Background

In the Singapore High Court case of Public Prosecutor v. Zheng Jia [2025] SGHC 76, Mr Zheng Jia (the Respondent) was a company director who operated a business which included incorporating companies in Singapore primarily for foreign clients. The suite of services offered by the Respondent included (i) registering himself as the locally resident director of these companies; and (ii) assisting in opening bank accounts for them. However, he exerted no control or supervision over those companies’ affairs and did not review banking transactions for those accounts.

The Respondent eventually enlisted the help of the co-accused, Mr Er Beng Hwa (Er), to act as a locally resident director for companies and assist in opening bank accounts. On the Respondent’s instructions, Er similarly exerted no control or supervision over the affairs of those companies.

In 2020, the proceeds of scams were routed through the bank accounts of two companies, Ocean Wave Shela Pte Ltd and Rui Qi Trading Pte Ltd, of which the Respondent and Er were the respective directors. Consequently, the Respondent was convicted of the following two charges under section 157(1) of the Companies Act 1967 (CA):

a) Failing to exercise reasonable diligence in the discharge of his duties as a director of Ocean Wave (the First Charge)

b) Abetting Er’s omission to exercise reasonable diligence in the discharge of his duties as a director of Rui Qi (the Second Charge)

At first instance, the district judge (DJ) applied the sentencing framework laid down in Abdul Ghani bin Tahir v. Public Prosecutor [2017] 4 SLR 1153, which establishes that (i) the starting point for “purely negligent breaches” of section 157(1) CA is a fine; and (ii) imprisonment is reserved for instances where a director has breached their duties “intentionally, knowingly, or recklessly”. The DJ imposed a total fine of S$8,500 in respect of the First Charge and the Second Charge.

Decision

On appeal, the High Court rejected the use of the Abdul Ghani framework, given that (i) the Respondent is a chartered accountant whose business was premised on being a locally resident nominee director for Singapore companies; and (ii) he subsequently failed to oversee the affairs of those companies. The High Court was of the view that such conduct went beyond mere neglect as the Respondent had acted knowingly (if not intentionally) in abdicating his duty under section 157(1) CA.

Instead, the High Court adopted a revised three-step framework (the Revised Framework) for sentencing offences under section 157(1) CA, as follows:

a) Identifying the relevant offence-specific factors

b) Situating the offence within the appropriate sentencing band

c) Calibrating the indicative sentence for offender-specific factors

The High Court also held that the Revised Framework is equally applicable to the sentencing of persons who have assisted or abetted in a director’s breach of duty under section 157(1) CA (known as “accessories”), pursuant to section 109 of the Penal Code 1871. Each of the three steps above is elaborated further below.

Step 1. Identifying the relevant offence-specific factors

The High Court set out a non-exhaustive list of offence-specific factors to be taken into account for offences under section 157(1) CA:

a) The extent of due diligence conducted by the director

b) Efforts made by the director to monitor or review company transactions

c) The extent to which the director knew, or should have known, that their failure to exercise reasonable diligence in overseeing company affairs could or would enable abuse of the corporate structure by others

d) The duration of the offending conduct

e) Whether the offending conduct was part of a business or profit-driven scheme

f) Whether the director tried to conceal their wrongdoing

g) Whether the offence was transnational

h) The nature and extent of the harm caused

For cases involving accessories to a breach, the High Court took the view that the factors above may not apply and identified the following offence-specific factors that should be considered:

a) The abettor’s reasons for abetting or aiding the director’s breach of duty

b) Any disparity in knowledge or expertise between the abettor and the director

c) Whether the abettor’s acts were motivated by profit

Step 2. Situating the offence within the appropriate sentencing band

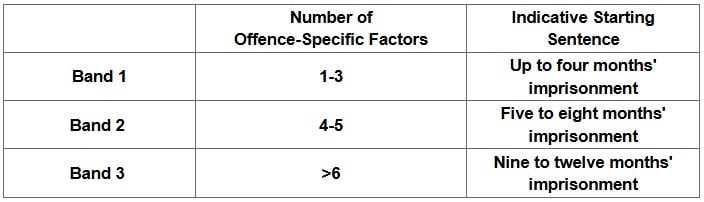

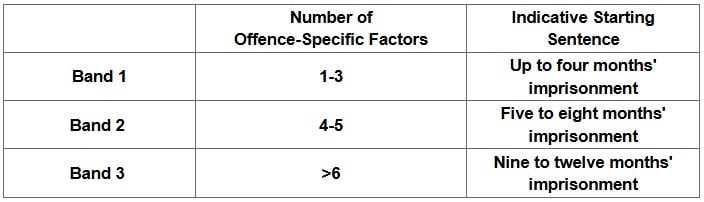

Based on the above offence-specific factors, the offence will be classified within the appropriate sentencing band to arrive at an indicative starting sentence, as set out in the following table.

In determining the appropriate sentencing band, the court should not simply count the number of offence-specific factors present but should instead assess the gravity of each of the relevant factors.

In addition, in cases such as the present, there is a presumption that a custodial sentence will apply, and the onus falls on the director to explain why it should not apply in their case.

Step 3. Calibrating the indicative sentence for offender-specific factors

The indicative sentence will then be adjusted based on any offender-specific factors. Such factors include (i) other offences taken into account for sentencing; (ii) antecedents; (iii) remorse; (iv) plea of guilt; (v) restitution; and (vi) cooperation with the authorities.

Applying the Revised Framework to the present case, the High Court held that the First Charge was within Band 2, with an indicative sentence of five months’ imprisonment, on the basis that.

a) the Respondent was a chartered accountant familiar with his duties as a director and contemplated that Ocean Wave and its bank accounts could be used for illegal purposes;

b) the Respondent took no steps to understand Ocean Wave’s business or monitor the banking transactions in its accounts;

c) the Respondent’s consistent dereliction of his duties in relation to Ocean Wave was part of his broader method of operation, which amounted to evading corporate regulations (including the requirement for a locally resident director) for his clients;

d) the Respondent’s conduct was motivated by recurring profits; and

e) the harm was not insubstantial.

With regard to the Second Charge, the High Court considered the offence to fall within Band 3 of the Revised Framework, with an indicative sentence of at least ten months’ imprisonment. This was because:

a)the Respondent had employed Er (who was unfamiliar with the duties of a director) and gave unequivocal instructions to adopt a hands-off approach as a nominee director of Rui Qi;

b)the Respondent, as part of his profit-driven exploitation of Er’s ignorance, paid Er low remuneration; and

c)the Respondent enabled substantial harm as the routed proceeds amounted to over US$2 million stolen from three victims.

At the third step of the Revised Framework, the High Court took into account the Respondent’s guilty plea and accordingly calibrated the sentences for the First Charge and the Second Charge to imprisonment terms of three and seven months respectively.

Conclusion

This case serves to highlight the Singapore courts’ intolerance for individuals whose appointment as nominee directors is part of their business model of providing little to no oversight over company affairs. This is demonstrated in particular by the High Court’s introduction of the Revised Framework, where the starting point for such cases involving breaches of section 157(1) CA is a custodial sentence.

It is also apparent that the Revised Framework was introduced with a view to deter directors who knowingly or intentionally fail to exercise control or supervision over company affairs. Indeed, the High Court emphasised that such egregious behaviour not only poses a risk to the director’s companies but also Singapore’s corporate and financial ecosystem. In this respect, while the Revised Framework was applied to the specific facts of this case, there is potential scope for it to also apply to cases of similar magnitude, such as a director who persistently fails to exercise oversight over many (if not all) of their company’s affairs.

At the same time, the High Court made it clear that the minimum sentence in these cases is not necessarily imprisonment as the presumption of a custodial sentence under the Revised Framework may be rebutted. In this regard, much will depend on the director’s explanation as to why imprisonment should not be imposed, including an assessment of the gravity of the offence-specific factors.

Ultimately, it is imperative that directors (including nominee directors) ensure that they have the requisite skills and capacity to oversee the affairs of their companies.

Reed Smith LLP is licensed to operate as a foreign law practice in Singapore under the name and style Reed Smith Pte Ltd (hereafter collectively, "Reed Smith"). Where advice on Singapore law is required, we will refer the matter to and work with Reed Smith's Formal Law Alliance partner in Singapore, Resource Law LLC, where necessary.

Client alert 2025-151