Authors

Key takeaways

- Stablecoins Bill will create a new licensing regime in Hong Kong

- Entities must meet various requirements to issue or actively market fiat-referenced stablecoins in Hong Kong

- Entities not in Hong Kong but wishing to issue Hong Kong dollar-denominated coins must also comply

- Reserve assets requirements are stringent, as expected

Introduction

Entities wishing to issue or offer stablecoins marketed in Hong Kong will soon have to comply with stringent requirements under the Stablecoins Bill, published in December 2024.

The Bill comes at a time when stablecoins are in the spotlight globally, with the EU’s Markets in Crypto-Assets Regulation (MiCA) coming into force at the end of 2024. Exchanges, issuers and market players are increasingly focused on compliance, in order to thrive in regulated environments.

History of the Bill

In our previous client alerts1, we set out plans by the Hong Kong Monetary Authority (HKMA) and the Financial Services and the Treasury Bureau (FSTB) to establish a regulatory regime for fiat-referenced stablecoins (FRS) in Hong Kong (the Proposed Regime).

Following the release of a consultation paper on 27 December 2023, which received 108 responses from the public, and the consultation conclusions published by the HKMA and FSTB on 17 July 2024, the Bill was gazetted and introduced into Hong Kong’s Legislative Council for its first reading on 18 December 2024. As described below, the Bill reflects regulators’ commitment to regulating FRS activities in Hong Kong.

What is a stablecoin?

The Bill broadly defines stablecoins as “a cryptographically secured digital representation of value” that:

(a) is expressed as a unit of account or store of economic value;

(b) is used or intended to be used as a medium of exchange accepted by the public for certain stated purposes;

(c) can be transferred, stored or traded electronically;

(d) is operated on a distributed ledger or similar information repository; and

(e) purports to maintain a stable value with reference to a single asset or a pool or basket of assets.

There are a number of exclusions from the definition, including:

(1) limited purpose digital tokens under the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (Cap. 615), such as customer loyalty or reward points or in-game assets; and

(2) floats or stored value facility deposits under the Payment Systems and Stored Value Facilities Ordinance (Cap. 584), which are subject to a distinct licensing regime overseen by the HKMA.

The Proposed Regime governs “specified stablecoins”, which are defined as (a) stablecoins which purport to maintain a stable value with reference wholly to one or more official currencies, units of account or stores of value as specified by the HKMA, or a combination of the foregoing; or (b) a (class of) digital representation of value as specified by the HKMA. That is, under the Bill, the HKMA has the statutory power to designate any unit of account, store of economic value, or a (class of) digital representation of value as a “specified stablecoin”, which means the Proposed Regime may be expanded in the future to cover non-FRS stablecoins.

Similarly, other than the issuance and offering of FRS, the HKMA may specify other activities which will be regulated and require a licence from the HKMA.

What stablecoin activities will be regulated under the Proposed Regime?

Under the Proposed Regime, the following activities will require a licence from the HKMA:

(a) issuing an FRS (which is referred to as a “specified stablecoin” in the Bill) in Hong Kong in the course of business;

(b) issuing an FRS in a place outside Hong Kong in the course of business, where the FRS purports to maintain a stable value with reference (whether wholly or partly) to Hong Kong dollars; and

(c) actively marketing to the Hong Kong public, whether locally or internationally, the issuance or purported issuance of FRS.

Additionally, the offering or active marketing of FRS will require a licence from the HKMA, unless the relevant entity is an authorised institution regulated by the HKMA, a Type 1 (dealing in securities) licensed corporation under the Securities and Futures Ordinance (Cap. 571) or a virtual asset trading platform (VATP) licensee regulated by the Securities and Futures Commission.

Whilst the Bill does not explicitly define what comprises “issuing” stablecoins, the context would suggest that it refers to the creation and initial distribution of an FRS by an entity in the course of business. It remains to be seen if the lack of a definition leads to interpretation and enforcement challenges.

What are the key requirements to obtain a licence?

Adequate financial resources: The licensee must have a minimum paid-up share capital of HK$25 million (or its equivalent in another currency). This is on top of a licensing fee of HK$113,020, which has to be paid upon obtaining a licence and then annually. These amounts, although not insignificant, are unlikely to deter serious issuers.

Reserve assets management: With memories still lingering of the collapse of Terra UST, HKMA has, as expected, implemented robust measures to protect investors and imposed stringent requirements on licensees’ reserve assets management, including the following:

- The licensee must maintain a pool of high quality, highly liquid reserve assets for each type of FRS it issues.

- The market value of the reserve assets must at all times be at least equal to the par value of the FRS in circulation; i.e., providing full backing may require over-collateralization.

- Except with prior written approval from the HKMA, the reserve assets must be held in the same reference asset as that referenced by the type of FRS.

- The reserve assets pool for each type of FRS must be segregated from other reserve assets held by the licensee. Segregated accounts must be established with licensed banks or, subject to HKMA approval, other asset custodians.

- The licensee must allow holders to redeem stablecoins at par value in the referenced currency in a timely manner. Whilst unspecified in the Bill, HKMA has indicated that such requests must be fulfilled within one business day. No excessive conditions can be imposed, and only reasonable fees can be charged.

Key personnel of a licensee: The chief executive, alternate chief executive and stablecoin manager must be ordinarily resident in Hong Kong and meet fit-and-proper standards. Although directors are not required to be ordinarily resident in Hong Kong, they are subject to similar standards. The consultation materials do not provide much insight into the role and responsibilities of the stablecoin manager, a position introduced by the Bill, and so further guidance from the HKMA would be much appreciated. Having senior management on the ground will facilitate oversight by the HKMA and, on a positive note for the industry, contribute to the vibrant fintech community in Hong Kong.

Are there any transitional arrangements?

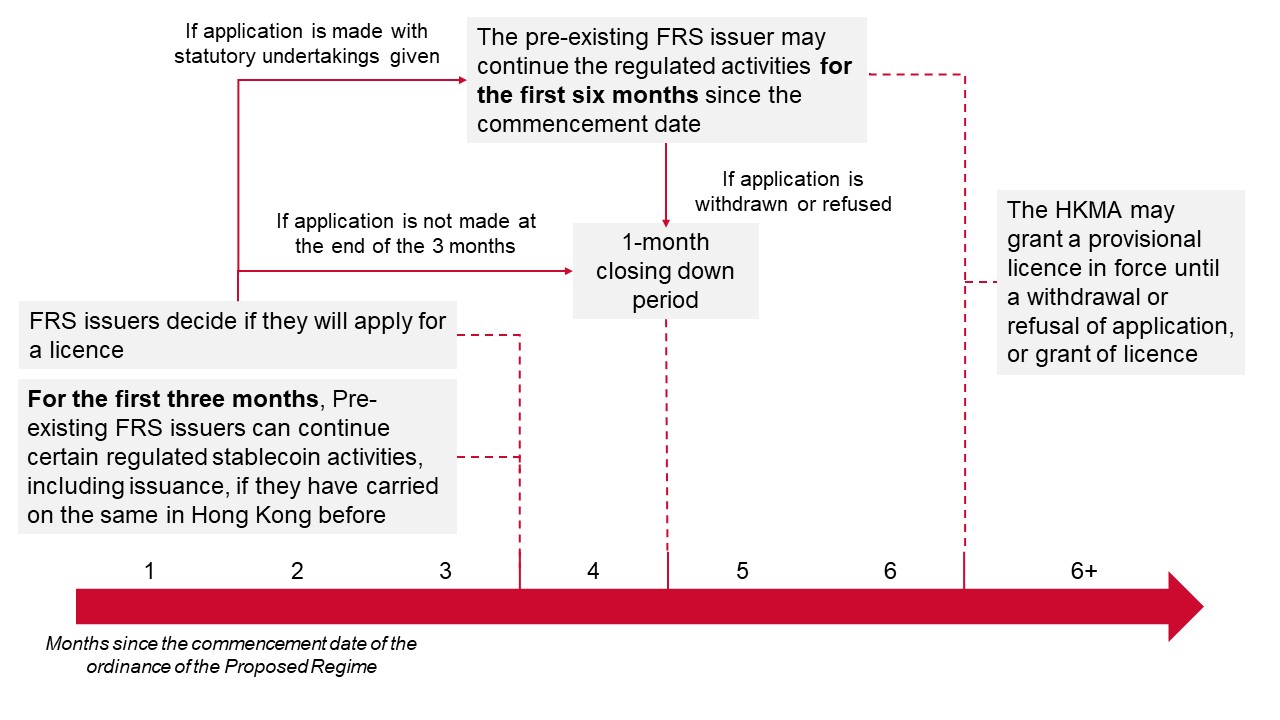

The Bill provides for certain transitional arrangements to assist market players in the stablecoin sector during the early stages of the Proposed Regime’s implementation. In the first three months following the commencement date of the ordinance of the Proposed Regime, a pre-existing FRS issuer may continue certain regulated stablecoin activities, including issuance, if it was operating in Hong Kong prior to the commencement date. If the issuer applies for a licence during these three months and has provided certain statutory undertakings on regulatory compliance to the HKMA, it may continue its activities for up to six months. However, if the issuer does not apply for a licence within the first three months, or its application is rejected or withdrawn, it will have to enter into a one-month closure period, subject to the HKMA’s discretion to grant an extension. For licence applicants who have shown a reasonable prospect of compliance with the Proposed Regime, the HKMA may grant a provisional licence, which will remain in force until the application is withdrawn or refused, or a full licence is granted.

We provide below an indicative timeline for illustrative purposes:

What are some areas that may benefit from further clarity from the regulators?

Whilst it is appreciated that the Bill strives to provide more detail on how the Proposed Regime is to operate (including an Explanatory Memorandum at the end of the Bill), we believe that there remain areas which could benefit from further clarity, whether through amendments to the Bill, guidelines from the HKMA or other means.

Among other things, the scope of regulated activities may still lead to confusion. In particular, the “offering” of an FRS refers to communication to another person about the FRS, the terms on which it will be offered, and the channels through which it will be offered, to enable the person to decide whether to acquire the FRS. However, how will this be applied? For example, would any reference to a website of a distinct FRS issuer constitute the offering of FRS?

Whilst reserve assets is an area of the Bill that has drawn significant attention, some gaps need to be addressed. For example, the Proposed Regime requires reserve assets to be high quality and highly liquid, with minimal investment risks. Previously, the HKMA indicated in its consultation materials that such reserve assets may include coins, banknotes and deposits placed with licensed banks, but this level of detail is missing from the Bill. Whilst a more high-level approach may give the HKMA some flexibility to refine the regulatory framework, from a practical and operational perspective, more concrete guidelines from the HKMA would be welcomed by the industry.

The way forward

The Proposed Regime for stablecoins is yet another example of Hong Kong’s commitment to the financial regulation of virtual assets and related products, following developments such as the licensing of VATPs.2

To allow industry players to ease into the regulations, the HKMA has opened applications for its regulation sandbox and released the list of approved participants. Sandbox participants are expected to comply with the sandbox requirements and will not handle the general public’s funds during the initial stage.

Several of the features of the Proposed Regime outlined above demonstrate the rigorous regulatory scrutiny that participants in the FRS market should be prepared to face. However, the HKMA will need to address any concerns that over-regulation could stifle innovation. We believe that it will take a pragmatic approach, so as to balance the need to instil public confidence in investing in virtual assets with the goal of fostering the growth of Hong Kong as a virtual assets hub.

We regularly advise clients on licensing and regulatory issues involving traditional and virtual assets. If you have any questions, feel free to reach out to any member of our On Chain team.

- See our client alerts published on 16 February 2023 and 16 January 2024.

- See our client alerts published on 17 March 2023, 31 May 2023 and 10 July 2024 (via an article on WealthBriefingAsia).

In-depth 2025-007