Authors

Authors

Key takeaways

- Material transactions completed on or after April 01, 2024 require notice to California’s Office of Health Care Affordability

- New materiality thresholds determine the entities impacted by CMIR, but “health care entity” definition remains broad

- New regulations extend notice and review timeline up to 265 days

Payers, providers, and integrated delivery systems operating in California must now provide notice of material transactions. California’s Office of Administrative Law (OAL) approved the so-called Cost and Market Impact Review (CMIR) final regulations, implementing the Office of Health Care Affordability’s (OHCA’s) health care transaction reporting requirements. These finalized regulations require certain health care entities to notify OHCA of any “material change” transactions occurring on or after April 1, 2024.

California is one of several states that has adopted new laws aimed at regulating health care transactions, including by requiring parties to provide advance notice before finalizing a transaction. Aspects of this law are focused on transactions involving private equity-backed health care entities. The motivation for other aspects is broader, aimed at scrutinizing and assessing the ownership and operation of health care providers for potential anticompetitive effects on consumers and the industry.

California’s notice requirement will result in the disclosure of a significant amount of sensitive information that could reshape the way health care transactions are conducted in the state going forward, and the finalized CMIR regulations may delay deals for up to a year. Below is a brief summary and key concerns pertaining to the newly finalized CMIR regulations.

Who and what transactions fall under the CMIR regulations

In California, health care entities must notify OHCA of material transactions completed on or after April 1, 2024. The state’s “health care entity” definition is broad, encompassing payers, providers, or fully integrated delivery systems. These transactions include mergers, acquisitions, affiliations, or agreements involving: (i) a health care entity, or (ii) the provision of health care services in California, that involve a transfer of assets (such as selling, leasing, exchanging, or disposing) or control, responsibility, or governance of the assets or operations of the health care entity, either wholly or partially, to one or more entities.

Furthermore, the finalized CMIR regulations specify that for a health care entity to come under the scope of the notice requirement, the entity must undergo a “material change” transaction and meet one of the following criteria:

(1) Have annual revenue of at least $25 million or possess California assets valued at a minimum of $25 million;

(2) Have annual revenue of at least $10 million or possess California assets valued at a minimum of $10 million and be engaged in a transaction with any health care entity meeting the first requirement; or

(3) Be situated in a designated primary care health professional shortage area in California.1

Exemptions: Transactions not currently subject to OHCA review include agreements or transactions involving health care service plans subject to review by the director of the Department of Managed Health Care or the Insurance Commissioner. Additionally, agreements or transactions by a county acquiring a health care entity for continued access to services in that county, and agreements or transactions involving nonprofit corporations are also exempt from the new notice requirements.

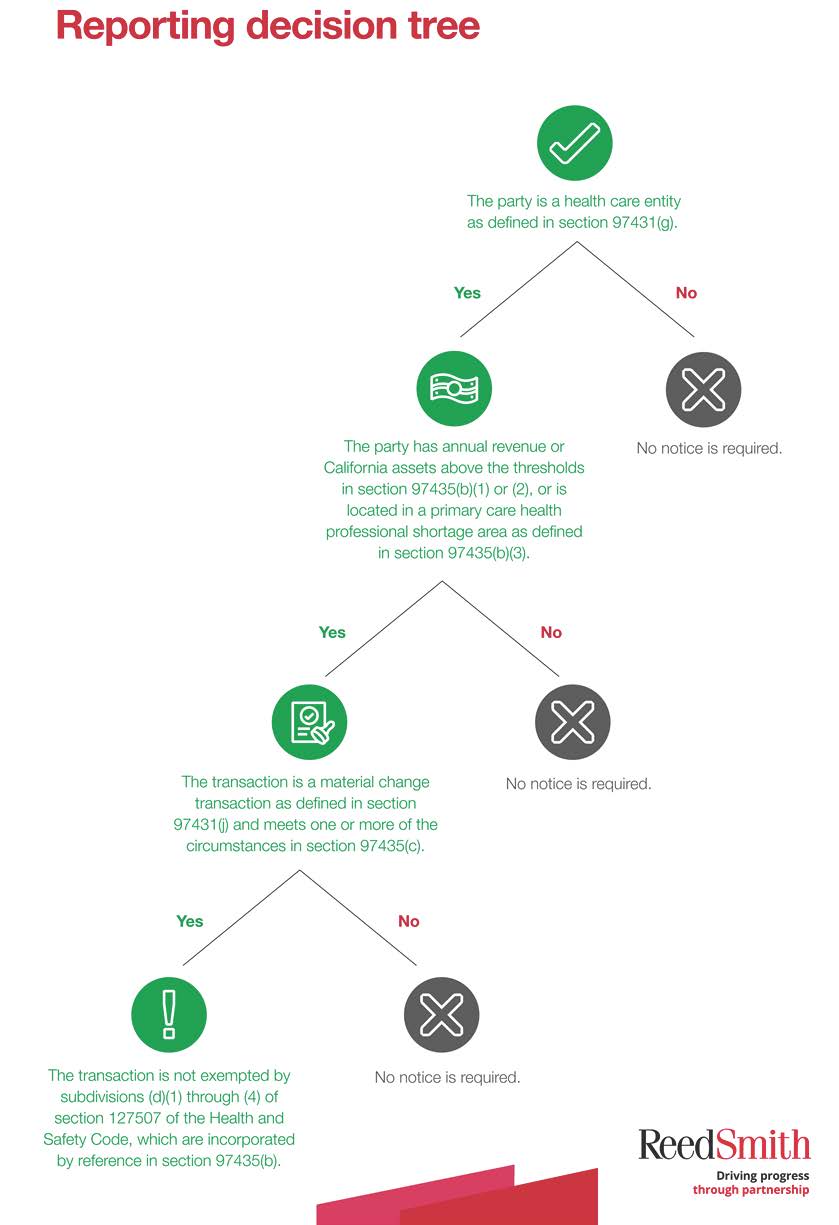

Reporting decision tree

To determine if any particular transaction is subject to the new notice requirements, we developed a decision tree that walks through each applicable question. Because all parties to a transaction are potentially subject to the notice requirements, we recommend applying the decision tree to each party individually.

Notice requirements

A health care entity must submit notice via OHCA’s submission portal. Each applicable health care entity involved in the transaction must submit a notice that includes, but is not limited to, the following:

- General information about the health care entity, such as business name, website, address, etc.

- Description of organization including, but not limited to, business lines or segments; ownership type (corporation, partnership, limited liability company, etc.); and governance and operational structure (including ownership of or by a health care entity).

- For health care providers or fully integrated delivery systems, the description must include a summary of provider type (hospital, physician group, etc.); facilities owned or operated; service lines, number of staff, geographic service area(s), and capacity (e.g., number of licensed beds) or patients served (e.g., number of patients per county) in California in the last year.

- For health care service plans, health insurers, risk-bearing organizations, and fully integrated delivery systems, the description must include number of enrollees per county in the last year.

- Federal employer tax identification number and tax status as for-profit or non-profit.

- List of current California health care-related licenses issued by regulatory agencies such as the Department of Managed Health Care, the Department of Insurance, and the Department of Public Health, including: (a) state and local business licenses related to the provision of health care services; (b) registration(s) with the Secretary of State held by the submitter, if any; and (c) for any current health-care related license(s) held outside of California, identification of the license type and the state of issuance.

- Contact person, title, email address, and mailing address for public inquiries.2

Health care entities reporting a material change transaction must provide copies of the documents specified in the CMIR regulations, including agreements and term sheets governing or related to the proposed material change (e.g., definitive agreements, affiliation agreements, stock purchase agreements), any pro forma post-transaction balance sheet for any surviving or successor entity, and certified financial statements for the prior three years and any documentation related to the liabilities, debts, assets, balance sheets, and statements of income and expenses, among other documents.

Notice and review timeline

- 90 days prior to closing: A health care entity that meets the criteria above must submit a written notice of material change to OHCA at least 90 days before the date of the transaction. Upon receipt of the complete notice, OHCA will review and make an initial determination as to whether to conduct a Cost and Market Impact Review.

- 45 days after receipt of notice: OHCA must submit a written waiver to health care entities within 45 days of receipt if it does not intend to conduct a Cost and Market Impact Review. The transaction may close without further OHCA delays.

- 60 days after receipt of notice: If OHCA decides to move forward with the Cost and Market Impact Review, then it must notify health care entities within 60 days of receiving an entity’s notice. The transaction will be barred from closing until the review is complete.

The Cost and Market Impact Review process comprises a preliminary assessment, followed by a report issued by OHCA, public comment submissions, and a final report. The final report must address the effect of the transaction on: (i) the availability and quality of health care services to the community, (ii) competition, (iii) the labor market, and (iv) barriers to entry in the health care market, among other factors.

This notice and review process may prolong transaction closures by up to 265 days. Furthermore, OHCA retains the authority to extend the outlined timeframes if awaiting supplemental information from transacting parties or during review by other regulatory entities.

Although the review may be extensive, OHCA may not block a transaction from occurring. But OHCA does reserve the right to refer a transaction to the California attorney general for further review.

Public disclosures

The burden of claiming confidentiality of documents and information submitted to OHCA is on the party submitting the notice. All information provided to OHCA will be treated as public record unless the applicant designates the information as confidential and provides justification for maintaining confidentiality. OHCA must maintain confidentiality regarding all non-public information acquired during the review process. However, OHCA reserves the right to disclose non-public information in its preliminary and final reports if it deems it to be in the public interest, while considering factors such as privacy, trade secrets, and anticompetitive concerns. This could pose significant challenges for entities seeking to safeguard certain information, potentially leading some businesses to shy away from material change transactions in order to protect sensitive data. Health care entities should exercise diligence and caution when determining what information to include in their notice to the state.

Recommendations

Be prepared. As highlighted above, the review process may significantly delay closing material transactions. Factoring this process into a deal timeline is a crucial first step before engaging in any transaction with a California health care entity.

Be diligent. Prior to entering into a transaction with a health care entity, carefully evaluate whether both parties qualify as health care entities and if the intended transaction is considered material under the statute. Collaborate closely with legal advisors to ensure that the notice is comprehensive, minimizing the need to provide further information.

Be ready. Anticipate public disclosures. Unlike other transactions, health care deals do not enjoy the luxury of remaining undisclosed. The public will have the opportunity to discover transactions and offer comments that may influence the review process. Preparing for early publication is essential and will help shape the narrative of a desired transaction.

Reed Smith attorneys will continue to closely monitor developments in California and other states to ensure compliance. If you have questions regarding the notice and review process, feel free to contact any of the authors of this client alert or the lawyers with whom you normally work.

- Cal. Code Regs. tit. 22, section 97435.

- Cal. Code Regs. tit. 22, section 97438(b).

In-depth 2024-094

Authors