Authors

Read time: 8 minutes

The transport sector accounts for 26% of the overall global energy consumption and nearly 20% of global CO2 emissions, 75% of which are attributed to road transport. The transition to “clean” modes of transport – including Electric Vehicles (EVs) – is thus seen as both inevitable and a key contributor to net-zero targets. It is forecast that global rates of EV production and sales will grow at 45% and 53% per annum respectively until 2030, driven by investments from governments, corporations and entrepreneurs in the EV space. EVs are predicted to comprise 72% of the global vehicle fleet by 2050.

NEW: Energy transition in Asia 2024

Although Asia Pacific has established global EV market dominance with 42% revenue share in 2022, current levels of EV adoption vary substantially across the region. According to McKinsey, China in particular dominates the global EV market, having already reached a 16% adoption rate for new EVs and accounted for 35% of global EV exports in 2022. Per an IEA report, as more than half of EVs on roads worldwide are now in China, China is responsible for approximately 59% of global EV sales, exceeding its 2025 target for new EV sales. DNV forecasts the uptake of EVs in China to be the fastest among all regions, with EVs reaching 50% of new vehicle sales there by 2027 and comprising 50% of the entire fleet of vehicles by 2031. Along with Japan and South Korea, China is considered a mature market in terms of its EV ecosystem, which includes well-developed physical infrastructure, bespoke regulation and a range of financial subsidies.

Other Asian countries, in particular India and the majority of the ASEAN members, have been lagging behind their North Asian peers partly due to the regulatory delays and the lack of bolder policies to promote EV uptake. However, per a [recent] IEA report, India, Thailand and Indonesia are demonstrating promising signs for EVs market. 2022 was marked as a growth year for these countries, with the sales of EVs more than tripling compared to 2021. In India, the increase of EV and EV component production have been largely driven by the government’s $3.2 billion incentive program that attracted $8.3 billion of investments into the space. Additionally, DNV observed that India is pushing for a market share in EVs, with a projected 81% share of new sales of two- and three-wheelers being electric by 2030, and almost 98% in 2050.

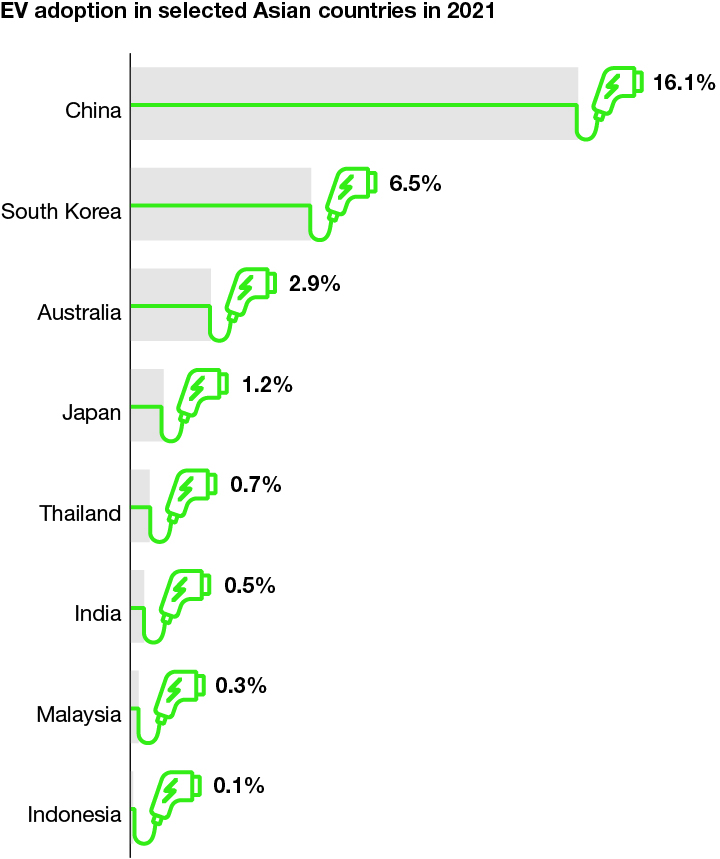

The chart below shows the EV adoption in selected Asian countries in 2021 and in summary shows the EV adoption by selected Asian counties in 2021, namely that:

- China had a 16.1% EV adoption rate

- South Korea had a 6.5% EV adoption rate

- Australia had a 2.9% EV adoption rate

- Japan had a 1.2% EV adoption rate

- Thailand had a 0.7% EV adoption rate

- India had a 0.5% EV adoption rate

- Malaysia had a 0.3% EV adoption rate

- Indonesia had a 0.1% EV adoption rate

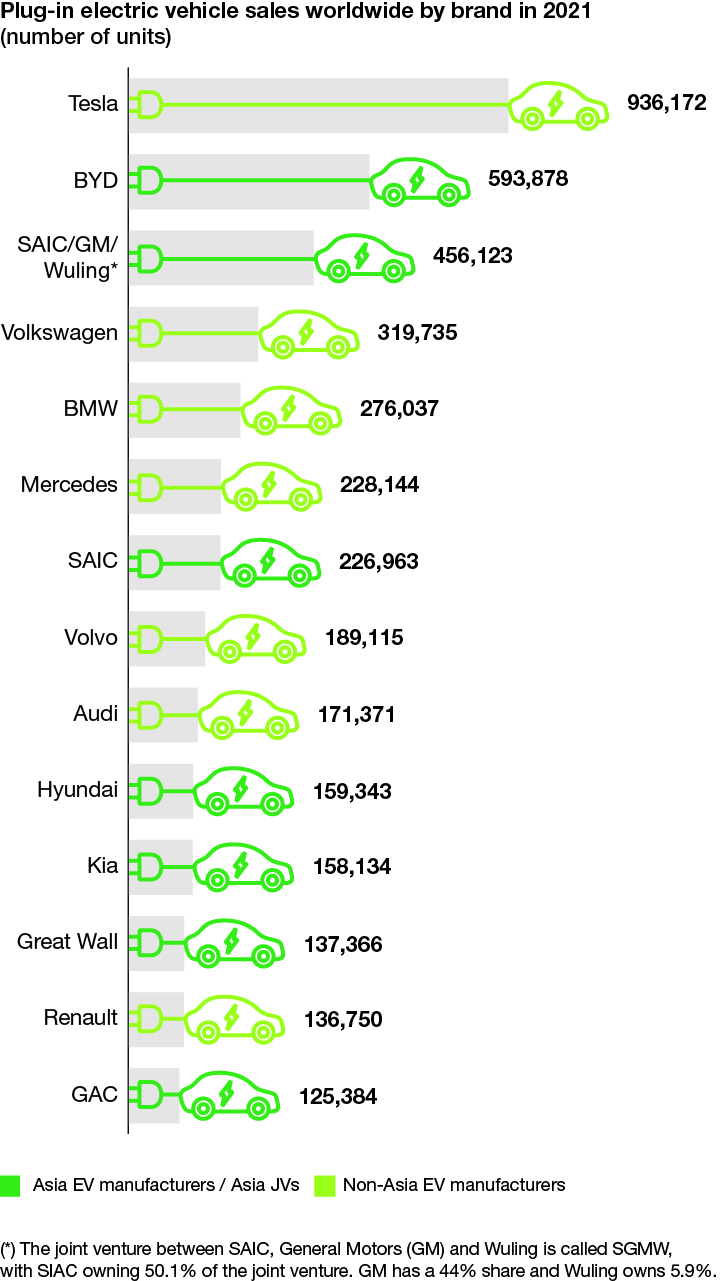

Given such high levels of EV adoption in China and South Korea in particular, it is not surprising that EV manufacturers from these markets were among the leaders in worldwide plug-in EV sales in 2021.

The chart below shows the plug-in electric vehicle sales worldwide by brand in 2021 by number of units:

- Tesla (non-Asia EV manufacturers) sold 936,172

- BYD (Asia EV manufacturers) sold 593,878

- SAIC / GM / Wuling (Asia EV manufacturers) sold 456,123

- Volkswagen (non-Asia EV manufacturers) sold 319,735

- BMW (non-Asia EV manufacturers) sold 276,037

- Mercedes (non-Asia EV manufacturers) sold 228,144

- SAIC (Asia EV manufacturers) sold 226,963

- Volvo (non-Asia EV manufacturers) sold 189,115

- Audi (non-Asia EV manufacturers) sold 171,371

- Hyundai (Asia EV manufacturers) sold 159,343

- Kia (Asia EV manufacturers) sold 158,134

- Great Wall (Asia EV manufacturers) sold 137,366

- Renault (non-Asia EV manufacturers) sold 136,750

- GAC (Asia EV manufacturers) sold 125,384

The leading Asian EV manufacturers are vertically integrated and have pursued direct investments on a global basis both upstream and downstream in order to grow their businesses. They have invested in upstream areas, such as financial services, flexible mobility solutions and charging infrastructure. Whereas in downstream areas, they have targeted raw material production, artificial intelligence equipment, energy storage devices and related technologies.

EV manufacturers from other developing markets in Asia have, to some extent, pursued a similar strategy. For example, Thailand-listed Energy Absolute has invested upstream in the production and distribution of renewable energy and the manufacturing of batteries, and downstream in EV charging infrastructure.

One of the key components of an EV is the battery, which currently accounts for around one-third of the total cost of EV production. According to DNV, Chinese battery companies comprise more than six tenths of the global market share. The lithium-ion battery is presently the dominant storage technology for EVs and is expected to continue to be so for the remainder of this decade. Alternative battery technologies are available, including flow batteries, but these are yet to have an appreciable impact in the EV space.

According to data analytics and consulting company GlobalData, the global battery storage market is expected to more than double from the 2021 level of $5 billion to reach around $11 billion in 2026, with the Asia-Pacific region accounting for 68% of total demand in 2026. China, Japan, India, South Korea and Australia are expected to drive this growth in the regional market, fueled by the increased overall demand for electricity and the wider use of batteries as a means of addressing intermittency in renewable energy generation.

The demand for lithium-ion batteries, in turn, drives the demand for the metals used to produce them, such as nickel, lithium and cobalt. As a result, the prices of these commodities have surged in recent years as manufacturers compete for reliable supplies, with lithium prices soaring more than seven times higher in May 2022 than in early 2021. Since Russia is a major producer of these metals and supplies 20% of global battery-grade nickel, this problem has been further exacerbated by sanctions imposed on Russia arising from the war in Ukraine. All this is on top of the global supply chain issues resulting from the COVID-19 pandemic, which have become a persistent headache for EV manufacturers. This will, however, present an opportunity for countries like Indonesia and the Philippines. Collectively, they contribute to almost 50% of worldwide nickel production, a crucial element in EV batteries.

There still remains the need to meet ESG standards which has led to a strong emphasis on supply chain sustainability. Consequently, automakers are increasingly looking to source raw materials from producers who are able to warrant, among other things, a low carbon footprint, thereby intensifying the demand further for some producers. This has resulted in some raw material producers proactively articulating their green credentials. For example, Allkem describes its Olaroz production facilities as follows: “The facilities are supported by favorable operating conditions and local infrastructure with very limited rainfall combined with dry, windy conditions which enhances the brine-evaporation process. Additionally, high lithium recoveries, zero liquid discharge, potential utilization of solar energy, minimal waste and no impact on fresh water support a very low environmental footprint.”

In light of this situation, it is not surprising that EV manufacturers are increasingly resorting to corporate transactions in order to secure the supply of these raw materials. By way of example, in March 2022, Volkswagen announced its intent to joint venture with Chinese metal giants Tsingshan Group and Huayou Cobalt to secure nickel and cobalt supplies for EVs in China and manage costs at a time of surging raw material prices. Elsewhere, in the first half of 2022, Chinese-listed automaker BYD announced its investment in Chengxin Lithium Group, which engages in lithium salt mining, production and sale in China. BYD’s talks to acquire six lithium mines in Africa has also been in the news.

What we can expect

- The global EV market is poised for significant growth. However, headwinds and challenges are likely for Asian EV manufacturers in the form of less-than-favorable government policies and initiatives, aimed at protecting the local market. An example of such a policy is the U.S. Inflation Reduction Act, enacted in August 2022, which limits tax credits for the purchase of EVs to those that meet certain specific criteria, including being assembled in the United States.

- For an industry where manufacturers are heavily reliant on materials produced in other parts of the world, continued stress in the global supply chain is likely to give rise to more contractual disputes, for example, where delivery schedules are missed by raw material suppliers and the EV manufacturer consequently defaults on commitments made to its end customers.

- We expect the continuation of strong buy-side demand from EV manufacturers for raw material producers and other EV component makers. This should drive more auction-based M&A activity, where higher pricing can be expected as sellers take advantage of a competitive market from buyers looking to vertically integrate.

- As more businesses across the EV and battery value chain are forced to raise ESG standards, we expect to see increasing attention and demand for green and sustainable practices. We may also see increased standardization of ESG rules both at a national level and on an industry-wide basis.

- EV ecosystem comprises data harnessed from EVs, public and private chargers and charge point operators that interlinks with other ecosystems, including energy, buildings, and public and civil organizations. Given the emergence of such a complex EV environment, data collection and management will pose both a major challenge, in particular with regard to data storage, ownership, usage and regulation and a major opportunity for those who can gather and monetize such data.