On July 6, 2017, the Illinois Legislature enacted Public Act 100-0022 (SB9), which made a number of changes to the Illinois Income Tax Act (“IITA”), including repeal of the “non-combination rule”, which precluded a single combined return for members of a unitary business group (“UBG”) if one or more members of the UBG were required to apportion their business income under a statutory apportionment formula different from that used by the other group members. This change was effective for tax years ending on or after December 31, 2017.

With the repeal of the non-combination rule, a UBG will file a single unitary return, regardless of whether its members apportion their income under different subsections of IITA section 304 (e.g., insurance companies, §304(b); financial organizations, §304(c); federally regulated exchanges, §304(c-1); transportation companies, §304(d); and all other taxpayers, §304(a)).

To implement this significant change in Illinois income tax law, the Illinois Department of Revenue (the “Department”) has filed proposed regulations with the Joint Committee on Administrative Rules (“JCAR”), which set forth the Department’s rules for combining members using different apportionment formulas in a single unitary return.1 The Department’s proposed regulation can be found on ilga.gov.

As set forth in the Department’s proposed regulations, determining the Illinois combined income of a unitary business group with members using different apportionment formulas will be a multi-step process. The first step, in what the Department refers to as the “subgroup method,” is to divide the members of the UBG into subgroups based on the members’ statutory apportionment formulas—i.e., the “sales factor subgroup,” the “insurance company subgroup,” the “transportation group,” etc.

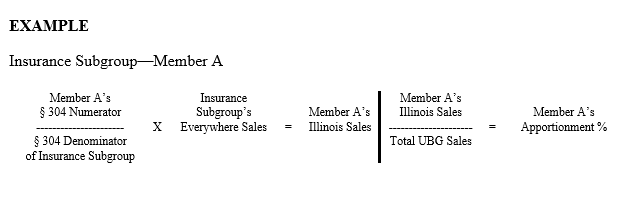

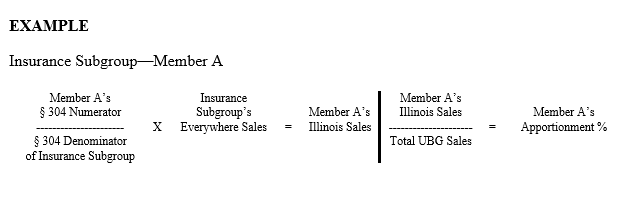

The second step is to determine a separate apportionment percentage for each subgroup member. This is accomplished by first computing each subgroup member’s “Illinois sales”. This amount is computed by multiplying the total sales of the subgroup by a fraction equal to the subgroup member’s Illinois statutory apportionment percentage numerator (determined under IITA section 304) divided by the subgroup’s total Illinois statutory apportionment percentage denominator (also determined under IITA section 304). The member’s Illinois sales are then divided by the everywhere sales of the UBG, to derive the subgroup member’s Illinois apportionment percentage. The second step is illustrated in the example below for Member A of the Insurance Subgroup.2

The third step is to add the apportionment percentages for all members of the UBG, as determined using the above two-step process, and then multiply the total apportionment percentage for the UBG by the combined unitary income (or loss) of the UBG, to determine the unitary group’s Illinois apportioned business income.

Unitary Partnerships

The Department has also promulgated specific rules for a partner engaged in a unitary business with a partnership. When a partner and its partnership are engaged in a unitary business and apportion their income under the same statutory apportionment formula, then the partner will simply include its share of the partnership’s factors, business income, and everywhere sales in its own apportionment factors, business income, and everywhere sales for purposes of determining its Illinois apportioned business income. However, when a partner and its partnership are engaged in a unitary business, but use different statutory apportionment formulas, then the partnership is to be treated as a member of the partner’s UBG, and the subgroup method described above will be applied, using only the partner’s distributive share of the partnership’s factors and sales. The partner will then add the partnership’s apportionment percentage, determined using the subgroup method, to its own apportionment percentage.

Other Key Takeaways

A few additional takeaways from the Department’s proposed regulations and 2017 corporate tax forms Schedule UB and Subgroup Schedule (UB): (1) inter-company transactions between UBG members are eliminated in determining the group’s combined business income and apportionment factors; (2) the Department appears to be allowing the pre-2017 losses of UBG members to carry over to any new, expanded unitary filing group and allowing such losses to be used to offset income of any of the other members of the expanded group; (3) the everywhere sales of each UBG member will be determined by applying Department regulations 100.3370 and 100.3380, as if the member was required to determine its denominator of its sales factor under IITA section 304(a)(3)(A) (i.e., the general sales factor denominator); (4) the “United States”, for purposes of the definition of a UBG, has been expanded to include the outer continental shelf; and (5) a holding company that is unitary with other UBG members will now use its own apportionment formula to apportion its business income, even if the other UBG members use different apportionment formulas.

Conclusion

Taxpayers should be mindful of these proposed regulations and the effects they have when evaluating their tax planning for tax years ending on and after December 31, 2017. Additionally, given the potential impact that the repeal of the non-combination rule may have on unitary filers in Illinois (positive and negative), it may be advisable for taxpayers to consult with their tax professionals as to whether they are in fact engaged in a unitary business with their affiliated members before filing a single unitary return for tax years affected by repeal of the non-combination rule.

The official comment period for the proposed regulations expired on December 24, 2018. Nonetheless, the Department typically considers any public comments it receives after the public comment period ends, if those comments are received before the Department submits the proposed regulation for JCAR review. During JCAR review (or “second notice”), which is 45 days unless extended, any new or additional public comments regarding the prosed regulations should be sent directly to JCAR. Taxpayers are encouraged to review the Department’s proposed regulations and submit their comments to JCAR (or, as mentioned above, to the Department) within the applicable comment period.

- See 42 Ill. Reg. 19605, November 9, 2018.

- The Department’s proposed regulations apply this formula on an individual member basis. However, mathematically, the formula could be applied on a subgroup basis using the subgroup’s combined Illinois receipts as the § 304 numerator. For taxpayers apportioning income under IITA § 304(a), the apportionment percentage for the sales factor subgroup can be determined by simply dividing the subgroup’s total Illinois sales by the everywhere sales of the unitary business group.

As reflected in the above example, it is important to note that the insurance subgroup’s total income (premiums, investments, etc.) is apportioned to Illinois using just the group’s insurance premium factors under IITA § 304(b). Thus, the insurance company’s non-insurance income will be apportioned to Illinois based on its insurance premium factors.

Client Alert 2019-004