Authors

That decision was recently the subject of an appeal to the Singapore Court of Appeal (the CoA).

This alert reports on the decision of the CoA in Crédit Agricole Corporate & Investment Bank, Singapore Branch v PPT Energy Trading Co Ltd and another appeal [2023] SGCA(I) 7, the effect of which changed the outcome for the parties and overturned the SICC judgment on some of the issues. It will be of interest to issuers and beneficiaries of LCs, but it is of wider interest where LOIs are used in connection with sales of goods.

The SICC had dismissed claims brought by Crédit Agricole Corporate & Investment Bank, Singapore Branch (CACIB) in connection with an LC and an LOI, the latter being among documents presented under the LC for payment. The SICC allowed a claim by PPT Energy Trading Co Ltd (PPT) to retain a payment of US$23.7 million made by CACIB under the LC.

The facts

A summary of the facts relating to the appeal is set out below. For further details about the facts, please refer to our 9 February 2022 client alert reporting on the SICC judgment.

- Zenrock Commodities Trading Pte. Ltd (Zenrock) entered into a series of transactions for the sale of a cargo of crude oil amounting to so-called “round-tripping”. Zenrock featured both as a seller and a buyer in a circle of sale contracts relating to the same cargo. Total Oil Trading SA (TOTSA) was both the initial seller of the cargo in the circle of transactions as well as the ultimate buyer. One of the transactions in the circle was the sale of the cargo by PPT to Zenrock (the PPT Sale Contract). Zenrock onsold the cargo to TOTSA, thereby completing the series of transactions.

- In order to procure financing for the PPT Sale Contract, Zenrock provided CACIB with a copy of the PPT Sale Contract as well as a fabricated sale contract for the sale of the same cargo by Zenrock to TOTSA (the Fabricated TOTSA Contract). The Fabricated TOTSA Contract suggested that Zenrock would make a profit from its sale to TOTSA as opposed to a loss, and Zenrock assigned the proceeds of this sale to TOTSA to CACIB. CACIB later discovered that the TOTSA receivables were the subject of a competing security interest granted by Zenrock to another bank, ING. Zenrock also granted both CACIB and ING a floating charge in respect of all goods each bank financed.

- CACIB was induced by Zenrock’s fraud to issue an LC to PPT to facilitate Zenrock’s purchase under the PPT Sale Contract. The LC allowed PPT to be paid upon the presentation to CACIB of a commercial invoice and an LOI in lieu of original bills of lading.

- PPT presented its commercial invoice and a compliant LOI to CACIB for payment under the LC. The LC was subject to the Uniform Customs and Practice for Documentary Credits (UCP 600). CACIB therefore had five banking days from presentation to provide PPT with notice of any defective or invalid presentation. CACIB did not send PPT any such notice. At the time of the documentary presentation, CACIB investigated information received from TOTSA including evidence that Zenrock had assigned the TOTSA receivables twice and that the Fabricated TOTSA Contract was not genuine. CACIB did not make payment under the terms of the LC.

- CACIB was granted an interim injunction by the Singapore High Court prohibiting payment under the LC. The injunction was ultimately discharged, and CACIB paid PPT under the LC. However, it did so in return for a bank guarantee from PPT’s bank securing a reimbursement of the LC proceeds if CACIB’s original refusal to pay was ultimately found to have been justified.

The SICC proceedings

In the proceedings before the SICC, CACIB claimed that PPT was not entitled to receive payment under the LC and that CACIB was entitled to be reimbursed. If PPT was entitled to CACIB’s payment under the LC, CACIB argued that PPT was liable under the LOI to indemnify CACIB for all losses arising from PPT’s breaches of the representations and warranties contained in the LOI.

PPT counterclaimed for (i) a declaration that payment was due under the LC and (ii) damages for CACIB’s non-payment, including the costs of obtaining the bank guarantee.

The SICC held that that Zenrock had committed a fraud, but it dismissed CACIB’s claim for the reimbursement of the LC proceeds paid to PPT and denied CACIB’s claims for damages against or indemnification by PPT under the LOI.

CACIB appealed the decision.

What did the CoA decide and why?

CACIB’s appeal concerned two main issues:

- Was CACIB entitled to rely on Zenrock’s fraud to set aside and avoid liability to pay under the LC issued in PPT’s favour?

- Was CACIB entitled to its claim for indemnification by PPT under the LOI in respect of two relevant promises it contained? The relevant promises were:

- PPT’s warranty that property had passed under the PPT Sale Contract and that PPT had “marketable title to such shipment, free and clear of any lien or encumbrance” (the Warranty); and

- PPT’s agreement to protect, indemnify and hold CACIB harmless from and against any and all damages, costs and expenses which it might suffer or incur by reason of the original bills of lading remaining outstanding or breach of warranties given (the Indemnity).

The CoA’s decision

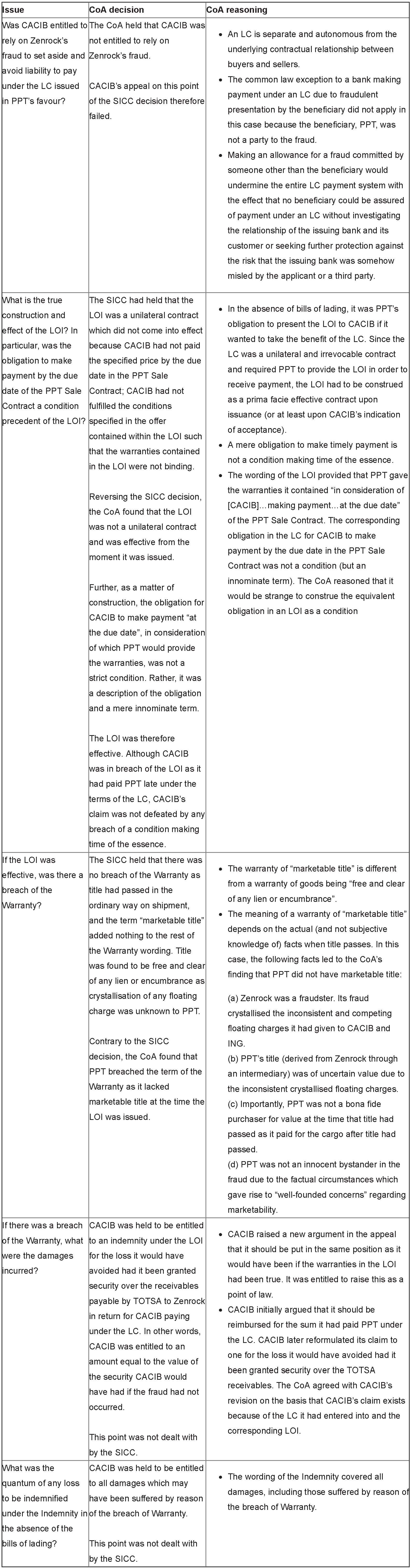

For simplicity’s sake, the CoA decision is summarised in the table below.

The CoA allowed CACIB’s appeal solely on the ground that PPT had breached the Warranty. CACIB was awarded US$10.3 million for breach of the Warranty.

What does this decision mean for you?

The case provides the following takeaways for commodity market participants including traders and financiers:

- The CoA reinforced the autonomy principle relating to LCs. Documentary LCs are independent, autonomous and irrevocable unilateral contracts, and banks must pay upon a compliant presentation of the documents required for payment.

- A bank may only refuse to make payment to a seller upon presentation of compliant documents under an LC under the very limited and specific circumstances of fraud, including in particular a beneficiary taking the benefit of an LC while having knowledge of the buyer’s fraud.

- Whether a party holds ‘marketable title’ capable of transfer turns on actual facts at the time of title passing, and not on mere knowledge or constructive knowledge of facts.

- In a departure from the SICC decision, the CoA held that on the facts, the LOI was effective from the moment of issue (or at least upon CACIB’s indication of acceptance), and the warranties and indemnities contained within it were binding. This was the case even though CACIB failed to make timely payment.

In-depth 2023-256