Authors

Authors

Alicja Lysik

Key takeaways

- Businesses need to carefully review their customer practices in light of new subscription rules and CMA’s enforcement powers

- New obligations around unfair practices aimed at cracking down on fake reviews and drip pricing

As consumers we are now all too familiar with the importance of reviews and the convenience of subscription services, yet the frustration of uncovering hidden fees or grappling with subscription cancellations can be equally common. Meanwhile, businesses are already navigating a complex legal landscape and restrictions on targeted advertising-based business models and are about to face more regulatory requirements.

The Digital Markets, Competition and Consumers Act (DMCC) is a sprawling piece of legislation which covers many different areas including competition provisions. In this article we focus only on the new requirements for traders offering subscription contracts, and requirements regarding unfair commercial practices.

Subscription contracts

1. Before the subscription starts: Pre-contract information

The DMCC is much more prescriptive than existing UK consumer law, requiring businesses to provide consumers with specific information before entering into certain subscription contracts.

According to the DMCC, subscription contracts are agreements that provide for an automatically recurring or continuous supply of goods, services or digital content to the consumer for either an indefinite or fixed period, making the consumer automatically liable for each supply or recurring liabilities. The definition also includes contracts that initially offer goods, services, or digital content for free or at a specified rate for a certain period, and then automatically impose payments or higher charges after that period. Some contracts are excluded from this definition, including contracts for utilities (gas, electricity, water and heating), insurance and financial services, medical prescriptions, rental contracts, childcare and gambling. This list is non-exhaustive and may be amended by the secretary of state.

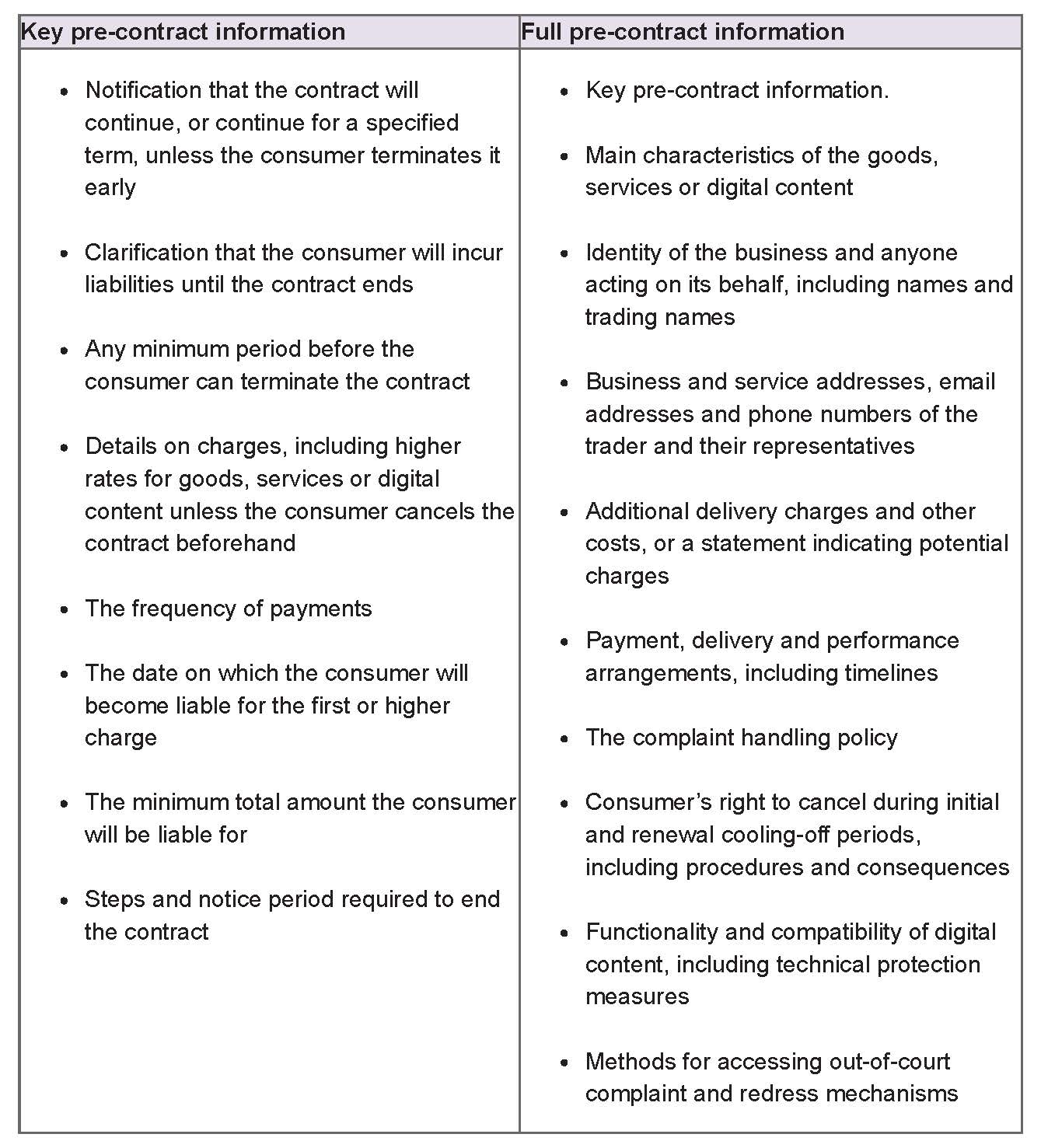

The required details include both (i) “key pre-contract information”, which must be provided separately to any other details (i.e., it can’t just be put in terms and conditions or together with “full pre-contract information”) and therefore require changes to the customer flows; and (ii) “full pre-contract information”. For contracts entered online and remotely, key pre-contract information must be given in writing and in such a way that the consumer is not required to take any steps to read the information, other than the steps the consumer must take to enter into the contract. Full pre-contract information must be made available in writing and in a durable medium before the goods are delivered or services are supplied under the contract.

2. Trials, promotional periods and long-term subscriptions: Cooling-off periods

Did you buy a new subscription in the heat of the moment or are you struggling to keep on top of renewal dates? Worry not, as the DMCC provides for “cooling-off periods” which make it easier for consumers to cancel subscriptions or their renewals. For business of course, this means more administrative issues to manage and is also likely to result in an increase in cancellations.

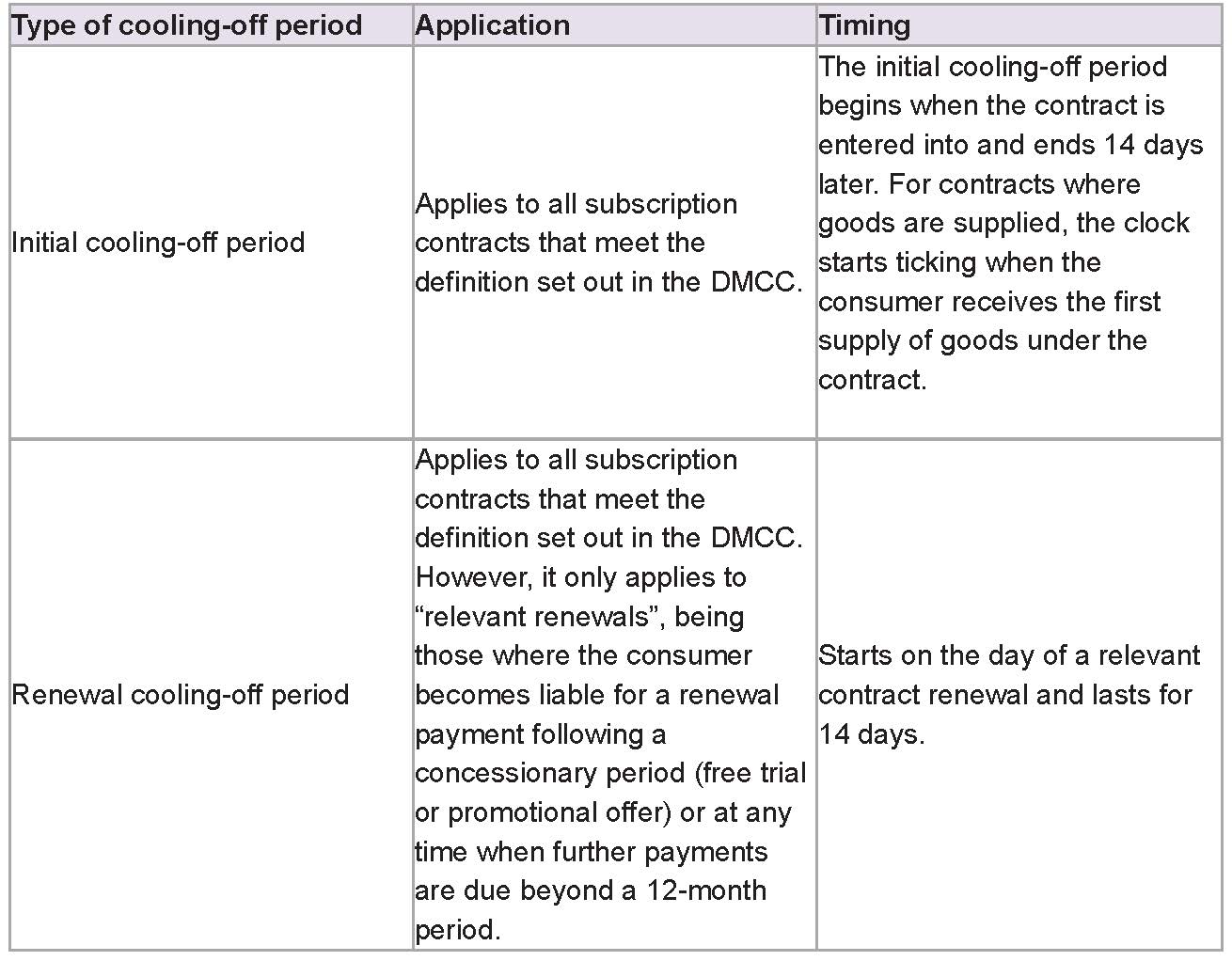

Under the DMCC, consumers have the right to cancel subscription contracts during both the initial cooling-off period (as currently) and, for some subscription contracts only, the DMCC introduces a new renewal cooling-off period. This right can be exercised by notifying the trader of the cancellation decision. Upon cancellation, both the consumer’s and the trader’s obligations under the contract cease, and whether any pre-payments made by the consumer may be refunded will be determined by further regulations issued by the secretary of state. Details regarding cooling-off periods are set out in the table below.

Traders are required to provide consumers with a cooling-off notice for each renewal cooling-off period as applicable, detailing their rights, how to cancel and any associated refund information, among other requirements.

3. During the subscription period: Reminder notices

The DMCC stipulates that traders must give notice to consumers prior to initial and renewal payments being taken. For subscriptions without a concessionary period, reminder notices need to be issued every six months starting the day after the contract is entered into. Where there is a free trial or a discounted period, reminder notices must be sent ahead of the first renewal payment after the concessionary period ends and then every six months thereafter.

Reminder notices must be clear, be prominent compared to other information given to the consumer at the same time and follow specific regulations set out in the DMCC. The reminder notice must be given within the period specified by the trader in the key pre-contract information. In any event, the reminder notice should be provided in advance of the last cancellation date, giving the consumers reasonable time to decide whether to end the contract and avoid the next payment.

The reminder notice must, among other requirements, include the renewal date and amount, the previous renewal payment amount and any increase in the renewal payment. It should also state if the consumer will incur further payments after the renewal date, including their frequency and amount. The notice must also provide the total minimum amount payable if the contract is not cancelled, the date of the next renewal payment, and steps to end the subscription to avoid further charges, including contact details and deadlines.

4. Bringing subscriptions to an end: Cancellations

When entering a subscription contract, traders must provide consumers with straightforward arrangements to cancel the contract. Once a consumer decides to cancel, they should be able to do so without unnecessary steps. For example, consumers must be able to cancel their subscription by making “a single communication”. Further, for online contracts, cancellation options must be prominently displayed. Again, for some businesses, this will require changes to their customer flows.

After a cancellation request, traders must acknowledge the cancellation with an “end of contract notice” and refund any overpayments. This notice must detail the cancellation date and comply with specified regulations.

Consumers have also gained a right to cancel a contract due to a breach by the trader. Such cancellation ends all future obligations and extinguishes any related payments. Companies cannot impose penalties for such cancellations.

No more fake reviews and misleading practices

As the adage goes, “If something seems too good to be true, it probably is”, exemplified by seemingly low prices of products that balloon at checkout due to hidden fees. Consumer protection laws already include provisions around unfair trading practices; however, the DMCC provides further obligations by updating the existing list of banned tactics under the Consumer Protection from Unfair Trading Regulations 2008 and provides more prescriptive rules on certain practices. Most notably, the DMCC updates the existing rules to explicitly outlaw the following:

- Fake reviews: The DMCC includes a new ban on commissioning individuals to write and/or submit fake consumer reviews. If a customer receives an incentive for submitting or writing a review, this must be clearly disclosed. Finally, the regulations also go a step further, as they require traders to take steps to verify whether the published reviews are genuine.

- Drip pricing: The DMCC extends existing regulations by providing more prescriptive rules about what must be included. Namely, traders must clearly set out the total price of the product, including any fees, taxes, delivery charges or other payments the consumer will incur if they purchase the product. Finally, if the nature of the product makes it impractical to calculate the total price in advance, the regulations require an explanation of how the price (or any part of it) will be determined.

Enforcement

Previously, the Competition and Markets Authority (CMA) had to seek enforcement orders from the court, but under the DMCC, it will now have new direct powers to enforce infringements of the new regulations. The CMA can now impose fines of up to £300,000 or 10% of the trader’s global annual turnover, whichever is higher.

Additionally, the DMCC introduces criminal offences for breaches of duties outlined in the new legislation, including violations related to unfair commercial practices and cooling-off periods.

Next steps

There is a lot to digest and implement as the new rules impose significant obligations on traders. The government has acknowledged this by announcing that the subscription rules will not take effect before spring 2026. However, with upcoming elections, it remains uncertain what the new government will prioritise. Despite this uncertainty, organisations should begin assessing the impact of the DMCC on their practices and consider necessary adjustments to ensure compliance.

In-depth 2024-142

Authors

Authors

Alicja Lysik