Overview of the new prudential regime

Those 125K limited licence firms that deal on own account (as defined in MiFID II) and hold client money will be categorised as ‘class 2 firms’ (unless they have very large group balance sheets), meaning that they will be subject to the full application of the new regime. See our previous alert for an overview of the classification of firms under the IFR and IFD on reedsmith.com.

These firms will become subject to a much higher minimum capital requirement of EUR 750,000 in common with other firms that deal on own account. Any firm that is currently a 125K limited licence firm but does not have any form of principal dealing permission will likely become subject to a new minimum capital requirement of EUR 150,000. This minimum requirement is just one element of the new own funds requirement which will require firms that deal on own account to maintain capital above the highest of three figures: (a) EUR 750,000; (b) the fixed overheads requirement; and (c) the new K-factor requirement.

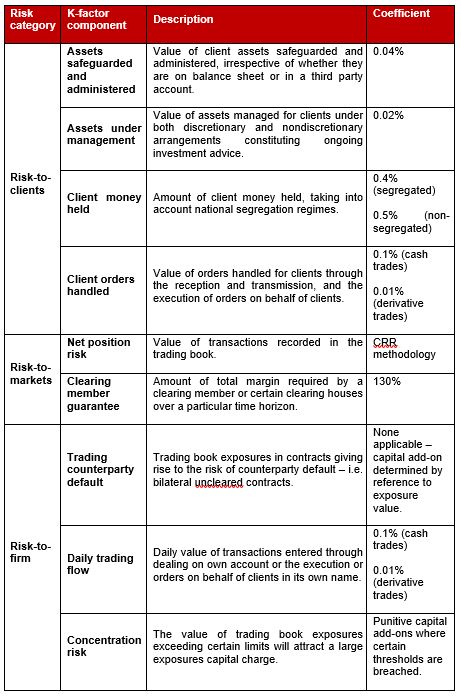

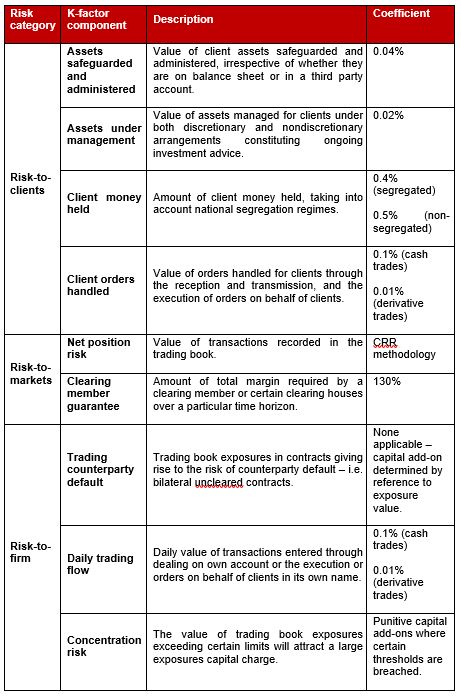

The K-factor requirement is the biggest change in the new regime. It applies percentages (‘coefficients’) to the value of specific risks encountered by firms. The new regime is intended to be a major improvement as it is calibrated to the risks of investment firms rather than banks. The risk categories and their corresponding components are set out in the following table.

Firms should note that the trading counterparty default and concentration risk exposure calculations can be mitigated if there is an effective netting contract supported by independent, written and reasoned legal opinions for the legal regimes of the counterparties. This could be an important consideration in reducing the counterparty credit risk exposure particularly where there is a single significant overseas hedging counterparty. The detailed scope of the K-factor calculations will be subject to additional legislation and regulatory guidance. However, there is enough in the current material for firms to begin assessing the likely impact on their capital requirements.

When designing the new regime, the EBA commented that due to the weakness of the current regime in capturing the relevant risks for investment firms under Pillar 1 requirements, local regulators commonly set significant additional requirements under Pillar 2 to mitigate that weakness. An important result of the new regime being calibrated to the specific risks of investment firms is the scope for firms to make a case for a reduction in Pillar 2 requirements. As set out in the new IFD, additional capital requirements should only be imposed by regulators where: “the firm is exposed to risks or elements of risks, or poses risks to others that are material and are not covered or not sufficiently covered by the own funds requirement, and especially K-factor requirements”. We understand that many 125K limited licence firms have extremely large Pillar 2 requirements so this is a matter which firms should consider discussing with their regulator otherwise there is a risk of double-counting.

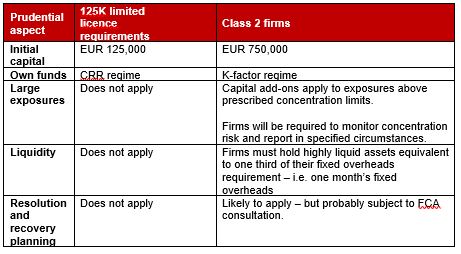

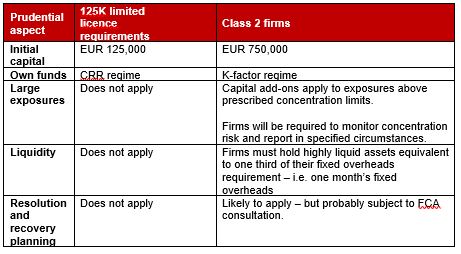

The following table compares the current own funds requirements applicable to 125K limited licence firms with the requirements for class 2 firms which deal for own account under the new regime.

Other important changes

As well as the impact on solo own funds requirements, there are other changes introduced by the new regime.

Consolidation: some of the new rules will apply on a group-wide basis and the new regime has a clear focus on investment firm group consolidation. This could involve regulators requiring that firms in groups with a non-EEA holding company may be required to interpose an EEA intermediate holding company.

Liquidity requirements: firms will be required to maintain a liquidity cushion of cash or near-cash assets equivalent to one month of fixed overheads.

Remuneration: the principles on remuneration policies and variable remuneration are substantially similar to the current remuneration code. However, there is no bonus cap, and the de minimis concession to disapply certain principles is narrower under the IFD. It will be interesting to see how the FCA will implement the remuneration principles for proportionality level three firms. Under the current remuneration regime, the FCA acknowledges that certain principles may be disapplied by 125K limited licence firms, for instance, relating to buy out, retained shares and other instruments, deferral and performance adjustment.

Disclosures and regulatory reporting: the content reporting and disclosure requirements will be familiar to most firms, however, the frequency and content varies from current requirements and the reporting on remuneration policy and practice is more granular than current Pillar 3 disclosures.

BRRD: it is expected that, as a result of becoming EUR 750,000 firms, those firms that are currently. 125K limited licence firms will be subject to the requirements of the Bank Recovery and Resolution Directive which requires the production of a detailed recovery plan.

Note that the CRR leverage ratio and capital buffers were not considered appropriate to apply to investment firms that are subject to the new prudential regime.

Transitional Relief

There is a five year transitional period from 26 June 2021 which puts an upper limit on the increase in some of the regulatory capital requirements for firms; this is intended to enable the gradual build-up of capital to meet the new requirements.

Notably, firms can limit their own funds requirement to double their requirement under the current regime for a five year period; this means that firms will have to calculate their requirements under both the old and the new regime if they wish to take advantage of this transitional relief.

Brexit

Although the IFR/IFD will apply only after end of the Brexit transitional period on 31 December 2020 (assuming there is no extension), HM Treasury intends to take powers to enable the introduction of an updated prudential regime for investment firms in the UK. This fits with our understanding that the UK regulators were heavily involved in shaping the new EU regime. The FCA will consult on the detail of its implementation of the new regime but this has understandably been delayed by its work on COVID-19 business disruption.

Next steps

While the full detail of the new regime is yet to emerge, there is enough information in the published level 1 text to start planning and modelling for the new regime.

It is clear that any investment firm or group considering any form of reorganisation or acquisition in the months ahead should consider the impact of this new regime and plan accordingly. Firms should also plan to take the following actions:

- Identify which group entities will be affected and whether consolidated supervision may be imposed;

- Determine the relevant class for each firm;

- Consider which data points are required to classify the firm and uplift systems to monitor these thresholds;

- Calculate the new requirements using the K-factors;

- Assess the extent to which the firm is required to introduce additional own funds and liquid assets;

- Prepare for large exposure monitoring and reporting;

- Review all contracts with key counterparties to ensure netting opinions are in place that meet the upcoming requirements;

- Consider any arguments for Pillar 2 reductions in light of the new K-factor requirements to avoid double-counting;

- Identify current remuneration practices and assess how these may change;

- Consider preparing a recovery and resolution plan; and

- Review whether any corporate or group reorganisation could help mitigate the impact.

Client Alert 2020-298