Introduction

In the United States, the earliest stages of financing a company are usually done with convertible instruments such as a convertible bond or simple agreement for future equity (SAFE), with fixed price equity issues1 occurring on a less frequent basis.

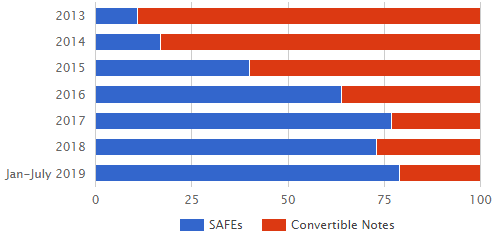

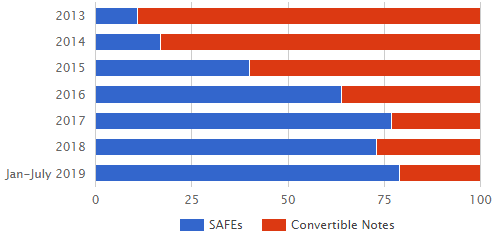

AngelList (a platform for start-ups which, among other things, compiles data regarding angel investments in the United States) tracked individual investments made through its network which (a) utilised convertible instruments (including SAFE instruments) with a valuation cap under US$20 million, and (b) were made before any fixed price equity financing round (which serves to isolate ‘bridge rounds’ between fixed price equity financing rounds), and the following results illustrate an increasing use of SAFE instruments since their introduction in 2013:

Source: Abe Othman’s article titled “For Seed Funding, SAFEs Have Won Against Convertible Notes” dated 21 August 2019 published on the AngelList Blog

In Hong Kong, while convertible bonds and fixed price equity issues are often utilised in the fundraising context, SAFE instruments have not been widely applied in venture capital financings even though it is a concept of which venture capitalists in Hong Kong are generally aware, perhaps because SAFE instruments are generally not well understood in a practical sense.

In light of the above, this article seeks to explain the nature of a SAFE instrument, provides a comparison of its key features compared to a convertible bond, sets out some of its key advantages and disadvantages, and describes some circumstances in which it is suitable to be used.

What is a SAFE instrument?

A SAFE instrument is a relatively new tool used in early-stage venture capital financing, having first been introduced by YCombinator (a well-known ‘start-up accelerator’ in the United States) in 2013. It was developed as a more issuer- and user-friendly alternative to the convertible bond. Whilst others have developed similar documents under various names (e.g., Keep it Simple Security or ‘KISS’), we will refer to such instrument in this article as a ‘SAFE instrument’ (and the YCombinator SAFE instrument as a ‘traditional SAFE instrument’).

In essence, a traditional SAFE instrument involves making an advance subscription payment for equity to be issued at a later date upon the occurrence of a future equity financing round, or with a cash-out at the time of a sale of the issuer or an initial public offering (IPO) of the issuer. Upon the occurrence of such triggering event, the advance subscription payment is converted into equity, or is cashed out, at a price determined based on the valuation of the issuer under that triggering event. The conversion price is an effective share issue price – the higher the price, the fewer the number of shares to be issued to the SAFE investor. Any valuation cap acts like a floor on the number of shares which can be issued, or on the amount of the cash-out.

In addition, on a liquidation of the issuer, a SAFE investor is entitled to receive cash equal to its original invested amount instead of equity, but the traditional SAFE instrument provides a limited repayment priority only before the ordinary shareholders of the issuer, and on par with any preference shareholders of the issuer or holders of other SAFE instruments.

There are four SAFE instrument variations: (a) one with a valuation cap and a conversion price discount, (b) another with no valuation cap but with a conversion price discount, (c) a further one with a valuation cap but no conversion price discount, and (d) an additional one with neither valuation cap nor conversion price discount but with a ‘most favoured nation’ provision in favour of the investor.

As the YCombinator SAFE instrument is subject to Californian law and is drafted in the U.S. style, it requires significant adaption before it can be applied in Hong Kong (and there is no local ‘standard form’ which is widely used in Hong Kong).

A convertible bond in an early-stage venture capital context

A convertible bond is also commonly used in early-stage venture capital financing. Typical characteristics of such instruments include (a) an up-front investment subscription amount being paid, (b) a future conversion into equity occurring on certain triggering events such as a future financing round, or a sale or IPO of the issuer, (c) a future conversion price tied to the relevant conversion triggering event (and often with a fixed discount applied to that conversion price), (d) a fixed maturity date on which the convertible bond will be repayable as debt of the issuer if any such conversion triggering event has not occurred prior to such maturity date, and (e) interest being payable on the investment amount (which is usually rolled up into equity at the time of conversion into equity). However, there is no widely used ‘standard form’ convertible bond in Hong Kong so its features and form may vary considerably.

Key similarities and differences between a traditional SAFE instrument and a typical early-stage venture capital convertible bond

A SAFE instrument shares a number of similarities with a convertible bond that is used in early-stage financings, including that (a) an investment amount is paid up-front in return for future equity, (b) the conversion price is not known at the time of investment (as it is based on an issuer valuation under the future triggering event), (c) a discount to that future conversion price is commonly applied, and (d) on a liquidation of the issuer, there is certain repayment priority but this is far more limited than the repayment priority applicable to unsecured debt.

However, there are certain key differences between the two instruments, such as (a) prior to conversion, a convertible bond constitutes a debt of the issuer which, if unconverted and unsecured, will result in the bondholder being treated as an ordinary creditor, whereas a SAFE instrument will, generally speaking, only give the investor holder a very limited priority right in respect of ordinary shareholders in the case of a cash-out on liquidation, (b) a convertible bond may bear interest up to the maturity date, which does not apply under a traditional SAFE instrument, and (c) whilst a convertible bond would typically have a fixed maturity date, there is no maturity date or repayment deadline stipulated in a traditional SAFE instrument. Certain other material differences may arise depending on the features of the relevant convertible bond.

Key advantages of a traditional SAFE instrument and a typical convertible bond compared to a fixed price equity issue

Compared to a fixed price equity issue, the key benefits of using a traditional SAFE instrument or a typical convertible bond in early-stage venture capital financing include the following:

- No need to pre-determine a valuation/conversion price: neither a traditional SAFE instrument nor a convertible bond typically used for early-stage companies requires the investor and issuer to fix a valuation/conversion price for the equity at the time of investment as that price is set by reference to the future triggering events (e.g., a future equity financing round). However, they may specify a ‘conversion cap’ which provides for an effective minimum on the number of shares which will be issued, or the amount of cash received, depending on the issuer’s fully diluted capital. This gives a SAFE instrument or a convertible bond a key advantage over a fixed price equity issue, as valuing early-stage companies can be extremely difficult, for example, because the revenue streams and future capital expenditure may be highly uncertain, customer take-up of the issuer’s product may be unknown, etc.

- Short and simple form documents: being a ‘stand-alone’ document, a SAFE instrument or a convertible bond is usually relatively easy and inexpensive to negotiate and document, particularly the SAFE instrument which has a widely used ‘standard form’ (at least in the United States). A fixed price equity issue usually involves multiple documents (e.g., subscription agreement, shareholders’ agreement and amended articles of association) and has more complex terms and mechanisms, which seek to incorporate more comprehensive shareholders’ rights and protective mechanisms. This can materially increase the time and cost of investment.

- Less complicated investment terms: as a SAFE instrument or a convertible bond piggy-backs off the investment terms in a future investment round, there is no need to negotiate it at the time of investment, which saves time and cost.

Key disadvantages of using a traditional SAFE instrument and a typical early-stage venture capital convertible bond compared to a fixed price equity issue

- Takes up future financing round ‘allocation space’: a SAFE instrument or a venture capital convertible bond both take up allocation space in the next fixed price equity financing round without further investment contributions being made by the original SAFE investor. Therefore, depending on the size of the converted SAFE or convertible bond investment relative to the size of the next fixed price equity financing round, it may make a future fixed price equity financing more difficult.

- Unknown future dilution effect: a traditional SAFE instrument and a convertible bond converts into equity in the future at a conversion price which is unknown at the time of investment. However, this risk may be mitigated by including a valuation cap on the conversion. The actual amount of dilution at the time of conversion can be a nasty surprise for an issuer and can be difficult to calculate. For example, a future equity financing will usually involve a valuation of the issuer which includes the SAFE investment equity dilution, which dilution is in turn dependent on the future equity valuation. SAFE instrument users are encouraged to run through the potential dilution scenarios at the time of investment.

Contrasting a traditional SAFE instrument with a typical venture capital convertible bond

From an investor’s point of view, the key advantages of using a traditional SAFE instrument compared to a typical venture capital bond include (a) the availability of a ‘standard form’ agreement (at least in the United States), which makes it cheaper and faster to effect, and (b) after investment, it involves a minimal time commitment for the investor given the SAFE instrument lacks ongoing supervisory and veto rights (this tends to be less typical for a venture capital convertible bond, which usually requires the issuer to produce financial reports and which may contain veto matters in favour of the investor).

From an investor’s point of view, the key disadvantages of using a traditional SAFE instrument compared to a typical venture capital convertible bond include:

- No guaranteed conversion or repayment: the lack of a maturity date means that if a future triggering event does not occur (e.g., there is no future qualified funding round or no sale or IPO of the issuer), then the instrument may (theoretically) never convert into equity or result in a cash-out for the investor. That could occur, for example, where the issuer generates sufficient profit to sustain its own future financing needs without needing to undertake a future equity financing round. A convertible bond will typically specify a fixed maturity date on which the convertible bond will be repayable as debt in the absence of an event triggering conversion.

- Uncertainty in tax and accounting treatment: there is more uncertainty as to the tax and accounting treatment prior to any conversion of a SAFE instrument, in particular, as to whether the investment under the SAFE instrument should be treated as a payment for future equity (akin to a forward contract) or as a debt (given that the SAFE investment must be repaid if the issuer becomes insolvent). The treatment of a typical convertible bond is generally well established (i.e., it constitutes debt before conversion, and equity after conversion).

- Lack of investor protection rights: a traditional SAFE instrument also lacks many typical equity investor protections which may be built into a convertible bond (or a fixed price equity issue), such as the following (none of which are in a traditional SAFE instrument, but they could be added to a bespoke SAFE like instrument):

- Pre-emptive rights: fixed price equity and convertible bond investors will commonly have the right to participate in future equity issues of the issuer on a pro-rata basis according to their then fully diluted percentage shareholding in the issuer to prevent potential dilution of the investor in future equity financing rounds (should the investor wish to participate).

- Information rights: fixed price equity and convertible bond investors will typically have the right to receive financial information from the issuer, such as monthly, quarterly or annual financial statements, annual operating budgets and financial forecasts, to give the investor visibility on the issuer’s operations, financial performance and liquidity.

- Board seat or observer rights: larger or strategic fixed price equity and convertible bond investors may be granted the right to appoint a director or observer to the board of directors of the issuer to give the investor visibility on the issuer’s operations.

- Most favoured nation rights (included in only one SAFE variant): large or strategically important fixed price equity and convertible bond investors may require the issuer to provide the investor with the benefit of any more favourable terms given to any other investor in any future fundraising.

- Ongoing business undertakings: fixed price equity and convertible bond investors may impose positive obligations on the issuer or founder in respect of the general conduct of the business (e.g., a requirement for the investment proceeds to be used as working capital, a clear definition of the nature of the issuer’s permitted business activities, non-compete and customer and employee non-solicitation undertakings, etc.).

- Reserved matters: fixed price equity and convertible bond investors may have the right to veto certain decisions made in respect of the issuer (e.g., changes to the articles of association, certain changes to the share capital of the issuer, related party transactions of the issuer, etc.), the extent of which will usually depend on the strength of the investor’s bargaining position.

When should an investor use a SAFE instrument?

A traditional SAFE instrument is typically suitable for (a) investors looking to invest at such an early stage that it is very difficult to value the issuer (e.g. pre-revenue start-ups), (b) the investment amount is so small that the potential investment costs do not warrant any material negotiations regarding terms other than the absolute basics (i.e. the investment amount, valuation cap, conversion discount, etc.), and/or (c) bridge financings, which are very minor relative to any future proposed financing. As the issuer’s business takes shape and becomes more substantial, the issue of a convertible bond or fixed price equity financing would provide better protection and more certainty for an investor. Regardless, if an investor wishes to proceed with a bespoke SAFE-like instrument, then careful consideration needs to be given to whether to add any additional conversion triggers (to ensure ultimate conversion) and/or any general investor protections, including anti-dilution protection, veto rights and access to financial information.

-

A fixed price equity issue refers to the issue of shares or interests in a company at a specified issue price which is known at the time of issue of the shares or equity interests. This is to be contrasted with SAFE instruments and certain convertible bonds, where the issue price of shares or interests in a company typically depends on the valuation of the company in connection with the occurrence of a triggering event, e.g., a future funding round.

In-depth 2021-087