Key takeaways

- Certain amendments, primarily to reflect the recent changes in the regulations of the PRC relating to its overseas listing regime and align the requirements specific to PRC issuers with those applicable to other issuers, have been made to the Listing Rules, effective on 1 August 2023.

- Following the repeal of the Mandatory Provisions, the “class” distinction between “domestic shares” and “H shares” is removed.

- The class meeting requirements in the existing articles of association of PRC issuers remain valid and binding upon PRC issuers until and unless they amend their articles of association to remove.

Certain amendments, primarily to reflect the recent changes in the regulations of the People’s Republic of China (the PRC) relating to its overseas listing regime and align the requirements specific to PRC issuers with those applicable to other issuers, have been made to the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited (the Listing Rules or Rules), effective on 1 August 2023.

Background

On 17 February 2023, the State Council of the PRC issued the “Decision of the State Council to Repeal Certain Administrative Regulations and Documents”, and the China Securities Regulatory Commission issued the “Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies” and related guidelines (collectively, the New PRC Regulations). The New PRC Regulations came into effect on 31 March 2023, and were followed by the repeal of the “Special Regulations on the Overseas Offering and Listing of Shares by Joint Stock Limited Companies” (the Special Regulations) and the “Mandatory Provisions for Companies Listing Overseas” (the Mandatory Provisions).

Following the repeal of the Mandatory Provisions, the “class” distinction between “domestic shares” and “H shares” is removed. The New PRC Regulations do not require PRC issuers to follow the previously implemented Mandatory Provisions to deem holders of domestic shares and H shares (which are both ordinary shares) as different classes of shareholders, thereby removing the class meeting requirements applied to holders of domestic shares and H shares in certain circumstances. Accordingly, one of the key consequential Rule amendments is the removal of the class meeting requirements for the issuance or repurchase of shares.

On 24 February 2023, The Stock Exchange of Hong Kong Limited (the Stock Exchange) published the “Consultation Paper on Rule Amendments Following Mainland China Regulation Updates and Other Proposed Rule Amendments Relating to PRC Issuers”, introducing consequential amendments to the Listing Rules to reflect the above-mentioned changes in the PRC regulations, as well as seeking the market’s views on other proposed Listing Rules amendments to remove or modify certain requirements specific to PRC issuers which are no longer necessary, with a view to aligning the requirements for PRC issuers with those applicable to other issuers incorporated elsewhere.

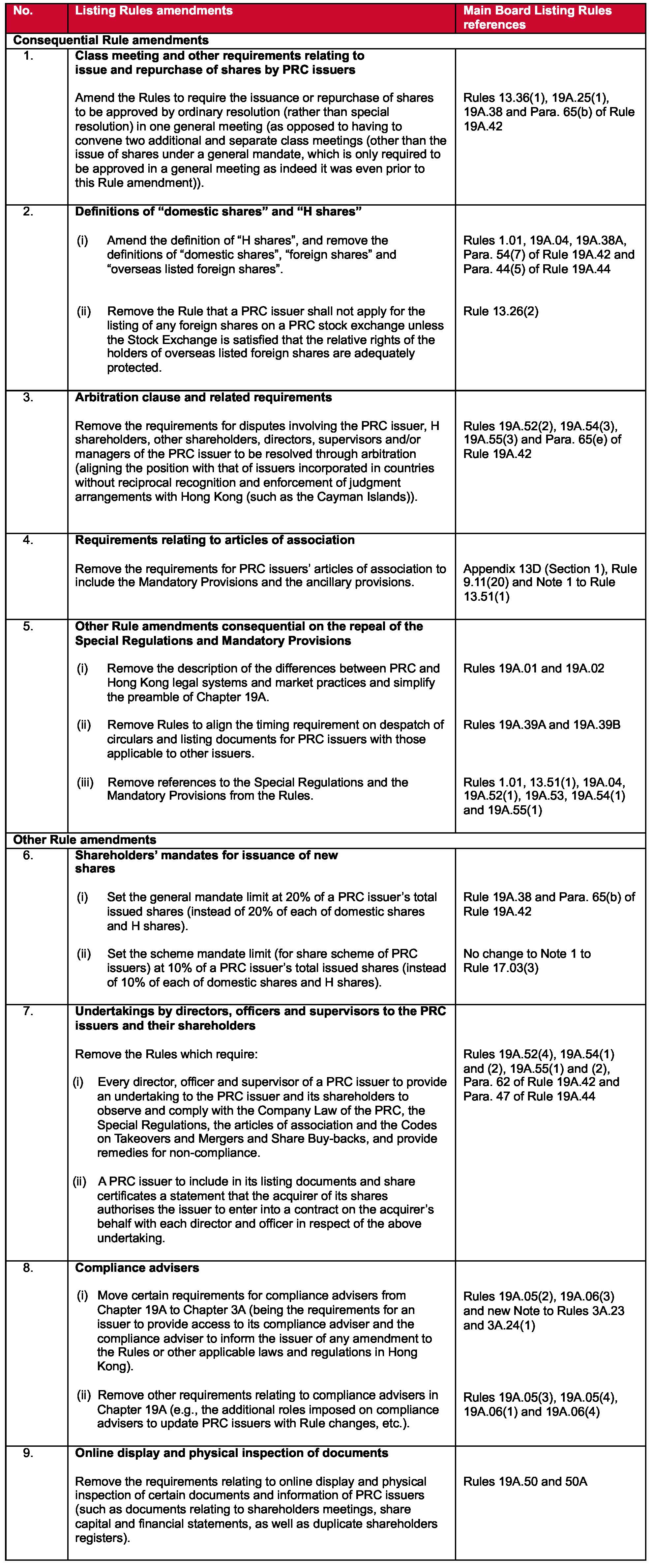

The consultation conclusions were published in July 2023, and the amendments made to the Listing Rules became effective on 1 August 2023. The key Listing Rules amendments applicable to listed PRC issuers are summarised below:

Brief notes on certain amendments

1. Class meeting requirements

Following the repeal of the Mandatory Provisions, the “class” distinction between “domestic shares” and “H shares” is removed. PRC issuers are no longer required to follow the previously implemented Mandatory Provisions to deem holders of domestic shares and H shares (which are both ordinary shares) as different classes of shareholders, thereby removing the class meeting requirements applied to holders of domestic shares and H shares in certain circumstances.

However, the requirement for H shareholders’ approval for matters affecting the listing or trading of H shares on the Stock Exchange has been retained. In particular, a withdrawal of listing of H shares from the Stock Exchange would require approval by H shareholders, as their ability to trade their securities on the Stock Exchange would be materially affected by the withdrawal of listing. This position is also adopted by the Securities and Futures Commission of Hong Kong (the SFC) and reflected in “Practice Note 25 – Guidance Note on the application of the Codes on Takeovers and Mergers and Share Buy-backs (Codes) following the abolition of the Special Regulations and the Mandatory Provisions and other matters relating to offers for A and H shares of a listed issuer” issued in March 2023.

Despite the repeal of the Mandatory Provisions, the Stock Exchange has also clarified that (a) the class meeting requirements in the existing articles of association remain valid and binding upon PRC issuers until and unless they amend their articles of association to remove the relevant requirements as PRC issuers are bound by their existing articles of association, and (b) in general, where PRC issuers voluntarily propose to amend their articles of association to remove the class meeting requirements, they should obtain the approval of domestic shareholders and H shareholders at separate class meetings based on the provisions in their existing articles of association.

Hence, if a PRC issuer intends to obtain a general mandate to repurchase shares in its coming annual general meeting but has not amended its existing articles of association to remove (i) the “class” distinction between “domestic shares” and “H shares”, and (ii) the class meeting requirements, such general mandate to repurchase shares will still be subject to the approval of the general meeting and class meetings of the PRC issuer.

2. Shareholders’ mandates for issuance of new shares

As regards a PRC issuer whose H shares and domestic shares are listed on the Stock Exchange and a PRC stock exchange, respectively (i.e., an A + H issuer), given that A shares and H shares are the same class of shares, the dilution impact of a share issuance would be the same for all shareholders regardless of whether the shares issued are A shares or H shares. Hence, the Stock Exchange considers that the mandate limit for issuance of new shares should be referenced to the total issued shares, which aligns with the requirements applicable to other issuers.

As regards concerns about the potential reduction in the relative size and liquidity of the H share market if PRC issuers issue new shares primarily in the form of A shares after listing, the Stock Exchange has stated that it would consider the suggestion to impose an ongoing H share public float requirement (relating to PRC issuers which have issued shares in other regulated markets) in its review of the public float requirement.

3. Disclosure of interests

Regarding disclosure of interests in PRC issuers under Part XV of the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong), the SFC has taken the position that, as the domestic shares (A shares listed on a PRC stock exchange or unlisted domestic shares) are not shares traded on the Stock Exchange, and the domestic shares and H shares are not interchangeable, interests in H shares of a PRC issuer should continue to be calculated as a proportion of the number of issued H shares separately from the number of issued domestic shares, and that the current practice of reporting H shares and domestic shares separately remains unchanged.

In-depth 2023-202