Background

Launched in March 2018, the Taskforce (consisting of HM Treasury, the FCA and the Bank of England) is monitoring developments in the cryptoassets industry. Indeed, the FCA has been ramping up its efforts in this sector. In April 2017, it sought stakeholder views on the future development and market integration of DLT1 and published its feedback in December 2017,2 emphasising its ‘technology-neutral’ approach to regulation. The UK’s participation in the Global Financial Innovation Network sandbox initiative exemplifies this approach.

Closely related to the development of DLT is the rise of cryptoassets such as ‘tokens’ (namely, security and utility tokens), often issued through initial coin offerings (ICOs). Earlier in October 2018, the European Securities and Markets Authority (ESMA) set out an own initiative report on how to contain the risks of ICOs and virtual currencies for investors.3 From ESMA’s perspective, the key question was whether and how cryptoassets should be regulated. To help answer this, the report undertook a benefits and risks analysis of various types of tokens, before determining whether they could fit under the specific definitions of ‘transferable securities’ and ‘commodities’ under MiFID II. The significance of these definitions is that whether a token is a transferable security or commodity helps determine whether it is a financial instrument.

If the tokens qualify as financial instruments for the purpose of MiFID II, then by extension the secondary market involving such tokens may be considered as a Multilateral Trading Facility or Organised Trading Facility, thereby bringing the trading platform within the scope of regulation. It is anticipated that ESMA may provide greater clarity through level 3 guidelines on the applicability of these definitions to cryptoassets, and implications for persons giving investment advice on such tokens.

However, the FCA’s ambition of creating ‘technology-neutral’ regulation will not extend to areas such as data regulation, as the trading of cryptoassets, typically over DLT/blockchain networks, raises certain EU General Data Protection Regulation (GDPR) concerns. One such concern is in respect of the homogeneity of DLT/blockchain networks, which would mean that all members of a cryptoasset platform would be considered to be ‘controllers’ who are subject to the GDPR regardless of their location. Another concern relates to the ‘right to be forgotten’ by data subjects, which would be in conflict with the immutability of records that is a cornerstone feature of DLT/blockchain networks.

The Taskforce’s final report

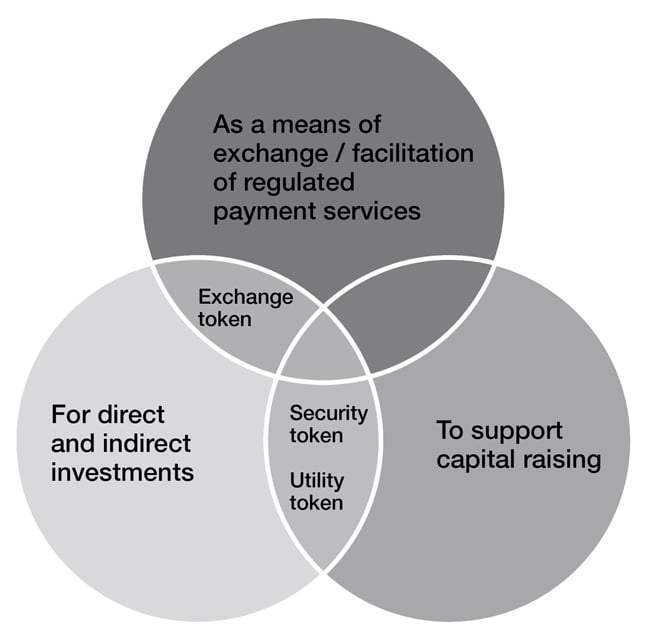

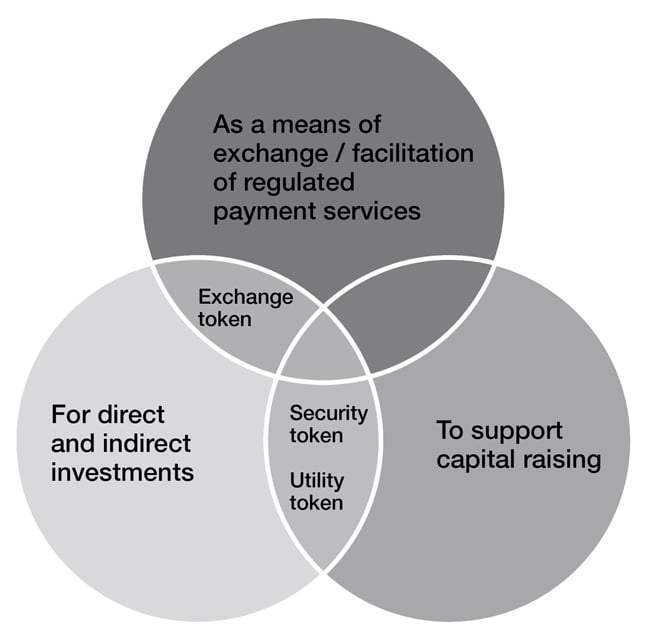

In its efforts to mitigate risks to consumers, promote market integrity, and prevent the use of cryptoassets for illicit activity, the Taskforce has identified key risks brought by cryptoassets, and which require “strong action” to be taken. The Taskforce began by distinguishing between exchange, security and utility tokens, and the common uses of each (Fig. 1).

Fig. 1: Common uses of each cryptoasset

In identifying the common uses of each token, the Taskforce was able to provide an indication as to where each token might fall within the current UK regulatory perimeter. For example, security tokens as specified investments under the FSMA 2000 (Regulated Activities) Order 2001, or exchange tokens used for the facilitation of regulated payment services, may fall within the Payment Services Regulations 2017.

In addition, the Taskforce has identified key challenges posed by cryptoassets for the regulatory landscape. In particular, the Taskforce states that the authorities should re-assess the regulatory perimeter where new business models or use cases are not appropriately captured by the current regime. For example, although security tokens fall within the current perimeter, due to the “novel nature of some cryptoassets” and “presence of new market participants”, the report states that the FCA will consult on perimeter guidance by the end of 2018, to provide further clarity on the way regulation applies to security tokens.

Conclusions and actions

In line with the Taskforce’s objectives set out at the start of this alert, the report lists some of the Taskforce’s key conclusions and deliverables for DLT and cryptoasset-related activity in the UK. Some of these conclusions are summarised in the table below (Fig. 2), and suggest that we are that ‘bit’ closer to regulation in the crypto space.

| |

Conclusions

|

Actions |

Key Dates |

| 1. |

Prevention of financial crime by broadening the UK’s approach: addressing risks of illicit activities by “going significantly” beyond the EU Fifth Anti-Money Laundering Directive (5MLD).

|

HM Treasury to transpose 5MLD, and broaden the scope of the anti-money laundering and counter terrorist finance regulation.

|

Consultation in the new year.

Legislation in 2019

|

| 2. |

Providing further clarity on the way regulation applies to security tokens.

|

The FCA to consult on perimeter guidance for cryptoasset activities currently within the regulatory perimeter.

|

By end 2018

|

| 3. |

Eliminating fraudulent activity, protecting investors, and ensuring market integrity: firms may bypass regulation when issuing cryptoassets that have comparable features to specified investments (e.g., shares or units in a collective investment scheme) by structuring them in particular ways.

|

HM Treasury to consult on potential changes to the regulatory perimeter, to extend to cryptoassets with comparable features to specified investments. |

In early 2019

|

| 4. |

Regulation of financial instruments referencing cryptoassets: addressing concerns surrounding consumer protection and market integrity.

The FCA supported ESMA’s restrictions on the sale to retail consumers of CFDs referencing cryptoassets.

|

The FCA to consult on a prohibition of the sale to retail consumers of all derivatives referencing exchange tokens (e.g., Bitcoin), including CFDs, futures, options and transferable securities.

|

By end 2018 |

| 5. |

Ensuring a coordinated international approach through active involvement with international bodies.

|

The UK shall engage internationally, for example:

- Leading the G20 and G7 cryptoassets discussions.

- The FCA chairs the Fintech Network of the International Organization of Securities Commissions.

- The Prudential Regulation Authority is actively participating in discussions on the prudential regulation of cryptoassets, including at the Basel Committee on Banking Supervision.

- HM Treasury has led the Financial Dialogues and Fintech Bridges, which are bilateral agreements that commit the UK to sharing FinTech policy experience and expertise with counterparts in Hong Kong, Australia, Singapore, China and the Republic of Korea.

|

Ongoing |

Fig. 2: Selected examples of conclusions and actions to be undertaken

Extra thought: ban on CFD products

It is worth highlighting item 4 in Fig. 2: The FCA has said that it may potentially ban the sale to retail consumers of contracts for difference (CFDs) referencing cryptoassets. Earlier this year, ESMA instituted restrictions on retail CFDs and binary option products4 under article 40 of MiFIR, which affected products referencing cryptoassets (for more information on this, see our client alert on 29 January 2018).5 It took effect on 1 August 2018 (to be renewed from 1 November 2018), limiting leverage on such products to 2:1, reflecting the high price volatility of these instruments.

The FCA’s potential ban takes the stringent attitudes to retail derivatives referencing cryptoassets one step further, and would extend to derivatives referencing exchange tokens (e.g., Bitcoin). The ban will not cover derivatives referencing cryptoassets that qualify as securities.

Furthermore, in preserving the integrity of regulated markets, the FCA “will not authorise or approve the listing of a transferable security or a fund that references exchange tokens unless it has confidence in the integrity of the underlying market, and that other regulatory criteria for funds authorisation are met.” It is clear that listing securities with cryptoassets as the underlying asset must not be detrimental to investors’ interests. To date, the FCA has not approved the listing of any exchange-traded products with exchange tokens as the underlying asset.

The Taskforce has stated in its action plan that it will continue to monitor market developments and regularly review the UK’s approach to DLT and cryptoassets. With that in mind, the Taskforce will convene every six months. It is expected that more directions will be released from the Taskforce in the near future.

- FCA: Discussion Paper on Distributed Ledger Technology (April 2018).

- FCA: Distributed Ledger Technology Feedback Statement on Discussion Paper 17/03.

- SMSG Advice to ESMA: Own Initiative Report on Initial Coin Offerings and Crypto-Assets (19 October 2018).

- Press release: “ESMA agrees to prohibit binary options and restrict CFDs to protect retail investors” (27 March 2018).

- ESMA consults on product intervention measures for retail CFDs

Client Alert 2018-233

|

Conclusions

|

Actions

|

Key dates

|

|

1.

|

Prevention of financial crime by broadening the UK’s approach: addressing risks of illicit activities by “going significantly” beyond the EU Fifth Anti-Money Laundering Directive (5MLD).

|

HM Treasury to transpose 5MLD, and broaden the scope of the anti-money laundering and counter terrorist finance regulation.

|

Consultation in the new year

Legislation in 2019

|

|

2.

|

Providing further clarity on the way regulation applies to security tokens.

|

The FCA to consult on perimeter guidance for cryptoasset activities currently within the regulatory perimeter.

|

By end 2018

|

|

3.

|

Eliminating fraudulent activity, protecting investors, and ensuring market integrity: firms may bypass regulation when issuing cryptoassets that have comparable features to specified investments (e.g., shares or units in a collective investment scheme) by structuring them in particular ways.

|

HM Treasury to consult on potential changes to the regulatory perimeter, to extend to cryptoassets with comparable features to specified investments.

|

In early 2019

|

|

4.

|

Regulation of financial instruments referencing cryptoassets: addressing concerns surrounding consumer protection and market integrity.

The FCA supported ESMA’s restrictions on the sale to retail consumers of CFDs referencing cryptoassets.

|

The FCA to consult on a prohibition of the sale to

|