1. The rise of perpetuals

A perpetual is an exchange-traded contract to buy or sell a cryptocurrency at an unspecified point in the future. The value of the contract tracks the spot value of an underlying cryptocurrency, and when a party decides to close out the contract, settlement occurs in a designated cryptocurrency (which does not need to be the same as the underlying cryptocurrency – in fact, the latter is not itself traded). A perpetual can be held indefinitely without the need to be rolled over, and payments are regularly exchanged between the parties to the two sides of the contract. The settlement amount and the recipient of such amount are determined based on the difference between the contract price and that of the underlying currency, as well as the difference in leverage between the two sides.

Perpetuals are popular because they allow traders to enhance their buying power through the use of leverage – but they also magnify the degree of risk. Initial required margin may only be 1 per cent of the value of the contract (i.e., leverage may be as high as 100x – and in some cases even higher). Once the contract is entered into, the parties must maintain a minimum amount of margin to keep their trading position open. If a party’s margin balance drops below this minimum amount, the party will receive a margin call (requesting that further funds be added to the trading account) or their position will be liquidated (the latter being the more common approach taken by exchanges).

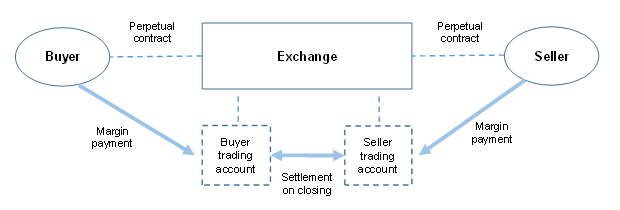

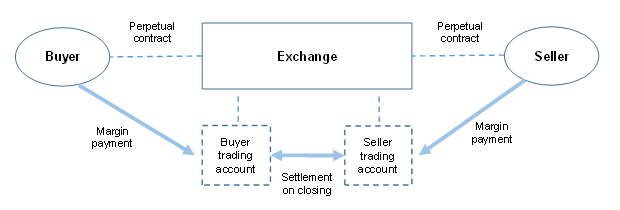

In broad terms, a typical transaction flow is as follows:

- The exchange will accept an order (i.e., a bid or an offer) from a user, and once the order can be filled by being matched with a corresponding order from another user, the exchange will enter into a perpetual with each user as principal, on a back-to-back basis;

- margin payments may be made either in a cryptocurrency, or in a fiat currency or stablecoin, between the user and the exchange, each acting as principal; and

- the user will make a margin payment to the exchange when placing an order, and may make further margin payments during such time as the position remains open.

2. Setting up a perpetuals exchange: regulatory factors

An initial question is whether operating your perpetuals exchange in Singapore is likely to give rise to any regulatory licensing or approval requirement under Singapore law. Singapore licensing and approval requirements for activities relating to derivatives – including for persons operating a derivatives exchange and/or clearing house, and persons marketing derivatives traded on an exchange – are set out in the Securities and Futures Act (Cap. 289) (SFA). These licensing requirements may be triggered where the activity in question relates to a contract or arrangement which is a ‘derivatives contract’ under the SFA, a defined term which includes both over-the-counter and exchange-traded derivatives (e.g., futures contracts).Whether a perpetual constitutes a derivatives contract needs to be assessed on the basis of the relevant product features. A perpetual will typically constitute a derivatives contract on the basis that it requires each party to discharge obligations at some future time (namely, to settle the position upon the contract being closed) and that the value of the perpetual depends on the value of the underlying cryptocurrency (or on fluctuations in such value). However, if the perpetual is a derivative of a ‘payment token’1 (such as Bitcoin or Ether), it is only regulated under the SFA if it is traded on an ‘approved exchange’. At present, there are only three approved exchanges that offer trading in derivatives, namely Singapore Exchange Derivatives Trading Limited, Asia Pacific Exchange Pte Ltd and ICE Futures Singapore Pte Ltd.

In summary therefore, perpetuals are not a derivatives contract under Singapore law if their underlying cryptocurrency is a payment token such as Bitcoin or Ether and they are offered by an exchange other than an approved exchange. In such case, offering the perpetuals should not in itself trigger any regulatory licensing or approval requirement for an exchange under the SFA. Caution should nonetheless be exercised, and a holistic assessment of the regulatory position should be conducted, in light of the following factors:

- Product features: If your exchange also supports perpetuals for which the underlying cryptocurrency is not a payment token but another underlying, such as a stablecoin (i.e., a token referencing one or several fiat currencies), this could bring the activities of the exchange within the scope of regulation.

- Margin payments: You should also consider whether the manner in which users make margin payments to your exchange gives rise to any additional regulatory considerations. For example, while such payments will typically be structured to occur as an outright transfer to the exchange, you should assess whether the drafting of the exchange rules and other customer documentation gives rise to any risk of the exchange providing a safeguarding service to users in respect of ‘digital payment tokens’ (‘DPT’) as defined in the Payment Services Act 2019 (PS Act), such as Bitcoin or Ether, which may qualify as a regulated payment service pursuant to amendments to the PS Act that are due to take effect in due course.

- User interface: If your exchange offers an interface allowing users to execute transactions, and if these include transactions in fiat currency and/or digital tokens qualifying as ‘e-money’ under the PS Act, you will need to make an assessment as to whether you are issuing a ‘payment account’ to users and therefore providing an ‘account issuance service’ under the PS Act. Depending on the transactional flow (including, e.g., any fiat-currency on-ramp or off-ramp), you may also need to consider whether other regulated payment services under the PS Act are engaged, such as a ‘domestic money transfer service’ or ‘cross-border money transfer service’.

- MAS engagement: Even if you should opt for a structure for your exchange which does not trigger any immediate requirement for regulatory approval, if you intend to service retail users, you may wish to consider providing the Monetary Authority of Singapore (MAS) with advance notice of the proposed establishment of your exchange and to invite the MAS to inform you if it has any queries or concerns. Such notification is advisable given the risks to retail investors which the MAS has identified as arising from payment token derivatives,2 and it will allow you to provide the MAS with assurance on the measures that you will implement to mitigate such risks (e.g., limits on leverage and risk warnings).

- Threshold and ongoing requirements: If you structure your exchange to remain outside the scope of regulation, it will not be formally required to comply with any specific threshold conditions or ongoing requirements under the Singapore financial services regulatory framework. However, given the risks which the MAS has highlighted as arising in connection with trading payment token derivatives, you should consider implementing certain measures for investor-protection purposes. These include, in particular, limits on leverage, risk warnings in investor-facing communications and materials, a level of capitalisation that adequately reflects the potential for legal claims from users, and personnel with a suitable level of competence and experience.

- Sharing of resources with regulated DPT exchange: It is common for operators of a perpetuals exchange to contemplate a parallel spot exchange offering. If your perpetuals exchange is incorporated and operating in Singapore, it may in principle share certain resources with a DPT exchange regulated under the PS Act. However, this type of integration must be approached with caution, as the MAS has stated that the PS Act requirements for payment service firms are right-sized to cover the risks posed by payment services regulated under the PS Act, and that PS Act licensees therefore should not offer payment token derivatives under their suite of activities.3 The perpetuals exchange and the regulated DPT exchange must therefore ensure that their respective resources remain adequate at all times and are not commingled in a manner which gives rise to undue risk. In this regard, you will need to consider the appropriate segregation and delineation of functions and management of risks in connection with any sharing of physical premises, customer communication channels and customer-facing materials, and operational systems. Dual-hatting of key individual roles may need to be minimised or avoided in light of the attendant risks of customer confusion, mishandling of confidential information, conflicts of interest and blurred delineation of functional responsibilities.

3. How we can help

To support you in setting up a perpetuals exchange, we can assist with the regulatory analysis and structuring, guide you on any regulatory engagement, draft your exchange rules and customer on-boarding documentation, and draw up your internal governance structure, policies and procedures. For a conversation on how we can help, please reach out to any of our global team, or your usual Reed Smith contact.

Reed Smith LLP is licensed to operate as a foreign law practice in Singapore under the name and style, Reed Smith Pte Ltd (hereafter collectively, "Reed Smith"). Where advice on Singapore law is required, we will refer the matter to and work with Reed Smith's Formal Law Alliance partner in Singapore, Resource Law LLC, where necessary.

- A ‘payment token’ is defined in the SFA as a digital representation of value (a) that is expressed as a unit; (b) the value of which is determined in any way, other than being permanently fixed by its issuer at the time when it is issued to either a single currency or two or more currencies; (c) that is, or is intended to be, a medium of exchange accepted by the public, or a section of the public, as payment for goods or services or for the discharge of a debt; and (d) that can be transferred, stored or traded electronically.

- MAS Consultation Paper on Proposed Regulatory Approach for Derivatives Contracts on Payment Tokens, 20 November 2019, paragraph 4.1.

- MAS Response to Feedback Received on the Proposed Regulatory Approach for Derivatives Contracts on Payment Tokens, 15 May 2020, footnote 2.

In-depth 2021-187