Short of establishing a registered presence in China, many foreign companies conduct business through purely contractual arrangements, such as trading, licensing or distribution agreements, with Chinese counterparties. These arrangements can continue without the foreign party needing to register a presence in China and the business can be developed and serviced through occasional customer or counterparty meetings in China under a business visa.

This short ‘crib sheet’ touches on different options for establishing a basic onshore presence where required or desired.

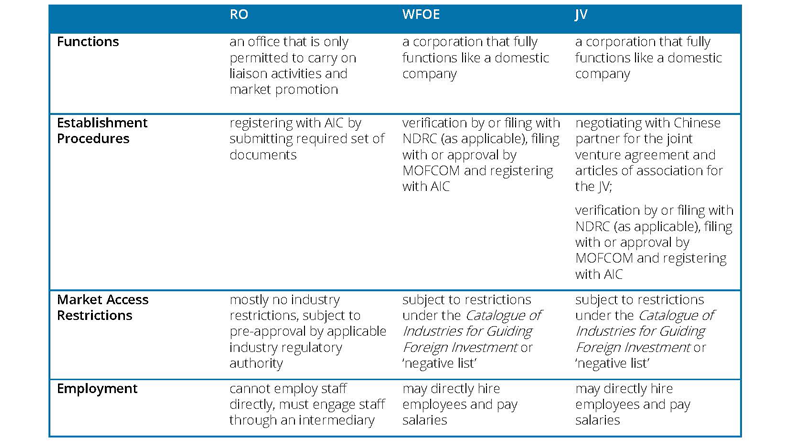

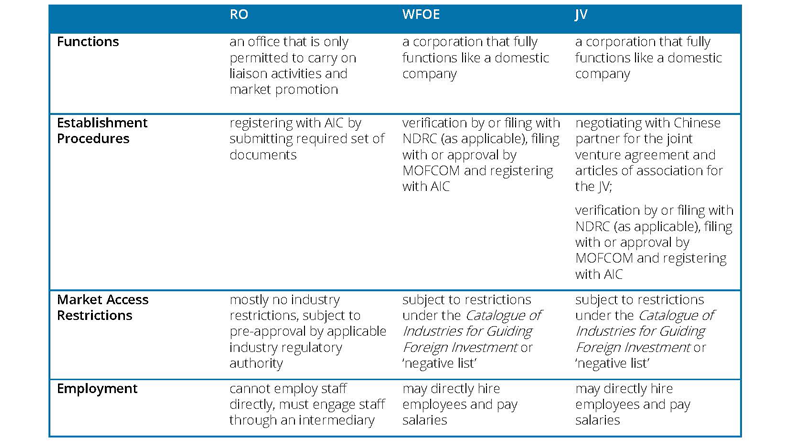

There are three principal forms of registered presence for foreign investors to conduct business in China: (i) a representative office (“RO”); (ii) a wholly foreign-owned enterprise (“WFOE”); and (iii) a joint venture (“JV”).

a) Representative Office

An RO is established as a non-independent legal entity under Chinese law. Thus, the foreign entity does not have to inject any capital into its RO in China except for the costs of covering anticipated daily expenses.

In general, an RO may only engage in indirect business activities, to the extent related to the business of its foreign parent, and is prohibited from engaging in direct profit- generating activities. In addition, any employment of local Chinese nationals must be arranged through a government-accredited agency.

In most cases a foreign entity intending to establish an RO should apply to register the RO with China’s State Administration for Industry and Commerce or its local counterpart (“SAIC”) without having to obtain approval in advance from China’s Ministry of Commerce or its applicable local counterpart (“MOFCOM”), or other governmental authority. If the foreign parent’s business falls into a specially regulated industry, then a pre-registration approval must be obtained from the relevant authority overseeing such industry.

b) Wholly Foreign-Owned Enterprise

A WFOE is a limited liability company established in the PRC by one or more foreign investors who hold its entire registered capital (equity) and is an independent Chinese legal entity under Chinese law.

Although similar establishment procedures apply to the setting up of a WFOE as apply to a JV (see below), establishing a WFOE is normally much less time-consuming and onerous than establishing a JV, in part because no negotiation with a joint venture partner is involved (at least not on the onshore side). A wholly owned Chinese subsidiary may also be a better choice as the foreign investor will retain full control of, for example, the WFOE’s governance structure, budget and operational decisions and, by no means of least importance, its intellectual property rights.

As a result of the liberalisation of China’s market-access restrictions on foreign ownership in more industrial sectors in recent years, the WFOE form has become a significantly more popular and practical structure for foreign investment in China.

c) Joint Venture

A JV, being an independent legal entity under Chinese law1, might be jointly invested in and established by one or more Chinese entities, together with one or more foreign entities and individuals. Although the WFOE has increased in popularity as the operational vehicle of choice for foreign investors, various imperatives may lead a foreign investor to form a Sino-foreign JV for its PRC business or an element of it.

Clearly, where the particular business to be conducted falls within the sectors for which a joint venture form is required under the ‘negative list’ or ‘restricted sectors’ in the Catalogue of Industries for Guiding Foreign Investment (“the Foreign Investment Catalogue”), the foreign investor will need to partner with one or more local counterparts. Examples of such sectors include value-added telecommunication services, car manufacturing, banking, and film and TV production. Additionally, a local joint venture partner may facilitate market access and bring particular local expertise that will enable an accelerated ramping up of the initial operations.

On the other hand, foreign investors should be aware of challenges associated with a JV and address such issues upfront in joint venture agreements and articles of association, as well as other relevant agreements. Typical issues include how to protect the technology that the foreign investor contributes or licenses to the JV, the JV partner’s right of first refusal in respect of equity transfers and capital increases, shareholders’ rights as between the JV partners.

For a JV that does not fall within the negative list for foreign investment, the establishment process involves making an online filing with MOFCOM and the provision of a variety of information regarding the proposed JV, such as the scope of business, registered capital and ultimate controlling person of the JV. For projects that fall within the negative list, the joint venture agreement and the articles of association must be approved by MOFCOM and a pre-approval from the applicable industry regulatory authority may be required. For certain projects, prior verification by or filing with China’s National Development and Reform Commission or its applicable local counterpart (“NDRC”) is also a requisite. Afterwards the JV must also be registered with, and obtain a business licence from, the AIC.

- Except for contractual joint ventures that are structured as non-legal person entities.