Key takeaways

- FCA publishes new rule amending the Code of Conduct (COCON) to address serious non-financial misconduct, such as bullying and harassment, for non-banks

- FCA is also consulting on draft Handbook guidance to support consistent application of the rules, including updated guidance on the application of the Fit and Proper test

- The new COCON rule is set to come into force on 1 September 2026

Overview

On 2 July 2025, the Financial Conduct Authority (FCA) published Consultation Paper CP25/18, setting out amendments to its regulatory framework to tackle non-financial misconduct in financial services.

The FCA’s new rule aims to address serious work-related non-financial misconduct, such as bullying, harassment and violence, by clarifying when such behaviour constitutes a breach of regulatory rules and by aligning the scope of COCON for non-banks with that for banks. The FCA is also consulting on draft guidance to support firms in interpreting and applying the rules consistently.

Scope and application

The new COCON rule will make explicit that serious non-financial misconduct in the workplace falls within the regulatory perimeter for non-banks. Although the FCA has suggested in places that this is a clarification of the existing position, it also makes clear that the new rule will not apply retrospectively and does not extend to conduct in an individual’s private or personal life, although such conduct may still be relevant to the Fit and Proper Test.

The new non-financial misconduct rule will apply from 1 September 2026 to all firms authorised under the Financial Services and Markets Act 2000 and all staff in those firms who are subject to COCON. Before this date, firms will be well advised to have regard to the clear direction of travel and ensure that all staff are aware of the types of behaviour that will not be tolerated and will be subject to internal disciplinary proceedings and, potentially, regulatory sanction.

Key proposals

Amendments to COCON

- Non-financial misconduct will be a conduct issue under COCON if it (i) has the purpose or effect of violating an individual’s dignity or creating an intimidating, hostile, degrading, humiliating or offensive environment, or (ii) involves violence towards an individual.

- The new rule applies specifically to misconduct between colleagues, which includes employees of group companies and contractors. However, the FCA makes clear that work-related misconduct towards clients and business contacts could fall within the scope of the existing rules.

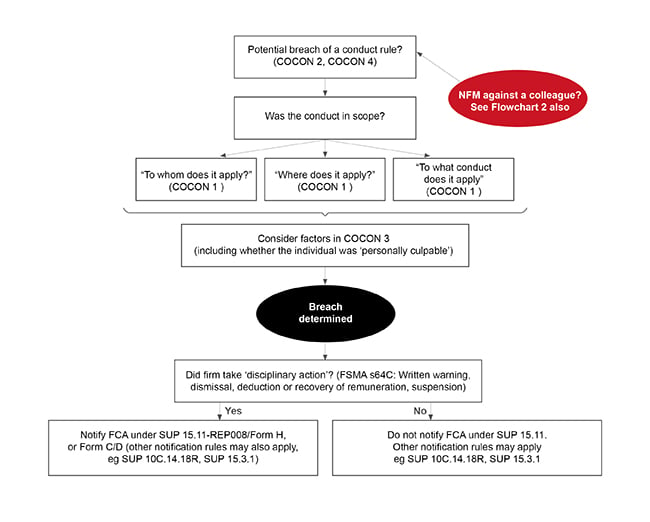

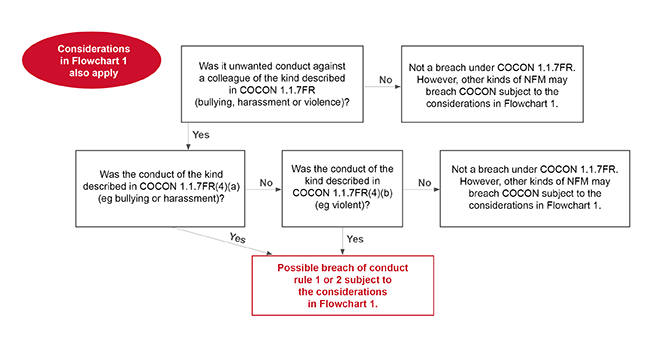

Within CP25/18, the FCA has provided two helpful decision trees, to assist firms with navigating both the existing COCON rules and the new rule, which we have reproduced at the end of this alert.

We have advised many clients grappling with the question of whether non-financial misconduct is required to be disclosed in a regulatory reference, particularly under Question G (“Are we aware of any other information that we reasonably consider to be relevant to your assessment of whether the individual is fit and proper?”). The FCA clarifies that, while this question is intended to allow firms to comment on matters that might be reasonably relevant to the assessment of an individual’s fitness and propriety, the risk of an inappropriate or unfair reference is mitigated by Handbook guidance and the duty under general law to provide fair and accurate references.

The FCA also points out that while firms must “have regard” to certain matters when responding to Question G, they are not required to disclose information that they reasonably believe to be irrelevant. This is the case even if that information would need to be disclosed in a Senior Management Function (SMF) application or, if they were an approved person, under SUP 10C.14.