The new IFPR regime will increase the capital requirements of those MiFID investment firms that are currently categorised as BIPRU firms by the FCA. These are firms which are authorised to execute client orders and/or provide portfolio management services (and may also provide investment advice and/or receive and transmit orders) but do not hold client money or securities. Since January 2014, the FCA has exercised its discretion to exclude these firms from the more onerous CRR/CRD regime and they have been subject instead to the less complex requirements in the recast CAD; they have therefore been treated differently from so called ‘IFPRU firms’. In exercising such discretion, the FCA acknowledged that the CRR/CRD was essentially the EU implementation of Basel III for banks and its application to investment firms conducting less risky activities was a temporary measure pending the outcome of the Commission’s review of the prudential regime for investment firms.

BIPRU firms currently benefit from a base capital requirement of just EUR 50,000 and have a relatively simple variable capital requirement (which is: one quarter of audited annual fixed overheads or, if higher, the sum of the credit risk and market risk calculation). As most BIPRU firms operate on an exclusively agency model, the fixed overheads requirement is usually the relevant variable capital requirement. This capital treatment is not carried forward in the new IFPR regime, which the FCA states is scheduled to apply from Summer 2021 to broadly coincide with the EU’s implementation of the IFR/IFD on 26 June 2021. Such firms will remain subject to a fixed overheads requirement but, in some cases, will be subject to a new and more complex variable capital requirement involving the so-called K-factors.

Some collective portfolio management investment firms (CPMI), such as alternative investment fund managers with top-up permissions to provide MiFID services, are also currently categorised as BIPRU firms. The FCA has stated in its discussion paper on the IFPR that it intends to apply the provisions of the IFPR to CPMIs, in addition to the requirements imposed on them by AIFMD/UCITS Directive.

Overview of the new prudential regime

It is highly unlikely that a BIPRU firm would be categorised as a systemically-important firm (so they will not be treated as if they are banks and will not be subject to the capital requirements in the current CRR/CRD regime). Unless they can meet all of the tests to qualify as a “small and non-interconnected firm” (SNI), BIPRU firms will be Non-SNI firms and so subject to the full application of the new regime. Please see our previous alert for an overview of the classification of firms under the new regime. Note that the EBA in its various publications on the IFR/IFD has used the terms “class 1”, “class 2” and “class 3” firms to refer to what the FCA has termed in the discussion paper on the IFPR, “systemically-important”, “Non-SNI” and “SNI” firms, respectively.

Most BIPRU firms will become subject to a higher permanent minimum capital requirement (PMR) of EUR 75,000. This is just one element of the new own funds requirement which will require those larger BIPRU firms that become Non-SNI firms to maintain capital above the highest of three figures: (a) EUR 75,000; (b) the fixed overheads requirement; and (c) the new K-factor requirement. A SNI firm is exempt from the K-factor requirement (although such firms will need to monitor their activity with respect to certain K-factor-based thresholds) but will be required to meet the higher of EUR 75,000 and the fixed overheads requirement. A few BIPRU firms that engage in matched principal trading will be moved to a much higher PMR of EUR 750,000 and will automatically become Non-SNI firms. The remainder of this client alert addresses only those BIPRU firms that do not conduct any form of principal trading.

The fixed overheads requirement

All BIPRU firms will be broadly familiar with having to calculate a fixed overheads requirement and, as is currently the case, this requirement is calculated by taking one quarter of the audited fixed overheads of the firm from the previous accounting year. The full details of how to calculate this figure are to be included in regulatory technical standards (which are currently the subject of an EBA consultation and which the FCA will likely consider in implementing the IFPR), but the broad calculation takes a similar approach to the BIPRU regime as there will be deductions for elements of variable expenditure such as discretionary bonuses and other discretionary appropriations of profit.

How do we qualify as a SNI firm?

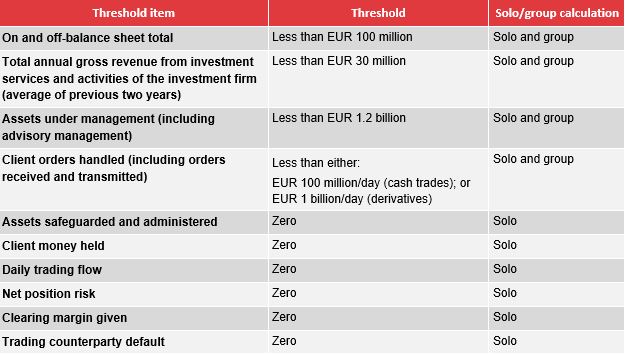

SNI firms are seen as lower risk and so are subject to a reduced capital and reporting burden under the new regime relative to Non-SNI firms. The conditions in the following table must all be met in order to qualify as a SNI firm.

Importantly, the size tests for balance sheet size, annual gross revenue, assets under management and client orders handled are applied on a combined basis for all investment firms that are part of the same group. The other conditions are only applied on an individual entity basis. The group approach to the size tests is clearly intended to reduce the incentive for groups to restructure operations between multiple entities; however, it is likely to lead to some existing BIPRU firms failing to meet the SNI tests. This will mean that they are Non-SNI firms and will be subject to a greater overall burden under the new regime, including the K-factor capital requirement. It is currently unclear whether or not this group test for SNI status applies worldwide.

Non-SNI firms and the K-factor requirement

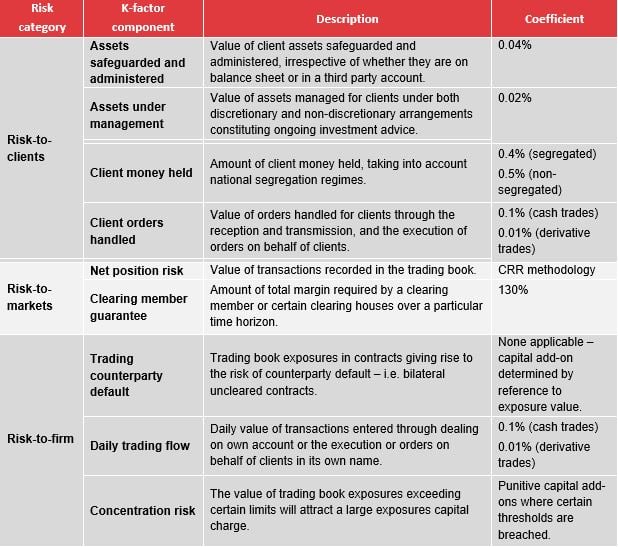

The K-factor requirement is the biggest change in the new regime. It applies percentages (‘coefficients’) to the value of specific risks encountered by firms. The new regime is intended to be a major improvement as it is calibrated to the risks of investment firms rather than banks. The risk categories and their corresponding components are set out in the following table.

Most BIPRU firms will not be subject to the majority of these risk factor calculations as only assets under management and client orders handled appear to be relevant. It is worth noting that assets are not counted as ‘under management’ for this purpose if a separate manager entity has delegated the performance of the portfolio management to the relevant firm. The detailed scope of the K-factor calculations is currently subject to a consultation exercise by the EBA, the results of which the FCA has says it will take into account when implementing the IFPR. However, there is enough in the current material for firms to begin assessing the likely impact on their capital requirements.

What counts as own funds?

Own funds will comprise Common Equity Tier 1 capital (CET1), Additional Tier 1 capital (AT1) and Tier 2 capital (T2) – these definitions follow the CRD/CRR regime rather than the BIPRU regime, although the IFPR diverges from the CRR/CRD in respect of the applicable deductions. Certain types of capital which are permitted under BIPRU rules, such as Tier 3 capital, will no longer be permitted. As a proportion of the own funds requirement, CET1 must be at least 56 per cent, and CET1 plus AT1 must be at least 75 per cent. This means that long-term subordinated debt and other T2 capital can amount to no more than 25 per cent of a firm’s own funds when meeting its own funds requirement. BIPRU firms currently enjoy a more relaxed gearing treatment.

ICARA/SREP

BIPRU firms will be subject to the new internal capital and risk assessment process (ICARA). In short, this requires firms to assess whether they need to maintain additional capital and liquidity beyond the levels required under the standard rules. This assessment is then potentially subject to the supervisory review and evaluation process (SREP) which can lead to the specific imposition by the regulator of additional own funds and/or liquidity requirements. The FCA states in its discussion paper that it is planning to require an ICARA for all firms and may use its discretion to request a SREP for a SNI firm “where appropriate”.

Other important changes

As well as the impact on solo own funds requirements, there are other changes introduced by the new regime.

Consolidation: some of the new rules will apply on a group-wide basis and the new regime has a clear focus on investment firm-only group consolidation (i.e. groups containing investment firms, but not any banks). This could involve regulators of firms with a non-domestic (i.e. non-UK for UK firms under the IFPR, and non-EEA for EEA firms under the IFR/IFD) holding company requiring the interposition of a new domestic intermediate holding company. A light touch approach is available in the case of group structures “deemed to be sufficiently simple”, although it remains to be seen exactly how this will be defined. It is worth noting that some SNI firms may be able to apply for an exemption from the solo capital requirements and liquidity rules if they are a subsidiary in a consolidation group and the regulator agrees to such an exemption. It should be noted that if the group contains a bank, the consolidation group will be subject to CRR/CRD.

Liquidity requirements: firms will be required to maintain a liquidity cushion of cash or near-cash assets equivalent to one month of fixed overheads plus 1.6% of any guarantees granted to clients. Again, SNI firms (and in some cases their parents) may be exempted from these liquidity requirements in certain limited circumstances.

Remuneration: BIPRU firms which become Non-SNI firms will be subject to prescriptive principles on remuneration policies and variable remuneration. The new requirements are similar to the CRR/CRD regime and generally require firms to: establish remuneration committees; introduce limitations on certain staff around their variable remuneration, such as the payment of guaranteed bonuses, malus and clawback, the composition of variable remuneration, and deferrals; and make remuneration-specific annual disclosures and regulatory reports. SNI firms will be subject to the remuneration provisions of MiFID. It should also be noted that if the group contains a bank, the consolidation group will be subject to the CRR/CRD remuneration rules. Please see our previous alert on the IFR/IFD remuneration rules.

Transitional relief

There is a five-year transitional period from 26 June 2021 which puts an upper limit on the increase in some of the regulatory capital requirements for firms; this is intended to enable the gradual build-up of capital to meet the new requirements.

The policy intention is that firms can limit their own funds requirement to double their requirement under the CRR/CRD regime for a five-year period; this means that firms will have to calculate their requirements under both the CRR/CRD regime and under the new rules if they wish to take advantage of this transitional relief. In its recent discussion paper on the IFPR, the FCA has stated that the requirement under the CRR/CRD regime will have to be calculated on a regular, updated basis and that a single, historic calculation will not be permitted. Given that BIPRU firms will not be familiar with the CRR/CRD regime, it is unlikely that many will be attracted to this option. In addition, it is unlikely that many BIPRU firms will see a major change in the amount of their capital requirements, so the transitional relief is unlikely to be useful except in a small minority of cases (e.g. for Non-SNI firms where the K-factor requirement is substantial).

Most BIPRU firms will have a phased increase in the PMR from EUR 50,000 to EUR 75,000 in annual increments of just EUR 5,000 over five years.

Brexit

Although the IFR/IFD will apply only after the end of the Brexit transitional period on 31 December 2020 (assuming there is no extension), HM Treasury confirmed on 23 June that the UK played an instrumental role in the introduction of the IFR/IFD at EU level and is supportive of the intended outcomes.

Accordingly, the UK will endeavour to introduce its equivalent regime by Summer 2021, which is broadly consistent with the applicability date of the EU’s IFR/IFD, although as the framework is to be introduced through the Financial Services Bill, the specific timing of the new regime’s introduction will depend on the Bill’s passage through Parliament.

Additionally, the FCA has highlighted in the discussion paper that various level 2 technical standards and guidelines are required to be produced by the EBA to supplement the IFR/IFD.Although these will come into effect after the end of the Brexit transitional period (and are therefore not required to be transposed into UK law), the FCA has indicated that it would consider such level 2 regulation in designing and implementing the UK’s IFPR.

Next steps

While the full detail of the new regime is yet to emerge, there is enough information in the published level 1 text, the EBA consultation papers and the FCA’s discussion paper to start planning and modelling for the new regime.

It is clear that any investment firm or group considering any form of reorganisation or acquisition in the months ahead should consider the impact of this new regime and plan accordingly.

BIPRU firms should also plan to take the following actions:

Identify which group entities will be affected and whether consolidated supervision may be imposed.

- Determine the relevant class for each firm.

- Check whether an exemption from the solo requirements may be available for SNI firms that are subsidiaries in groups subject to consolidated supervision.

- Consider which data points are required to classify the firm and uplift systems to monitor these thresholds.

- Calculate the new fixed overheads requirement and, if relevant, the K-factor requirement.

- Consider whether current types of capital will remain eligible as “own funds” and whether current gearing levels are consistent with the new requirements.

- Assess the extent to which the firm is required to introduce additional own funds and liquid assets.

- Identify current remuneration practices and assess how these may change.

- Review whether any corporate or group reorganisation could help mitigate the impact.

- Review and respond to the EBA/FCA consultations.

Client Alert 2020-390