Current fundraising landscape, for traditional and for clean energy

Starting in the early 2000s, PE has generally had a relatively easy time raising capital for oil and gas projects. More recently, however, PE firms have increasingly focused more investment into energy transition companies with a focus on industrial decarbonization, clean energy and renewables. One reason for a shift in focus is the low rates of returns over the last 10 years from traditional energy investments. Also, the public is demanding more carbon reductions in a bid to protect the atmosphere and reduce human influence on climate change. For example, pension and endowment funds are less willing to invest sizeable equity into the traditional energy space. Some would argue that clean and renewable energy companies have outperformed both listed fossil fuel companies and public equity market indices in recent years, and with lower volatility.

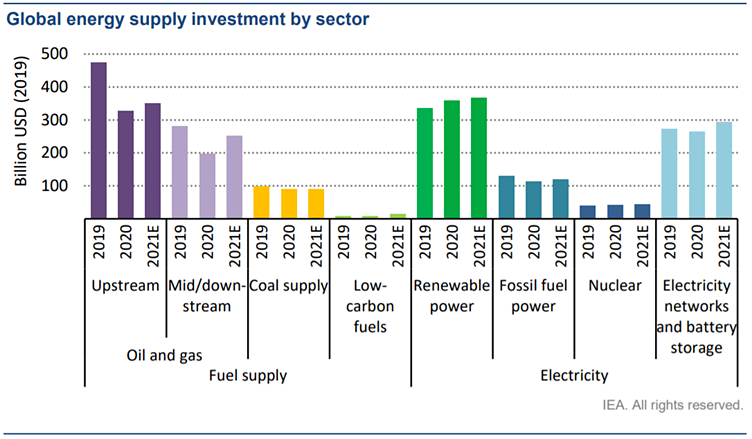

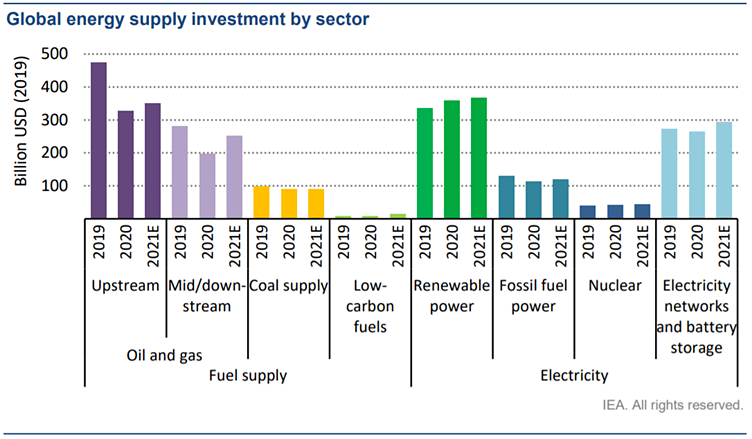

The above chart, obtained from the International Energy Agency (IEA), shows a decline in capital investment in traditional oil and gas sectors, and an increase of investment in renewable power and electricity networks and battery storage.

The IEA says more governments, companies and financial institutions are making commitments to achieve net zero emissions by 2050 or soon thereafter.

Current approach to capital raising in the energy sector

According to James Wang, managing director of Ara Partners, the issue of capital allocation by PE firms in the energy sector appears to be LP specific. On one end of the spectrum, some LPs want none of their investments to be in fossil fuels-based businesses, whereas other LPs believe in an incremental shift away from fossil fuels to investments in industrial decarbonization businesses such as hydrogen blending and renewable competing alternatives.

Wang commented on the historical return rates of traditional energy plays. Over the last 10 years, the return on investment in the traditional energy space has not been encouraging, especially taking into consideration steady, low gas prices (barring the impact of recent world events in hiking prices). In making their investment decisions, LPs not only look at the ESG policies and goals of the businesses, but also their potential return on investment.

Unintended consequences in the green energy sector

Despite the many benefits of clean energy and renewables, the energy transition sector faces its own challenges and unintended consequences, which cannot be ignored. For instance, transitioning from gas powered to electric vehicles results in a proliferation of lithium ion batteries, increasing waste, and creates issues around how such waste is disposed. In addition, electric vehicles will put a strain on power grids as a whole and are less effective in times of natural disasters such as floods and hurricanes.

Future of fossil fuel extraction and consumption

According to David Finan, a partner at EIV Capital, there is a strong likelihood that five to 10 years from now, the world will be consuming more hydrocarbons – not fewer – because developing countries around the world are far behind developed countries in terms of readiness to move away from fossil fuels. For instance, he stated that picking the bottom 30% of the global population over the next decade, and trying to raise the standard of living for this population to that of a country such as Mexico, would increase global energy consumption by 40%. Finan also stated that the energy intensity of the developing world would have an increased impact on global energy consumption and emissions. Thus, the transition to cleaner, green and renewable energy on a global scale will likely take a much longer period than anticipated.

Areas of opportunity for PE investors in energy transitions

When investing, PE firms should look to make not only incremental changes, but also practical changes. Wang provided several examples. One example for Wang’s firm is to invest in reducing and eliminating waste through recycling plastics. Another area of opportunity he sees is in the recycling of lithium ion batteries, which are used to power various devices, including smart phones and electric vehicles. Also, PE firms are investing in processes that turn waste to value by converting waste plastic feedstock to post-consumer products that trade at a premium. Finan also gave an example of how his firm is investing in feedstock substitutions by substituting methane derivative products with ethanol.

PE’s role in energy transition

PE firms can play a very important role when it comes to the transition from traditional to cleaner forms of energy. PE firms may have the ability to assist traditional energy companies in making incremental improvements to help decarbonization efforts. They understand that traditional energy companies trying to making significant investments in non-fossil fuel-based businesses can be hampered, given that traditional energy companies are generally not set up to experiment with new technologies or processes outside their core business of fossil fuels extraction and production. Finan also mentioned the fact that the valuation expectations at energy transition companies are much higher in comparison to traditional energy companies, which trade at a much lower level. If traditional energy companies partner with PE firms, this can create comfort for companies to dabble in the renewable energy sector. PE firms are often better equipped to evaluate early-stage companies through due diligence and organizational management, which can help those companies grow and become viable investments for traditional energy companies.

Impact of recent world events on carbon fuels

The current rise in inflation is a problem for new energy as costs of raw materials have gone up. Also, the Russia-Ukraine crisis has highlighted the importance of energy security as a national security concern for the United States and other large, western economies. In the future, countries will be less willing to rely on unstable regimes as their sole or primary source of energy. This creates an incentive to invest in both transitional energy and traditional energy in order to ensure energy security and independence.

About the authors

Efren Acosta has a broad based M&A practice, representing private and public clients, including private equity firms, in mergers, acquisitions, joint ventures, and other transactional matters across a variety of industry sectors, including the energy sector. Efren has substantial cross-border M&A experience, with a particular focus on Latin America. His experience extends to representation of both U.S. and Latin American clients in mergers, acquisitions, joint ventures, and other matters in the region.

Kirsten S. Polyansky has a broad commodities transaction practice, representing energy companies, trading houses, private equity firms, and global financial institutions. Kirsten’s range of commodity coverage includes crude, refined products, NGLs, LPGs, renewables, metals, agricultural products, and credits, as well as the physical (e.g., long-term supply and offtake arrangements, storage and transportation via pipe, vessel, rail, and truck) and financial trading of same. Kirsten’s practice also focuses on large-scale structured transactions involving inventory monetization, intermediation, and true sale arrangements for refineries and storage and pipeline positions.

Ron J. Scharnberg advises clients on a wide range of federal tax matters, with particular emphasis on the federal tax planning and structuring of domestic and cross-border/international mergers and acquisitions, tax-free reorganizations, spin-offs and divestitures, joint ventures and partnerships, and restructurings. He has experience in connection with upstream, downstream, midstream, and other energy and energy-transition-related acquisitions, dispositions, joint ventures, tax equity, and tax partnerships, and the Section 45Q tax credit for carbon capture and sequestration.

Kunle Uthman represents clients in commodity and derivative transactions, with a focus on energy transactions. His experience includes advising on mergers and acquisitions, private equity, oil and gas, and complex real estate transactions. He has also worked on structured finance arrangements related to inventory monetization and a number of structured wholesale and retail power and gas transactions, including transportation agreements, exchange agreements, and storage agreements.