The proposed new framework will supplement and build upon initial, more specifically targeted UK regulatory initiatives relating to cryptoassets, including the Financial Conduct Authority’s (FCA) anti-money laundering and counter-terrorist financing (AML/CTF) registration regime for cryptoasset businesses,1 the extension of the financial promotion regime to promotions of certain cryptoassets, and the proposed regulatory regime for fiat-backed stablecoins to be introduced via the Financial Services and Markets Bill 2022 (FS&M Bill), which is currently going through Parliament.

The Consultation acknowledges the need to introduce a risk-appropriate regulatory framework for cryptoasset activities, notably in light of recent events that have led to increased volatility in the cryptoasset sector and a decline in cryptoasset market capitalisation. However, the Consultation strikes a notably upbeat tone and emphasises the sector’s potential for technological innovation and growth. The proposals therefore represent a significant step in positioning the UK as a globally competitive cryptoasset hub.

The Consultation will close on 30 April 2023 at 9am. Taking account of the Consultation feedback, the Treasury is then expected to issue secondary legislation to formalise the cryptoasset regulatory framework under the Financial Services and Markets Act 2000 (FSMA) as amended by the FS&M Bill. This will be followed by FCA consultations on supplementary regulatory rules and guidance. In due course, depending on how the cryptoasset markets evolve, the UK government may launch a further phase of rulemaking to capture broader activities such as the trading of and investment in cryptoassets.

Scope of proposed regulation

Consistent with the definitions used in the FS&M Bill and other frameworks such as the European Union’s Markets in Crypto Assets Regulation and the Financial Action Task Force’s AML/CTF standards for virtual asset service providers, the Consultation proposes a broad and technology-neutral definition of “cryptoasset”. Specifically, a cryptoasset is defined as any cryptographically secured digital representation of value or contractual rights that (a) can be transferred, stored or traded electronically, and (b) uses technology supporting the recording or storage of data (which may include distributed ledger technology, although the definition is agnostic as to the technology used). Specific parts of the UK regulatory framework may use narrower definitions where required to capture or exclude certain subsets of asset (e.g., certain rules on payment systems may relate only to digital assets used for settlement of payments).

This broad definition may capture specified regulated activities relating to a range of asset types, including in particular exchange tokens, utility tokens, security tokens, non-fungible tokens (NFTs), stablecoins, asset-referenced tokens, commodity-linked tokens, crypto-backed tokens, algorithmic tokens, governance tokens and fan tokens. Relevant subsidiary legislation under FSMA will be amended to designate cryptoassets as a “specified investment”; correspondingly, persons carrying on specified activities in relation to cryptoassets by way of business will require authorisation under FSMA.

Transition from existing rules

Cryptoassets are currently regulated in the UK in a targeted way. Certain types of cryptoassets already fall within the existing scope of financial services regulations. For instance, security tokens, which provide rights akin to securities, are regulated under FSMA by virtue of falling within the scope of existing categories of specified investment.

Once the proposals outlined in the Consultation come into effect, the existing AML/CFT registration regime for cryptoasset businesses will be subsumed into a harmonised authorisation process which will regulate cryptoasset activities. Existing firms that are already registered under this AML/CFT regime will need to reapply for authorisation under the amended FSMA pursuant to a streamlined application process.

In addition to the Consultation, the UK government is considering the introduction of a regulatory regime for the issuers, custodians and payment service providers of fiat-backed stablecoins used for payments. This regime will be introduced via the FS&M Bill and will be administered by the FCA. The UK government is also expanding the existing financial promotions regime to regulate cryptoasset promotions.2 Together, these regulatory initiatives form part of the ongoing alignment of the regulation of cryptoasset activities with traditional financial services.

Regulated cryptoasset activities

The Consultation proposes to regulate cryptoasset activities that are undertaken by way of business. These activities will be brought into the scope of regulation in phases, with certain cryptoasset issuance, payment, and safeguarding and administration services being introduced as regulated activities in the first instance. Indicatively, cryptoasset activities that will be brought into the regulatory perimeter over time include:

- Issuance: the issuance of a cryptoasset or making a public offer of a cryptoasset

- Payment: the execution of payment transactions or remittances involving cryptoassets

- Exchange: operating a cryptoasset trading venue which supports the exchange of cryptoassets, fiat currency and other types of assets

- Investment and risk management: dealing or arranging in cryptoassets

- Lending, borrowing and leverage: operating a cryptoasset lending platform

- Safeguarding and/or administering (custody) services: safeguarding or administering a cryptoasset

- Validation and governance: mining or validation

Platforms such as cryptoasset exchanges which undertake multiple cryptoasset activities on a “vertically integrated” basis will need to follow rules covering all those activities. Firms that are already authorised under FSMA and intend to undertake a cryptoasset activity will generally need to apply for a variation of their permission.

Territorial scope

Cryptoasset activities “provided in or to the UK” are proposed to be regulated. This will capture UK firms which provide cryptoasset activities to persons located anywhere, and any firms outside of the UK which offer cryptoasset activities to UK persons. A narrowly defined reverse solicitation exemption may apply to firms outside of the UK that do not solicit or target UK customers – any regulatory provisions allowing for such reverse solicitation will be defined in a way to prevent misuse and regulatory arbitrage. The Consultation does not provide any specific indication as to whether the well-established “overseas persons exclusion” under the existing FSMA regime (which allows persons operating from outside the United Kingdom to provide certain services to UK clients subject to conditions, e.g., where the activity is conducted with or through an authorised person, and in compliance with the financial promotions regime) will apply in relation to cryptoasset activities. Overseas firms typically rely on the exclusion to obtain access to the UK’s wholesale financial markets. That the new regime will be based on the existing regulatory perimeter suggests the exclusion should be made available to cover activities in cryptoassets on a consistent basis with its availability to cover the same activities in other investments.

Firms may need a UK presence in order to be authorised to provide cryptoasset activities in the UK – this will be determined by the FCA at the point at which firms apply for authorisation (although specific requirements will likely apply for cryptoasset trading venues, as further outlined below). This is subject to the FCA’s existing framework for international firms and the possible risks of harm, e.g., to clients and client assets. Firms authorised in countries outside of the UK may not require a UK presence if they are subject to an equivalent standard of regulation and there are suitable mechanisms for cooperation between regulators in place.

Cryptoasset issuances

Requirements relating to cryptoasset issuances and disclosures will be aligned with the principles of the UK prospectus regime for offerings of securities, which is currently undergoing reform. Cryptoassets admitted to a cryptoasset trading venue will be subject to the venue’s admission and disclosure rules and principles that are to be set by the FCA. Public offers of cryptoassets (including initial coin offerings) may be treated like security token offerings, in which case a prospectus requirement will apply, subject to exemptions (e.g., for offers falling below a minimal monetary threshold). Where a public offer of cryptoassets does not meet the definition of a security token offering, an alternative form of regulation may be implemented (e.g., a requirement for the offering to be conducted via a regulated platform).

Cryptoasset issuers will need to prepare disclosure documents, based on “necessary information”. This means information that enables an investor to make an “informed assessment” of the cryptoasset, ranging from disclosing the features, prospects and risks of the cryptoasset to outlining its underlying technology. Issuers are also required to satisfy financial requirements and are liable for the statements made in their disclosure documents. The FCA will centrally store all disclosure documents and is considering whether issuers should be required to make ongoing disclosures.

Cryptoasset trading venues will be required to conduct due diligence on the issuer and may take on the responsibilities of an issuer for decentralised cryptoassets such as Bitcoin. Venues will also need to ensure there are rules governing the accuracy and fairness of advertisements and other financial promotions.

Cryptoasset trading venues

Firms operating cryptoasset trading venues (essentially, exchanges) will be subject to a framework similar to that for currently regulated trading venues (e.g., MTFs: multilateral trading facilities) and will accordingly require authorisation. While the territorial scope of regulation for cryptoasset trading venues will depend on criteria such as whether the venue is incorporated in the UK and/or provides services to persons in the UK, such venues will likely need to set up a UK subsidiary in order to apply for authorisation. Cryptoasset trading venues will be subject to prudential, consumer protection, governance, operational resilience, data-reporting, and resolution and insolvency-related requirements.

Cryptoasset intermediaries

Dealers, liquidity providers, agency brokers, specialist cryptoasset firms and large traditional financial services firms offering intermediation services for cryptoassets may need to apply for authorisation. Firms which deal, arrange deals, or make arrangements with a view to transactions, in cryptoassets will fall within the authorisation regime. Applications will need to include details such as business plans, organisational and governance arrangements, controls and risk management, cybersecurity, outsourcing and financial resources. In addition, intermediaries will be subjected to a raft of prudential, consumer protection, governance, operational resilience and data-reporting requirements.

Intermediaries will be required to act honestly and fairly, and in the best interests of their clients. This entails, among other measures, taking all reasonable steps to obtain the best possible result for the client and assessing the appropriateness of cryptoassets for consumers.

Cryptoasset custody

Persons who safeguard, or safeguard and administer, or who arrange either of the foregoing, will likely also need to apply for authorisation. The details required for applications and the corresponding requirements to be imposed on custodians are similar to those for trading venues and intermediaries. The rules will be based on the existing FCA Client Assets Sourcebook, with the aim of ensuring investors can recover their assets in the event a custodian becomes insolvent. These rules include restricting the commingling of the custodian’s and its customers’ assets, and books and recordkeeping requirements. The FCA is also considering whether to apply investor compensation protections under the Financial Services Compensation Scheme should an authorised cryptoasset custodian fail. Finally, the UK government will consider whether a new resolution regime should be developed for such firms (akin to the special administration regime for investment firms).

Cryptoasset lending and borrowing

Drawing on the lessons of high-profile collapses of lending platforms such as Celsius, it is proposed that operating a cryptoasset lending platform will require authorisation. The activity subject to regulation will include borrowing collateralised and uncollateralised cryptoassets, or borrowing fiat currency and providing collateral in cryptoassets. Applications for authorisation will require (among other information) details about lenders, borrowers, loans, the legal title of assets, liquidity, capital and risk-management practices, and how liabilities are met.

Cryptoasset lending platforms are likely to become subject to prudential requirements set by the FCA that include minimum capital and liquidity requirements to mitigate a range of risks. In addition, detailed business conduct requirements will apply, including client disclosures, risk warnings and clear contractual terms on the ownership of title, collateral requirements and margin calls.

Market abuse framework for cryptoassets

A new cryptoasset market abuse regime is proposed to apply to activities in respect of cryptoassets that are, or have been requested to be, admitted for trading on a UK trading venue. The proposed new regime will set out market abuse offences similar to those under the existing UK on-shored version of the EU Market Abuse Regulation, including insider dealing, market manipulation and unlawful disclosure of inside information. It will also capture certain types of market abuse that occur outside of the UK. Significantly, the Consultation contemplates requiring all regulated firms undertaking cryptoasset activities to disclose inside information and maintain insider lists.

Cryptoasset trading venues will be responsible for preventing, detecting and “disrupting” market abuse, under FCA supervision. This includes implementing know-your-customer requirements, public blacklists, order-book surveillance, reporting suspicious transactions and information-sharing between trading venues, among other measures. Intermediaries will also be required to prevent and detect market abuse. The Consultation invites comment as to the appropriate balance of responsibilities between the FCA and trading venues.

Regulating DeFi

The Consultation also requests feedback on how best to regulate decentralised finance (DeFi) offerings. The options range from regulating any activity which establishes or operates a protocol, to applying rules to any person who can maintain significant control over a DeFi arrangement performing cryptoasset activities. Other suggestions include regulating centralised on- and off-ramps, such as exchanges or interface providers who provide access to DeFi offerings. The UK government’s ultimate aim is to achieve similar regulatory outcomes between centralised and DeFi offerings, while encouraging the innovation offered by DeFi.

Regulating other cryptoasset activities

The Consultation briefly discusses whether cryptoasset activities other than those outlined above should be regulated. Cryptoasset investment advice and portfolio management will not be brought within the scope of specific regulation for the time being, given the relatively limited impact these activities currently have on the retail customer segment and the practical difficulties involved in requiring cryptoasset investment advisers to align with traditional conduct requirements for this type of role (e.g., carrying out due diligence on issuers of assets). Regulation of cryptoasset settlement activities may be introduced in the future where the settlement activities are systemic and pose a risk to financial stability, or to the extent warranted in light of further experimentation with settlement solutions in the FMI Sandbox initiative. Cryptoasset clearing activities may also in due course be subject to regulation similar to that which applies to the clearing of derivatives. In relation to mining and staking activities, the Consultation notes that while there may not be strong justifications to regulate mining (given the low levels of mining activity undertaken in the UK), there are arguments for regulating staking services, some of which target consumers in the UK. The Consultation further asks about the environmental indicators of cryptoasset activities and whether these could be applied as a set of disclosure requirements.

Implications for the cryptoasset industry

The Consultation aligns the treatment of cryptoassets with other assets which have been traditionally regulated by financial services laws, such as securities. While these new rules will make it more onerous to operate a cryptoasset business in the UK, they also confer additional legitimacy to the UK as a credible and competitive crypto hub. In addition, locating the UK’s cryptoassets regime in the UK’s existing and well-respected financial services regime is likely to streamline its implementation, both for firms and for the FCA. More broadly, these proposed rules also reflect the UK government’s efforts “to manage, not stifle” innovation. The UK has historically set standards that have inspired regulatory policy elsewhere in the world, and the proposals outlined in the Consultation will likely influence the development of cryptoasset regulations in other jurisdictions.

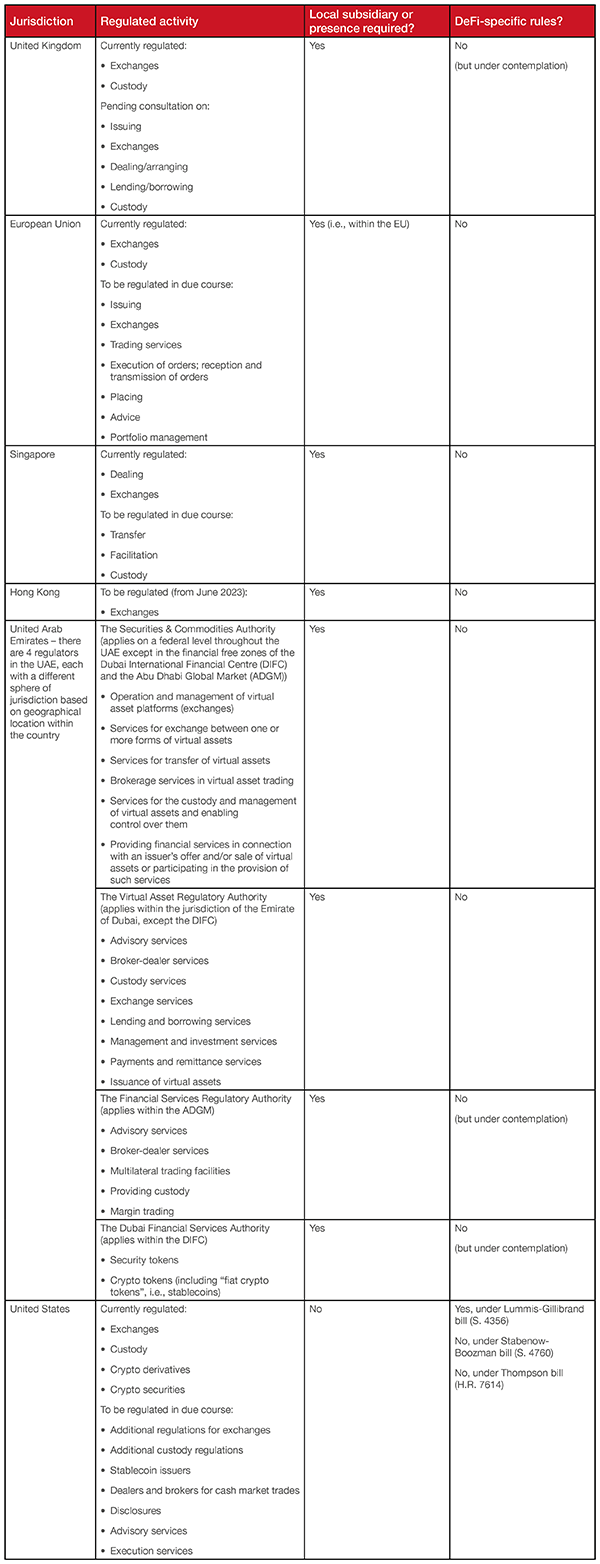

Cryptoasset businesses will need to think carefully about whether they want to be located in, or service customers from, the UK. At this juncture, they may wish to compare the current and proposed regulatory position in the UK with that in other jurisdictions. To put the UK position into context, the following is a brief snapshot of the development of cryptoasset regulation across key jurisdictions.

- These cryptoasset businesses comprise firms or sole practitioners undertaking activities in the UK in relation to the exchange, arranging or making arrangements with a view to the exchange of money for cryptoassets, cryptoassets for money, or one cryptoasset for another; the operation of a machine which utilises automated processes to exchange cryptoassets for money or money for cryptoassets; and the safeguarding or safeguarding and administering of cryptoassets or private cryptographic keys in order to hold store and transfer cryptoassets.

- In January 2022, the government published a consultation response setting out its intention to legislate to bring the promotions of certain cryptoassets within the FCA’s remit. On 1 February 2023, the government published a policy statement announcing the introduction of an exemption under the financial promotions regime which will enable cryptoasset businesses that are registered with the FCA under the existing AML/CTF regime (but that are not otherwise authorised persons) to communicate their own cryptoasset financial promotions to UK consumers, subject to certain conditions.

In-depth 2023-045