Primary Market Corporate Credit Facility (PMCCF)

The PMCCF will initially have $500 billion in capital available to make purchases of eligible corporate debt and syndicated loans directly from eligible investment-grade issuers, either as the sole investor or as a member of a syndicate.

Secondary Market Corporate Credit Facility (SMCCF)

The SMCCF will initially have $250 billion in capital available to purchase in the secondary market portions of bonds or exchange-traded funds (ETFs) whose investment objective is to provide broad exposure to the market for U.S. corporate bonds. The preponderance of ETF holdings will be of ETFs whose primary investment objective is exposure to U.S. investment-grade corporate bonds, and the remainder will be in ETFs whose primary investment objective is exposure to U.S. high-yield corporate bonds.

Eligible issuers

Issuers must be investment-grade (BBB-/Baa3 or above) companies as of March 22, 2020, as rated by a major nationally recognized statistical rating organization (NRSRO).1 Currently, the ratings criteria refer to ratings provided by three NRSROs (S&P Global Ratings, Moody’s Investor Service Inc., and Fitch Ratings, Inc.), though the Board is considering including other NRSROs. Issuers must also:

- Be companies created or organized in the United States or under the laws of the United States with significant operations in the United States and a majority of U.S.-based employees

- Not have received certain other support under the CARES Act or any subsequent federal legislation

- Not be a federally insured depository institution or depository institution holding company, each as defined in the Dodd-Frank Act

- Satisfy the conflicts of interest rules in the CARES Act (issuers are generally not 20 percent owned by members of Congress or senior members of the executive branch, or their respective family members)

Eligible issuers under the PMCCF and SMCCF will be required to certify compliance with the eligibility criteria. The requirements and processes for certification are under development by the FRBNY.

Eligible sellers (under the SMCCF)

All sellers under the SMCCF must be companies created or organized in the United States or under the laws of the United States with significant operations in the United States and a majority of U.S.-based employees. The seller must also satisfy the conflicts of interest rules in the CARES Act. Each seller must provide a statement of eligibility.

To expedite the implementation of the SMCCF, the SMCCF will begin by transacting with primary dealers2 that meet the eligible seller criteria. The Federal Reserve will add additional counterparties as eligible sellers under the SMCCF, subject to adequate due diligence and compliance work.

Termination

The programs will continue through September 30, 2020, unless further extended by the Board. The FRBNY will continue to fund the facility after such date until the facility’s holdings either mature or are sold.

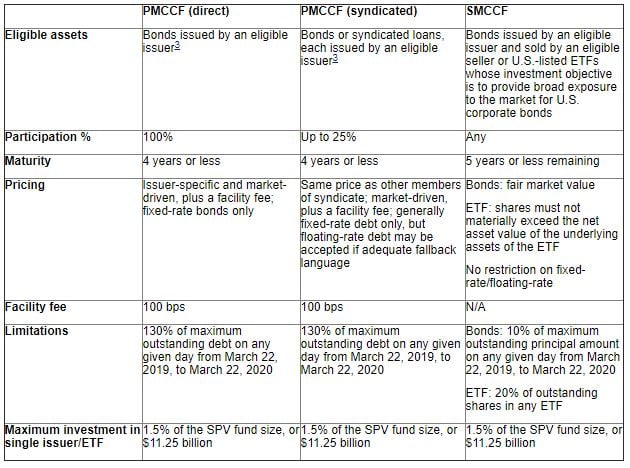

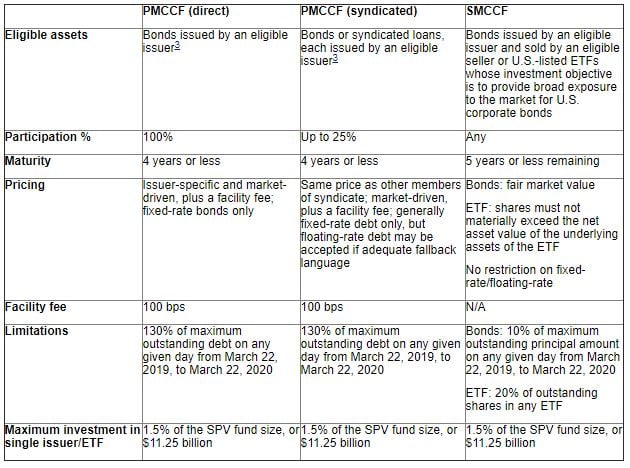

Terms and conditions comparison

Questions and answers

On April 17, 2020, the Board issued frequently answered questions to supplement its initial guidance and the term sheets. Those FAQs can be found at newyorkfed.org.

Below are some additional questions and answers for issuers to consider.

How can issuers determine eligibility?

First, issuers should analyze the eligibility requirements, namely the ratings requirements. We understand that many corporate issuers may not be aware of their corporate debt rating, may not have a corporate debt rating, or may be rated by one of the secondary ratings agencies.

The other threshold requirements are similar to other CARES Act requirements, and many issuers will have already completed the analysis regarding the conflicts of interest rules and whether such issuers are U.S. companies. However, additional guidance is expected regarding what other CARES Act support would disqualify an issuer from participating in the PMCCF program or having its debt purchased by the SPV via the SMCCF program.

How much debt can issuers place with the SPV?

There are two steps to this calculation. First, issuers must determine the maximum outstanding debt during any day between March 22, 2019, and March 22, 2020. If an issuer had $1.0 billion maximum outstanding on any day during that time, the issuer can seek to refinance the $1.0 billion plus issue an additional $300 million in debt under the PMCCF program. The second step is to determine if the issuer would have more than $11.25 billion in debt held by the SPV via the PMCCF and SMCCF programs as the aggregate maximum per issuer/ETF cannot exceed 1.5% of the $750 billion available funds in the SPV.

The Board will likely issue guidance on whether issuers can have existing debt purchased by the SPV through the SMCCF program while also issuing new debt pursuant to the PMCCF program.

Are there any restrictions on the use of proceeds?

At this time there are very few restrictions regarding the use of proceeds. However, note that if issuers take advantage of the option to defer any scheduled payments on the debt placed with the SPV pursuant to the terms of the PMCCF program, such issuers would not be permitted to use the funds for stock buybacks or dividends for certain periods of time.

Can scheduled payments on the debt be deferred?

Yes. Scheduled debt payments on the debt placed with the SPV via the PMCCF program can be deferred for up to six months.

What other considerations should issuers complete before approaching the Fed?

Issuers should analyze their current debt agreements to determine available capacity to issue additional debt and whether any consents are needed to participate in the PMCCF. Issuers should consider whether refinancing their entire debt structure is economically advisable in the event additional debt cannot be placed without consents or amendments.

Conclusion

Further guidance from the Board regarding the PMCCF and the SMCCF programs is expected before the end of the month. Investment-grade issuers should consider capital needs, eligibility, and individual covenant restrictions to determine their options regarding each program. We expect to update this summary once the Board issues further guidance on the programs. Clients are encouraged to engage their financial and legal advisors with further questions.

Our Reed Smith Coronavirus team includes multidisciplinary lawyers from Asia, EME and the United States who stand ready to advise you on the issues above or others you may face related to COVID-19.

For more information on the legal and business implications of COVID-19, visit the Reed Smith Coronavirus (COVID-19) Resource Center or contact us at COVID-19@reedsmith.com.

- An issuer that was rated at least BBB-/Baa3 as of March 22, 2020, but was subsequently downgraded, must be rated at least BB-/Ba3 as of the date on which the facility makes a purchase. If rated by multiple major NRSROs, such issuer must be rated at least BB-/Ba3 by two or more NRSROs at the time the facility makes a purchase.

- For the list of primary dealers, lease visit newyorkfed.org.

- For the avoidance of doubt, eligible assets shall not include any investment-grade senior secured bonds that are issued by a non-investment-grade issuer.

Client Alert 2020-255