FCA’s policy statement on financial promotion rules for cryptoassets

On 8 June 2023, the Financial Conduct Authority (FCA) published a policy statement on the financial promotion rules for cryptoassets (PS23/6). These rules will take effect from 8 October 2023.

This followed the passing of parliamentary legislation which brought ‘qualifying cryptoassets’ within the scope of the Financial Promotions Order (FPO), on 7 June 2023.1

Broadly, ‘qualifying cryptoassets’ are any cryptographically secured digital representation of value or contractual rights that is transferable and fungible (including exchange tokens such as Bitcoin). This would exclude instruments that already fall within the regulatory perimeter (e.g., securities, derivatives and units in collective investment schemes), electronic money, non-fungible tokens (NFTs) or cryptoassets that can be used only in a limited network.

The proposed rules on financial promotions will apply to all firms marketing qualifying cryptoassets to UK consumers regardless of whether the firm is based in the UK or overseas or what technology is used to make the promotion (i.e., social media or website).

In light of the new regime, UK and overseas firms marketing cryptoassets to UK consumers will need to reconsider and recalibrate their approach to ensure compliance with the new regime.

Routes to cryptoasset promotion

The government has introduced four routes to legally promote qualifying cryptoassets to consumers.

These cover communications made:

- by an authorised person with a Part 4A permission2 (i.e., not e-money institutions or payment services firms);

- by an unauthorised person provided the promotion has been approved by an authorised person;

- by a cryptoasset business registered with the FCA; or

- where an FPO exemption applies.

Route 2 is likely to be difficult to navigate since authorised firms wishing to approve promotions in relation to cryptoassets will have to apply to the FCA via the new financial promotions gateway and will need to demonstrate relevant competence and expertise in cryptoassets before they are permitted to approve such promotions.

Route 3 refers to a specific exemption (article 73ZA) in the FPO for cryptoasset businesses registered with the FCA under the Money Laundering, Terrorist Financing and Transfer of Funds Regulations 2017 (MLRs). This exemption allows cryptoasset businesses that are registered with the FCA under the MLRs but are not authorised firms, to communicate their own cryptoasset financial promotions to UK consumers.

Current FPO exemptions will generally apply to the promotion of cryptoassets. However, the article 48 (high net worth individual) and article 50A (self-certified sophisticated investor) exemptions will not apply.

Financial promotions not made using one of the four routes above will be in breach of section 21 of the Financial Services and Markets Act, which is a criminal offence punishable with up to two years’ imprisonment, the imposition of a fine or both.

Non-UK firms will not be able to promote qualifying cryptoassets in the UK unless they become registered under the MLRs or find an authorised person to approve the promotion.

Restricted mass market investments

The FCA has categorised qualifying cryptoassets as ‘restricted mass market investments’ (RMMIs), a category of high risk investment. RMMIs can be mass marketed to retail investors provided they comply with certain rules3 dealing with risk warnings, risk summaries and incentives.

Changes made in new FCA rules and guidance for financial promotions to consumers

The policy statement contains new rules and additional guidance following feedback on a consultation paper published by the FCA in 2022. A number of changes have been made to the proposals set out in the previous FCA publications.

These changes affect a number of areas, including those described below.

Rules that apply to all financial promotions in relation to cryptoassets

Prescribed generalised risk warnings

The FCA has emphasised the importance of consumers understanding that they should not expect to be protected by the Financial Services Compensation Scheme or the ombudsman services if something goes wrong. The proposed standard summary of risk information includes a link to “Take 2 mins to learn more” text, and wording such as “don’t invest unless you’re prepared to lose all your money invested” and “you are unlikely to be protected if something goes wrong”.

Ban on incentives

The FCA has adopted the same approach to cryptoassets as it takes to the ban on incentives for contract for difference products. Incentives such as refer-a-friend benefits, time-limited offers and the offer of free cryptoassets for signing up will not be allowed. The shareholder benefit exemption, which applies to other investment products, will not apply to financial promotions of cryptoassets.

Tailored rules for Direct Offer Financial Promotions (DOFPs) in relation to cryptoassets

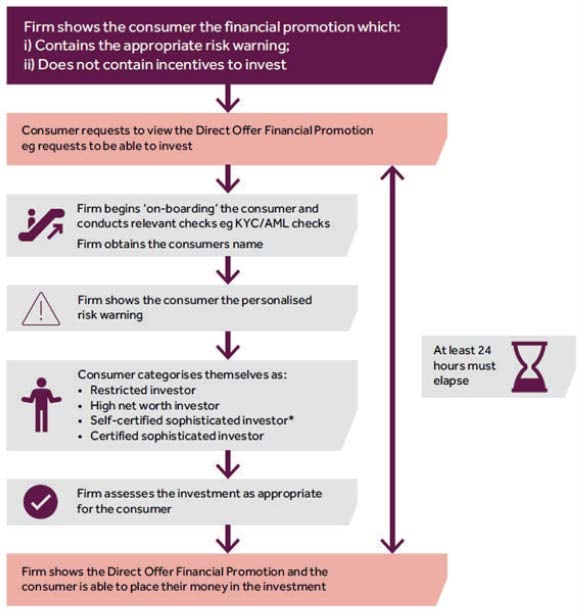

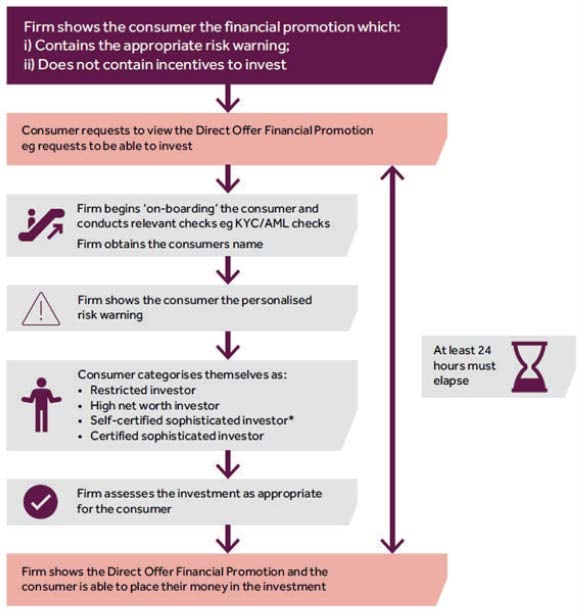

The changes below relate to DOFPs approved or made to consumers. A DOFP refers to a promotion which contains an offer or invitation to enter into an agreement, and specifies a means of response. Not all financial promotions will be DOFPs but in order to sell a product to a consumer, a DOFP will need to be made eventually.

Mandated cooling-off period for first time investors

First time cryptoasset investors with a particular firm will have to wait 24 hours between their request to be able to invest and the purchase itself. This cooling-off period applies even where the investors have been trading cryptoassets with other firms (i.e., it applies on a firm-by-firm basis). During that time, they cannot receive a DOFP enabling them to invest. However, firms can still provide certain information to consumers, such as information on pricing, and can continue to conduct 'anti-money laundering and "know your customer" checks. If consumer on-boarding takes more than 24 hours, there is no requirement for an additional period, but the consumer will still need to provide their active consent to proceed with the investment.

Prescribed personalised risk warnings

Personalised risk warnings, using the actual name of the consumer, must be provided before the consumer is able to invest.

DOFPs can only be made to certain categories of consumers

A cryptoasset DOFP can only be targeted towards consumers categorised as restricted (broadly, those with no more than 10% of their net assets invested in RMMIs), high net worth (broadly, those with annual income of £100,000 or more or net assets of £250,000 or more) or certified sophisticated investors (those with a certificate from an authorised firm confirming that they understand the risks of investing). A new certification will need to be undertaken every 12 months if a firm wishes to make further DOFPs. Importantly, the category of self-certified sophisticated investor will not apply.

Appropriateness assessment requirements

Before an application or order for an RMMI can be processed in response to a DOFP, the firm must assess whether the specific RMMI is appropriate for the consumer. The firm must establish that the consumer has the necessary experience and knowledge to understand the risks involved in relation to a specific product/service offered/demanded.

From their second assessment onward, consumers must wait at least 24 hours before retaking the appropriateness test. Firms must not inform consumers of the specific responses that caused them to fail but can explain in general terms why the firm has judged the investment as being inappropriate. Similarly, while firms can provide consumers with the option of retaking a failed test, this should not be communicated in a persistent or persuasive way. Firms are advised to consider whether the investment is appropriate for those consumers who repeatedly fail.

The FCA has summarised the requirements that apply in figure 2 of its policy statement:

Record-keeping requirements

Record-keeping requirements for financial promotions of cryptoassets will only apply in respect of client categorisation and the appropriateness assessment.

Application of the Consumer Duty (the Duty)

The Duty will apply to authorised firms. Firms will need to act to deliver good outcomes for retail consumers. However, the Duty does not apply to firms that fall within an exemption from the FPO.

New cryptoasset promotion rules consultation – emphasis on fair, clear and not misleading

Simultaneously, the FCA has also launched a consultation on guidance for cryptoasset financial promotions (GC23/1). This consultation focuses on the FCA’s approach with regard to firms’ compliance with the FCA’s cryptoasset financial promotion rules. A particular focus is placed on the core requirement for financial promotions to be fair, clear and not misleading.

The deadline for responses is 10 August, with an aim to publish the confirmed rules in the autumn of 2023.

- The Financial Services and Markets Act 2000 (Financial Promotion) (Amendment) Order 2023.

- Under The Financial Services and Markets Act 2000, as amend.

- Set out in the FCA’s Rulebook at COBS 4.12A.

Client Alert 2023-141