Autoren: Joseph M. Motto

These revisions will have a dramatic impact on the NFA’s regulated members because its jurisdiction will be more aligned with the jurisdiction over swaps given to the CFTC by the Dodd Frank Act of 2010.2 This means that the NFA could regulate, investigate, and enforce its requirements applicable to swaps similarly to the NFA’s traditional authorities applicable to futures. Preparing for compliance with these revisions, NFA-regulated entities will need to review their trading practices, assess the adequacy of their compliance programs, revise their compliance manuals, train their personnel, and become prepared for future NFA audits in connection with their swap activities.

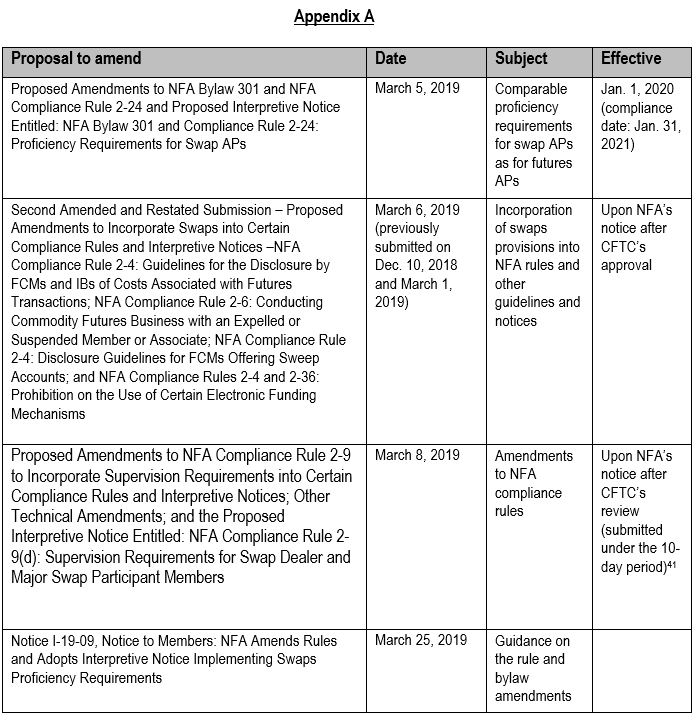

This Reed Smith client alert summarizes the amendments relating to swaps and reminds NFA members, regardless of whether they are located in the United States or overseas, of their recurring compliance obligations, including compliance with respect to transactions in crypto-assets. For a summary of the NFA’s amendments relating to swaps, please see Appendix A of this client briefing.

(1) Proficiency requirements for swap associated persons

The NFA has traditionally required that APs of registered or required-to-be-registered NFA members engaged in futures activities take and pass appropriate exams to demonstrate their proficiency (similar requirements apply to members of the Financial Industry Regulatory Authority (FINRA)).3,4 APs of SDs and MSPs and APs of other NFA registrants that only engaged in swaps business (i.e., “swap firms” or entities that did not engage in futures business) have not had to take any exams.5

On March 5, 2019, the NFA proposed amendments to NFA Bylaw 301 and NFA Compliance Rule 2-24 and proposed a new interpretive notice entitled “NFA Bylaw 301 and Compliance Rule 2-24: Proficiency Requirements for Swap APs.”6 The amendments became effective 10 days after receipt by the CFTC, and the new requirements adopted under the amendments are effective as of January 31, 2020.7

NFA Bylaw 301(l) and Compliance Rule 2-24

NFA Bylaw 301(l) governs NFA members’ and APs’ eligibility to conduct swap activities. Bylaws 301(l)(i) and (ii) require NFA members that are registered as futures commission merchants (FCMs), introducing brokers (IBs), commodity pool operators (CPOs), or commodity trading advisors (CTAs), and APs, to be approved as swap firms and swap APs, respectively. The amendment to Bylaw 301 states that any individual applying for approval as an FCM, IB, CPO, or CTA member swap firm, or swap AP of such member, shall not be granted approval unless the NFA receives satisfactory evidence that the applicant has passed the NFA’s swaps proficiency requirements.8

The swaps proficiency requirements must be passed within (2) two years of the NFA’s receipt of the application or there must have been no period of (2) two consecutive years since the date that the applicant took and passed the requirements during which the applicant was not approved as a swap AP of an FCM, IB, CPO, or CTA, approved as a swap firm that is a NFA member, or employed by a SD that is a NFA member or its affiliated entity.9

The NFA also amended Compliance Rule 2-24 to prohibit FCMs, IBs, CPOs, or CTAs that are NFA members to have associated with it any person engaging in swaps activity who has not satisfied the swaps proficiency requirements.10 SDs or MSPs are also prohibited from having associated with any person who is an “associated person” as defined under CFTC Regulation 1.3 who has not satisfied the requirements.11

The interpretive notice clarifies that the amendments arise from the NFA’s obligations under Section 17(p) of the Commodity Exchange Act (CEA).12 The CEA requires the NFA “to establish training standards and proficiency testing for persons involved in the solicitation of transactions subject to the provisions of [the CEA, and] supervisors of such persons.” The NFA’s board of directors determined that APs engaging in swaps activities at FCMs, IBs, CPOs, and CTAs, as well as individuals acting as APs at SDs and MSPs, should be required to meet a minimum proficiency standard that tests both their market knowledge and their knowledge of regulatory requirements involving swaps activities.13

Long track and short track

The NFA will administer the swaps proficiency requirements via the Internet through several individual modules covering specific topic areas. Each module will contain both a training and a testing component.

Due to the differences in the types of swaps activity performed by an individual who works for a SD and an individual who works for an intermediary, the NFA developed two proficiency tracks for the swaps proficiency requirements – a long track and a short track.14 The two tracks apply as follows:

- SDs must ensure that individuals designated as APs in sales and trading areas who negotiate, price, or execute swaps with counterparties or manage the SD’s swaps-related risks (and those responsible for supervising such APs) satisfy the long track. An SD who has designated APs who perform functions other than those described in the preceding sentence has the option of permitting such APs (and those responsible for supervising such APs) to satisfy either the long or short track.

- Intermediary swap APs (and those responsible for supervising such APs) are required to satisfy the short track.

A content outline covering the topics included in the swaps proficiency requirements is available on the NFA’s website at nfa.futures.org Additional information regarding the two tracks is also available on the NFA’s website.

Obligations of SDs

The interpretive notice discusses that APs at SDs are not required to register with the CFTC and are not NFA members. SDs are responsible for ensuring that any individual acting as an AP as defined in subsection 6 of the AP definition under CFTC Regulation 1.3 has satisfied the NFA’s swaps proficiency requirements prior to engaging in the defined activities on behalf of the SD.15 For individuals who satisfied the requirements prior to joining the SD, the SD will meet its obligation if it ensures:

- The individual satisfied the track required by the functions of the AP within the prior two years; or

- The individual satisfied the track required by the functions of the AP and, since the date of doing so, there has been no period of two consecutive years during which the individual has not been employed by an SD (or its affiliated entity) that is a NFA member, approved as a swap AP of an FCM, IB, CPO, or CTA, or approved as a swap firm that is a NFA member.

SDs must maintain records that show that the individuals have satisfied the swaps proficiency requirements and be able to provide those records to the NFA during an examination or otherwise upon request. Examples of adequate documentation include logs identifying individuals and dates of completion or copies of the certificate of completion that an individual receives upon successfully completing the requirements.

Individuals acting as APs at SDs located outside the United States (including non-U.S. branch offices of a U.S. SD) who solely solicit or accept swaps with counterparties that are non-U.S. persons or non-U.S. branch offices of U.S. SDs are excluded from the swaps proficiency requirements.

Compliance date

The compliance date to complete the swaps proficiency requirements is January 31, 2021; however, the NFA will publish its proficiency exam requirements and make the test available in January 2020 allowing for a one-year compliance period for affected APs. Individuals who are approved as swap APs at an FCM, IB, CPO, or CTA member firm or are acting as APs at SDs on the compliance date are required to satisfy the applicable swaps proficiency requirements by the compliance date in order to remain approved as a swap AP or continue acting as an AP at a SD after the compliance date. There is no grandfathering provision. Any individual seeking approval as a swap AP at an FCM, IB, CPO, CTA or SD after January 31, 2021, must satisfy the requirements prior to being approved as a swap AP and engaging in swaps activities.

(2) Incorporation of swaps into certain compliance rules

On March 6, 2019, the NFA requested that the CFTC review and approve proposed amendments to Compliance Rules 1-1, 2-2, 2-3, 2-6, 2-10, 2-38, and 3-15 to fully incorporate swaps into these rules.16 The amendments will be effective upon the NFA’s notice after the CFTC’s review and approval thereof.

The proposed amendment to NFA Compliance Rule 1-1 redefines the term “commodity interest” as “futures, forex and/or swaps.”17 The proposed amendment to Compliance Rule 2-2 (regarding fraud and related matters) extends the scope of the rule from commodity futures as products, customers as affected entities, and contract markets as the platforms upon which these transactions are executed, to include swap products, counterparties, and swap execution facilities, respectively.18

The NFA also modified its prohibition on activities with expelled or suspended members or associates under NFA Compliance Rule 2-6. The proposed amendment bars an FCM, IB, CPO, CTA, FDM, or associate from permitting expelled or suspended members to “maintain any affiliation with it or perform any activities for, on behalf of or in connection with its commodity interest business regardless of whether such affiliation or activities require registration or NFA Membership during the period the sanction is in effect unless authorized by the Business Conduct Committee, Hearing Committee or the Appeals Committee.”19

The proposed amendments to NFA Compliance Rules 2-10 and 2-38 extend certain record keeping, business continuity, and disaster recover requirements to CPO, CTA, FCM, foreign exchange dealer member (FDM), IB, MSP, and SD members. All such specifically listed members must adhere to the recordkeeping requirements in Compliance Rule 2-10(d).20 Under the proposed amendment to NFA Compliance Rule 2-38(a), each FCM, IB, CPO, CTA, and FDM must establish and maintain a written business continuity and disaster recovery plan that outlines procedures for an emergency or significant business disruption.21 The plan must be reasonably designed to allow the member to continue operating, reestablish operations, or transfer its business to another member with minimal disruption to customers, other members, and the commodity futures markets.

Under the proposed amendment to NFA Compliance Rule 2-38(b), each FCM, SD, and MSP member and each FDM must provide the NFA with, and keep current, the name and contact information for all key management employees, as identified by the NFA, in the form and manner prescribed by NFA.22 Each FCM, SD, and MSP member and each FDM must provide the NFA with the location, address, and telephone number of its primary and alternative disaster recovery sites.

The NFA also proposed conforming amendments to the following four interpretive notices:

(1) NFA Compliance Rule 2-4: Guidelines for the Disclosure by FCMs and IBs of Costs Associated with Futures Transactions,

(2) NFA Compliance Rule 2-6: Conducting Commodity Futures Business with an Expelled or Suspended Member or Associate,

(3) NFA Compliance Rule 2-4: Disclosure Guidelines for FCMs Offering Sweep Accounts, and

(4) NFA Compliance Rules 2-4 and 2-36: Prohibition on the Use of Certain Electronic Funding Mechanisms.

The proposed amendments include cleared swap transactions in the guidelines for the disclosure by FCMs and IBs of costs associated with futures transactions.23 They also prohibit FCM, IB, CPO, CTA members, FDMs, and associates from maintaining an affiliation with or permitting any suspended person (or person subjected to a similar sanction that temporarily prohibits the person from being an NFA member or associate) to perform any activities for, on behalf of, or in connection with its commodity interest business.24 The amendments revise the disclosure guidelines for FCMs offering sweep accounts by including “cleared swaps customer accounts” and “cleared swaps business.”25 Finally, the amendments revise the NFA’s interpretive notice on the prohibition on the use of certain electronic funding mechanisms by requiring members and associates to observe high standards of commercial honor and just and equitable principles of trade in the conduct of their commodity futures business and swaps business.26

(3) Extension of supervision requirements to SD and MSP members

On March 8, 2019, the NFA proposed amendments to NFA Compliance Rule 2-9 and several interpretive notices thereunder and proposed a new interpretive notice entitled “NFA Compliance Rule 2-9(d): Supervision Requirements for Swap Dealer and Major Swap Participant Members.”27 The amendments will be effective upon the NFA’s notice after the CFTC’s review and approval thereof.

The proposed amendments extend NFA Compliance Rule 2-9(a) to the commodity interest activities of FCM, IB, CPO, and CTA members, thereby covering the swaps activities of those member categories.28 The amendments also propose new NFA Compliance Rule 2-9(d), which requires SD and MSP members to diligently supervise the swaps activities of their employees and agents.29

The NFA also clarified the applicability of several interpretive notices issued pursuant to NFA Compliance Rule 2-9.30 The NFA also proposed a new interpretive notice entitled “NFA Compliance Rule 2-9(d): Supervision Requirements for Swap Dealer and Major Swap Participant Members,” which clarifies that the NFA retains examination and enforcement authority over SD and MSP members relying on substituted compliance, and that under the appropriate facts and circumstances, the NFA may find that a SD or MSP member relying on substituted compliance has violated the NFA’s supervision requirement under NFA Compliance Rule 2-9.31

The NFA did not add references to swaps and did not revise at this time the language in its Bylaw 1101, which applies only to “transaction[s] in commodity futures contracts.” Generally, Bylaw 1101 prohibits NFA members from transacting in commodity futures with other entities that should have registered with the NFA or are in violation of the NFA’s rules. The NFA will probably consider this revision in the future given potential inadvertent application to swap transactions by SDs and MSPs with their arm’s-length swaps counterparties in the over-the-counter markets and their inability to definitively ascertain their counterparties’ compliance status with NFA and CFTC rules and regulations (e.g., a representation in the International Swaps and Derivative Association agreement may not be sufficient).

The NFA did not add references to swaps and did not revise at this time the language in its Bylaw 1101, which applies only to “transaction[s] in commodity futures contracts.” Generally, Bylaw 1101 prohibits NFA members from transacting in commodity futures with other entities that should have registered with the NFA or are in violation of the NFA’s rules. The NFA will probably consider this revision in the future given potential inadvertent application to swap transactions by SDs and MSPs with their arm’s-length swaps counterparties in the over-the-counter markets and their inability to definitively ascertain their counterparties’ compliance status with NFA and CFTC rules and regulations (e.g., a representation in the International Swaps and Derivative Association agreement may not be sufficient).

(4) Recurring NFA compliance obligations

In addition to the recent amendments to the NFA’s compliance rules, bylaws, and interpretive notices, members should take this opportunity to be reminded of their recurring NFA compliance obligations, including completion of the annual questionnaire, the annual exemption or exclusion affirmation process, and other periodic reporting and disclosure requirements, as may be applicable.

Annual questionnaire

NFA members must complete an annual update process within 30 days of the anniversary of their NFA membership date. The process includes completing an annual questionnaire using the NFA’s annual questionnaire system and paying membership dues. If the annual update process is not completed within 30 days of the anniversary of the member’s membership date, the NFA will treat such failure as a request to withdraw the firm from NFA membership and/or CFTC registration. On an ongoing basis, NFA members should update their annual questionnaire in the event of a material change to business operations.

NFA members should review their business operations using the NFA’s self-examination questionnaire as part of the annual update process. The self-examination questionnaire is designed to help members recognize potential problem areas and alert them to procedures that need to be revised or strengthened.

Annual affirmation of exemptions or exclusions from CPO/CTA registration

Certain persons or entities claiming exemptions or exclusions from registration as CPOs or CTAs must annually affirm such exemptions and exclusions on the NFA’s exemption system. The CEA requires CPOs and CTAs to register with the CFTC and the NFA, unless an exemption or exclusion from registration applies. CFTC regulations also require a person or entity claiming an exemption or exclusion from CPO or CTA registration under CFTC regulations 4.5, 4.13(a)(1), 4.13(a)(2), 4.13(a)(3), 4.13(a)(5), or 4.14(a)(8) to file an annual affirmation of such exemption or exclusion with the NFA. The annual affirmation must be completed within 60 calendar days following the calendar year end (i.e., within 60 calendar days after December 31).

A failure to affirm an active exemption or exclusion from CPO or CTA registration by the deadline will result in the automatic withdrawal of such exemption or exclusion. For registered CPOs and CTAs, withdrawal of an active exemption or exclusion due to the failure to reaffirm in time will subject such CPOs or CTAs to CFTC Part 4 requirements, even if the CPO or CTA otherwise remains eligible for the exemption or exclusion.32 For non-registrants, withdrawal of an active exemption or exclusion may subject the person or entity to a CFTC or NFA enforcement action for non-compliance (i.e., for the failure to register in the absence of a valid exemption or an exclusion from registration).

Reed Smith has discussed the procedure for completing the annual affirmation process in detail in a previous client alert.

Other periodic reporting and disclosure requirements

NFA members may have additional periodic reporting and disclosure requirements depending on their registration type, including requirements related to disclosure documents, pool quarterly reports, and annual pool financial statements. For example:

- CPOs and CTAs must provide a disclosure document to each prospective client.33 These disclosure documents must be filed with the NFA through the electronic disclosure document filing system for review and acceptance prior to use. CPOs and CTAs should keep their disclosure documents current.34

- NFA members must keep Form 7-R current. Form 7-R includes such information as the member’s address, contacts, and listed principals. Form 7-R can be accessed through the NFA’s online registration system.

- On a quarterly basis, CPOs must report specific information about the firm and the pools that it operates to the NFA using EasyFile.35 The pool quarterly report is due within 60 days of quarters ending March 31, June 30, and September 30 and within 90 days of the quarter ending December 31.

- CPOs must distribute annual pool financial statements, or annual reports, to pool participants within 90 days of the pool’s fiscal year end.36 CPOs are also required to file the annual report electronically using EasyFile.

NFA members are best advised to utilize the services of regulatory compliance firms to help prepare, monitor, and review these – and similar – periodic reporting and disclosure requirements, as may be applicable to such members.

Compliance for Transactions with Cryptocurrencies

In August 2018, the NFA published a notice to members (CPOs, CTAs, IBs, and FCMs) reminding them that new disclosure and compliance requirements37 applicable to spot and derivative transactions with crypto-assets become effective on October 31, 2018.38 The NFA stated that adoption of the enhanced disclosure requirements was necessary “because of concerns that customers may not fully understand the nature of virtual currencies and virtual currency derivatives, the substantial risk of loss that may arise from trading these products and the limitations of NFA's regulatory authority over spot market virtual currencies.”39 Accordingly, after October 31, 2018, all NFA members transacting with crypto-assets either on spot or as swaps, futures or options, must comply with the additional notice and disclosure requirements.

- As its first step in 2013, the NFA adopted Rule 2-49 establishing that CFTC Regulation § 3.3 (chief compliance officer) and CFTC Part 23 are incorporated into the NFA’s rules and therefore SDs and MSPs violating these rules will be deemed to be violating NFA rules and regulations. Further, in 2015 the NFA amended Rule 2-4 to include swaps and to require that its members and APs “observe high standards of commercial honor and just and equitable principles of trade in the conduct of their commodity futures business and swap business.”

- The Dodd–Frank Wall Street Reform and Consumer Protection Act, Pub. L. 111–203, H.R. 4173 (July 21, 2010). These revisions are part of the continuing regulatory process and more changes to assert the NFA’s jurisdiction over swap business are likely to come in the future.

- The following entities are required to register (unless exempted or excluded) with the NFA and become members: SDs, MSPs, introducing brokers (IBs), commodity trading advisors (CTAs), commodity pool operators (CPOs), futures commission merchants (FCMs), retail foreign exchange dealers, and leverage transaction merchants. The following individuals are also required to register with the NFA: APs, floor brokers and floor traders, and principals.

- NFA Rule 401 requires qualification testing for various individuals associated with NFA members. Briefly, the tests are Series 3 (for all APs except of swaps-only firms), Series 31 (for FINRA members), Series 32 (for UK and Canada futures representatives), Series 30 (NFA branch managers) and Series 34 (retail off-exchange foreign exchange representatives).

- Note that a “swap firm” is not a registered category and is distinct from the categories of swap dealers and major swap participants. A “swap firm” is any other NFA member that exclusively, or in conjunction with its futures activities, is engaged in swap transactions. Thus, if an entity engages in transactions involving swaps, e.g., EFS or EFRP on an exchange, this activity will not necessarily case the entity to become a “swap firm” and its employees APs unless it also acts in any of the registered capacities, such as CPOs, CTA, IB, FCM or an SD or MSP.

- NFA, Proposed Amendments to NFA Bylaw 301 and NFA Compliance Rule 2-24 and Proposed Interpretive Notice Entitled “NFA Bylaw 301 and Compliance Rule 2-24: Proficiency Requirements for Swap APs” (March 5, 2019).

- NFA, Notice I-19-09, Notice to Members: NFA Amends Rules and Adopts Interpretive Notice Implementing Swaps Proficiency Requirements (March 25, 2019).

- NFA Bylaw 301(l)(vi).

- Note that if the AP had already taken a futures-related exam, e.g., Series 3, this futures proficiency qualification does not exempt the AP from also being required to take the swaps proficiency examination if required. Just like with respect to Series 3 qualification, swaps proficiency qualification is a one-time qualification and it is not necessary to requalify every year.

- NFA Compliance Rule 2-24(a)(2).

- NFA Compliance Rule 2-24(a)(3).

- Commodity Exchange Act (CEA), § 17(p), 7 U.S.C. § 21(p).

- Interpretive Notice, NFA Bylaw 301 and Compliance Rule 2-24: Proficiency Requirements for Swap APs.

- The long track consists of eight modules (swaps products and applications, regulation of the swaps market, onboarding, transactional disclosures, swap dealer anti-fraud and ethical practices, trade execution/clearing/margin, risk management, and supervision) and takes approximately eight hours to complete. The short track consists of four modules (swaps products and applications, regulation of the swaps market, supervision and intermediary compliance, and anti-fraud and other requirements) and takes approximately four hours to complete.

- 17 CFR § 1.3(6).

- NFA, Second Amended Submission, Proposed Amendments to Incorporate Swaps into Certain Compliance Rules and Interpretive Notices – NFA Compliance Rule 2-4: Guidelines for the Disclosure by FCMs and IBs of Costs Associated with Futures Transactions; NFA Compliance Rule 2-6: Conducting Commodity Futures Business with an Expelled or Suspended Member or Associate; NFA Compliance Rule 2-4: Disclosure Guidelines for FCMs Offering Sweep Accounts; and NFA Compliance Rules 2-4 and 2-36: Prohibition on the Use of Certain Electronic Funding Mechanisms (March 6, 2019). The NFA initially submitted the proposed amendments to the CFTC on December 10, 2018. The NFA resubmitted the proposed amendments to the CFTC on March 1 and March 6, 2019, to withdraw a proposed amendment to NFA Compliance Rule 3-1.

- Proposed NFA Compliance Rule 1-1.

- Proposed NFA Compliance Rule 2-2.

- Proposed NFA Compliance Rule 2-6.

- Proposed NFA Compliance Rule 2-10(d). Note that SDs and MSPs are already required to comply with the recordkeeping requirements relating to swaps through the application of NFA Rule 2-49.

- Proposed NFA Compliance Rule 2-38(a). Note that business continuity requirements as they apply to SDs and MSPs are already incorporated into NFA rules through the application of NFA Rule 2-49.

- Proposed NFA Compliance Rule 2-38(b).

- See proposed amendments to Interpretive Notice 9005 – NFA Compliance Rule 2-4: Guidelines for the Disclosure by FCMs and IBs of Costs Associated with Futures Transactions.

- The interpretive notice, in its current form, applies only to “commodity futures” transactions. See proposed amendments to Interpretive Notice 9056 – NFA Compliance Rule 2-6: Conducting Commodity Futures Business with an Expelled or Suspended Member or Associate.

- See proposed amendments to Interpretive Notice 9059 – NFA Compliance Rule 2-4: Disclosure Guidelines for FCMs Offering Sweep Accounts.

- See proposed amendments to Interpretive Notice 9068 – NFA Compliance Rules 2-4 and 2-36: Prohibition on the Use of Certain Electronic Funding Mechanisms.

- NFA, Proposed Amendments to NFA Compliance Rule 2-9 to Incorporate Supervision Requirements into Certain Compliance Rules and Interpretive Notices; Other Technical Amendments; and the Proposed Interpretive Notice Entitled NFA Compliance Rule 2-9(d): Supervision Requirements for Swap Dealer and Major Swap Participant Members.

- Proposed NFA Compliance Rule 2-9(a).

- Proposed NFA Compliance Rule 2-9(d).

- The NFA proposed amendments to: (1) Interpretive Notice 9010 – Information Available from NFA Regarding Background of Prospective Employees, to separately address the obligations of FCMs, FDMs, IBs, CPOs, and CTAs and the obligations of SDs and MSPs; (2) Interpretive Notice 9020 – Compliance Rules 2-9, 2-36 and 2-39: Self-Audit Questionnaires, to specify that it applies to FCMs, FDMs, IBs, CPOs, and CTAs; (3) Interpretive Notice 9021 – Compliance Rule 2-9: Enhanced Supervisory Requirements, to specify that it applies to FCMs, FDMs, IBs, CPOs, and CTAs; (4) Interpretive Notice 9051 – NFA Compliance Rule 2-9: Ethics Training Requirements, to clarify that members may tailor their ethics training programs to the specific obligations of their membership category and the roles of their personnel; and (5) Interpretive Notice 9070 – NFA Compliance Rules 2-9, 2-36 and 2-49: Information Systems Security Programs, to incorporate a reference to Compliance Rule 2-9(d) and to specify that the supervision obligations for FCMs, IBs, CPOs, and CTAs apply to all commodity interests. See also NFA Notice I-19-11, Reminder: Filing requirements for swap valuation dispute notices under NFA Compliance Rule 2-49 apply to all swap dealer Members (March 28, 2019), available at nfa.futures.org.

- See proposed Interpretive Notice – NFA Compliance Rule 2-9(d): Supervision Requirements for Swap Dealer and Major Swap Participant Members.

- Part 4 requirements are the rules and regulations set forth in Title 17, Chapter I, Part 4 of the U.S. Code of Federal Regulations applicable to CPOs and CTAs. See 17 C.F.R. sections 4.1–4.41.

- See 17 CFR § 4.21 (CPOs); 17 CFR § 4.31 (CTAs).

- See 17 CFR § 4.26 (CPOs); 17 CFR § 4.36 (CTAs).

- See 17 CFR § 4.27; NFA Compliance Rule 2-46.

- See 17 CFR § 4.22.

- See NFA Interpretive Notice, 9073 - DISCLOSURE REQUIREMENTS FOR NFA MEMBERS ENGAGING IN VIRTUAL CURRENCY ACTIVITIES, (May 17, 2018), available at nfa.futures.org.

- See NFA Notice I-18-13, Effective date of Interpretive Notice establishing disclosure requirements for NFA Members engaging in virtual currency activities, (Aug. 9, 2018), available at nfa.futures.org.

- See id.

- This rule was submitted under the CFTC’s 10-day review period (see CEA § 17(j)), which means that unless the CFTC affirmatively objects, the rule amendment will become effective within 10 days after the submission

Client Briefing 2019-088