The major enforcement trends and themes reflected in the SFC’s Q4 2021 Quarterly Report are summarised in the tables and sections below (the full report can be found at sfc.hk (PDF download), and our previous article on the SFC’s Q2 2021 Quarterly Report can be found at reedsmith.com):

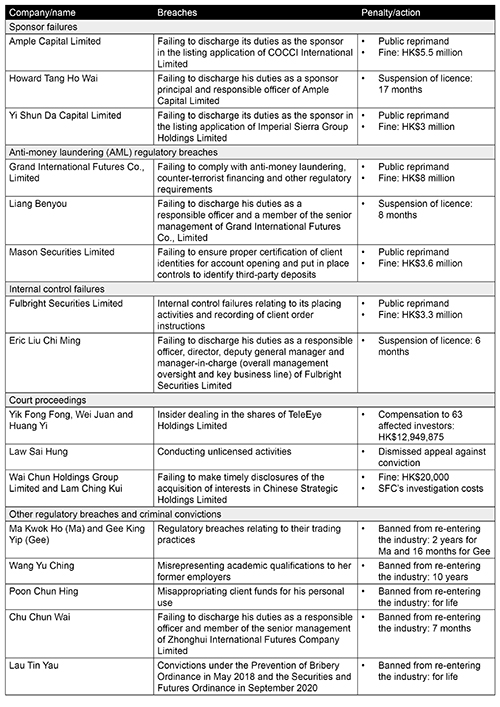

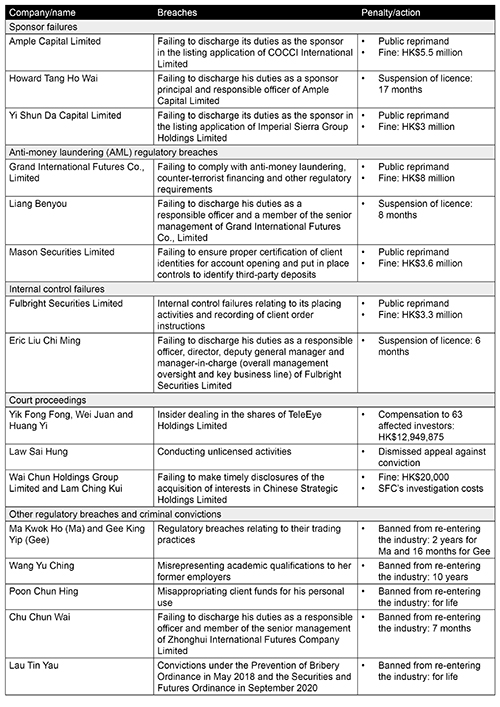

Highlights of the recent enforcement actions

The above case highlights show that:

- Sponsor failures, AML breaches and internal control failures remain high priority areas where the SFC will continue to investigate and impose disciplinary action as appropriate. With respect to sponsor failures, it is noteworthy that the SFC is still committed to initiating disciplinary action and imposing sanctions despite the fact that the listing applications in question had lapsed and no harm was caused to members of the investing public. Through this, the SFC intends to send a strong signal to the public that it will not tolerate any substandard due diligence work of sponsors which could facilitate the listing of companies that are not suitable for listing.

- In addition to taking disciplinary action against the licensed intermediary, the SFC continues to emphasise the accountability of senior management by taking active steps to impose sanctions on responsible officers and senior managers who have oversight of the relevant lines of business.

- Where bans from the industry are imposed on licensed individuals, the duration of the ban will depend on the type of misconduct, among other things. Where an element of dishonesty is involved, the duration of the ban will typically be a lot longer, if not indefinite.

Key trends in relation to the SFC’s recent enforcement activities

The SFC continues to be highly active in its enforcement activities, and we have observed the following trends (compared to this time last year) in the number of:

- Enquiries raised (substantial increases of 55.2 per cent in requests for production of documents and records through section 179 inquiries, and 23.6 per cent in requests for documents and written answers through section 182 directions).

- Investigations started (from 151 to 178 – an increase of 17.9 per cent).

- Criminal charges laid (from 12 to 28 – an increase of 133.3 per cent).

- Notices of Proposed Disciplinary Action issued (from 18 to 32 – an increase of 77.8 per cent).

- Notices of Decision issued (from 26 to 33 – an increase of 26.9 per cent).

- Search warrants executed (from 14 to 36 – an increase of 157.1 per cent).

- Investigations completed (from 159 to 91 – a decrease of 42.8 per cent).

- Compliance letters issued (from 182 to 129 – a decrease of 29.1 per cent).

Overall, these statistics suggest that the SFC is continuing to expand its investigative efforts into potential cases of misconduct and taking enforcement action where appropriate. The decrease in the number of investigations completed may, however, reflect the increasing complexity of investigated matters and be a potential indicator of inadequate resourcing in light of reported staff departures at the SFC.

Separately, the SFC reportedly conducted 61 on-site inspections of licensed corporations to review their compliance with applicable regulatory requirements and 396 breaches were identified. Approximately 70 per cent of the breaches related to a breach of the Code of Conduct for Persons Licensed by or Registered with the Securities and Futures Commission, non-compliance with anti-money laundering guidelines, or internal control weaknesses.

Collaboration with other enforcement agencies and authorities

In October 2021, four people, including two former executive directors of Convoy Global Holdings Limited, were convicted of conspiracy to defraud at the District Court pursuant to the joint operation between the SFC and the Independent Commission Against Corruption back in 2017.

In November 2021, the SFC and the China Securities Regulatory Commission (CSRC) held their fifth joint enforcement training session, where discussions focused on ways to crack down on serious securities market violations in both markets and further collaboration opportunities. In December 2021, the SFC and the CSRC held the 12th regular high-level meeting on further enforcement cooperation, and the discussions revolved around:

- Enhancement and optimisation of the cooperation mechanism for collecting and handling evidence.

- Refinement of arrangements for providing assistance in urgent, major cross-boundary cases.

- Strengthening of communication among officers from both regulators.

In December 2021, the SFC also conducted a joint operation with the Hong Kong Police Force, the Monetary Authority of Singapore and the Singapore Police Force against a syndicate suspected of operating cross-border ramp-and-dump market manipulation schemes in Hong Kong and Singapore. During the operation, 33 premises in Hong Kong and Singapore were searched and 10 people were arrested.

Highlights of the other major regulatory enhancements

The SFC has introduced the following regulatory enhancements:

- Capital market transactions: Released the conclusions of a consultation on conduct requirements for capital market transactions in Hong Kong to clarify the roles of intermediaries and set out the expected standards for book-building, pricing, allocation and placing activities.

- Pooled retirement funds: Concluded a consultation on amendments to the Code on Pooled Retirement Funds to strengthen investor protection and ensure regulations applying to such funds are up to date and fit for purpose.

- Investment-linked assurance schemes (ILAS): Issued a circular to provide enhanced guidance and requirements for ILAS product design to achieve better investor outcomes.

- Virtual assets: In January 2022, the SFC and the Hong Kong Monetary Authority (HKMA) issued a joint circular to provide guidance for intermediaries who wish to distribute virtual asset-related products and engage in virtual asset dealing and advisory services.

Special purpose acquisition companies (SPAC): Issued a new practice note in December 2021 to provide guidance on the formal application process for waiving the application of Rule 26.1 of the Takeovers Code for de-SPAC transactions.

- Review of SEHK’s work: Published a report on its review of the Hong Kong Stock Exchange’s performance in its regulation of listing matters during 2019 and 2020.

- Operational resilience: Issued a circular and report to set out regulatory standards and measures for preventing and responding to disruptions and managing the risks of remote working.

- Joint product survey: Published a joint report with HKMA of the first joint annual survey on the sale of non-exchange traded investment products.

- Spread charges: Issued a circular setting out key observations from a thematic review of intermediaries’ spread charges and related practices, as well as their disclosure of transaction-related information.

Conclusion

The above highlights of the recent enforcement actions, statistics and regulatory enhancements reported in the Q4 2021 Quarterly Report demonstrate the SFC’s consistent focus on its enforcement priorities and its emphasis on responsible officers properly discharging their roles and responsibilities. The SFC is also further enhancing and adapting the regulatory framework in response to new developments in the finance sector and the prevailing post-COVID-19 economic conditions.

Financial intermediaries, listed companies and licensed persons are reminded to stay up to date with all relevant changes in the regulatory framework. In particular, licensed corporations should note that a substantial number of regulatory breaches are regularly identified in the course of on-site inspections, and the most common types of breaches involve non-compliance with the SFC’s Code of Conduct and AML requirements, as well as internal controls failures. It is therefore recommended that internal reviews are conducted regularly into these aspects to ensure compliance with all applicable rules and regulations, and to pre-emptively address any issues that may result in adverse findings during on-site inspections.

In-depth 2022-066