Authors

Authors

Key takeaways

- The Financial Conduct Authority (FCA) has published its final Policy Statement (PS23/16) (the Policy Statement) on Sustainability Disclosure Requirements (SDR) and investment labels following a consultation (CP22/20) (the Consultation Paper), which closed in January 2023.

- The Policy Statement introduces a package of environmental, social and governance (ESG) related measures aimed at preventing greenwashing, enhancing transparency and comparability, and facilitating informed consumer choice in the sustainability investment market.

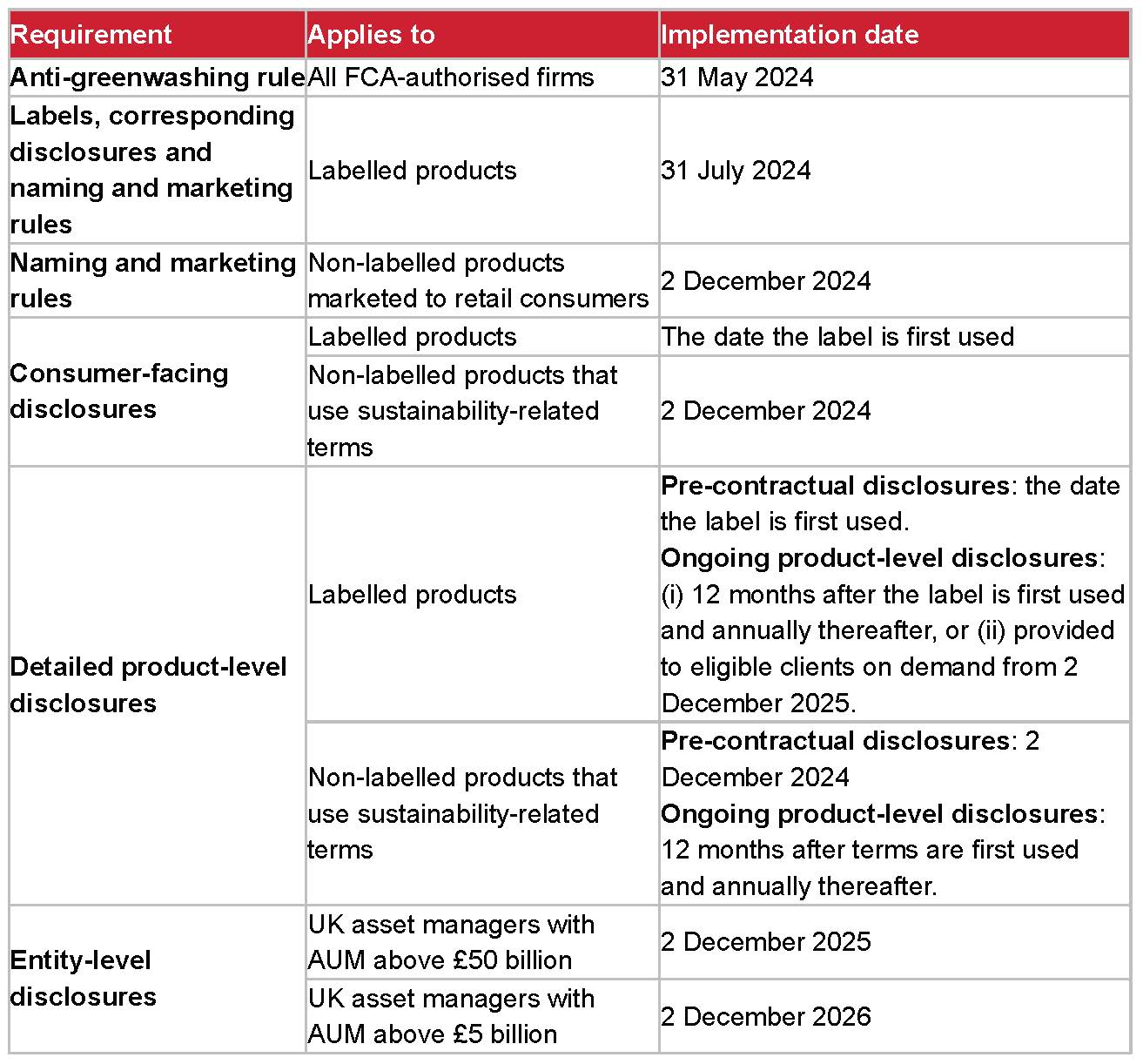

- The Policy Statement sets out an implementation timeline, which is staggered according to the complexity and impact of the changes (see “Annex 1: Implementation Timeline”). The anti-greenwashing rule will come into force on 31 May 2024 and the remaining components will come into force in stages, from 31 July 2024.

The FCA has published its final Policy Statement (PS23/16) on SDR and investment labels following a consultation (CP22/20) which closed in January 2023. The Policy Statement introduces a package of ESG-related measures aimed at preventing greenwashing, enhancing transparency and comparability, and facilitating informed consumer choice in the sustainability investment market.

Following substantial feedback on the Consultation Paper, the FCA has made several changes to its initial proposals, including delaying the implementation of the anti-greenwashing rule and introducing a fourth investment label for funds with “mixed goals”. The FCA has also addressed some operational considerations and concerns regarding interoperability and compatibility with other disclosure regimes, particularly the EU Sustainable Finance Disclosure Regulation (SFDR).

Overview of the FCA’s proposals

- An “anti-greenwashing rule” for all regulated firms making sustainability-related claims about their products or services, requiring them to ensure that such claims are fair, clear and not misleading, and substantiated by reliable and up-to-date information.

- Sustainability investment labels that UK asset managers can apply to their investment products if they meet certain qualifying criteria.

- Product naming and marketing rules to restrict use of certain sustainability-related terms – such as “ESG”, “green” or “sustainable” – in the naming or marketing of funds without sustainability labels.

- A tiered system of sustainability information disclosures introduced at the consumer-facing, product and entity levels for funds that use labels or sustainability-related terms, covering information such as the sustainability objectives, strategies, methodologies, indicators and outcomes of the funds.

- Rules requiring distributors to communicate the labels and disclosures of the funds they distribute to their clients, and to ensure that their own communications or financial promotions are consistent with the labels and disclosures of the funds.

The Policy Statement sets out an implementation timeline, which is staggered according to the complexity and impact of the changes (see “Annex 1: Implementation Timeline”). The anti-greenwashing rule will come into force on 31 May 2024 and the remaining components will come into force in stages, from 31 July 2024.

This Client Alert provides an overview of the main features and implications of the Policy Statement and highlights the key actions that firms might take to ensure compliance with the new rules.

Firms and investment products in scope of the regime

- All FCA-regulated firms that make sustainability-related claims about their products or services will be impacted by the anti-greenwashing rule.

- UK investment product managers (including wealth, fund and asset managers) will be impacted by the product labelling and disclosure rules.

- Distributors of investment products to retail investors in the UK will be subject to aspects of the labelling, naming and marketing regime and the anti-greenwashing rule.

- The rules do not currently apply to non-UK funds and asset managers, but the FCA has flagged that it is considering, together with HM Treasury, an appropriate regulatory framework to cover products offered from overseas to the UK market. The FCA has also removed portfolio management products and services from scope of the SDR following feedback on its Consultation Paper.

Anti-greenwashing rule

The FCA is introducing an “anti-greenwashing rule”, which requires FCA-authorised firms to ensure that sustainability-related claims made about their products or services are consistent with the sustainability characteristics of the relevant product or service and are fair, clear and not misleading. The rule remains substantially the same as in the FCA’s Consultation Paper but will be supplemented by new guidance. The implementation of the rule has been delayed to 31 May 2024 (rather than coming into force immediately on publication of the Policy Statement) to allow for a period of consultation on the guidance (GC23/3).

While the “fair, clear and not misleading” requirement is not an unfamiliar concept and reflects existing FCA business conduct requirements, the FCA has emphasised that it must be addressed separately and actively in the context of greenwashing. Firms will have to have specific regard to any “sustainability-related” claims they might make, which includes any communication that refers to the environmental or social characteristics of a financial product or service, whether contained in statements, strategies, policies or other media. The Guidance states that such references must be:

- correct and capable of being substantiated;

- clear and presented in a way that can be understood;

- complete, considering the full life cycle of the product or service and not omitting or hiding important information; and

- fair and meaningful in relation to any comparisons to other products or services.

The Guidance offers a number of helpful examples to elaborate on the FCA’s thinking and expectations in this area and is a welcome addition. It should prove instructive for firms navigating the requirements under the new regime.

The anti-greenwashing rule should prove helpful in deterring firms from making false or exaggerated sustainability claims that could mislead consumers and harm market integrity. However, while the new requirements should empower the FCA to take action against cases where it can show deliberate or reckless misrepresentations, a challenge remains in cases where there are inadvertent misrepresentations – for example, where there has been accidental double counting, or differing reporting standards or baselines. There remains ambiguity in these instances, which may mean that some milder forms of greenwashing persist.

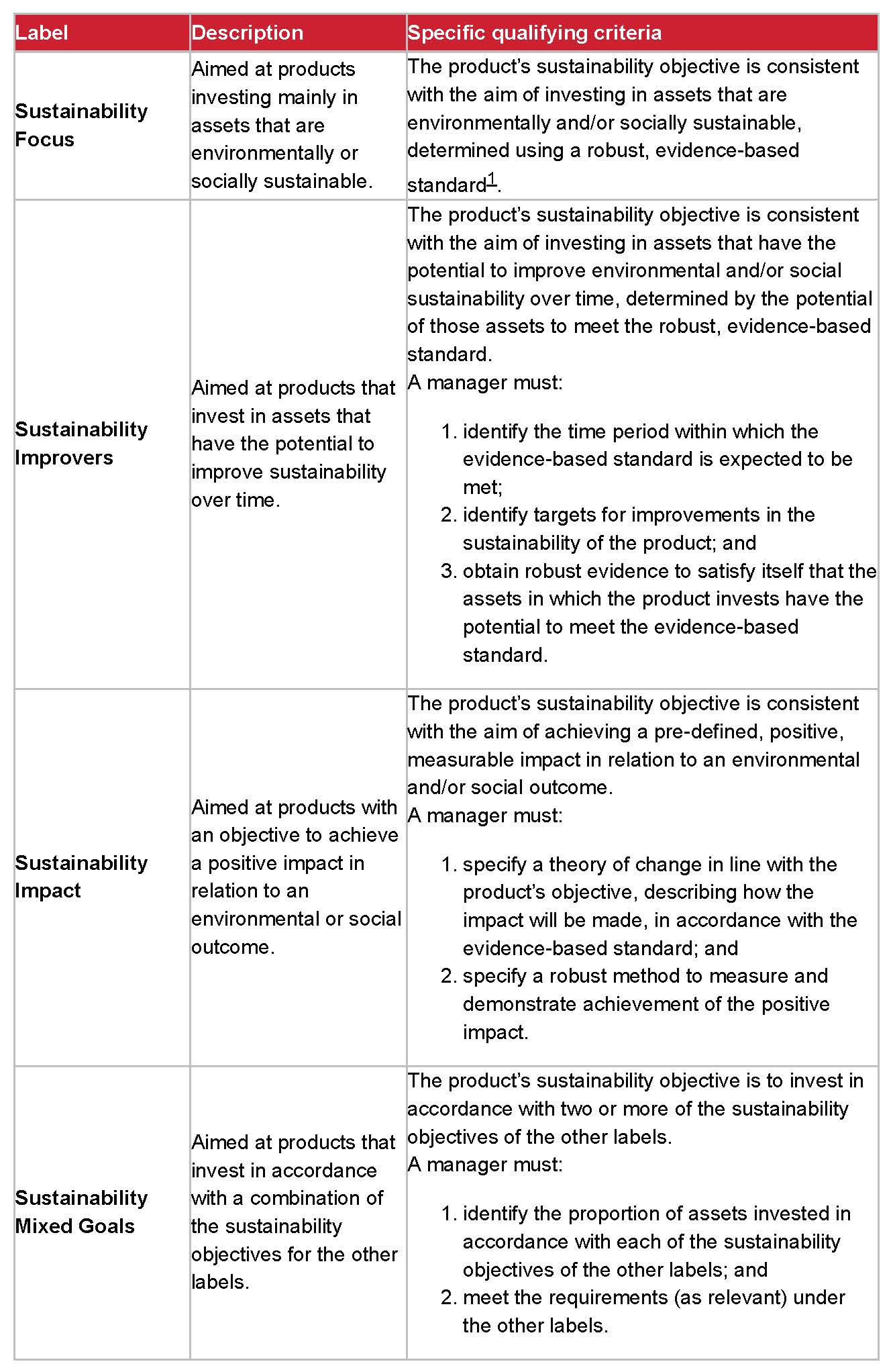

Sustainability investment product labels

In its Consultation Paper the FCA proposed introducing three “labels” for investment products that seek positive sustainability outcomes: “Sustainable Focus”, “Sustainable Improvers” and “Sustainable Impact”. In the Policy Statement the term “Sustainable” has been replaced with “Sustainability” to create room for transitional products and better reflect that the labels represent an investment approach. In addition, a fourth “Sustainability Mixed Goals” label has been introduced for funds with investment strategies that contain attributes of more than one label.

The FCA has emphasised that the labels are not intended to create a hierarchy, but to help consumers identify and compare funds that have different sustainability objectives and investment approaches. The regime is voluntary, and UK asset managers can choose to label their products or services provided they meet certain qualifying criteria.

The four sustainability investment product labels are as follows:

The FCA has taken on board industry feedback and provided some welcome clarification on the requirements for each label. Asset managers using the “Sustainability Focus” label can assess the “robust, evidence-based standard” internally provided the internal process is disclosed and independent of the manager’s investment process, and firms using the “Sustainability Improvers” label can decide how to treat products or assets that have met their targets for improvement. On the “Sustainable Impact” label, firms are not required to invest in new capital or direct capital to underserved markets, alleviating concerns regarding financial additionality.

In addition to the label-specific qualifying criteria set out in the table above, all labelled products must meet general qualifying criteria, which can be divided into five overarching principles:

- Sustainability objective: the product must have a clear, specific and measurable sustainability objective that aligns with one of the labels.

- Investment policy and strategy: at least 70% of the gross value of the product’s assets must be invested in accordance with its sustainability objective.

- Key performance indicators (KPIs): firms must identify KPIs to measure the product’s progress towards achieving its sustainability objective.

- Resources and governance: firms must implement appropriate organisational arrangements and resources to support delivery of their sustainability objective.

- Stewardship: firms must identify and disclose the stewardship strategy needed to support the delivery of the sustainability objective and set out an escalation plan for when assets do not demonstrate sufficient progress.

In a notable development from the Consultation Paper, the 70% minimum investment threshold has been extended to all labels, rather than applying only to the “Sustainability Focus” label. The FCA has also introduced requirements – somewhat akin to the EU SFDR’s “do no significant harm” requirement – that (i) labelled products must not invest in any assets that conflict with their sustainability objective and (ii) firms must disclose if pursuing their sustainability objective could have a negative environmental or social impact. However, the complexities associated with demonstrating compliance with the SFDR’s “do no significant harm” requirement appear thankfully to have been avoided.

UK asset managers that choose to label their products will need to ensure ongoing compliance with the specific and general qualifying criteria. They will need to notify the FCA when using a label and display a graphic prescribed by the FCA along with details on how to access consumer-facing disclosures. While the FCA is capable of reviewing and challenging the use of a label, it will not make a formal approval or endorsement of the label. In practice, firms will need to grapple with what to do when the sustainability objective for a particular labelled product has been achieved (for example, when underlying assets have been “improved” or the relevant impact has been realised). The question of whether these products should be relabelled to avoid misleading potential investors (and, if so, how) remains.

With firms responsible for selecting, verifying and reviewing use of a label, it will be interesting to see how the FCA approaches enforcement over the coming years. Leeway may need to be given in certain circumstances which have not been considered in the Policy Statement – for example, in “ramp down” situations where a fund is winding down and falls below the 70% investment requirement.

Naming and marketing rules

A key criticism of the initial proposals in the Consultation Paper was the blanket prohibition on the use of sustainability-related terms in naming and marketing of non-labelled products to retail consumers. Sustainability-related terms are defined as any words or phrases that imply or suggest a fund has a sustainability strategy or sustainability features, such as “green”, “ESG” and “low carbon”.

Stakeholders were concerned that the proposals could potentially hinder consumers’ ability to differentiate between non-labelled products, discourage firms from adopting sustainable investment approaches and/or cause a disconnect between retail and institutional investors and UK and EU investors.

The FCA has re-worked the rule such that non-labelled products will still be allowed to use sustainability-related terms in their names and marketing materials, subject to restrictions:

- The product must have sustainability characteristics and at least 70% of the product’s portfolio should be aligned with those characteristics.

- The product’s name must accurately reflect its sustainability characteristics, but the terms “sustainable”, “sustainability”, “impact” and any variation of those terms must not be used.

- Firms must produce the same disclosures as required for a labelled product, and a statement that the product does not use a label and the reasons why.

- In the case of feeder funds, the product can only use terms in its name that are consistent with those used in the master fund.

The amended requirement aims to strike the balance necessary to deter greenwashing while also ensuring consumers have sufficient information to navigate both labelled and non-labelled products and make informed investment decisions.

There remains a question mark around how the rules might affect products offered directly only to institutional investors. While the naming and marketing requirements apply only to products “made available” to retail consumers, it is not entirely clear how narrowly this will be construed. As is the case with the FCA’s Consumer Duty, firms marketing products to institutional investors may be required to implement safeguards to ensure their products are not reaching retail consumers, whether directly or indirectly, to avoid having to comply with the rules. Some firms might also consider using the naming and marketing rules as guidance to help ensure compliance with the anti-greenwashing rule.

Disclosures

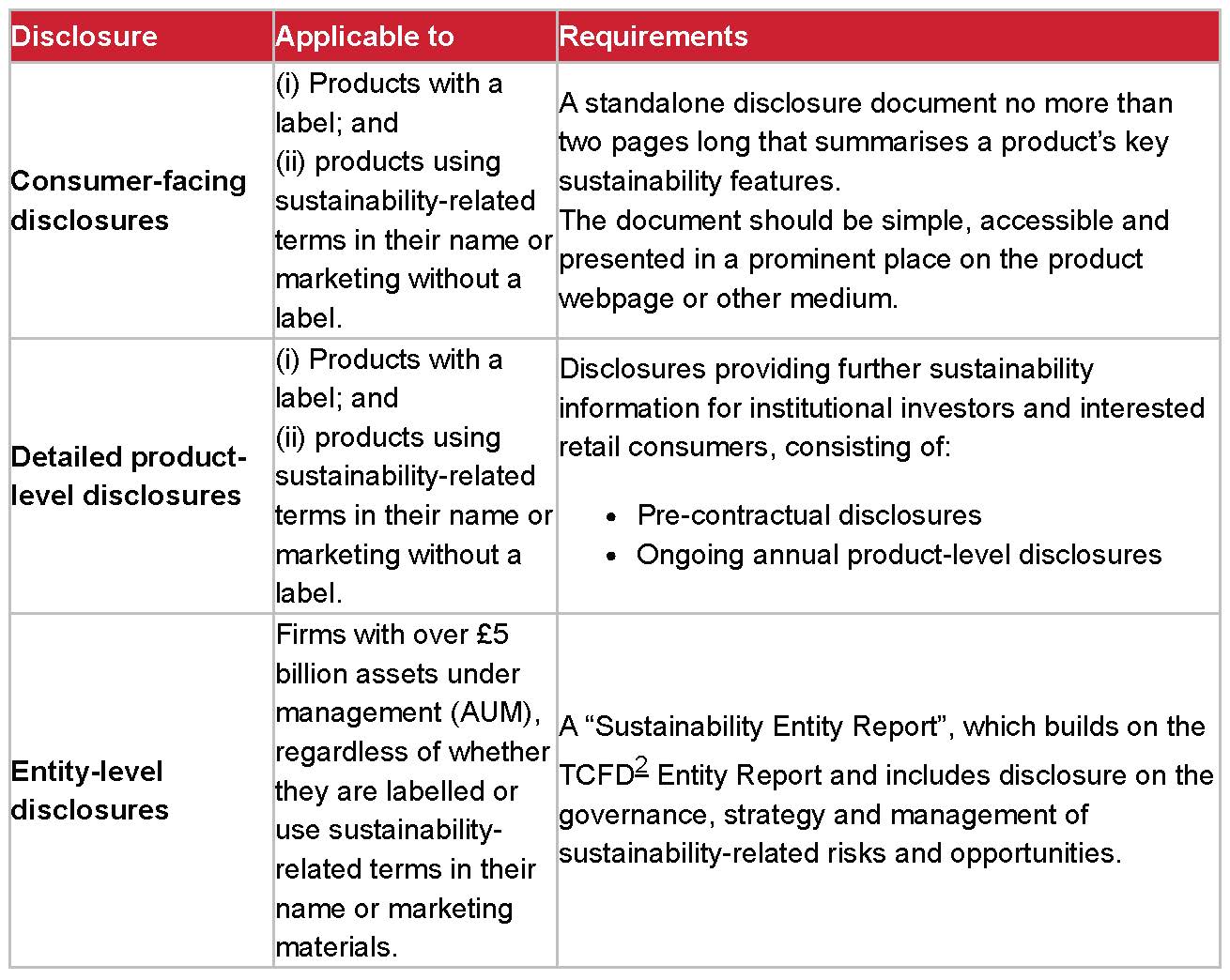

The FCA is implementing a three-tiered system of sustainability information disclosures for UK asset managers and their funds:

The FCA has not prescribed templates for disclosures at this stage, allowing for some flexibility, which could prove helpful for firms seeking to utilise existing data and disclosure materials used for other regimes, such as the SFDR (which does prescribe disclosure templates). The FCA does, however, prescribe certain content to be included in disclosures, with which firms will need to become familiar. For example, labelled firms will need to disclose details of assets held that do not form part of the sustainability objective. The FCA acknowledges that the market may find it helpful to come up with disclosure templates to promote standardisation in the way information is presented to potential investors. It is to be hoped that such templates emerge and are widely adopted.

Distributors

A distributor is defined in the SDR as “a firm which offers, sells, recommends, advises on, arranges, deals, proposes or provides a sustainability product”. Firms will be required to undertake a scoping exercise to determine whether they fall within this category and should familiarise themselves with the applicable requirements under the regime.

UK distributors of labelled products or products in scope of the naming and marketing requirements will be required to ensure that labels and up-to-date consumer-facing disclosures are communicated clearly and promptly to retail consumers. When distributing overseas products that are not subject to the UK SDR and investment label requirements, UK distributors will need to provide consumers with a notice to this effect.

Interoperability

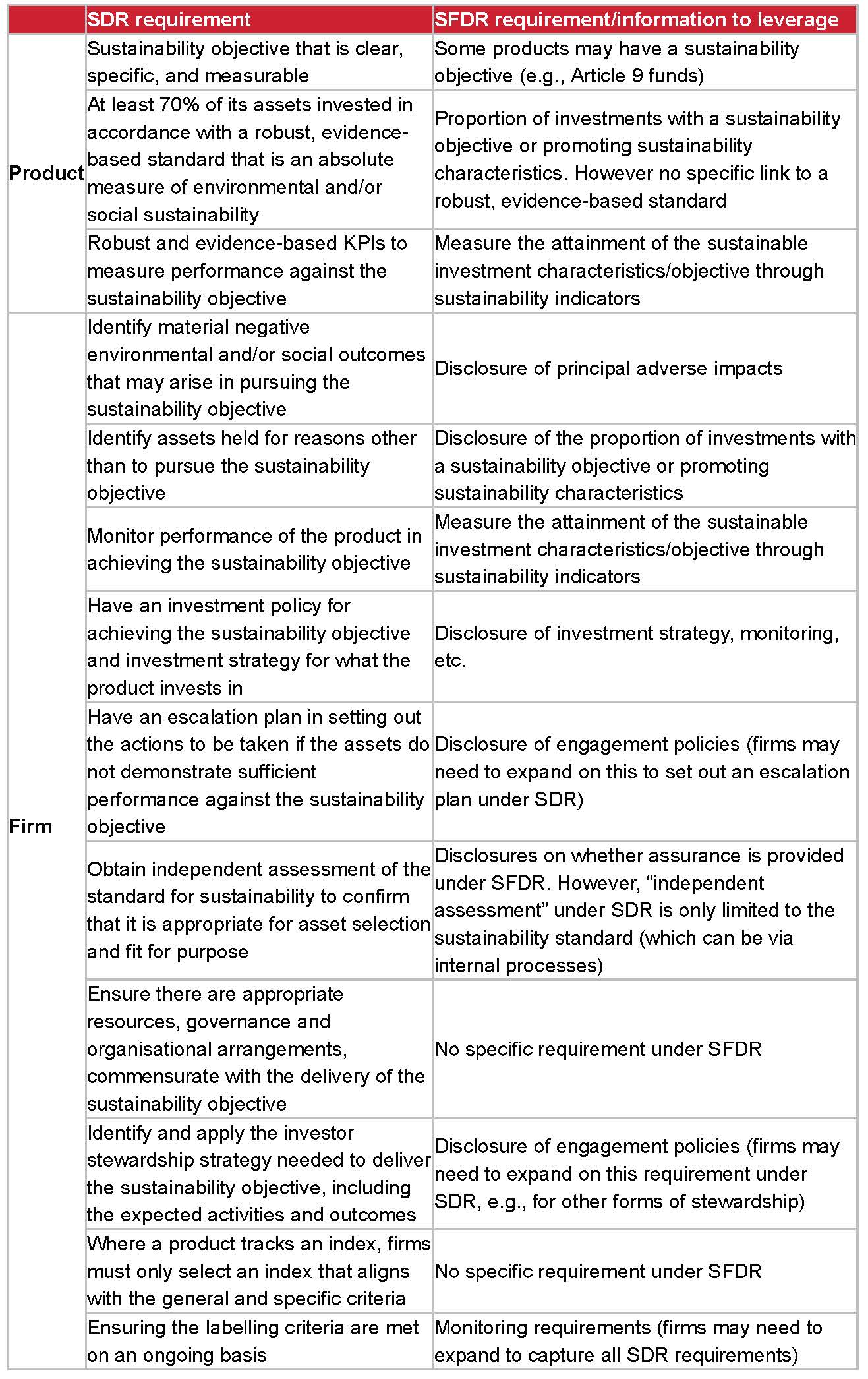

The FCA has emphasised that ensuring compatibility with international frameworks and standards, most notably the EU SFDR, was a priority when developing the new SDR and investment labels regime. The Policy Statement contains a table mapping the SDR requirements onto the SFDR (see “Annex 2: FCA table mapping SDR onto SFDR” below).

The table suggests that the UK and EU regimes are broadly comparable and compatible. For example, both regimes require firms to identify and disclose any potentially negative outcomes of investments and methods used to measure progress towards objectives. The FCA has also built on areas that are arguably lacking in other regimes, for example by providing a more clear and workable system for recognising transitional investments through the “Sustainability Improvers” label.

There are, however, areas of divergence which are likely to cause some issues. The approach taken to product classification in the SDR is significantly more granular while the SFDR remains, as the European authorities have frequently had cause to re-emphasise, a disclosure regime at its heart. The majority of funds’ labelling and disclosure will not automatically translate from one regime onto the other. For example, while all SDR-labelled products must have a sustainability objective, only “Article 9” products are required to have one under the SFDR. This leaves open the possibility that many products disclosed as “Article 8” under the SFDR will not qualify for a label at all under the SDR. Firms will have to take careful steps when navigating the two regimes and familiarise themselves with the different approach for classifying products under the UK SDR.

Since there is a great deal of evidence that the SFDR disclosure regime is in fact being treated by investors as a labelling regime, it is worth noting that the European Commission is proposing a new categorisation system for financial products (See Consultation on the Implementation of the SFDR). The proposed product categories A-D appear to be more closely aligned to the UK’s approach in the SDR than the current regime. It will be interesting to see how the UK and EU coordinate over the coming months; market participants will no doubt welcome the greatest possible degree of harmonisation.

The UK SDR’s interaction with the SFDR, other international regimes and frameworks such as the planned UK Green Taxonomy will be fundamental in shaping the future of the market for sustainable investment. It will have an impact not only on product classification but also on product design itself, as well as risk management, cross-border marketing and other operational considerations.

Overall, the FCA’s measures appear to have taken into careful consideration the views of asset managers, owners and other financial services stakeholders, and are an encouraging sign for the development of the sustainable investment market in the UK.

Next steps for firms

Firms should take steps to prepare for the implementation of the SDR and labelling regime, including by:

- Reviewing policies and procedures in place for greenwashing risk-management as a priority, given the tight deadline for preparing for the anti-greenwashing rule.

- Identifying in-scope entities and products and preparing a framework for completing consumer-facing, entity-level and ongoing sustainability disclosure reports.

- Assessing products against general and specific labelling criteria to determine the extent of alignment and identify any necessary product changes.

- Ensuring that, once in place, labels are reviewed regularly (at least annually) and the qualifying criteria are met on an ongoing basis.

- Implementing appropriate strategies, governance and resources for selecting assets in line with the sustainability objective of the product and undertaking thorough independent assessment of the robust, evidence-based standard for sustainability to confirm that it is appropriate for selecting the product’s assets.

- When developing a sustainability strategy, taking into consideration other FCA requirements such as the Consumer Duty, and interaction with other frameworks such as the planned UK Green Taxonomy.

In addition, distributors should, where relevant, prepare to add a notice on overseas funds to inform consumers that they are not subject to the regime.

Annex 1: Implementation timeline

Annex 2: FCA table mapping SDR onto SFDR

- A robust (i.e., stands up to scrutiny), evidence-based standard (i.e., derived from or informed by an objective and relevant body of data or other evidence) that is an absolute measure of environmental and/or social sustainability. The standard may be based on general environmental and/or social criteria such as the percentage of revenue associated with sustainability matters, make reference to an authoritative taxonomy such as the EU taxonomy or forthcoming UK Green Taxonomy or set a minimum threshold of greenhouse gas (GHG)emissions for assets.

- Taskforce on Climate-Related Financial Disclosures.

In-depth 2024-017

Authors