Authors

Authors

Anna Tranter

Key takeaways

- A new EU carbon trading scheme is being created for heating and transport fuel supply

- Fuel providers must acquire and surrender allowances by 31 May annually for carbon emissions from burning fuel that they supply

- Auctions of allowances to start in 2027 (unless delayed a year for exceptional energy prices in 2026)

Overview

The EU is establishing a stand-alone emissions trading system (which, for want of a better name, is currently known as ‘EU ETS 2’1). It will target reductions of carbon dioxide emissions from the combustion of fuel used in sectors that are not currently required to comply with the existing EU emissions trading system, with the objective being to extend the success of the existing EU ETS scheme (in this alert, EU ETS 1) to 75 per cent of EU industry and thereby contribute to the achievement of the EU’s 2050 net zero target.

The amending directive creating the new scheme came into force on 8 June 2023. The activities that will fall within EU ETS 2 are the release of numerous types of fuel destined for combustion in the road transport sector, buildings, energy, manufacturing and construction industries.

Trading in allowances under the new scheme will be possible after the first auctions begin in 2027. This is unless the Commission uses its right to delay the start of auctions by a year if there are exceptionally high energy prices (mindful of the energy price impacts of the war in Ukraine). This brake on launch has been included because the new scheme will increase costs for fuel suppliers, and those costs will likely be passed on to fuel users.

Highlights

- “Regulated entities” will be required to obtain a permit by 1 January 2025 and to monitor, report and verify emissions from fuel supplied to users within the in-scope sectors.

- Auctions of allowances by Member States will commence in 2027.

- Permit holders will be required to surrender sufficient allowances to match the associated emissions by 31 May each year.

- Allowances will be fully tradable and held at the EU Registry in the same manner as allowances issued under EU ETS 1.

- The two schemes (1 and 2) are initially separate, though they may later be amalgamated.

- Permit holders must report how much of the cost they have passed on to their customers in fuel prices, and the Commission reserves the right to take action if there is evidence of profiteering.

- Since EU ETS 2 is created as a new chapter of the existing Emissions Trading Directive, under the Markets in Financial Instruments Directive, allowances would constitute financial instruments on the same basis as allowances under EU ETS 1.

Scope

EU ETS 2 will apply to the following activities:

Release of fuel for consumption in any of the following sectors:

- Road transportation, excluding the use of agricultural vehicles on paved roads

- Commercial/institutional buildings

- Residential buildings

- Combined Heat and Power Generation and Heat Plants, providing heat to buildings in 2 and 3 above

- Energy Industries2

- Manufacturing Industries and construction3

Member States have the option to bring further sectors into the scheme within their own jurisdictions, subject to the Commission’s approval.

Regulated entities

The scheme does not seek to impose obligations on individual vehicle and buildings owners who use the fuel and create the emissions, as this was felt to be unworkable, but instead the person responsible for compliance (the regulated entity) is generally the person liable to pay excise duty on the fuel, rather than the final fuel consumer.

The definition of “regulated entity” is a broad one. This makes it somewhat difficult to determine who exactly the regulated entity is and involves the application of EU excise laws. Generally speaking, it will be (in priority order): (i) the warehouse keeper (if the fuel is taxed at a tax warehouse), (ii) the person storing or holding the goods outside a tax warehouse, (iii) the producer or the importer, (iv) the person who would have been liable to pay excise duty if the goods were not exempt or (v) failing any of the above, any person the relevant Member State designates to be liable.

The regulated entity therefore could be, for example, a refiner dispensing fuel at its road loading terminal or the person importing ready-made fuel into the country for distribution to petrol station forecourts, depending on the circumstances. Excise can, however, also become payable due to certain infringements, for example, during a movement of excise goods under a duty suspension arrangement. In that instance, even a transporter of fuel can become liable.

Member States also have the ability to designate who should be liable if there is more than one person within the relevant category.

There is also an important distinction to be made between natural gas for heating and fuels for road transport – the distinction being that the moment excise duties become due is not the same. For natural gas, the excise duty arises at the moment of delivery to the final customer. The regulated entity will be the one who supplies the gas to the end-user. For road fuels, the release for consumption takes place when the fuel is sent from the tax warehouse to the fuel station. The regulated entity will be the tax warehouse.

Which fuels are included?

The types of fuel covered by the EU ETS 2 are many and varied. They include certain listed fuels as well as any product that is intended for use, offered for sale or used as motor fuel or heating fuel, including where the fuel is used to generate electricity. They specifically include:

- Leaded and unleaded petrol

- Gas oil

- Kerosene

- LPG

- Natural gas

- Heavy fuel oil

- Coal and coke

- Electricity

They also include certain categories of biofuel.

However, certain categories of fuel are exempted:

1. Those used in activities that are already regulated under EU ETS 1 (e.g., fuel combusted at any facility with a thermal input generating capacity of 20MW or more, such as a power station4), except:

a. If used for transport of greenhouse gases for geological storage

b. If used in an installation notified by a Member State that in each of the three years preceding the notification either:

i. Has reported emissions of less than 2,500 tonnes of carbon dioxide equivalent, disregarding emissions from biomass or

ii. Is a reserve or backup unit that did not operate more than 300 hours per year

2. Fuels for which the applicable emission factor is zero, e.g., biomass

3. Hazardous or municipal waste used as fuel

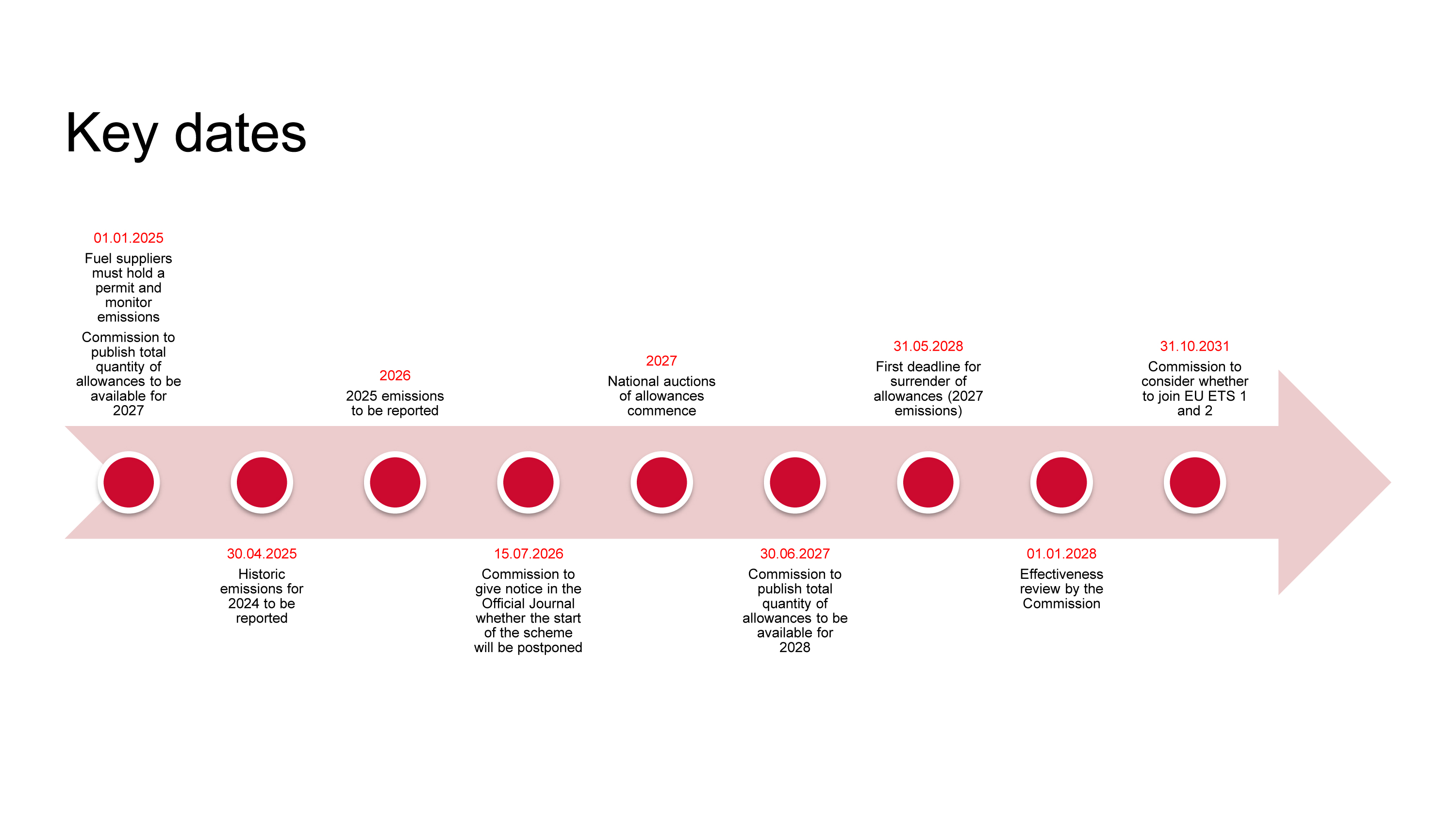

Figure 1: Key dates for implementation of EU ETS 2

Compliance

Requirement for a permit

From 1 January 2025, it will be illegal for a regulated entity to dispense fuels that are subject to EU ETS 2 without a permit obtained from its competent authority. Applications for a permit have to include information regarding the end use to which the fuel will be put. This may require applicants to gather this information from the persons they supply, who may in turn need to obtain information from further down their own supply chain. This could be onerous where a fuel has multiple potential uses and many categories of buyer. Guidance is likely to be needed to clarify this.

Penalties for non-compliance, such as dispensing fuel without a permit, will be contained in Member State domestic legislation.

Monitoring, reporting and verification

The monitoring, reporting and verification procedures laid down for EU ETS 1 also apply to EU ETS 2 emissions, with certain small modifications. Permit holders must record emissions corresponding to the quantities of fuels they dispense, including precise quantities of each type of fuel supplied and its final use, and they must report them to their competent authority in the following year beginning with 2026.

The obligation to monitor starts from 2025, with the first monitoring reports being due in 2026. However, before then, permit holders are under a separate requirement to report their 2024 emissions on 30 April 2025. In practice, therefore, this would appear to mean that they must have ‘up and running’ a system in place to identify precisely the quantities of fuel being sold for uses falling within the EU ETS 2 scheme from as early as 1 January 2024.

From 2028, permit holders must also report (by 30 April each year) how much of the cost of buying EU ETS 2 allowances they have passed on to their customers (the precise requirements and format for this are to be set out in secondary legislation). The Commission will be checking for ‘improper practices’, which might potentially include the fuel supplier seeking to profiteer by inflating the costs that are passed on.

Monitoring reports must also be independently verified.

Member States can, however, opt to allow simplified monitoring, reporting and verification where annual emissions are less than 1000tCO2e (in the same manner as for EU ETS 1).

Surrender obligation

Permit holders must surrender EU ETS 2 allowances for cancellation by 31 May each year to cover the emissions corresponding to the quantity of fuel they have “released for consumption” in the preceding calendar year. The first surrender date will be 31 May 2028.

Member State penalties for non-compliance must include an excess emissions penalty for missing allowances, in the same way as for EU ETS 1.

A derogation from the requirement to surrender allowances is available for fuel suppliers who are subject to national carbon taxes that are in force by the end of 2023 and have been notified to the Commission.

Administration of the scheme

Setting the cap

The total quantity of allowances made available under EU ETS 2 is intended to decrease annually in a linear trajectory to reach the emissions reduction target for 2030, based on achieving 43 per cent emissions reductions from the buildings and road transport sectors by 2030 compared to 2005 and, combined with the additional sectors, a total contribution of 42 per cent.

When auctioning starts in 2027, the cap will be set by the Commission by reference to the 2024 baseline year for the sectors covered in EU ETS 2. This will then be adjusted by a linear reduction factor of 5.1 per cent.

From 2028 onwards, the baseline changes to the average emissions that have been reported within EU ETS 2 for 2024-2026 and the linear reduction factor becomes 5.38 per cent. However, the reduction factor changes if average emissions reported for 2024-2026 are more than 2 per cent higher than the cap set for 2025, so long as the increase does not result from a less than 5 per cent difference between the emissions reported and the 2025 inventory data for the EU ETS 2 sectors. If so, the reduction factor is determined according to a specific formula.

From 2028, the cap is to be adjusted each year to compensate for allowances surrendered where there has been double counting or where allowances have been erroneously reported from non-EU ETS 2 sectors (including those within EU ETS 1).

If a Member State opts to apply EU ETS 2 to further sectors, the cap for the following year will be increased accordingly, provided a report of the verified emissions for the new sector has been submitted to the Commission by 30 June.

Auctioning

Allowances under EU ETS 2 must be auctioned separately from EUAs issued under EU ETS 1, but the applicable auction conditions will be the same for both.

In 2027, the number of EU ETS 2 allowances to be auctioned will be front-loaded, i.e., topped up by an extra 30 per cent. The allowances in that 30 per cent can only be used for surrendering and may be auctioned until 31 May 2028. This suggests they will not be available for trading to non-regulated entities, but it would still seem to allow trading among regulated entities.

A corresponding number of allowances will be deducted from the number of allowances that are released for auction between 2029 and 2030.

Deductions and use of proceeds

In order to compensate low-income households against the potentially inflationary effect of the EU ETS 2 scheme on heating bills, the Social Climate Fund has been created, and the auction proceeds of 150 million EU ETS 2 allowances will be contributed to it in 2027. Further contributions of auction proceeds over the period 2027-2032 are scheduled to raise the fund value to a maximum of € 65 billion, subject to annual caps.

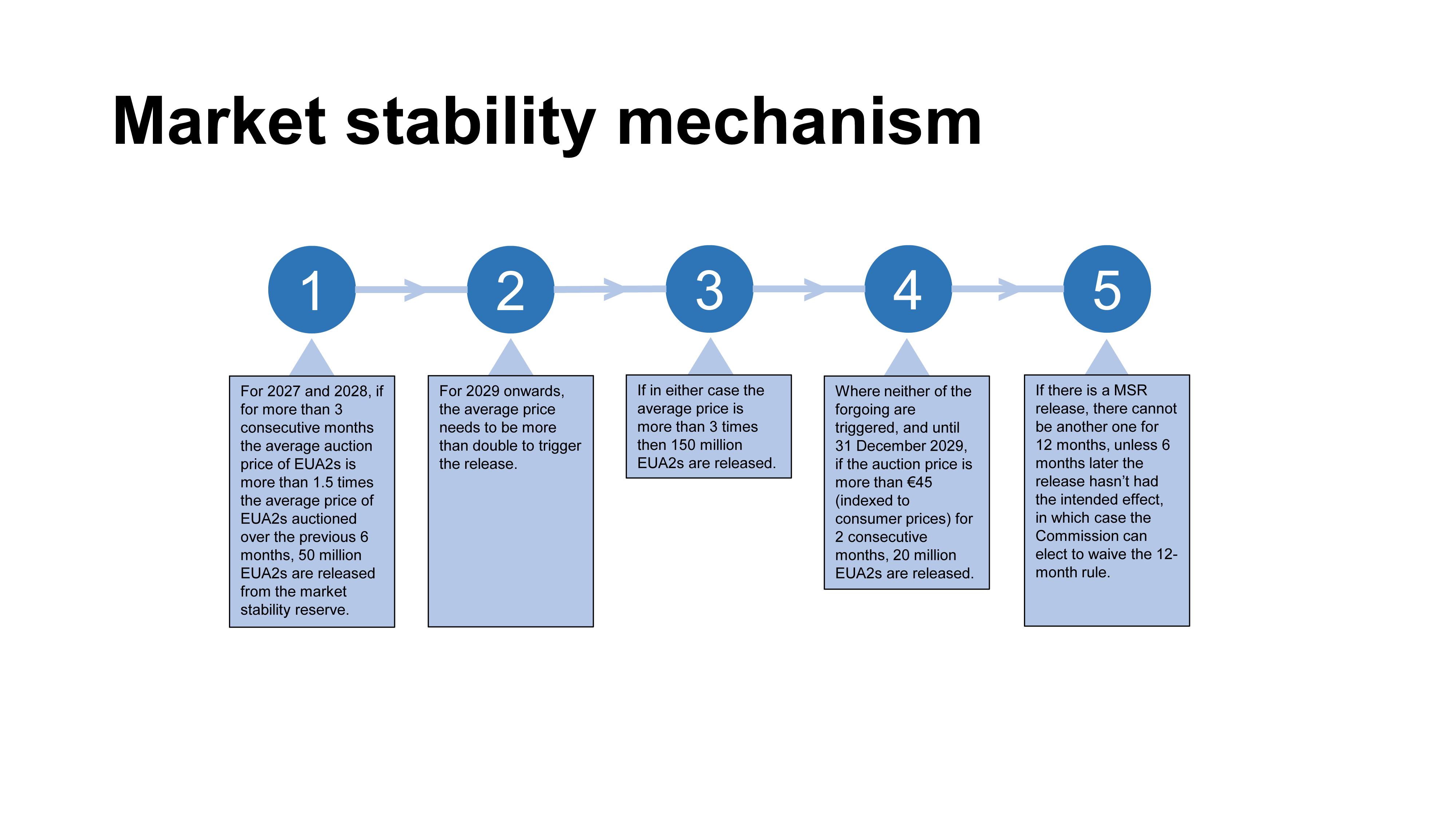

Learning from past instability in the EU ETS 1 market, there will also be a market stability reserve for EU ETS 2. This acts as a pressure valve on the price of an allowance. Figure 2 explains how the reserve will be triggered.

In 2027, 600 million EU ETS 2 allowances will be set aside to fund the reserve.

The remaining auction proceeds will be redistributed among the Member States in pre-agreed shares but must be used by Member States for authorised purposes only, e.g., to support decarbonisation of heating and cooling of buildings or to reduce energy demand in buildings.

Figure 2: Key steps in triggering the the market stability reserve

Possible postponement to 2028

The scheme could be pushed back to start in 2028 in the event of exceptionally high fuel prices, if one of two conditions is met:

- Average TTF gas prices for 1H 2026 are higher than the average in February and March 2022 or

- Average Brent Crude prices for 1H 2026 are more than double the average during 2020-2025

If the scheme is postponed, the start of auctioning will be in 2028, and the first surrender deadline will be 31 May 2029.

- EU ETS 2 is contained in a new chapter IVa of the EU ETS directive (2003/87/EC) that was inserted by new Directive (EU) 2023/959 adopted on 10 May 2023 and published in the Official Journal on 16 May 2023.

- As defined in the 2006 IPCC Guidelines for National Greenhouse Gas Inventories. This includes (but is not limited to) electricity generation, petroleum refining and manufacture of solid fuels.

- As defined in the 2006 IPCC Guidelines for National Greenhouse Gas Inventories. This includes (but is not limited to) iron and steel, chemicals, mining and quarrying, non-ferrous metals and wood and wood products.

- As set out in Annex I of Regulation 2003/87/EC.

In-depth 2023-201

Authors

Authors

Anna Tranter