Change to rules

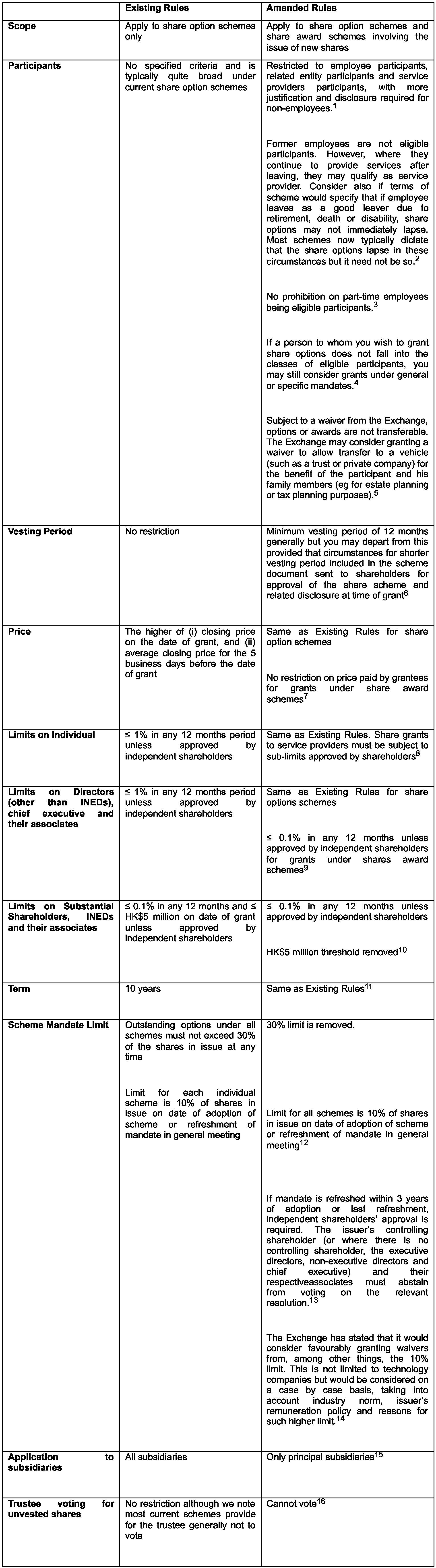

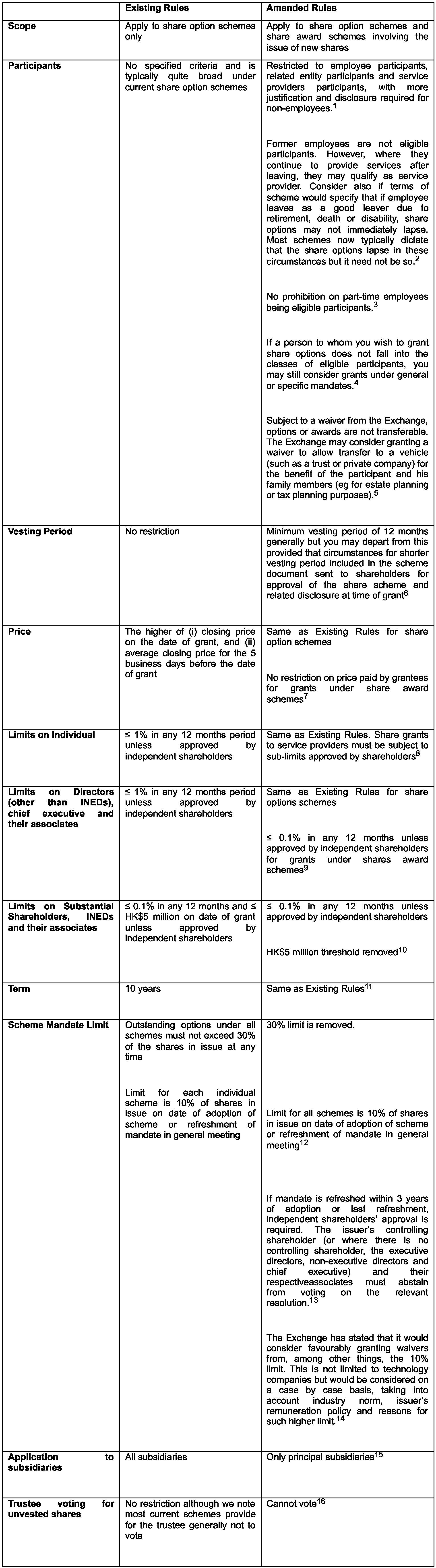

Highlights of the key changes to Share Schemes involving the issue of new shares are as follows:

Highlights of the key changes to Share Schemes involving existing shares of listed issuers are as follows:

None of the above (except the restriction on trustee voting for unvested shares) will apply to share award schemes funded by the issuer but where grants are in respect of share awards funded by existing shares of the listed issuer. Note though new requirements for disclosure in annual report.18

Chapter 17 to apply to principal subsidiaries

The present Chapter 17 applies to share option schemes of a listed issuer and any of its subsidiaries.

In light of the comments received on the rationale of Chapter 17, i.e. to govern dilution of interest in the issuers’ securities, under the amended Rules the requirements of Chapter 17 will only apply to share schemes of a principal subsidiary, i.e. a subsidiary whose revenue, profits or total assets accounted for 75% or more of the issuer in any of the latest three financial years. It shall be noted that the scheme mandate for Share Schemes of each principal subsidiary should be calculated with reference to the total issued shares of that subsidiary and not the issuer.19

For Share Schemes of other subsidiaries, they will be governed under Chapter 14 and Chapter 14A as disposal (of existing shares of subsidiaries) or deemed disposal (where new shares or options over new shares are granted).20

Effective Date and transitional arrangements

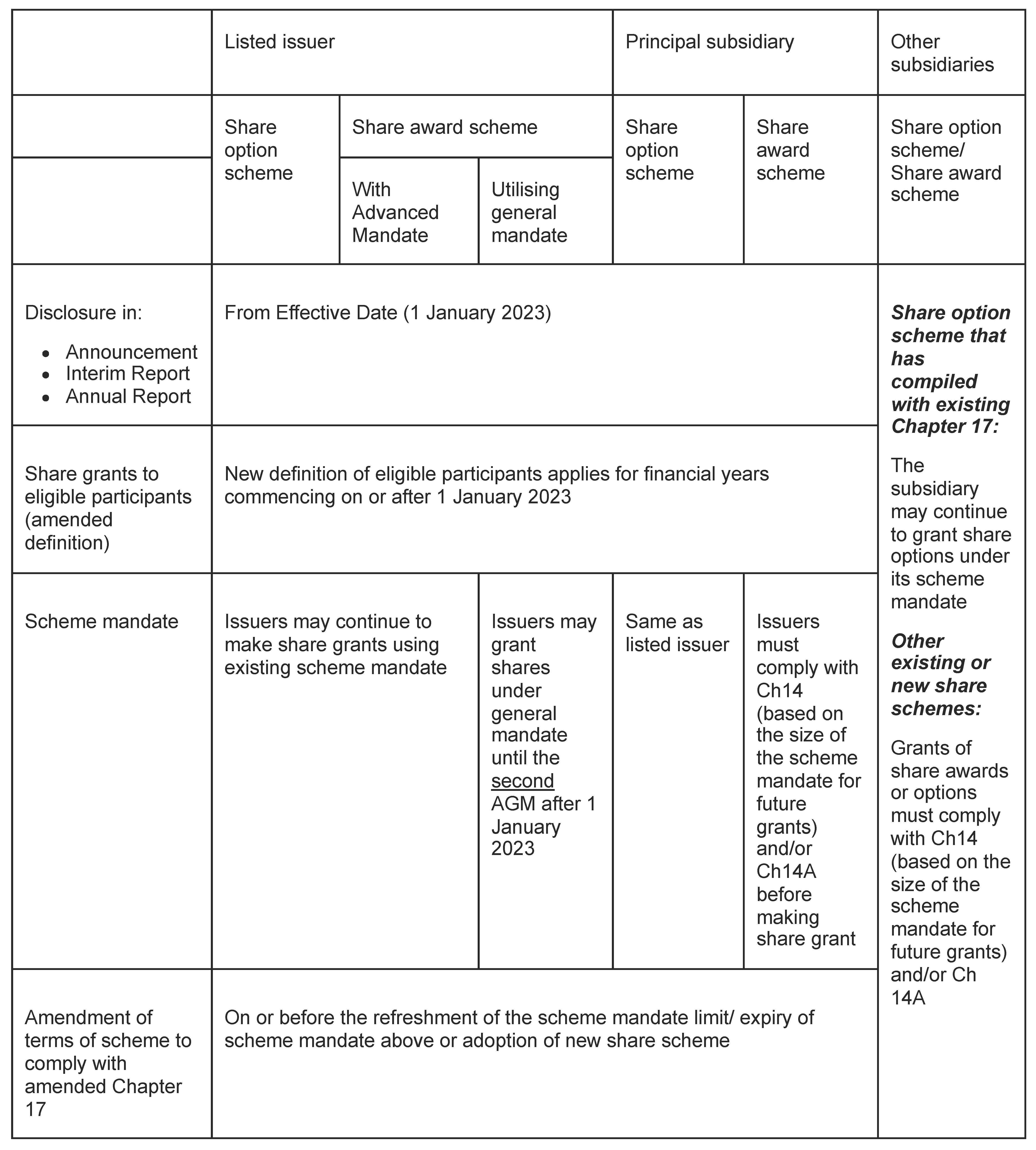

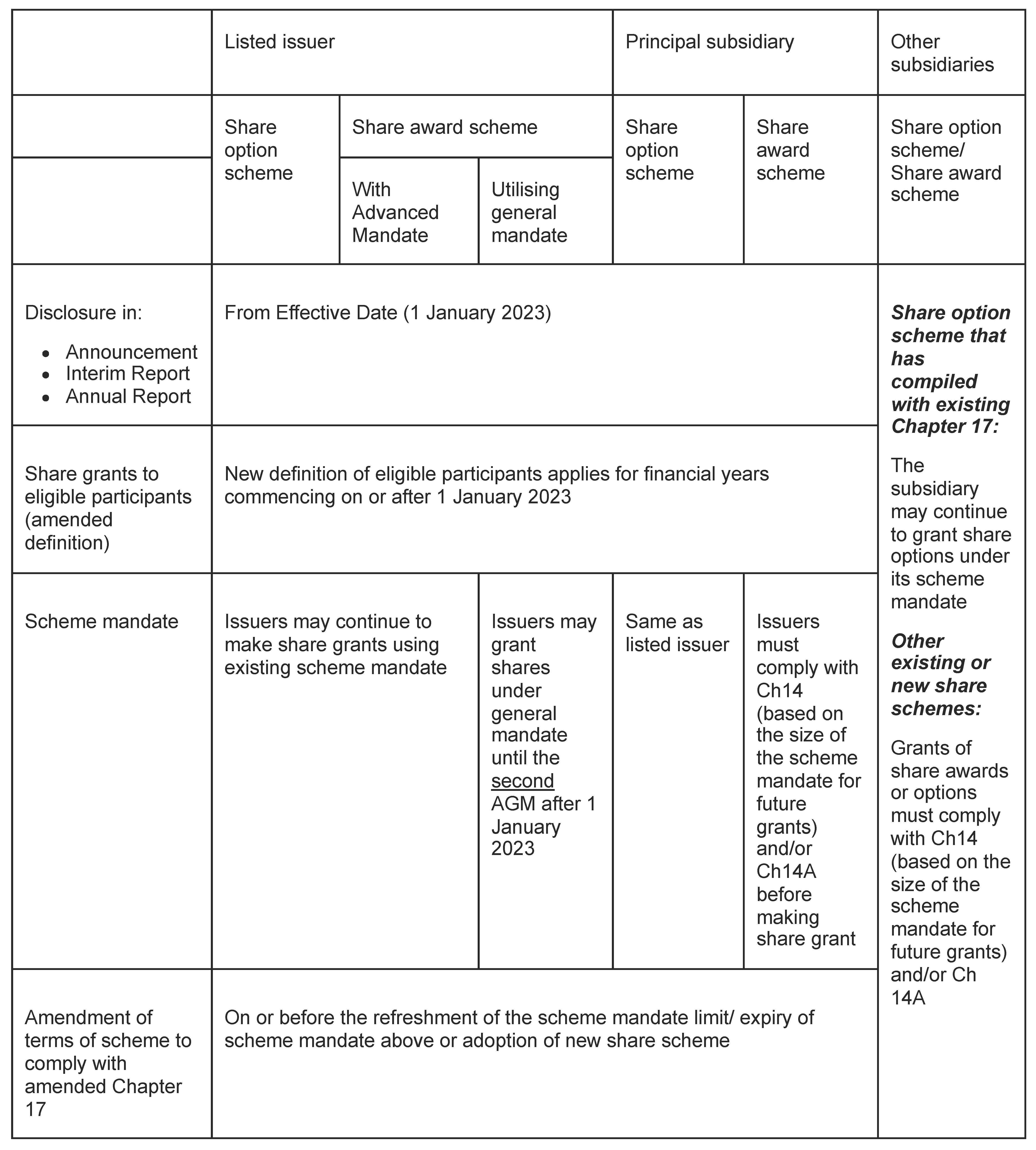

The new disclosure requirements will take effect on the Effective Date. The limits on participants will applies for financial years commencing on or after the Effective Date.

For Share Schemes with existing scheme mandate, issuers may continue to make share grant with such mandate, and the terms of the schemes must be amended to comply with the amended Rules on or before the refreshment or expiry of scheme mandate.

For share award schemes that utilise general mandate, issuers may continue to grant shares under the general mandate until the second AGM after the Effective Date.

See below table21 for transitional arrangement details:

Next Steps

Issuers should review their Share Schemes to ascertain the extent to which they may continue to grant options or awards under the transitional arrangements after the Effective Date, and plan ahead to allow sufficient time for the amendment of existing schemes or adoption of new schemes which requires shareholders’ approval.

If we can assist issuers in their review of share schemes to ascertain compliance on or before Effective Date, please feel free to contact us.

Reference materials:

Consultation Paper – Proposed Amendments to Listing Rules relating to Share Schemes of Listed Issuers (October 2021)

Consultation Conclusions – Proposed Amendments to Listing Rules relating to Share Schemes of Listed Issuers and Housekeeping Rule Amendment (July 2022)

Marked up amendments to the MB Rules (Appendix III of the Consultation Conclusions)

Marked up amendments to the GEM Rules (Appendix IV of the Consultation Conclusions)

Frequently Asked Questions on the amended Rules and the transitional arrangements for existing Share Schemes (July 2022)

- Unless otherwise specified, reference to the MB Rules, GEM Rules or Rules in this client’s alert is reference to the amended Rules which will take effect from 1 January 2023, the Effective Date. See Chapter 23 of the GEM Rules.

- MB Rule 17.03A, and GEM Rule 23.03A

- FAQ 084-2022

- FAQ 083-2022

- MB Rule 13.36, GEM Rule 17.39

- MB Rule 17.03(17),GEM Rule 23.03(17) and FAQ 095-2022

- MB Rule 17.03F, GEM Rule 23.03F, FAQ 092-2022

- MB Rule 17.03E, GEM Rule 23.03E

- MB Rule 17.03D, GEM Rule 23.03D. For service providers sub limit, see MB Rule 17.03B(2), GEM Rule 17.03B(2).

- MB Rule 17.04(2), GEM Rule 23.04(2)

- MB Rule 17.04(3), GEM Rule 23.04(3)

- MB Rule 17.03(11), GEM Rule 23.03(11)

- MB Rule 17.03(3), 17.03B(1) and 17.03C(2), GEM Rule 23.03(3), 23.03B(1) and 23.03C(2)

- MB Rule 17.03C(1)(b), GEM Rule 23.03C(1)(b)

- FAQ 090-2022

- MB Rule 17.01(c), GEM Rule 23.01(c)

- MB Rule 17.05A, GEM Rule 23.05A

- MB Rules 17.01(1)(b) and 17.12, GEM Rules 23.01(1)(b) and 23.12

- MB Rules 17.01(1)(c), 17.13 to 17.15, GEM Rules 23.01(1)(c), 23.13 to 23.15

- MB Rule 14.32A, GEM Rule 19.32A

- Extracted from FAQ 099-2022

Client Alert 2022-220