Background

This is one of the most recent in a series of cases decided in the Singapore courts following the bankruptcy of Zenrock Commodities Pte Ltd (Zenrock). The case examined, and the court decided, several complex issues relating to the financing and trading of commodities. The decision may be of assistance to commodities market participants, including banks, in connection with transactions involving:

- Structured commodity trading, in particular, so-called transit, ‘circular’ or ‘round-tripping’ transactions;

- Documentary letters of credit;

- Payment letters of indemnity (LOIs);

- The transfer of title under contracts for the sale of goods; and

- Fraud in the context of letters of credit.

Crédit Agricole Corporate & Investment Bank (CACIB) commenced proceedings against PPT Energy Trading Co Ltd (PPT), and the case was referred to the SICC by the High Court. The SICC was tasked with determining claims arising out of trading activities conducted by Zenrock, with Zenrock having been placed under judicial management in May 2020 amidst allegations by creditors that Zenrock had engaged in a series of dishonest transactions designed to defraud its financiers.

What happened between the parties in the case?

PPT was the beneficiary of a letter of credit (LC) issued by CACIB with Zenrock being the applicant of the LC and purchaser of a crude oil cargo under a sale contract with PPT (the PPT Sale Contract).

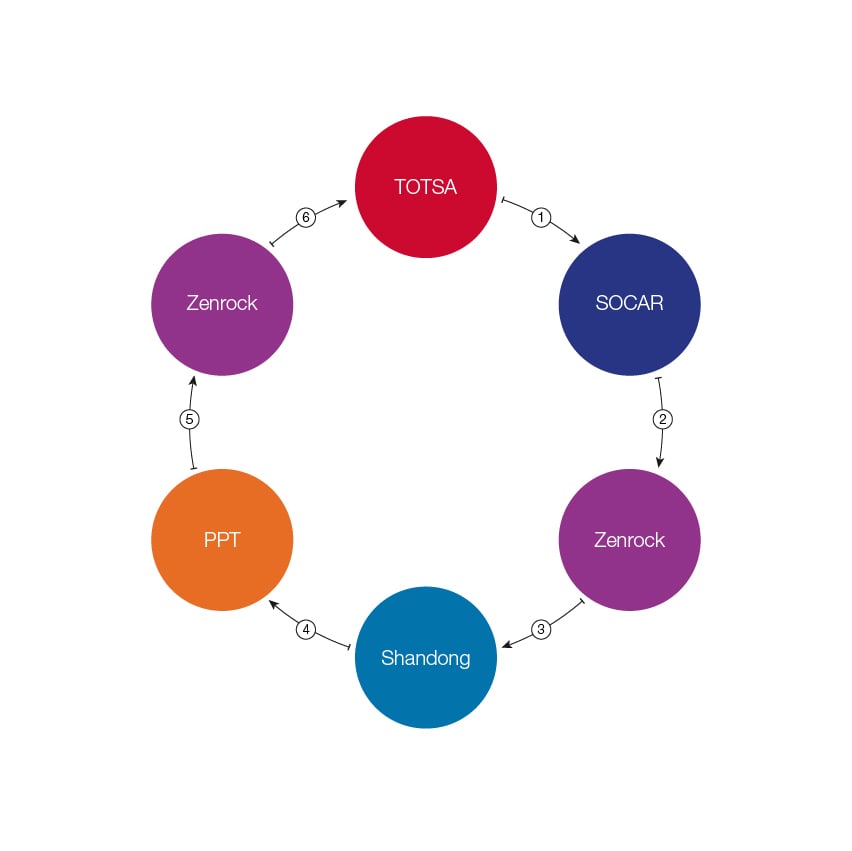

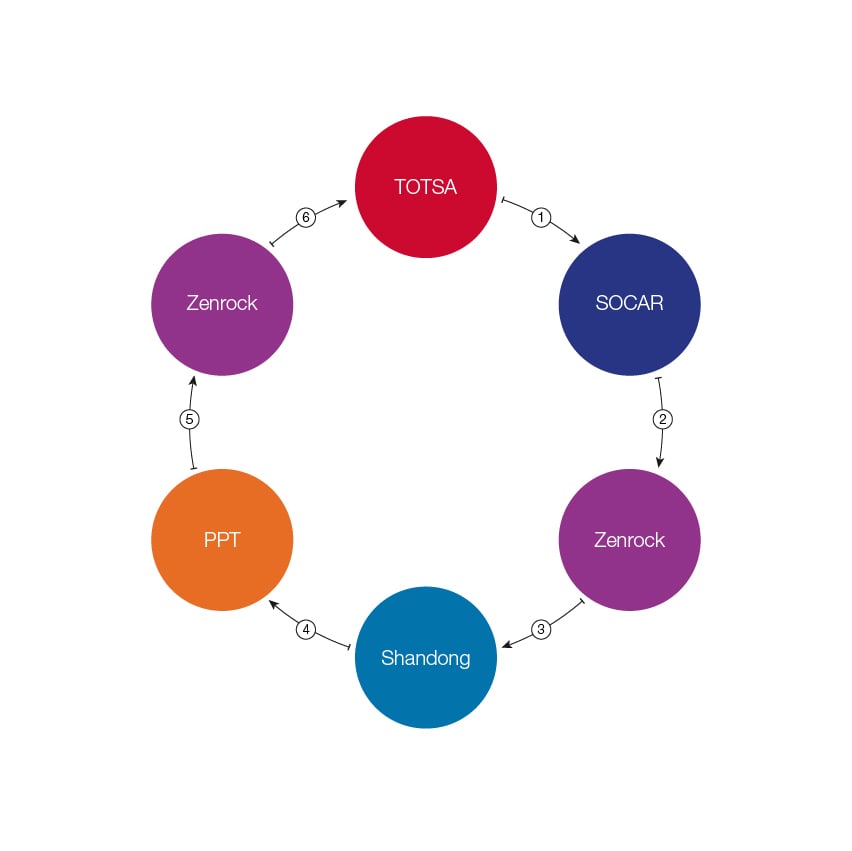

The crude oil cargo was subject to what the court described as ‘round-tripping’ transactions. These transactions comprised the following sales and purchases:

- A crude oil cargo was sold by Total Oil Trading SA (TOTSA) to SOCAR Trading SA (SOCAR).

- SOCAR sold the cargo to Zenrock.

- Zenrock sold the cargo to Shandong Energy International (Singapore) Pte Ltd (Shandong).

- Shandong, in turn, sold the cargo to PPT.

- PPT then sold the same cargo to Zenrock.

- Finally, Zenrock sold the cargo back to TOTSA, thereby completing the series of so-called ‘round-tripping’ transactions.

In respect of the PPT Sale Contract, Zenrock applied for, and CACIB issued, a documentary LC in favour of PPT. As is common in commodities transactions, the LC allowed PPT to be paid upon presentation to CACIB of a commercial invoice and an LOI in lieu of original bills of lading. In support of its application for the LC, Zenrock submitted (i) a copy of the PPT Sale Contract and (ii) a fabricated and falsified version of its sale contract with TOTSA (the Fabricated TOTSA Sale Contract). The latter reflected a higher price for the crude cargo than both the price actually payable by TOTSA to Zenrock under the genuine sale contract between TOTSA and Zenrock and the actual price payable by Zenrock to PPT under the PPT Sale Contract. Thus, Zenrock created the impression to CACIB that it would earn a profit under the two contracts when, in fact, it was making a loss. Zenrock also assigned the receivables arising from the Fabricated TOTSA Sale Contract to CACIB. CACIB later discovered that Zenrock had already assigned the actual receivables due from TOTSA to another bank and that, in effect, there had been a double assignment of the TOTSA receivable.

PPT presented its commercial invoice and a compliant LOI to CACIB for payment under the LC. The LC incorporated UCP 600, which required CACIB to determine the validity of the documentary presentation by PPT on the documents’ face and to provide notice to PPT of any defective or invalid presentation within five banking days of the presentation, failing which it would be precluded from claiming that the LC’s presentation was non-compliant. CACIB never sent such a notice. At the relevant time, CACIB was conducting an investigation based on information it had received from TOTSA that Zenrock had assigned the TOTSA receivables twice and that the Fabricated TOTSA Sale Contract submitted in support of the LC application was not genuine.

CACIB did not refuse to pay PPT under the LC until it sought and obtained an interim injunction from the Singapore High Court on an ex parte application to restrain payment to PPT under the LC.

The interim injunction was eventually discharged after the parties agreed that CACIB would pay PPT US$23.6 million under the LC in return for a bank guarantee securing PPT’s obligation to repay the LC proceeds if it was found that PPT was not entitled to the payment as a result of fraud.

Before the SICC, CACIB claimed that:

- PPT was not entitled to receive payment under the LC and was liable to reimburse the same; and/or

- PPT was in breach of warranties given to CACIB under the LOI and so was liable to pay damages in the sum of US$23.6 million – the same amount that CACIB was liable to pay PPT under the LC.

PPT counterclaimed for:

- A declaration that it was entitled to the payment under the LC; and/or

- Damages for CACIB’s breach of the LC.

What did the SICC decide and why?

The SICC’s judgment ran to 105 pages, involving detailed analysis and reasoning relating to a number of issues of fact, the evidence adduced by the parties and issues of law. We summarise below the issues, what the parties argued and the court’s decision and reasoning.

Despite findings of fraud committed by Zenrock, the court dismissed CACIB’s claim for the reimbursement of the LC proceeds paid to PPT and denied CACIB’s claims for damages or an indemnity against PPT.

Download a PDF detailing the CACIB's allegations, PPT's defence, the SICC's decision, and the reasoning.

What does this decision mean for you?

This case highlights four points of significance for commodities market participants, including financiers:

- As regards documentary LCs, this judgment is a strong reinforcement of the principle of the autonomy of LCs. Banks must pay on presentation of documents that are compliant on their face with the terms of the LC.

- The case serves as an illustration of the limitations of the so-called ‘fraud exception’. The scope for looking behind otherwise compliant documents and avoiding payments based on the underlying facts is (generally speaking) limited only to cases of fraud by the beneficiary. Proving such fraud in such cases is a challenge. Even in cases such as this, where the beneficiary’s trading party (Zenrock) had, in fact, perpetrated a fraud, the ‘fraud exception’ did not apply. In this case, it could not be said that the beneficiary was a participant in Zenrock’s fraud despite knowing about the fact of the circular trading of the crude cargo. Meanwhile, it is suggested that mere recklessness as to fraud does not give grounds to restrain payment under an LC where the beneficiary does not act fraudulently.

- The case underscores the legitimacy of circular or string trading in general and rightly does not focus on the motives of the relevant parties to such transactions or their purpose. Instead, it focuses on whether the parties can transfer good title and whether title is, in fact, transferred.

- Finally, the case reiterates that LOIs, as unilateral contracts, are accepted only by way of full (and not partial) performance of the payment obligations to which they refer or relate. Only once full payment has been made do the warranties (and indemnities) in the LOI take effect.

In-depth 2022-036