio Supreme Court that Tyler Pipe’s use of independent contractors that were physically present in Washington was a sufficient but not necessary condition to create nexus).

- LendingTree, LLC v. Dep’t of Revenue, 460 P.3d 640 (Wash. Ct. App. 2020).

- WAC 458-20-19402(303)(c).

- The Department interprets WAC 458-20-19402(303) to mean that the method for determining where a customer receives the benefit of a taxpayer’s service depends on the specific service. Thus, if a taxpayer provides a variety of services, it follows that, to the extent the various services can be reasonably distinguished, an individual examination of each service is required under Rule 19402 to determine where the customer receives the benefit of each discrete service.

Client Alert 2021-175