Authors

Key takeaways

- Changes to regulations bring identification of overpayment into line with False Claims Act statutory requirements.

- Medicare Parts A and B providers will now have a six-month timeline to investigate and quantify payments.

- Despite new administration, nature of changes and reasons for changes make a roll-back unlikely.

Included in the final 2025 Medicare Physician Fee Schedule (“MPFS”) Rule are modifications to the overpayment refund rule that impact all four parts of the Medicare program. The modifications include a new standard for what constitutes an “identified overpayment” and start the clock on the 60-day period for a refund of that overpayment. Additionally, the MPFS codifies the six-month timeframe for providers to investigate and quantify overpayments under Medicare Parts A and B.

These changes are the result of efforts starting in 2022, when similar proposals were originally made but never finalized. Additionally, the Centers for Medicare & Medicaid Services (CMS) has acknowledged that the changes are also, at least in part, in response to a court decision from 2018. While the changes to the regulations are final as of January 1, 2025, there is a possibility that an incoming Trump administration could rescind these provisions in whole or in part. Given their content and the context surrounding them, however, that is an unlikely outcome.

As discussed further below, the changes to the regulations make them consistent with the statutory language in the False Claims Act (FCA), removing the “reasonable diligence” knowledge standard for identifying overpayments that has been in the regulations since 2016.

Identified overpayment standard

The 60-day overpayment rule has its genesis in the Affordable Care Act. It requires providers who identify an overpayment from Medicare to repay that amount to CMS by the later of 60 days after identifying the overpayment or the date that a corresponding cost report for the overpayment is due. Failure to report and return the overpayment by that date creates the risk of liability under the FCA. The rule applies to all four aspects of Medicare: Part A (standard hospital care), Part B (standard physician care), Part C (Medicare Advantage) and Part D (prescription drug coverage).

The rules governing the 60-day overpayment period were finalized in 2014 for Parts C and D and 2016 for Parts A and B. Both rules established that an overpayment would be considered identified when the provider has determined, or could have determined through the exercise of reasonable diligence, that an overpayment has been made.

A group of Medicare Advantage Organizations (MAOs) challenged the Part C version of the rule, contending that the rule imported a negligence standard into the FCA by requiring an MAO to repay funds if it could have discovered the overpayment through reasonable diligence, rather than having specific knowledge of the overpayment. The district court in UnitedHealthcare Insurance Co. v. Azar agreed and ruled that the Part C rule improperly added a negligence standard to the FCA analysis.

In response, in December 2022, CMS proposed a rule revising the identified overpayment standard to align with the FCA by replacing “the exercise of reasonable diligence” language in the regulation with the FCA’s knowledge standard. In other words, an overpayment would be identified only if the person had “actual knowledge of the existence of the overpayment” or acted “in reckless disregard or deliberate ignorance of the overpayment.” CMS, however, never finalized the proposed rule.

In the 2025 MPFS, CMS revisited its December 2022 proposal, finalizing the rule to deem an overpayment identified only upon a person’s “actual knowledge” or “reckless disregard or deliberate ignorance” of its existence. Additionally, while CMS observed that the court’s opinion only spoke to the Part C section of the rule, CMS decided to change the language in all four parts of the Medicare program to ensure consistency and because each of those four parts relied on the same statutory language.

Additional six-month investigatory period

For providers and suppliers under standard Medicare (Parts A and B), CMS added an extra provision that would allow them “time to investigate and calculate overpayments” by formalizing the six-month investigatory period that was introduced in the preamble to the 2016 Parts A and B rule but never included in the regulatory text.

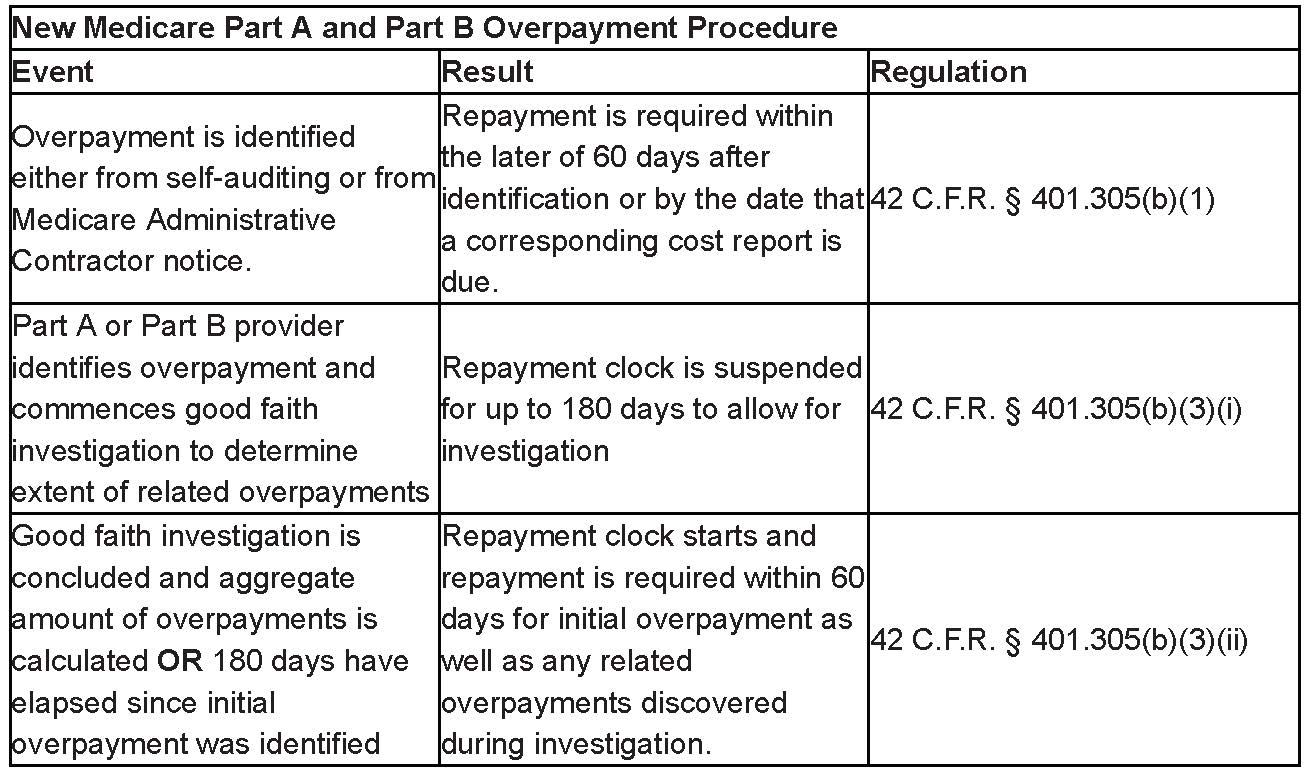

Under the pre-existing regulatory text, an overpayment must be reported by the later of: (1) 60 days after the overpayment was identified or (2) the due date of any corresponding cost report. However, the new final regulation at 42 C.F.R. § 401.305(b)(3) suspends the 60-day deadline if a person:

- has identified an overpayment but has not yet completed a good-faith investigation to determine the existence of related overpayments that may arise from the same or similar cause or reason as the initially identified overpayment; and

- conducts a timely, good-faith investigation to determine whether related overpayments exist.

If both conditions are met, CMS will suspend the deadline for reporting and returning both the initially identified overpayment and any related overpayments that arise from the same or similar cause or reason until the earlier of either (1) the date that the investigation has concluded and the aggregate amount of overpayments is calculated or (2) 180 days after the date on which the initial overpayment was identified.

This means that a provider or supplier under Parts A and B who has identified an overpayment with respect to one or more claims has up to 180 days to investigate other related claims to determine if there are other overpayments that need to be reported and returned. The clock on the 60-day timeframe for reporting and returning overpayments does not run during those 180 days as long as the investigation is conducted in good faith.

To ensure compliance with this provision of the final rule, providers should carefully document the date on which they discover the initial overpayment and the date on which their good-faith investigation begins.

Will the rule take effect?

The 2025 MPFS is set to take effect on January 1, 2025. In any other year, it would be final and effective on that day without much controversy. However, in an election year where the presidential administration is set to switch parties and congressional control appears to be doing the same, there is always some possibility that final rules implemented by the outgoing administration could end up voided either through congressional or presidential action.

Congress could decide to void the new rule through the Congressional Review Act (CRA), which allows Congress to issue a joint resolution of disapproval of any final rule within 60 legislative days of its printing in the Federal Register. In an election year, a new Congress is permitted to restart the clock on CRA review on the day the new Congress is sworn in for any rule that was finalized within the final 60 legislative days of the previous Congress.

A CRA challenge to a rule is a challenge to the entire rule and use of such a challenge would require vacating all of the payment provisions in the MPFS, upsetting the ordinary course of rate-schedule setting for the Medicare program. The overpayment provisions are included in the MPFS, which is a rate-setting rule and thus would typically be exempt from CRA review. However, since the rule includes a substantive change to regulation that impacts the rights and responsibility of non-agency actors, it is possible that the Government Accountability Office or a court could determine that the MPFS is CRA eligible, which would open the door to congressional action.

Alternatively, the presidential method would be much more surgical and less likely to generate litigation. The incoming CMS administrator could simply propose a new rule to rescind the 2025 MPFS provisions that impact the overpayment rule. This could be done either in the 2026 MPFS or in a separate rule.

Despite these possible avenues, it seems unlikely that either path will be followed to rescind the new overpayment rule changes. The regulation was changed in part to comply with a federal court opinion in the Medicare Part C context and then to coordinate the Part C regulations with the analogous rules for the other three parts of Medicare. Additionally, by formalizing the six-month investigation period, CMS gives providers and suppliers explicit guidance to safely and properly investigate their possible coding errors without fearing that they will be unable to complete a thorough investigation before the clock runs out and they become subject to FCA liability.

What does it mean?

Beginning on January 1, 2025, providers and suppliers across all four parts of Medicare will not be required to report and return Medicare overpayments that they could have identified through the exercise of reasonable diligence. Instead, for these providers or suppliers to be considered at fault, CMS will have to show knowledge of the identified overpayments more than 60 days before they were reported, or up to 240 days before any alleged failure to report, if a good-faith investigation was conducted to gather all possible overpayments by a Part A or B supplier or provider.

Reed Smith will continue to follow regulatory and FCA developments. If you have any questions, please reach out to the authors of this alert or to the health care lawyers at Reed Smith.

In-depth 2024-237

Authors