The decoupling of crude oil prices from fuel prices in Germany continues to put the country’s fuel wholesalers and refineries under the spotlight of the German Federal Cartel Office (Bundeskartellamt – FCO).

The FCO had already launched an ad hoc sector inquiry into wholesale fuel in April 2022 (for further details, please see our previous client alert). In view of the temporary cut in fuel tax rates, which came into effect on June 1, 2022, the government explicitly called on the FCO to monitor how the tax cut is passed on to consumers at the pump.

With its press release of May 31, 2022 (available in German and in English), the FCO confirmed that it would watch the market even more closely in the near future for any signs of cartel activity among the big players.

Current market data suggest that the temporary cut in energy tax may fail to serve its purpose as fuel prices at the pump have again increased.

On the back of these developments, the FCO will likely be in touch with all large oil companies active in Germany, requesting that they respond to potentially lengthy requests for information, or may even conduct unannounced inspections at their German premises.

The FCO’s dilemma is that it cannot force pricing decisions on market participants (who clearly should be subject to free competition) and yet the German government has declared that “it is now within the FCO’s responsibility to ensure that drivers and commuters will actually benefit from the new tax reduction."

The FCO’s current powers are widely subject to the prior explicit establishment of an infringement of competition by the FCO. Because establishing an infringement of competition on the fuel wholesale market reveals to be difficult, the German government plans to introduce new far-reaching powers for the FCO.

Background: Cut in energy tax rates for fuel

On June 1, 2022, as part of its fight against the current energy crisis and to make Germany more independent from Russian oil, the government introduced a temporary cut in energy tax rates (Cut). The Cut will continue for three months until August 31, 2022.

The Cut applies to all fuels that are generally available to the public at gas stations, covering not only E5 gasoline, E10 gasoline and diesel, but also LPG and CNG/LNG.

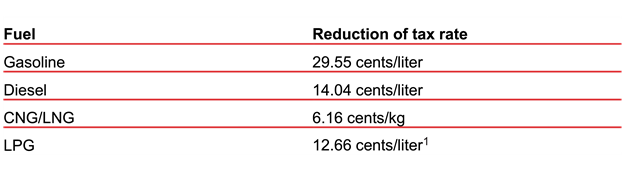

In real terms, tax rates for fuels subject to the Cut have been reduced to the minimum set out in Council Directive 2003/96/EC, as amended, as follows:

As a so-called indirect tax, it is intended that the fuel tax be passed on by oil companies to consumers. Therefore, there is an expectation that passing on a temporary reduction in the tax in full to consumers will result in a corresponding reduction in prices at the pump and thus offer some relief to consumers and the economy. A reduction of the consumer price level is the ultimate goal of the Cut (see the preparatory legislative documents, page 3), but what if this does not happen?

Although there is no explicit statutory duty to pass on the tax reductions in full to consumers, companies have been expressly called on to do so.2 At the same time, the government acknowledges that gas station operators, although generally free to determine their own retail prices, are dependent on their upstream supply chain.3

To ensure that the Cut does not miss its target, the government expressly called on the FCO to closely monitor how the Cut is passed on to consumers at the pump. Christian Lindner, the Federal Minister of Finance, said that it is now within the FCO’s responsibility to ensure that drivers and commuters will actually benefit from the new tax reductions.4

The FCO’s stance

These new developments have to be seen in the context of an already ongoing fuel sector inquiry, which the FCO announced on April 12, 2022 as an ad hoc measure in response to the energy crisis.

Under the German Act against Restraints of Competition, the FCO may conduct sector inquiries where it suspects anticompetitive behavior in an entire industry. Although sector inquiries do not target individual market participants, measures against individual companies may be taken as a consequence of the market insights the FCO obtains following the inquiries (for further details on the ongoing fuel sector inquiry, please see our previous client alert).

Having seen a price increase for E5 and E10 fuel of 15 cents in May 2022, Andreas Mundt, president of the FCO, said:

“We have been witnessing a decoupling of crude oil prices and sales prices charged by refineries and petrol stations for months and are therefore carefully monitoring the price development. In view of the upcoming tax reductions as of 1 June we have even intensified our monitoring activities. Additionally, we have launched an inquiry into refineries and wholesalers in an attempt to create maximum transparency for the entire fuel market. Although there is no legally binding obligation to pass on 100 percent of the tax reductions, the oil companies are under close scrutiny by the Bundeskartellamt. As a competition authority we cannot simply prohibit high or even very high prices. We can end anticompetitive conduct and impose high fines. However, we do not have any indications of such a conduct at the moment. There are many reasons for high prices, which can even occur if there is effective competition. The fuel market, however, is only subject to limited competition, which is why we are going to keep a close watch on the sector."5