Repatriation of funds

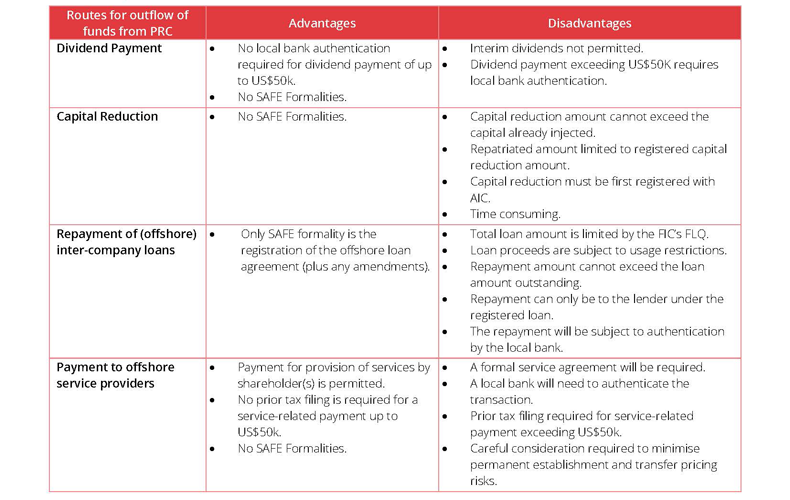

Examples of methods of repatriation of funds by a company incorporated by a foreign entity in the PRC pursuant to PRC laws, a foreign-invested company (“FIC”), include dividend payments, capital reductions, repayments of inter-company loans2, payments to offshore service providers3, the use of onshore funds to access offshore funding4 and structured physical transactions5.

Under the PRC foreign exchange control regime, each route for inflow or outflow of funds to/from the PRC must be based on a specific type of transactions. Transactions are either “current account transactions” or “capital account transactions”.

“Current account transactions” generally refer to import and export of goods and provision of cross-border services. In theory, foreign exchange payments and receipts for “current account transactions” are permitted to be made without SAFE approval or registration, provided that the settlement bank has authenticated such transactions after reviewing the relevant documents.

“Capital account transactions”, such as cross border direct investments, including green-field investments, M&A, and investments in equity securities and bond markets, cross border loans and cross border guaranty etc. are subject to the prior approval of SAFE or registration with SAFE. Subject to certain conditions, multinational companies may enjoy special conveniences provided under the foreign exchange “cash pooling” system. This includes centralized foreign exchange payment and receipt, “netting” settlement for “current account transactions” as well as aggregation of foreign loan quota (“FLQ”) on a group-wide basis.

1. Dividend Payments

Under PRC law, dividends can be remitted out of the PRC, without SAFE approval or registration, if it fulfills the following conditions:

- Authentication by the local bank for dividend payments exceeding US$50k;

- The dividend payment is not of an interim nature;

- Distributable profit must be on an audited financial report;

- All prior year losses have been offset;

- Tax filing for the dividend payment has been completed.

2. Capital Reduction

While a capital reduction does not need to be approved by or registered with SAFE7, it does require the carrying out of a number of processes (e.g. amendment of articles of association, approval or filing with the competent bureau of commerce, notification of creditors, registration with the company registration authority (AIC) etc.) before it can be legally effectuated. These processes can be time-consuming.

The foreign exchange registration through the FIC’s bank is required to reflect the capital reduction in the capital account system operated and maintained by SAFE. The maximum amount allowed for repatriation is capped at the capital reduction amount that has been reflected in such system.

In light of the challenges faced when repatriating funds from the PRC, during the course of determining the level of capital injection to an FIC, it will be prudent to note that proceeds of capital injections cannot be used for investments in securities, asset management products or lending to non-affiliated companies.

3. Repayment of (offshore) inter-company loans

When considering the possibility of using shareholder loans instead of a higher capital injection, shareholders should note that total loan amount is limited by the FIC’s outstanding FLQ, which is typically calculated on the difference between the “total investment amount”8 and “registered capital”.

While the repayment only requires the registration of the offshore loan agreement under SAFE, it must also fulfill the following conditions:

- Repayment amount cannot exceed outstanding loan amounts;

- Repayment can only be to the lender of the registered loan agreement;

- Authentication by the local banks is required.

4. Payment to (offshore) service providers

Current PRC laws allow for payment for the provision of services9, without SAFE approval or registration, provided the following conditions are satisfied:

- A formal service agreement is produced;

- Authentication by local banks of any payments against the service agreement;

- A prior tax filing for payments exceeding US$50k.

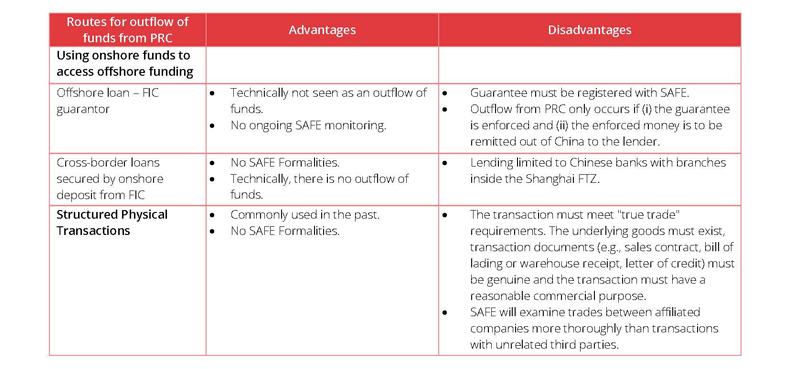

5. Using onshore funds to access offshore funding

In general, offshore loans are not seen as repatriation of funds as they have to be repaid eventually. However, there are two forms of offshore funding, both of which have different requirements.

- An offshore loan secured by a guarantee provided by an FIC must first have the guarantee registered with SAFE.

- A cross-border loan secured by an onshore deposit from the FIC occurs when the FIC deposits funds with an onshore Chinese bank and the bank will on-lend equivalent funds to the FIC’s overseas affiliate. However, the availability of such lending is limited to Chinese banks with branches within the Shanghai FTZ10.

6. Structured physical transactions

Under a typical structured physical transaction, the FIC may buy goods (i.e. commodities) from an overseas seller and then will resell the same goods to an overseas buyer. Such trades used to be a popular means of moving funds into or out of China in the past. The transaction must, however, meet the “true trade” requirements in that (i) the underlying goods must exist, (ii) the transaction documents must be genuine, and (iii) the transaction must have a reasonable commercial purpose.

While neither approval nor registration is required from SAFE, SAFE will examine the trade between affiliated companies more thoroughly than trade conducted with unrelated third parties. If a transaction violates SAFE rules, by way of example of consequences, a Class A11 FICs may be downgraded to Class B, and be prohibited from conducting any structured physical transactions. Such class classification is SAFE’s way of grading FICs and a higher class provides access to simplified procedures when processing cross-border payments in relation to trading in goods (i.e., import and/or export of goods).

In respect of structured physical trades, if the outbound foreign exchange payment exceeds the inflow of goods to the FIC during a 12 month period, should the difference between the two amounts and the outbound payments exceed a ratio of 20%, it will trigger a SAFE onsite inspection on the FIC and an investigation on all of the transactions conducted over the past 12 months.

Summary

- For the purpose of this note, the Hong Kong and Macau special administrative regions are excluded.

- Lenders may be overseas shareholders or affiliates.

- Foreign affiliated service providers provide services to the Company pursuant to the relevant service agreement.

- Such use of funds is only intended to provide overseas affiliates with temporary benefit of the excess funds sitting with the FIC. Eventually, the offshore loans will have to be repaid.

- Typically, the FIC will buy goods from an offshore seller and resell goods to an offshore buyer. Transfer of title to the goods will normally involve bill of lading or warehouse receipt with payment via letter of credit.

- Generally interim dividend declaration and payment by an FIC is not permitted.

- The information on capital reduction is required to be registered with the FIC’s bank which will carry out the update in the capital account information system operated and maintained by SAFE.

- The amount arrived at through "registered capital" multiplied by the applicable statutory ratio. Such ratio ranges from 10/7, 2/1, 5/2 to 3/1.

- ”Services” relevant to the commodities market include services of transportation (e.g. freight), construction, financial services, insurance service, computer and IT service, other business services, guaranty fee, etc.

- Shanghai FTZ includes bonded areas (e.g. Shanghai Waigaoqiao Bonded Zone) and non-bonded areas (e.g. the Lujiazui financial district).

- Class A is the highest ranking Class on the Trading Company List under SAFE’s foreign exchange regulation for trading in goods.